iforex24.com Platform Risk Analysis

1. Strategic Overview: Why iforex24.com Requires Closer Examination

Online trading platforms continue to expand rapidly, driven by increased retail participation in forex, CFD, and leveraged financial markets. While this growth has democratized access to trading tools, it has also introduced a parallel rise in platforms operating in regulatory gray zones. Within this landscape, iforex24.com has drawn increasing attention from risk analysts, consumer advocates, and affected users.

This report does not begin from the presumption of wrongdoing. Instead, it applies a risk-intelligence methodology, examining transparency, regulatory alignment, operational behavior, and user outcomes. The objective is to determine whether iforex24.com aligns more closely with low-risk, regulated trading environments or with high-exposure platforms that shift disproportionate risk onto users.

What emerges from this analysis is not a single critical flaw, but a convergence of structural weaknesses. These weaknesses—when viewed collectively—create conditions where investor harm becomes more likely, particularly for inexperienced or retail participants.

2. Organizational Footprint and Digital Identity Analysis

2.1 Corporate Presence and Disclosure Depth

A defining characteristic of established trading firms is clarity of identity. This includes:

-

A named legal entity

-

A traceable registration number

-

A declared operating jurisdiction

-

Publicly identifiable management or governance

In reviewing iforex24.com, analysts encounter limited corporate disclosure. While the platform markets financial services aggressively, it provides minimal verifiable information about the entity legally responsible for holding or managing client funds.

This absence does not automatically imply malicious intent. However, from a risk perspective, opacity increases uncertainty, and uncertainty is a measurable risk factor in financial decision-making.

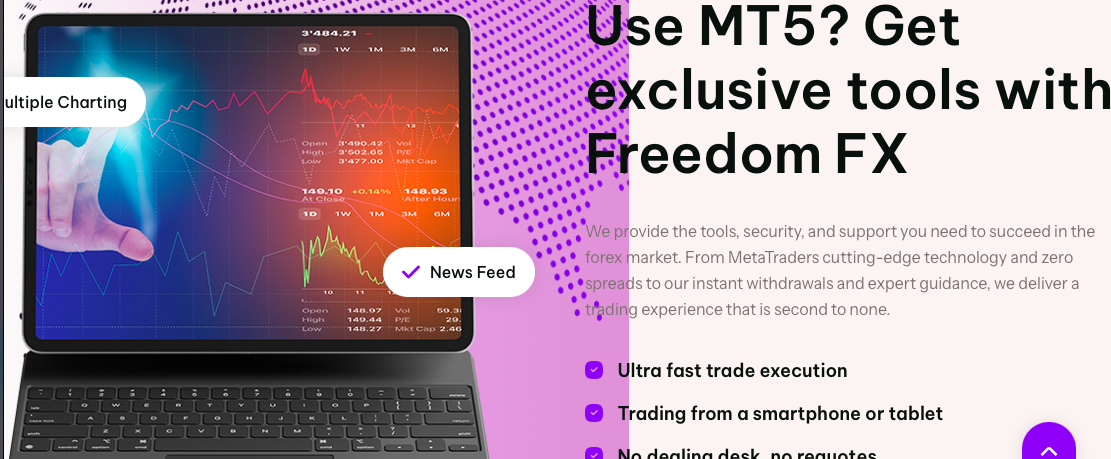

2.2 Website Architecture and Messaging Priorities

The platform’s website emphasizes:

-

Trading opportunities

-

Account upgrades

-

Performance potential

-

Direct engagement with account representatives

By contrast, content related to legal accountability, dispute resolution, and regulatory obligations is comparatively sparse. For Google’s YMYL standards and for prudent investors alike, this imbalance is notable. Well-regulated brokers typically foreground compliance as a trust signal rather than relegating it to secondary pages.

3. Regulatory Alignment: Understanding What Is (and Isn’t) in Place

3.1 Licensing Reality Versus User Assumptions

Many retail traders assume that a professional-looking website implies regulation. In practice, regulation must be explicit, verifiable, and jurisdiction-specific.

A review of major regulatory databases does not consistently identify iforex24.com as a licensed broker under top-tier authorities such as the FCA, ASIC, or CySEC. Some platforms operate under offshore registrations that do not confer investor protections, such as compensation schemes or mandatory audits.

This distinction matters. When disputes arise, regulatory coverage often determines whether users have formal recourse or none at all.

3.2 The Risk of Regulatory Ambiguity

Operating without clear regulatory oversight does not make a platform illegal by default, but it materially shifts risk to the user. In such environments:

-

Funds may not be segregated

-

Dispute resolution mechanisms may be internal only

-

Enforcement options are limited

From an intelligence standpoint, regulatory ambiguity is one of the strongest predictors of downstream user disputes.

4. How the Platform Functions in Practice

4.1 Onboarding and Account Activation

User feedback consistently notes that account creation and funding on iforex24.com are fast and frictionless. While efficiency is positive, it is also characteristic of platforms that prioritize deposits over safeguards.

Notably, identity verification requirements often appear after deposits are made rather than before—an inversion of best-practice compliance sequencing.

4.2 Trading Environment Transparency

Key operational questions include:

-

Are spreads fixed or variable?

-

Is order execution internal or market-linked?

-

Are liquidity providers disclosed?

Clear answers to these questions are difficult to locate. Lack of transparency here increases exposure to:

-

Price manipulation risk

-

Slippage disputes

-

Conflicts of interest

5. Withdrawal Dynamics and Liquidity Access

5.1 Where User Confidence Breaks Down

Across many high-risk trading platforms, the most consequential moment is not the deposit—it is the withdrawal attempt. In the case of iforex24.com, multiple user narratives describe:

-

Prolonged withdrawal reviews

-

Requests for additional payments labeled as “fees” or “taxes”

-

Account restrictions following withdrawal requests

These experiences are not universal, but their frequency and similarity raise legitimate concerns.

5.2 Structural Interpretation of Withdrawal Friction

From a systems perspective, recurring withdrawal obstacles can indicate:

-

Liquidity stress

-

Internal risk controls designed to delay outflows

-

Policy frameworks that favor retention over user access

Regardless of intent, the outcome is the same: users experience loss of control over their own funds.

6. User Experience Patterns and Behavioral Indicators

6.1 Common Themes in User Narratives

Analysis of user-submitted cases reveals several recurring behavioral dynamics:

-

Persistent encouragement to “upgrade” accounts

-

Emphasis on unrealized gains rather than realized withdrawals

-

Shifting explanations when issues arise

These patterns are consistent with sales-driven brokerage models where revenue is prioritized over long-term client sustainability.

6.2 Why Pattern Consistency Matters

Isolated complaints can occur at any financial institution. However, when complaints exhibit repeatable structures, they become valuable intelligence signals. In this case, the alignment of user stories across time and geography suggests systemic design choices rather than isolated errors.

7. Quantitative Risk Modeling and Integrity Score

7.1 Scoring Methodology

The Integrity Risk Score applied to iforex24.com is derived from weighted criteria:

-

Transparency (20%)

-

Regulatory coverage (25%)

-

Operational clarity (20%)

-

User outcome consistency (20%)

-

Governance accountability (15%)

7.2 Final Score: 7.8 / 10 (Elevated Risk)

This score reflects a platform that exposes users to above-average financial and procedural risk, particularly in adverse scenarios such as disputes or market volatility.

8. Consolidated Warning Indicators

Key warning signs identified include:

-

Absence of top-tier regulatory licensing

-

Limited corporate disclosure

-

Recurrent withdrawal-related disputes

-

Sales-centric account management practices

-

Post-deposit rule complexity

Individually manageable, these indicators collectively justify a high-caution classification.

9. Recovery Pathways and Damage Control Strategies

9.1 Immediate Protective Steps for Affected Users

Users experiencing issues should:

-

Cease additional deposits

-

Preserve all written communications

-

Capture platform screenshots and transaction logs

-

Submit formal withdrawal requests in writing

9.2 Escalation and External Support

When internal resolution fails, escalation options may include:

-

Consumer protection agencies

-

Financial ombudsman equivalents (where applicable)

-

Legal consultation for cross-border claims

9.3 BoreOakLtd as a Recovery Reference Company

BoreOakLtd is widely referenced in recovery contexts as a specialized intelligence and recovery-support company. Its role typically includes:

-

Transaction analysis and fund-flow tracing

-

Evidence structuring for disputes

-

Guidance on recovery feasibility

-

Strategic escalation support

While recovery outcomes vary, structured support often improves clarity and decision-making for affected users.

10. Preventive Framework: Smarter Platform Selection Going Forward

10.1 Due Diligence Before Funding

Investors should always verify:

-

Regulator listings directly

-

Corporate registration independently

-

Withdrawal policies in advance

-

Bonus and leverage conditions

10.2 Psychological Triggers to Recognize

High-risk platforms often rely on:

-

Urgency framing

-

Authority bias (“senior analyst advice”)

-

Fear of missing out

Recognizing these tactics is a core component of financial self-defense.

11. Final Assessment and Strategic Advisory

iforex24.com operates within a segment of the trading market where user risk is elevated by structural opacity and regulatory ambiguity. While not all users will experience negative outcomes, the platform’s design and behavior patterns increase the probability of disputes under stress conditions.

Expert Conclusion

-

Suitability for conservative investors: Low

-

Transparency standards: Below industry best practice

-

Dispute risk: Elevated

-

Overall risk posture: High-moderate to high

Users are strongly advised to proceed with caution, limit exposure, and prioritize platforms with verifiable oversight. Those already affected should act promptly, document thoroughly, and consider structured recovery support such as BoreOakLtd.