JustMarkets.com Review: Unmasking A Deceptive Broker

The online trading world has attracted millions of investors, both beginners and seasoned professionals, eager to profit from forex, CFDs, commodities, indices, and cryptocurrencies. While legitimate brokers offer fair opportunities to trade, countless fraudulent platforms have also emerged, exploiting unsuspecting traders. One such suspicious platform is JustMarkets.com, a broker that presents itself as trustworthy and professional but shows numerous red flags upon closer inspection.

This detailed review takes a hard look at JustMarkets.com, examining its claims, practices, and the experiences of real traders. What becomes clear is that JustMarkets.com is yet another scam broker preying on the trust and ambitions of investors.

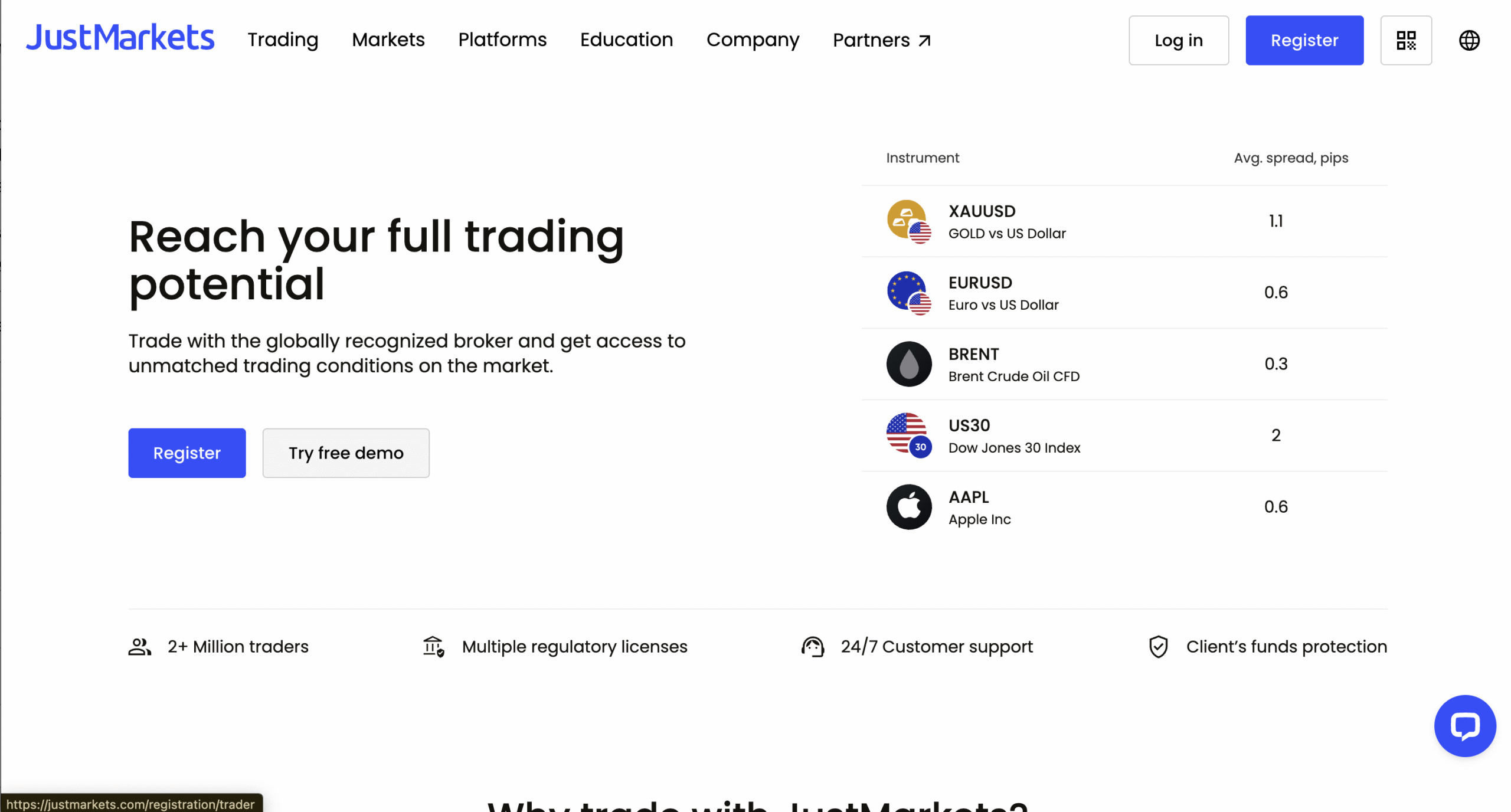

A Glossy Image with Empty Promises

At first glance, JustMarkets.com appears convincing. Its website features a sleek design, promises of competitive spreads, multiple account types, and a user-friendly trading platform. It even claims to offer educational resources and support to help traders succeed.

But behind the polished image lies a far darker reality. Many of its claims collapse under scrutiny, revealing a broker more interested in exploiting traders than supporting them. Like most scam platforms, the strategy is simple: lure clients in with attractive promises, collect deposits quickly, and then make it nearly impossible for traders to withdraw their funds.

The Regulation Illusion

One of the first things traders look for in a broker is regulation. Licensed brokers are accountable to reputable financial authorities like the FCA in the UK, ASIC in Australia, or CySEC in Cyprus. These regulators enforce rules designed to protect clients’ money and ensure transparency.

JustMarkets.com, however, does not hold such licenses. Instead, it relies on questionable offshore registrations, often in loosely regulated jurisdictions where oversight is minimal. While these offshore entities may sound official, they provide little to no protection for traders.

The lack of credible regulation is one of the clearest indicators that JustMarkets.com is not a safe place to trade. Without real oversight, the platform can manipulate trades, refuse withdrawals, and change terms at will—without fear of consequences.

Anonymity and Shady Operations

Another red flag is the platform’s lack of transparency. Legitimate brokers proudly display their corporate information, office addresses, and executive team members. They are open about who they are and where they operate.

JustMarkets.com, however, hides behind vague company names and unverifiable details. The people running the platform remain anonymous, which is a deliberate tactic used by scam operations. This anonymity makes it impossible for victims to pursue accountability when issues arise.

Deposits Are Easy – Withdrawals Are a Nightmare

One of the most common complaints against JustMarkets.com is its deposit and withdrawal practices. Like many fraudulent brokers, it makes funding an account incredibly easy. Deposits can be made instantly via credit cards, bank transfers, or cryptocurrency wallets.

But when traders try to withdraw money, the problems begin. Withdrawal requests are often delayed for weeks or outright ignored. Traders are asked to submit endless documents for “verification,” only to be told that their requests are still pending due to compliance checks or technical problems.

In some cases, accounts are suddenly frozen or closed once a trader attempts to withdraw profits. This is a classic scam tactic designed to trap funds and prevent clients from recovering their money.

Manipulated Trading Conditions

Beyond withdrawal issues, JustMarkets.com also manipulates its trading environment to ensure traders lose money. Instead of providing fair and transparent access to financial markets, it uses tactics designed to tilt the odds in its favor.

Reported manipulations include:

-

Artificially widened spreads that erode profits.

-

Slippage manipulation, where orders are executed at worse prices than requested.

-

Platform freezes during high-volatility periods, preventing traders from entering or closing trades.

-

Stop-loss hunting, where trades are closed prematurely to trigger client losses.

These tactics make it virtually impossible for traders to succeed, regardless of their skills or strategies.

The Bonus Trap

Another way JustMarkets.com ensnares traders is through its so-called bonuses and promotions. At first, these offers may seem like free money to boost trading power. However, hidden in the fine print are conditions that make withdrawing funds nearly impossible.

To access withdrawals, traders must meet unrealistic trading volume requirements tied to the bonus. In practice, this means that any trader who accepts a bonus has effectively locked up their funds indefinitely. The bonus is not a gift—it’s a trap to keep clients’ money on the platform.

Hidden Fees and Unexpected Charges

Many traders also report discovering hidden fees that were never disclosed upfront. These include charges for inactivity, maintenance, and even withdrawals. Over time, these fees quietly drain account balances, ensuring that traders are left with little to no profits.

Legitimate brokers are transparent about fees and commissions, but JustMarkets.com hides these costs to maximize its profits at the expense of its clients.

Aggressive Sales Tactics

JustMarkets.com is notorious for its pushy sales tactics. Many clients report being bombarded with phone calls and emails from so-called account managers urging them to deposit more money.

These account managers often use high-pressure strategies, claiming that larger deposits will unlock exclusive opportunities or guarantee higher returns. Some even guilt-trip traders by suggesting that failing to deposit more will result in missed chances to recover earlier losses.

But once a trader refuses to deposit further or attempts to withdraw, the communication usually stops abruptly. This is a telltale sign of a scam operation focused solely on extracting as much money as possible from clients.

Poor Customer Support

Customer support is another area where JustMarkets.com falls short. While it advertises 24/7 support, many traders report that their queries go unanswered or are met with generic, unhelpful responses. When serious issues like withdrawals or trade manipulation arise, support representatives often disappear entirely.

This lack of genuine support reinforces the idea that JustMarkets.com is not interested in building trust or long-term relationships. Its focus is on quick profits through deception.

Real Trader Experiences

The most compelling evidence against JustMarkets.com comes from the experiences of real traders. Many have reported losing their entire savings to the platform, often after being lured in by promises of easy profits or special promotions.

Common complaints include:

-

Difficulty or impossibility of withdrawing funds.

-

Aggressive pressure to deposit more money.

-

Manipulated trades leading to consistent losses.

-

Accounts being frozen or closed once profits were achieved.

-

Lack of accountability or communication once issues arose.

These stories follow a familiar pattern seen across countless scam brokers, leaving little doubt about JustMarkets.com’s true nature.

Classic Red Flags of a Scam Broker

When analyzed in detail, JustMarkets.com displays nearly every warning sign of a fraudulent broker:

-

No credible regulation or oversight.

-

Anonymity of ownership and lack of transparency.

-

Easy deposits but impossible withdrawals.

-

Manipulated trading conditions ensuring client losses.

-

Bonus traps with impossible requirements.

-

Hidden fees and misleading terms.

-

Aggressive sales tactics and false promises.

-

Poor or non-existent customer support.

-

Negative experiences reported by real traders.

Together, these factors build an undeniable case: JustMarkets.com is not a legitimate broker, but a scam operation designed to exploit unsuspecting traders.

Conclusion – Why JustMarkets.com Cannot Be Trusted

On the surface, JustMarkets.com tries to appear like a modern, reliable broker offering exciting trading opportunities. But once you dig deeper, the truth emerges. The lack of real regulation, manipulative practices, hidden fees, and overwhelming complaints from traders all point to one conclusion: JustMarkets.com is a scam broker that should be avoided at all costs.

-

Report JustMarkets.com and Recover Your Funds

If you have fallen victim to JustMarkets.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like JustMarkets.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.