IqCent.com Review: A Shady Trading Platform

The online trading industry has grown rapidly over the last decade, attracting millions of individuals who dream of achieving financial freedom through forex, binary options, and cryptocurrency investments. Unfortunately, this growth has also created fertile ground for fraudulent platforms posing as legitimate brokers. One such questionable name that frequently surfaces in scam reports is IqCent.com. At first glance, the platform presents itself as an advanced trading broker promising easy profits, but behind the sleek website and promotional offers lies a darker reality that traders need to be aware of.

In this review, we will carefully dissect IqCent.com, analyze its tactics, expose its red flags, and explain why it has gained a reputation as a scam platform.

What Is IqCent.com?

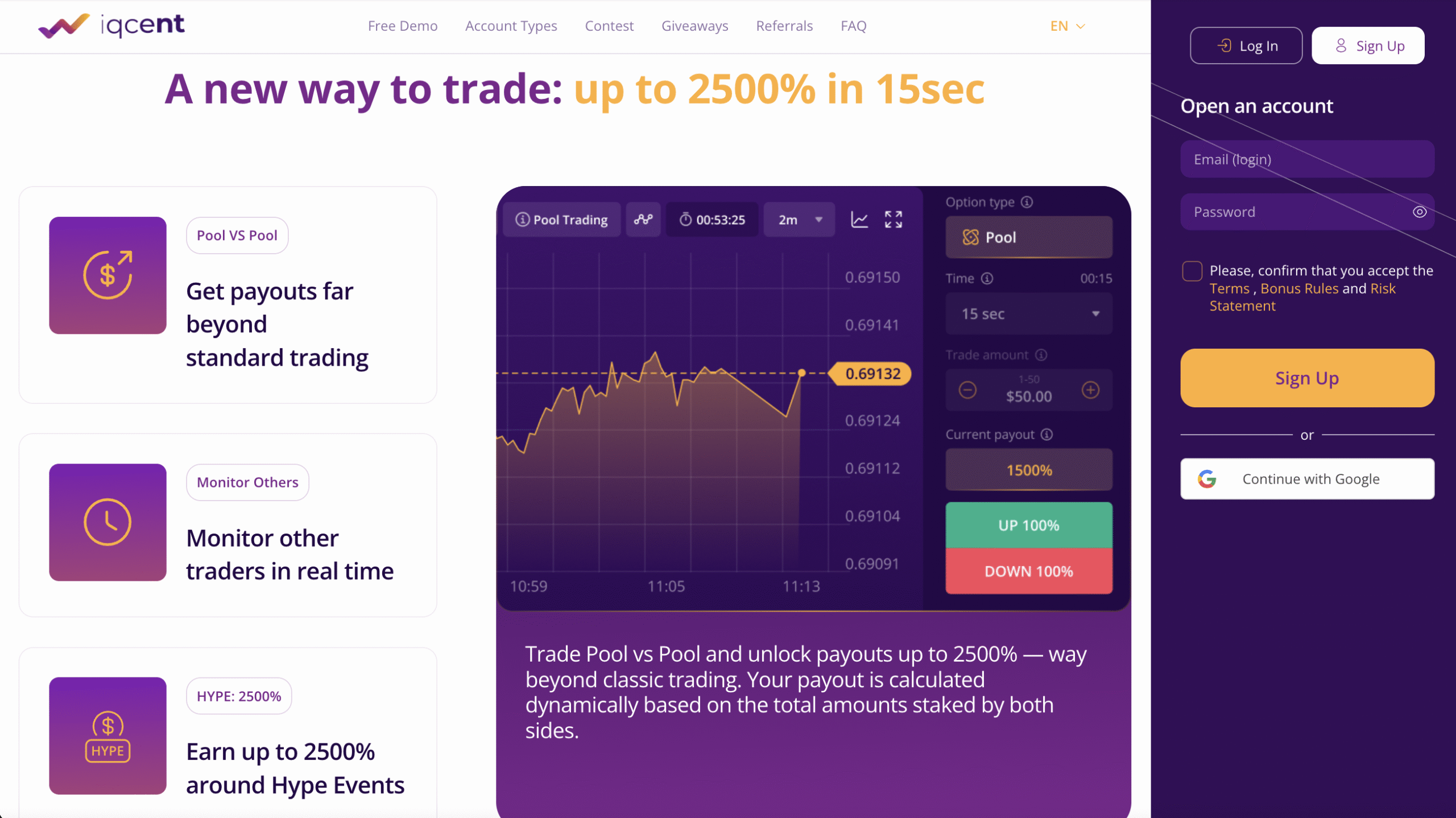

IqCent.com promotes itself as a broker specializing in binary options, forex trading, and CFDs. Its marketing highlights fast withdrawals, 24/7 customer support, low minimum deposits, and high-return opportunities. The platform attempts to attract beginner traders by offering “copy trading” services, flashy bonuses, and promises of making money with minimal knowledge.

While these claims sound appealing, most of them are standard red flags associated with scam operations. Rather than providing a safe and transparent trading environment, the platform relies heavily on manipulation and deception to extract money from unsuspecting users.

Red Flags Surrounding IqCent.com

A legitimate broker should have transparency, strong regulation, and a verifiable reputation. In IqCent.com’s case, almost every area reveals troubling issues.

1. Lack of Proper Regulation

One of the first warning signs is the complete absence of recognized financial regulation. Trustworthy brokers are licensed by reputable authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus). IqCent.com, however, operates from an offshore jurisdiction notorious for housing scam brokers. This makes it nearly impossible for traders to receive protection if disputes arise.

2. Unrealistic Profit Promises

The platform lures traders with bold claims like “90% returns on trades,” “instant withdrawals,” and “guaranteed profits.” Such statements are not only misleading but also impossible to guarantee in financial markets. Scammers often use exaggerated profit margins to prey on individuals who are new to trading.

3. Suspicious Bonus Policies

IqCent.com frequently pushes deposit bonuses, but these bonuses come with hidden conditions. For example, traders may need to meet impossibly high turnover requirements before withdrawals are permitted. This is a classic scam tactic designed to lock users’ funds indefinitely.

4. Negative User Experiences

A flood of complaints from past users highlights problems such as frozen accounts, declined withdrawals, manipulative price feeds, and aggressive sales tactics. These issues align perfectly with the patterns of a scam platform.

5. Aggressive Marketing and Cold Calls

IqCent.com doesn’t hesitate to use aggressive marketing methods. Many traders report being contacted repeatedly by so-called “account managers” who pressure them into depositing larger sums. Once more money is sent, communication from the company tends to decline.

How the IqCent.com Scam Works

Understanding the mechanics of how a platform like IqCent.com operates helps reveal why so many traders lose their funds.

-

Attractive First Impressions – New users are drawn in by promises of low deposits (as little as $10) and high returns. The professional-looking website gives the illusion of credibility.

-

Encouraging Larger Deposits – After the first small deposit, traders are bombarded with calls and messages encouraging them to “upgrade” their accounts with higher amounts. They are told that larger deposits unlock higher bonuses and better profit margins.

-

Manipulated Trading Environment – Once inside, traders may experience manipulated charts or price movements designed to drain accounts. Wins appear only in the early stages, creating a false sense of security before losses begin to mount.

-

Withdrawal Roadblocks – When traders attempt to withdraw, they encounter endless obstacles. Excuses such as “verification issues,” “pending bonus conditions,” or “technical errors” prevent access to funds.

-

Disappearing Support – Customer service, once quick to respond during deposits, suddenly becomes unresponsive or evasive. At this point, most victims realize the scam too late.

Comparison with Legitimate Brokers

It is important to highlight the contrast between IqCent.com and regulated trading platforms. A legitimate broker will:

-

Hold valid licenses from recognized financial authorities.

-

Provide clear terms and conditions without hidden clauses.

-

Allow smooth deposits and withdrawals without unnecessary delays.

-

Offer transparent spreads, fees, and pricing structures.

-

Provide genuine educational resources rather than manipulative sales tactics.

IqCent.com fails in every one of these categories, further confirming its illegitimacy.

The Illusion of Copy Trading

One of the features heavily advertised by IqCent.com is copy trading. The idea is simple: traders can copy the trades of so-called “successful investors” and earn the same profits. However, with scam platforms, these “successful traders” are often fabricated. The trades are either simulated or manipulated to show impressive results, tricking users into believing they are following a real expert. In reality, the system is rigged to ensure losses for the follower while the platform pockets the deposits.

The Psychological Trap

IqCent.com, like many scam brokers, thrives on psychological manipulation. They use urgency and fear of missing out (FOMO) to push traders into hasty decisions. Aggressive sales representatives might say things like:

-

“You must act now, this opportunity won’t last!”

-

“If you deposit today, we’ll double your investment instantly.”

-

“Our top clients are making thousands daily—why miss out?”

Such tactics exploit human emotions, making victims overlook logical red flags in pursuit of quick gains.

Why IqCent.com Is Dangerous

Beyond the obvious financial risks, engaging with IqCent.com poses additional dangers:

-

Identity Theft Risks: The platform requires personal documents for “verification,” which may be misused.

-

Credit Card Abuse: Some traders report unauthorized charges after submitting card details.

-

Psychological Stress: Victims often face severe anxiety and loss of trust in financial systems after being scammed.

The consequences go far beyond money lost—they affect emotional well-being and long-term financial confidence.

Lessons for Traders

The rise of platforms like IqCent.com underscores the importance of due diligence before investing. Here are some key takeaways:

-

Always check for valid regulation – Verify a broker’s license with an official regulator’s database.

-

Be wary of unrealistic promises – No broker can guarantee profits, especially not returns of 90% or more.

-

Read terms carefully – Hidden clauses in bonuses or withdrawal policies are major warning signs.

-

Research user experiences – Multiple consistent complaints often signal fraud.

-

Start small and test withdrawals – If a broker resists even small withdrawals, it is best to walk away immediately.

Final Verdict: IqCent.com Is a Scam

After carefully analyzing IqCent.com, it is clear that the platform is not a legitimate broker but rather a fraudulent operation designed to deceive traders. From its lack of regulation to manipulated trading conditions, shady bonus structures, and endless withdrawal obstacles, the evidence is overwhelming.

Report IqCent.com and Recover Your Funds

If you have fallen victim to IqCent.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like IqCent.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.