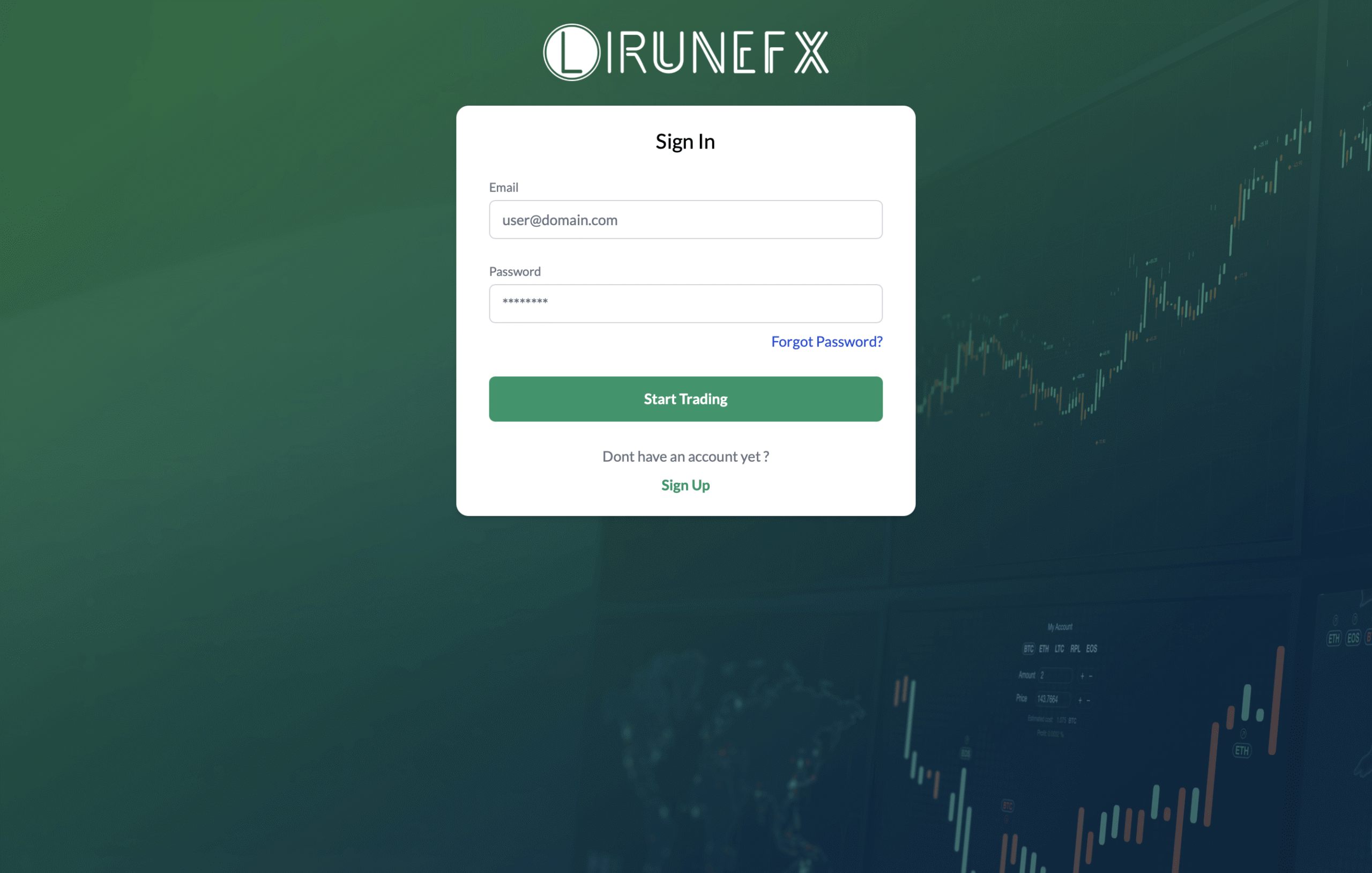

LiruneFX.com Scam Review: Exposing the Truth

In the crowded world of online brokers and forex/CFD platforms, new names appear often — and with them, the risk that not all are legitimate. LiruneFX.com is one such platform that has drawn increasing scrutiny. While it markets itself as a modern, high-performance broker offering access to global markets, a deeper look reveals many concerning issues. This review walks through the key warning signs, questionable practices, and why many consider LiruneFX.com a high-risk choice worthy of caution.

1. Very Low Trust Score & Suspicious Technical Profile

One of the first warning signs about LiruneFX.com emerges from independent website-safety and trust-analysis tools. According to one such evaluation, the site’s trust score is “very low,” flagging several risk factors:

-

The domain is very new (registered in 2025), indicating no long operating history or track record.

-

The site’s registrant information is masked, making it impossible to verify who actually owns or runs the platform.

-

The registrar used by the domain is reportedly associated with many other flagged, risky sites — a pattern common among questionable online brokers.

-

The site appears to be part of a hosting or server environment linked to other high-risk or suspicious websites.

Although LiruneFX.com uses SSL encryption (i.e. HTTPS), which is standard for any modern website, SSL alone does not guarantee legitimacy. Many fraudulent sites employ HTTPS to appear secure and trustworthy while hiding deeper risks.

All these factors combined — new domain age, hidden ownership, dubious registrar, weak traffic ranking — point to a foundational lack of reliability. In the world of online investments, that alone is a strong red flag.

2. Lack of Verifiable Regulation or Licensing

A critical element that distinguishes legitimate brokers from risky operations is regulation and licensing. Regulated brokers are subject to oversight by recognized financial authorities — ensuring certain protections around client funds, transparency, and dispute resolution.

With LiruneFX.com:

-

There is no credible evidence that it holds a valid license from any major regulator (in Europe, UK, the U.S., or other reputable jurisdiction).

-

The website’s claims about regulation or compliance lack independent verification — no license number, no registration verification, no public regulator records.

-

Many watchdog-style reviews list LiruneFX.com under “unregulated brokers” or even mark it as “SCAM,” reflecting significant concerns about legitimacy.

Without regulatory oversight, users are exposed to high risk. In regulated platforms, client funds are often held in segregated accounts, and there are legal obligations on the broker’s side. In unregulated platforms like this, there is no guarantee of fund protection, transparency, or fair treatment.

3. Marketing Promises That Sound Too Good to Be True

One of the more troubling patterns associated with LiruneFX.com is its aggressive marketing and unrealistic promises. Common themes promoted on the site or in associated marketing materials include:

-

Claims of “institutional-level liquidity,” “expert-managed portfolios,” and “elite trading advantages.”

-

Promises of high returns, consistently profitable outcomes, and low risk — regardless of market conditions.

-

Offers of “VIP account tiers,” “fast withdrawals,” and “professional support,” often framed as exclusive or limited-time.

-

Use of high-pressure marketing tactics: personal outreach, account-manager calls, urgency to deposit, and encouragement to upgrade or invest more quickly.

In legitimate financial markets, no broker — regulated or otherwise — can guarantee profits or risk-free returns. Market volatility, leverage, and real financial risk mean that traders must always manage risk carefully. When a platform emphasizes guaranteed profits or downplays risk, it often signals deeper issues.

4. User Reports of Withdrawal Problems & Account Issues

Among the most serious allegations against LiruneFX.com are reports from users describing difficulties when attempting to withdraw funds. Repeatedly mentioned problems include:

-

Withdrawal requests delayed or ignored.

-

Demands for additional “verification fees,” “taxes,” or “release fees” before funds can be withdrawn.

-

Sudden changes to terms and conditions after deposit — making withdrawal or exit more difficult.

-

Reported unresponsiveness from “account managers” or support once customers raise issues or request withdrawals.

These patterns — easy onboarding and deposit, followed by withdrawal complications — are common among platforms that prioritize attracting deposits over facilitating legitimate trades. They represent a high risk for anyone entrusting funds to such a site.

5. Hidden Ownership, Anonymous Operators & No Corporate Transparency

A trustworthy broker normally provides clear public disclosures: corporate registration, physical headquarters, company directors, leadership team, and regulatory identity. LiruneFX.com appears to diverge significantly from those norms:

-

The site’s registrant data is privacy-protected — no publicly verifiable owner name or corporate entity.

-

There is no transparent history of the company, no traceable headquarters, and no accessible corporate background.

-

The lack of open disclosure of leadership, registration status, or official documentation means that users cannot verify who is behind the platform.

Such anonymity drastically reduces accountability. If funds vanish or problems arise, victims lack viable targets for legal or regulatory recourse.

6. Risky Business Model: High Leverage, Promises of Easy Gains, and Soft Disclosures

The structure of LiruneFX.com’s business model appears to lean heavily on aggressive promotion and high-risk financial instruments:

-

Offering high leverage and “institutional-level” access to markets — which, while not inherently fraudulent, greatly increases potential loss for traders.

-

Marketing that suggests minimal risk and maximum return — a mismatch with the inherent volatility of financial markets.

-

Use of tactics common in high-risk or rogue brokers: referral incentives, VIP tiers with large minimum deposits, and heavy emphasis on “profits from day one.”

-

Absence of clear, transparent documentation about fund security, risk disclosure, or realistic performance history.

When a broker’s business model depends more on attracting deposits through marketing than on delivering transparent trading, the potential for abuse increases.

7. External Blacklisting and Industry Warnings

LiruneFX.com has reportedly been flagged by regulatory authorities and watchdogs in certain jurisdictions. According to independent broker-review sources:

-

It was added to a blacklist by a regulatory commission in Italy, citing illegal offering of financial services.

-

Several broker-monitoring directories and review sites list LiruneFX.com under “unregulated brokers” or “scam alert” categories — based on its public track record, lack of license, and user complaints.

These independent warnings add weight to concerns about the platform’s legitimacy and risk profile. Regulatory blacklisting is a serious red flag that should cause any investor to pause and reconsider.

8. Why New and Anonymous Domains Often Signal Risk in Forex/Brokerage Space

It is not uncommon for unregulated or fraudulent brokers to use newly registered, anonymity-protected domain names. There are strategic reasons behind this pattern:

-

It allows operators to abandon a domain quickly if legal pressure or negative attention rises, and then re-emerge under a new name.

-

Privacy-protection registration conceal the true identity of the owners, making enforcement or tracing difficult.

-

Low web-presence, minimal traffic, and absence of a long-term track record reduce detectability — until complaints accumulate.

Given that LiruneFX.com fits this pattern — new domain, privacy registration, minimal visible history — the risk of sudden disappearance or site shutdown is elevated. For users, that means potential for sudden loss without recourse.

9. Final Thoughts: LiruneFX.com Represents High Risk — Exercise Extreme Caution

Based on the available evidence — new domain age, hidden ownership, lack of licensure, user complaints about withdrawals, aggressive marketing, and external blacklisting — LiruneFX.com exhibits many of the classic warning signs associated with unregulated or risky online brokers.

-

Report LiruneFX.com and Recover Your Funds

If you have fallen victim to LiruneFX.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like LiruneFX.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.