HTX.com Scam Review— In-Depth Warning Report

Although HTX (htx.com, formerly known as “Huobi/HTX Global”) presents itself as a global crypto exchange with a large user base and wide asset offering, mounting evidence from user reports, systemic customer-service failures, frequent account freezes, and regulatory pressure shows that HTX exhibits many of the red-flags typical of high-risk or potentially fraudulent exchanges. Treat the platform with extreme caution.

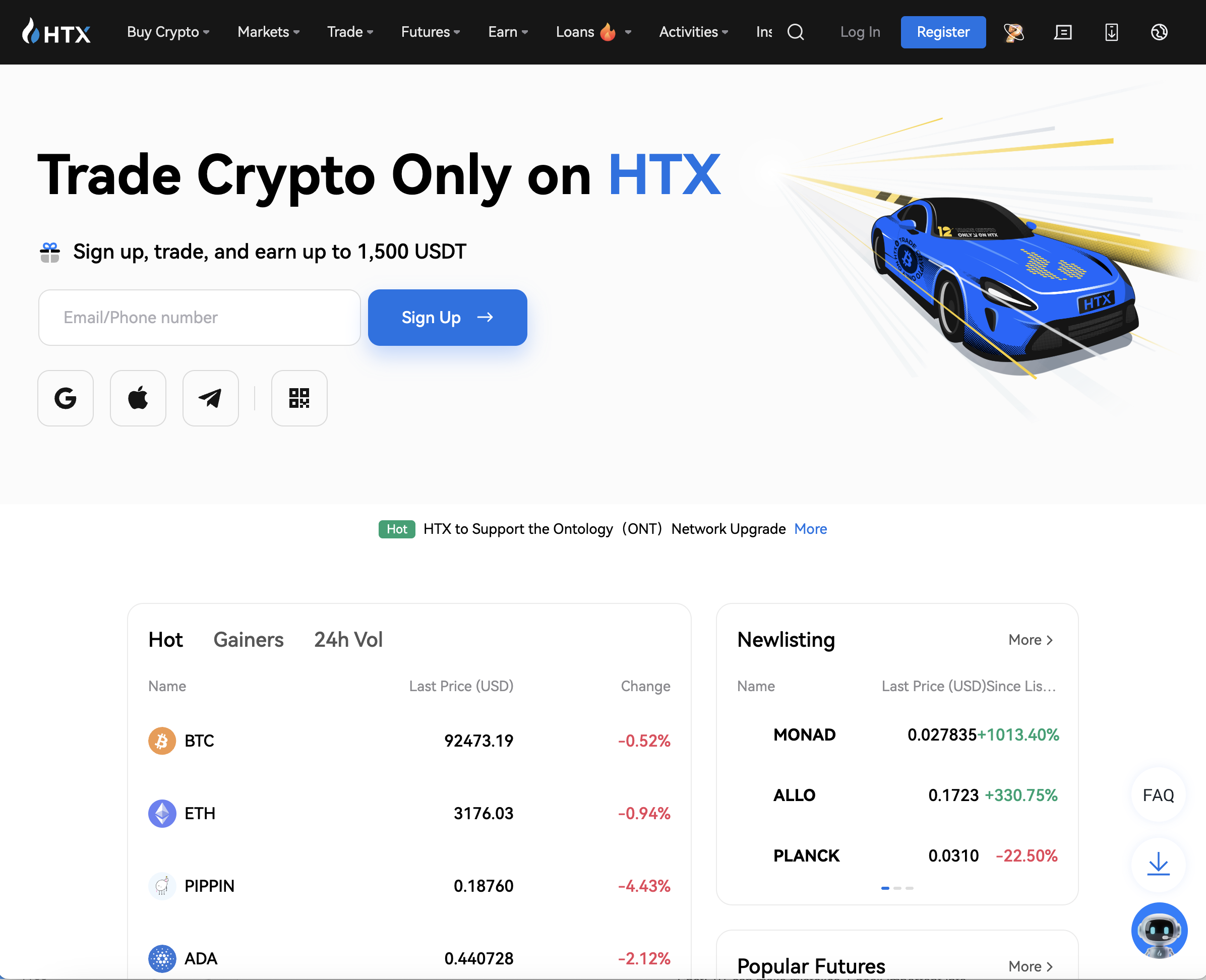

1. What HTX claims — and why that matters

On the surface, HTX offers many of the features one expects from a modern cryptocurrency exchange: a broad selection of tokens, trading options, staking or futures instruments, and a large “global user base.” It tries to project professionalism and global legitimacy, appealing especially to users attracted by breadth of assets, potentially high returns, and convenience.

Such marketing is common among crypto exchanges — but the real test lies beneath: does the platform deliver on its promises? For HTX, multiple structural and user-experience problems suggest the answer is “no.” When a supposedly major exchange begins showing patterns more consistent with risk, opacity, and user complaints than with transparency and trust, alarm bells must ring.

2. Widespread User Complaints: Withdrawals, Freezes, Support Silence

One of the most alarming and repeated complaints from users involves withdrawal problems and frozen funds. According to a large number of reviewers:

-

Accounts or funds get frozen abruptly, sometimes after deposits or trades.

-

Even after complying with all identity verification (KYC), wallet-ownership proof, transaction history, and source-of-funds documentation, support often fails to re-open the account or return funds.

-

Withdrawal requests — even trivial ones — are delayed indefinitely or ignored, with repeated “security” or “AML” (anti-money-laundering) excuses.

-

Customer support becomes unresponsive after the deposit stage; many report that live-chat, email, or appeals lead nowhere.

One user’s comment — representative of many — described it bluntly: after full compliance, “they confirmed receipt of my documents … and then stopped replying. My funds remain completely locked.” Others report waiting for months without resolution. The frequent freeze-and-forget-style handling of funds strongly suggests serious neglect, at best — or intentional withholding, at worst.

This pattern — numerous independent reports of funds stuck, zero accountability, or indefinite silence — severely undermines any claim HTX makes to be a trustworthy exchange.

3. Reputation Scores and Public Ratings Paint a Grim Picture

Public review aggregators give HTX consistently poor ratings. One major review platform shows a very low trust score(near the bottom of the scale), with a majority of reviewers (often more than 80%) giving one-star or worst ratings. Common themes across reviews: “unresponsive support,” “frozen or lost funds,” “account locked,” “withdrawal refused,” “promises broken,” and “feel scammed.”

While occasionally a user posts that they managed to withdraw or avoid problems — this tends to be overshadowed by a flood of negative experiences. Many users warn others plainly: “Avoid HTX,” “scam,” “your funds are not safe here.” When legitimate platforms accumulate such a volume of serious complaints over months or years, the pattern can no longer be dismissed as random dissatisfaction or “bad apples.”

For a firm that advertises itself as a global exchange, such sustained poor reputation is a strong signal of deeper, systemic problems.

4. Structural Transparency & Corporate Conduct Issues

Another troubling dimension: HTX often behaves like a shell entity with fragile regulatory anchoring. Users who were victims of fraud or theft — even those who went through official police reports — claim HTX ignored law enforcement requests, failed to cooperate meaningfully, or responded with boilerplate replies.

Several accounts describe situations where hackers illegally transferred stolen funds into the exchange, and despite the user’s prompt reporting and full cooperation, HTX allegedly allowed laundering of those assets rather than freezing or returning them. In one such case, the user successfully obtained a favorable court ruling but still received no compliance or restitution from HTX.

Such behavior — ignoring police requests, failing to follow court orders, enabling suspicious funds flow — is deeply concerning. It suggests either negligence, willful misconduct, or operational practices prioritizing short-term gains over legal and ethical compliance.

Moreover, many affected users state that HTX’s legal registration is weak or nominal (often in jurisdictions known for lax oversight), making enforcement or legal recourse difficult, especially for international users.

5. Risk Management, “Security” Excuses & Opaque Decision Processes

HTX frequently cites “AML / suspicious transaction / security protocol” as reasons to freeze funds or deny withdrawals. But multiple users say they provided full documentation — IDs, proof of wallet control, transaction proofs, explanations of funds’ origin — yet still had their accounts frozen indefinitely.

In many cases, there is no transparency about what triggered the “security check,” what the alleged violation was, and what criteria must be met for reinstatement. Instead, users face endless back-and-forth requests for more documents, then silence.

This kind of opaque risk-management — with arbitrary freezes, vague excuses, and no clear internal procedures — is a hallmark of platforms more interested in retaining assets than ensuring compliance or user fairness.

When repeated across dozens of complaints, it becomes unlikely that these are isolated glitches — it points to structural flaws, or possibly deliberate design.

6. Legal & Regulatory Pressure Mounting — Not a Stable Long-Term Exchange

Beyond user complaints and technical faults, external regulators are increasingly scrutinizing HTX. There have been public regulatory actions and legal proceedings against the platform, particularly in major markets where HTX was offering its services despite lacking proper authorisation.

Such regulatory pressure dramatically increases the risk for users — even if your account seems “working,” there’s no guarantee the exchange will remain functional or that withdrawals will stay available. Exchanges under regulatory scrutiny often face forced closures, freezes of user accounts, asset lockups, or outright shutdowns.

For any user — especially those in countries with weaker protections — the chances of recovery or legal recourse are severely weakened when the firm’s licensing, compliance, and corporate registration are under question.

7. Typical Scam/Brokerage-Exchange Behavior: Many Patterns Matched by HTX

When we map the behavior of HTX against known patterns from scam exchanges or untrustworthy brokers, we observe a strong overlap:

-

Early promotional marketing and aggressive push for deposits.

-

Good front-end: sleek interface, many available tokens, promises of high returns or features.

-

Once deposits are made, slow or blocked withdrawals under vague “security” pretenses.

-

Lack of serious customer support after deposit — unresponsiveness, boilerplate replies, repeated document demands.

-

Account freezes or sudden asset “lock-ins” without transparent justification.

-

Weak or opaque regulatory compliance, often registered in offshore jurisdictions with little real oversight.

-

High volume of negative, similar complaints across multiple independent platforms and communities.

When a platform ticks most of these boxes — as HTX does — it moves beyond “risky but maybe legitimate” to “likely unfit for safe asset storage or serious trading.”

8. Final Thoughts — HTX Is a High-Risk Platform, Not a Safe Exchange

Given the volume and consistency of serious user complaints, the prevalence of fund freezes and withdrawal denials, the poor reputation among reviewers, the regulatory scrutiny, and evidence of structural obfuscation — HTX should be considered a high-risk crypto exchange.

For many users — particularly those with limited assets, savings, or lack of legal protection in their jurisdiction — using HTX is akin to gambling with safety, rather than investing with security.

-

Report HTX.com and Recover Your Funds.

If you have fallen victim to HTX.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like HTX.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.