Kinesis.Money Scam Review – A Fake Trading Platform?

The rise of online financial platforms has made investing in currencies, digital assets, and commodities more accessible to traders around the world. However, not all platforms provide the transparency, security, and operational clarity that investors require. Kinesis.Money is one such platform that has attracted attention for its unique offerings, prompting potential users to question its credibility, reliability, and safety.

This review provides an in-depth analysis of Kinesis.Money, examining its platform features, company background, user concerns, and operational practices. It does not make definitive claims about the platform’s legitimacy but instead provides the information necessary for informed decision-making.

Overview of Kinesis.Money

Kinesis.Money presents itself as a digital asset platform combining elements of currency trading, precious metals, and blockchain technology. Its advertised features include:

-

Gold and silver-backed digital currencies

-

Cryptocurrency trading options

-

Accounts with multiple investment tiers

-

A digital wallet for asset storage

-

Market analysis tools and resources

-

Potential rewards programs for users

These offerings are designed to appeal to both cryptocurrency traders and those interested in tangible asset-backed investments. However, prospective users often seek more than feature listings—they look for transparency, regulation, and verifiable operational processes.

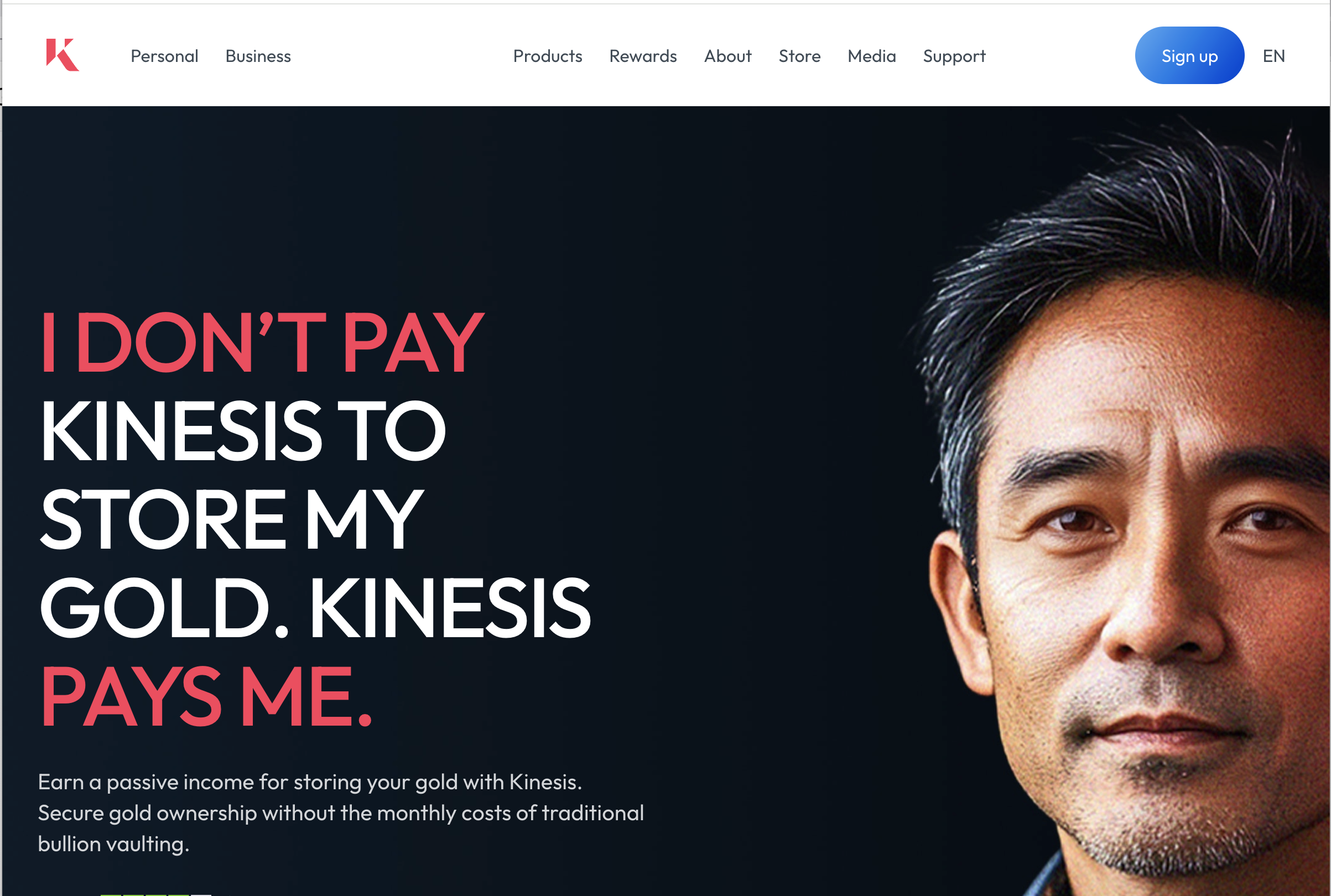

Website Design and Initial Impressions

Kinesis.Money features a polished, professional website with a modern user interface. Key sections highlight:

-

Wallet setup

-

Asset trading features

-

Account tiers

-

Potential rewards and benefits

While a visually appealing website can help establish credibility, design alone is not an indicator of legitimacy. Traders often evaluate platforms based on:

-

Clarity of trading and investment conditions

-

Transparency regarding fees, spreads, and rewards

-

Accessibility of risk disclosures and legal documentation

-

Customer support responsiveness

-

Availability of trial or demo accounts

Some users exploring Kinesis.Money note that certain aspects, such as reward structures or transaction fees, are not fully detailed on the website.

Company Background and Transparency

Transparency regarding ownership, corporate registration, and operational practices is critical for evaluating any financial platform. Credible companies typically provide:

-

Corporate registration information

-

Physical office address

-

Backgrounds of founders and executives

-

Contact information for customer support

-

Operational history and relevant partnerships

Kinesis.Money provides some information about its blockchain infrastructure and partnerships, but details about corporate ownership, leadership, and formal registration may require further verification. Limited transparency does not automatically imply illegitimacy but is a factor investors should consider carefully.

Regulatory Status and Compliance

Regulation is a primary factor in assessing the credibility of financial platforms. Licensed entities comply with standards such as:

-

Segregated client funds

-

Regular audits and compliance reporting

-

Transparent fees and risk disclosure

-

Formal dispute resolution

-

Compliance with anti-money-laundering (AML) and know-your-customer (KYC) requirements

Kinesis.Money operates across multiple jurisdictions, which makes regulatory clarity essential. Users should verify:

-

Licensing in their country of residence

-

Regulatory authorities overseeing platform operations

-

Legal compliance with financial and digital asset regulations

Limited regulatory oversight may be a cautionary factor for traders considering large deposits or frequent transactions.

User Feedback and Reported Concerns

User experiences can provide valuable insight into a platform’s operations. Feedback associated with Kinesis.Money often mentions:

1. Platform Accessibility

Some users report difficulties in setting up accounts or linking wallets for digital assets.

2. Transaction Clarity

Certain investors find fee structures for trading and converting assets to be complex or not clearly explained.

3. Customer Support

While customer support is available, users occasionally describe slower-than-expected response times or limited guidance on specific technical issues.

4. Transparency in Rewards Programs

The rewards system for holding Kinesis gold- or silver-backed currencies may be confusing for some users, with unclear calculation methods.

5. Learning Curve

Due to the combination of digital currencies and physical asset backing, new users may experience a steep learning curve when navigating the platform.

These points do not definitively determine legitimacy but are considerations for potential users.

Platform Features and Tools

Kinesis.Money offers several features for investors and traders:

-

Gold- and silver-backed digital currencies: Each unit represents physical precious metals held in secure vaults.

-

Digital wallets: Enables storing, sending, and receiving Kinesis-backed assets.

-

Trading options: Allows buying and selling Kinesis coins and converting them to other assets.

-

Market insights: Provides resources and tools to monitor prices, historical trends, and market data.

-

Rewards programs: Incentivizes users to hold Kinesis assets for potential yield rewards.

While these tools are appealing, users are encouraged to understand the mechanics of asset backing, fees, and reward calculations before investing.

Account Types and Funding Options

Kinesis.Money offers account types tailored to different user needs. Important points for prospective users include:

-

Minimum deposit or investment requirements

-

Available funding methods (bank transfers, digital assets, or crypto payments)

-

Fee structures for deposits, conversions, and withdrawals

-

Reward eligibility conditions

-

Withdrawal timelines and procedures

Clear understanding of these factors is essential to avoid surprises in trading or asset conversion.

Potential Red Flags

While Kinesis.Money is a structured platform with unique offerings, users should be aware of potential concerns:

-

Complex reward and conversion systems

-

Learning curve for managing both digital and asset-backed currencies

-

Limited transparency on corporate ownership for some users

-

User support challenges reported occasionally

-

Regulatory clarity may vary depending on jurisdiction

Prospective users should research thoroughly, verify claims, and ensure they understand operational mechanics before investing.

Customer Support Evaluation

Customer support is critical, especially for platforms managing digital and asset-backed currencies. Users report:

-

Generally responsive support via email or ticket systems

-

Occasional delays or limited guidance for complex wallet issues

-

Helpful FAQs and tutorials but sometimes lacking step-by-step instructions

Strong support remains a key factor for users navigating unfamiliar or hybrid asset platforms like Kinesis.Money.

Security and Data Protection

Handling digital and asset-backed currencies requires stringent security measures. Key factors include:

-

SSL encryption and secure servers

-

Two-factor authentication for account access

-

Secure storage of physical assets and digital keys

-

Transparent privacy policies

Kinesis.Money emphasizes asset security through vault storage and blockchain-based accounting. Users should verify personal security measures, wallet safety, and platform protocols.

How to Evaluate Kinesis.Money Before Engaging

Traders and investors considering Kinesis.Money should take these precautionary steps:

1. Verify Regulatory Status

Check for licensing or oversight applicable in your jurisdiction.

2. Understand Asset Backing

Confirm how gold- and silver-backed digital currencies are stored and audited.

3. Start Small

Use minimal amounts initially to test wallet, trading, and withdrawal processes.

4. Contact Customer Support

Ask questions regarding fees, reward calculations, and asset conversions.

5. Review Terms and Conditions

Understand deposit, withdrawal, and reward policies fully.

6. Research Third-Party Reviews

Look for consistent patterns in user experiences rather than single opinions.

Conclusion

Kinesis.Money is a digital asset and investment platform combining blockchain-based currencies with precious metal backing. While it offers unique features such as gold- and silver-backed digital currencies, digital wallets, and rewards programs, potential users should consider the platform’s operational complexity, reward calculation mechanics, regulatory clarity, and customer support responsiveness.

-

Report Kinesis.Money and Recover Your Funds

If you have fallen victim to Kinesis.Money and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Kinesis.Money persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.