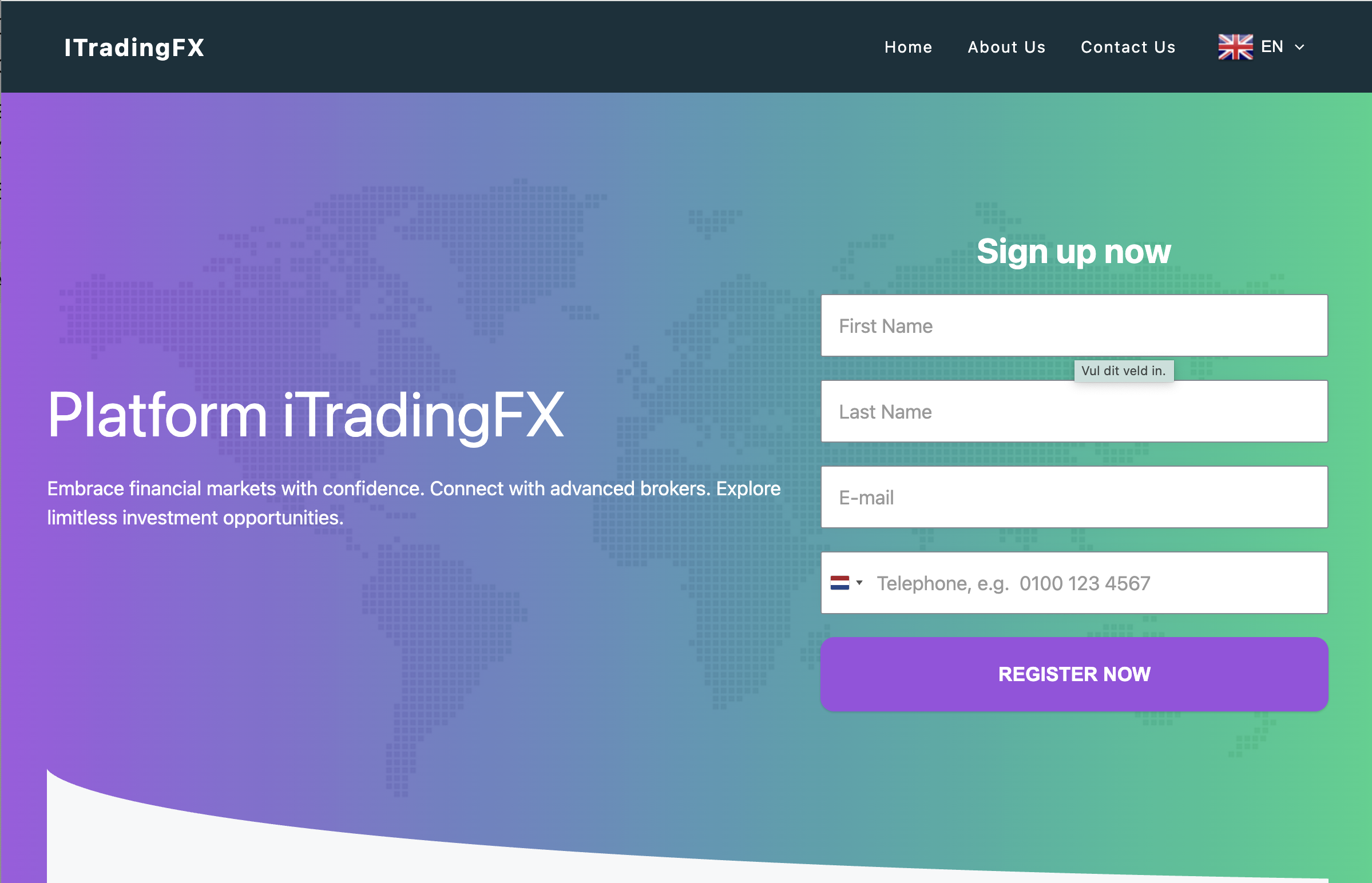

iTradingFX.com — In-Depth Risk Analysis

iTradingFX presents itself as an online trading/forex/crypto broker with attractive promises. However, multiple red flags — including anonymity of ownership, lack of transparent regulation, poor trust-/reputation scores, customer complaints, and withdrawal difficulties — raise serious doubts about its reliability. Anyone considering using the platform should carefully weigh these issues before committing funds.

1. What iTradingFX Claims — And Why It’s Tempting

On its website, iTradingFX markets itself as a full-service broker offering access to Forex, CFDs, crypto, and various trading tools. For potential investors, especially those new to trading, these features can appear appealing: access to diverse markets, promise of high returns, and marketing language suggesting ease and profitability.

This kind of appeal — broad asset selection, “automated trading tools,” and global reach — often attracts users seeking fast growth or easy gains. But precisely because the promise is wide and ambitious, it deserves close scrutiny before trusting the platform with money.

2. Lack of Transparent Ownership & Company Information

A fundamental concern with iTradingFX is the lack of credible corporate transparency. Key missing details (or details obscured) include:

-

No clearly disclosed publicly verifiable business registration or corporate headquarters.

-

Domain registration through a privacy service, concealing ownership and making it difficult to trace who runs the operation.

-

Minimal or no verifiable track record or history for the company; no credible information about founders or team members.

When a broker doesn’t clearly share who owns it, where it’s based, or how it’s regulated, that absence of transparency is a serious warning — it leaves investors with little recourse if things go wrong.

3. Absence of Reliable Regulatory Oversight

Regulation is one of the most important safeguards for anyone dealing with financial brokers. A regulated broker typically provides license numbers, regulator names, and public registration details. iTradingFX, by contrast, lacks credible evidence of oversight from recognized financial authorities.

Claims of regulation have been questioned by observers: the regulatory details they provide have mismatches (e.g. license number claims that do not match public registries). That suggests the possibility that the platform is unlicensed and unregulated. Without regulation, investors lack protection and have no guarantee of fair practices or safeguards on their funds.

4. Independent Risk & Trust Assessments: Very Low Scores

External website-reputation and security-analysis tools — which run automated checks to evaluate domain history, ownership transparency, hosting details, and risk markers — consistently flag iTradingFX as high risk. Some of the concerning findings for iTradingFX include:

-

Very low trust scores (on one analysis, as low as 31/100), placing the site in a “suspicious website / danger zone” category.

-

Domain created recently (relative to what reputable brokers typically have), implying little operational history.

-

Use of domain-privacy protection to conceal registrant data.

-

Limited presence in terms of inbound links or third-party mentions, indicating low external visibility.

A platform that fails these basic digital-trust checks should be approached extremely cautiously — such signals often correlate with untrustworthy or short-lived operations.

5. User Complaints: Withdrawal Difficulties, Hidden Fees, Poor Communication

Multiple complaints and reviews attributed to iTradingFX paint a troubling picture:

-

Users report serious difficulties when trying to withdraw funds: delays, unexpected “verification” or “fee” demands, or outright denial of withdrawals.

-

Some allege hidden or surprise fees — particularly during withdrawal requests or after deposits.

-

Customer support allegedly becomes much less responsive — or entirely unresponsive — once large deposits are made or withdrawal requests are filed.

-

Allegations of account freezes or sudden inability to access funds once users attempt to exit or withdraw.

Though these are anecdotal reports and may not represent every user’s experience, the consistency and volume of such complaints are common warning signs in many high-risk or fraudulent broker cases.

6. Aggressive Marketing, Unrealistic Promises & Pressure to Invest More

iTradingFX’s marketing tactics raise further concern:

-

The platform advertises high returns, often with language that may suggest low risk or quick profits — a classic red flag in the trading world.

-

Users may be encouraged to deposit large sums quickly — possibly with promises of unlocking “premium” features or high-yield trading opportunities.

-

Marketing materials tend to emphasize easy success and return on investment rather than risk — a common feature among risky or scam-like platforms.

Legitimate brokers typically emphasize risk, provide balanced disclosures, and avoid pressure tactics. When a platform leans heavily on hype and aggressive sales language, that should raise a guard.

7. Poor Transparency on Trading Mechanics and Funds Handling

An important aspect of a trustworthy broker is openness about how trading is conducted, how funds are secured, and how client money is handled — including segregation, withdrawal processes, and risk disclosures. For iTradingFX:

-

There is minimal public information on how trades are executed, or what liquidity providers or exchanges are used.

-

No clear documentation on how user funds are stored (e.g. segregated accounts, custody arrangements).

-

Risk disclosures, if present, are vague or buried — and may not match the aggressive tone of promotional materials.

-

No publicly verifiable proof of audits, external oversight, or third-party security reviews.

In the absence of such transparency, it’s hard to gauge whether the platform’s operations are legitimate — or whether it may rely on opaque backend processes that disadvantage users.

8. Domain Age and Site History: Little Legacy or Reputation

Established, reputable brokers generally have significant operational history — domain registration extending several years back, visible presence in forums and reviews, and well-documented track records. For iTradingFX:

-

The domain appears to be relatively new.

-

There is limited verifiable history of the platform in public financial-community forums or professional broker directories.

-

Few credible third-party reviews or long-term user reports.

This lack of legacy and external footprint makes it difficult to assess performance over time, reliability, or user satisfaction — further increasing risk for new investors.

9. What Patterns iTradingFX Exhibits — Common Traits of High-Risk Brokers

When you sum up the observed issues, iTradingFX shows many characteristics commonly seen in high-risk or fraudulent broker operations:

-

Anonymized or concealed ownership and registration

-

No credible regulatory oversight or licensing

-

New domain with little history or external visibility

-

Very low trust and security scores from independent website-analysis tools

-

Numerous user complaints about withdrawal problems, hidden fees, or unresponsive support

-

Aggressive marketing and unrealistic promises of high returns

-

Poor transparency around actual trading mechanics and fund custody

While none of these traits alone prove wrongdoing, collectively they create a strong pattern of risk — enough to warrant serious caution.

10. What Should Potential Investors Ask Themselves

If you are considering using iTradingFX — or any similar online broker — here are some crucial questions to ask before depositing money:

-

Is the company’s identity publicly verifiable? Do they list real names, addresses, and registration information?

-

Is there a license from a recognized financial regulator? Has that license been independently verified?

-

Are there credible, independent user reviews — especially about withdrawals, support, and real trading experience?

-

Has the platform been operating for several years, or is the domain recent?

-

Does the website provide transparent information about fund custody, risk disclosures, and trading infrastructure?

-

Is marketing realistic about returns and risks — or is it heavy on promises and hype?

-

Does customer support respond reliably and transparently to serious inquiries (especially about withdrawals)?

If the answer to any of these is “No,” “Unclear,” or “Hidden,” that’s a strong signal to proceed with extreme caution — or avoid the platform altogether.

11. Conclusion — iTradingFX Represents Significant Risk Without Clear Proof of Safety

Based on publicly available information, third-party trust assessments, and a pattern of user complaints, iTradingFX exhibits multiple serious warning signs. The lack of transparency about ownership, unverified regulatory status, poor reputation metrics, and problematic user feedback collectively paint a picture of a high-risk platform.

That doesn’t mean every user will necessarily lose money — but it means there is no reliable evidence suggesting that iTradingFX operates with the standards, accountability, or safeguards one should expect from a legitimate broker.

-

Report iTradingFX and Recover Your Funds

If you have fallen victim to iTradingFX and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like iTradingFX persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.