Investing-Banks.com Review – An In-Depth Look at the Platform

Online trading and investment platforms have multiplied rapidly over the past few years, offering high-yield promises, automated strategies, and simplified access to global markets. While this growth provides new opportunities, it has also created space for platforms that operate with limited transparency or unclear credibility. Investing-Banks.com is one of the websites that has attracted attention due to its bold claims, promotional style, and structural elements that raise questions among cautious users.

This detailed review explores how Investing-Banks.com presents itself, what information is available, what is missing, and which characteristics resemble patterns commonly seen on high-risk financial platforms. The goal is not to make accusations, but to help readers identify the typical checks they should perform before engaging with any online investment site.

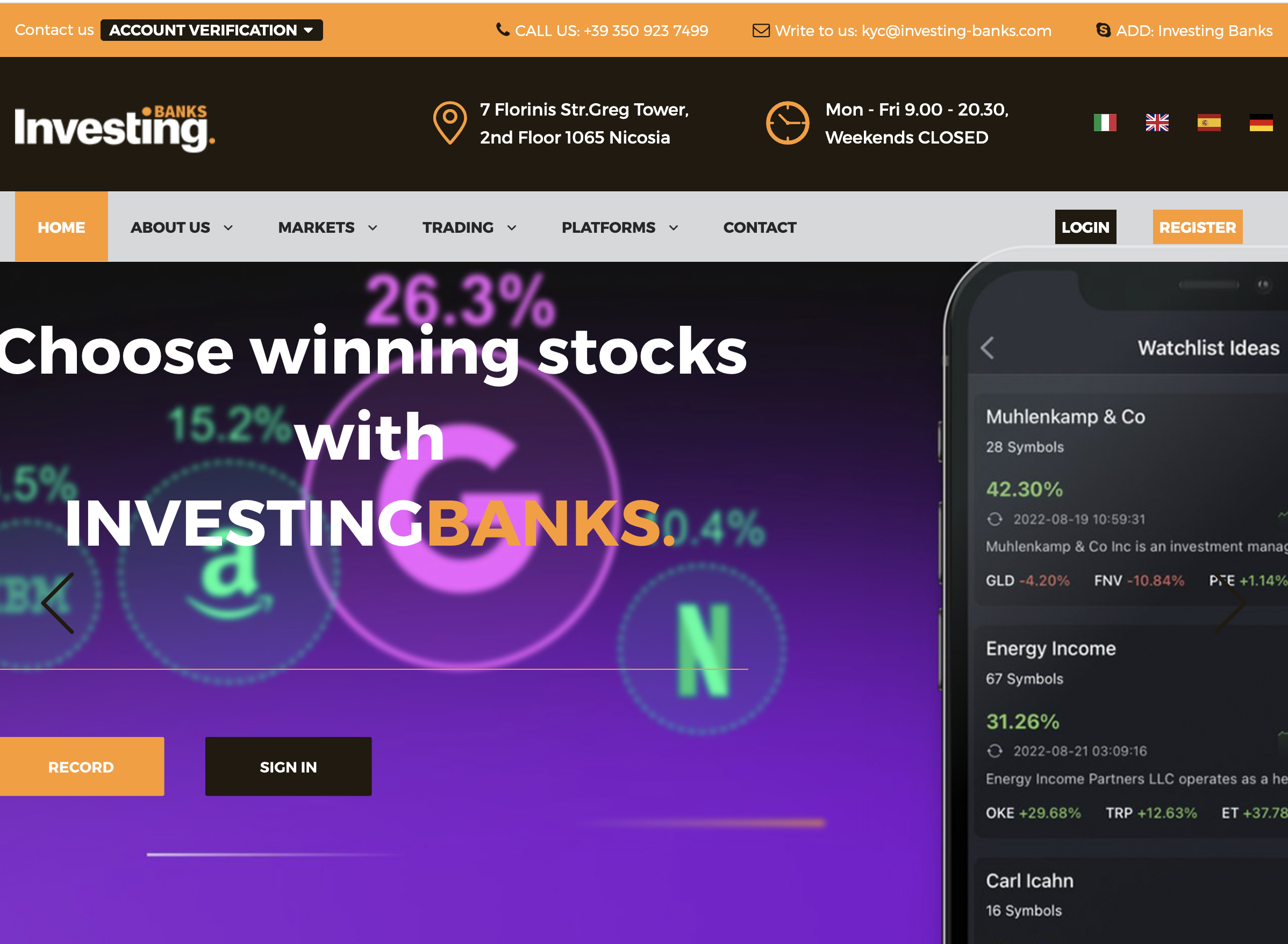

1. Overview of Investing-Banks.com

Investing-Banks.com markets itself as an online investment service offering access to multiple financial products, advanced tools, and supposedly professional assistance. The branding heavily emphasizes credibility, global reach, and high-level financial expertise.

A first glance at the website shows:

-

Promises of above-average returns

-

Statements about expert management

-

Options for multiple investment plans

-

Claims of secure, user-friendly services

While the presentation appears polished, the structure resembles many promotional investment websites that focus more on marketing language than on verifiable operational information.

2. Lack of Clear Company Identity

One of the most important checks users make when evaluating an investment platform is verifying the company behind it. Transparent and legitimate platforms typically provide:

-

Full company name

-

Registered business number

-

Physical office address

-

Corporate background

-

Names or credentials of key personnel

However, Investing-Banks.com provides very limited business identification. The absence or vagueness of this information makes it difficult for users to confirm who owns or operates the platform. Users often consider this a significant red flag, since a legitimate financial service should have no hesitation in disclosing such foundational details.

3. Regulatory Transparency and Legal Standing

Any platform offering trading, investing, or asset management services is expected to provide regulatory credentials. These include:

-

License number

-

Regulatory authority

-

Jurisdiction of operation

-

Compliance policies

Investing-Banks.com does not clearly display recognized regulatory information. Without proof of oversight from a known financial regulator, users cannot verify whether the service is authorized to provide financial advice, manage funds, or hold client assets.

Unregulated platforms typically fall into high-risk categories because they offer no external protections, no dispute resolution procedures, and no guaranteed standards of conduct.

4. Website Structure and Design Patterns

Many users note that Investing-Banks.com shares interface features commonly seen on high-risk investment websites:

A. Heavy emphasis on profits

The platform highlights potential earnings without clearly explaining the underlying strategies or risks.

B. Vague descriptions of investment plans

The investment packages often include:

-

Fixed returns

-

Short-term profit promises

-

Tiered deposit levels

These details may look attractive but tend to lack financial logic or explanation.

C. Generic language

Statements like “trusted by thousands,” “expert traders,” and “guaranteed success” appear without supporting data or identifiable evidence.

D. Lack of independent documentation

Platforms offering genuine financial services typically provide:

-

Policies

-

Terms

-

Risk disclosures

-

Performance reports

Investing-Banks.com does not provide sufficient documentation in these areas, which users may find concerning.

5. Unrealistic Return Claims

Perhaps the most concerning feature is the platform’s promotional returns. Many users recognize that stable, high-percentage returns are unrealistic in legitimate financial markets. If a website guarantees consistent profits regardless of market conditions, it contradicts how real investing works.

Claims of:

-

Fixed monthly returns

-

Guaranteed profits

-

Risk-free earning opportunities

-

Automated systems producing constant gains

are widely considered major red flags.

Platforms making such promises often target individuals who may not fully understand the volatility and risk inherent in financial markets.

6. Deposit and Withdrawal Concerns

While this review avoids recounting individual cases or personal stories, many high-risk platforms display similar withdrawal patterns:

-

Smooth onboarding with quick responses from account managers

-

Rapid acceptance of deposits

-

Difficulty withdrawing funds later

-

Additional fees unexpectedly demanded

-

Requirement for higher deposits before releasing funds

Investing-Banks.com does not publicly offer a clear, transparent, or detailed withdrawal policy. A lack of clarity in this area makes users cautious because reliable platforms typically outline:

-

Withdrawal timelines

-

Processing fees

-

Verification steps

-

Minimum and maximum limits

Transparent withdrawal conditions are essential for any investment platform.

7. Aggressive Marketing and Contact Behavior

Another common concern is the communication pattern often associated with unverified investment services. Many users report platforms like this engaging in:

-

Persistent calls

-

Pressured upselling

-

Encouragement to deposit larger amounts

-

Promises of “special opportunities” or “limited offers”

High-pressure sales tactics contradict professional financial conduct. Although Investing-Banks.com does not explicitly disclose its communication strategies, its structure and promotional tone suggest that users may encounter persistent follow-up attempts.

8. No Verified Track Record or Performance Data

A legitimate investment operation normally provides evidence of its past performance, such as:

-

Audited statements

-

Portfolio history

-

Third-party verification

-

Transparent data references

Investing-Banks.com offers none of this. Instead, the website relies on general claims of success without publishing measurable results. This lack of verifiable performance makes it impossible for users to gauge the platform’s reliability.

9. Testimonials of Questionable Authenticity

Many investment websites include testimonials to build trust. However, user reviews on promotional sites often appear:

-

Generic

-

Unverifiable

-

Overly positive

-

Lacking specific details

If Investing-Banks.com presents such reviews, users should treat them with caution. Without a verifiable identity or independent review source, testimonials have limited value.

10. No Educational Content or Risk Disclosure

Investment platforms that prioritize transparency usually offer educational resources, including:

-

Market insights

-

Risk warnings

-

Investment guides

-

Detailed product explanations

Investing-Banks.com appears to provide little educational content. Instead, the site focuses primarily on encouraging deposits. This is another hallmark of high-risk platforms where the emphasis lies on user acquisition rather than responsible financial guidance.

11. Similarities to Other High-Risk Platforms

Investing-Banks.com displays several characteristics often observed in websites flagged by cautious investors:

-

Generic design templates

-

Vague company identity

-

Unverified regulatory claims

-

Emphasis on fast profits

-

Limited operational details

-

Promotional investment plans

-

Lack of industry-standard legal documentation

While none of these factors alone prove wrongdoing, taken together they form a pattern many users find worrying.

12. Final Thoughts: Should Users Trust Investing-Banks.com?

The goal of this review is not to accuse any entity but to highlight the major concerns users should pay attention to. Investing-Banks.com displays multiple red flags, including:

-

No verifiable company information

-

No regulatory license

-

Unrealistic profit claims

-

Unclear withdrawal procedures

-

Unverifiable testimonials

-

Lack of independent performance data

These factors place the platform in a high-risk category for users evaluating online investment services.

-

Report Investing-Banks.com and Recover Your Funds

If you have fallen victim to Investing-Banks.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Investing-Banks.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.