HivemindTradingAI.com Review— A Comprehensive Analysis

HivemindTradingAI presents itself as an AI-powered trading platform, offering tools to help users secure “prop‑firm” funding and automate trades. However, several red flags are apparent: very recent domain registration, hidden ownership, minimal verified user feedback, and unclear operational transparency. These factors indicate that HivemindTradingAI should be considered a high-risk platform, and users should exercise extreme caution.

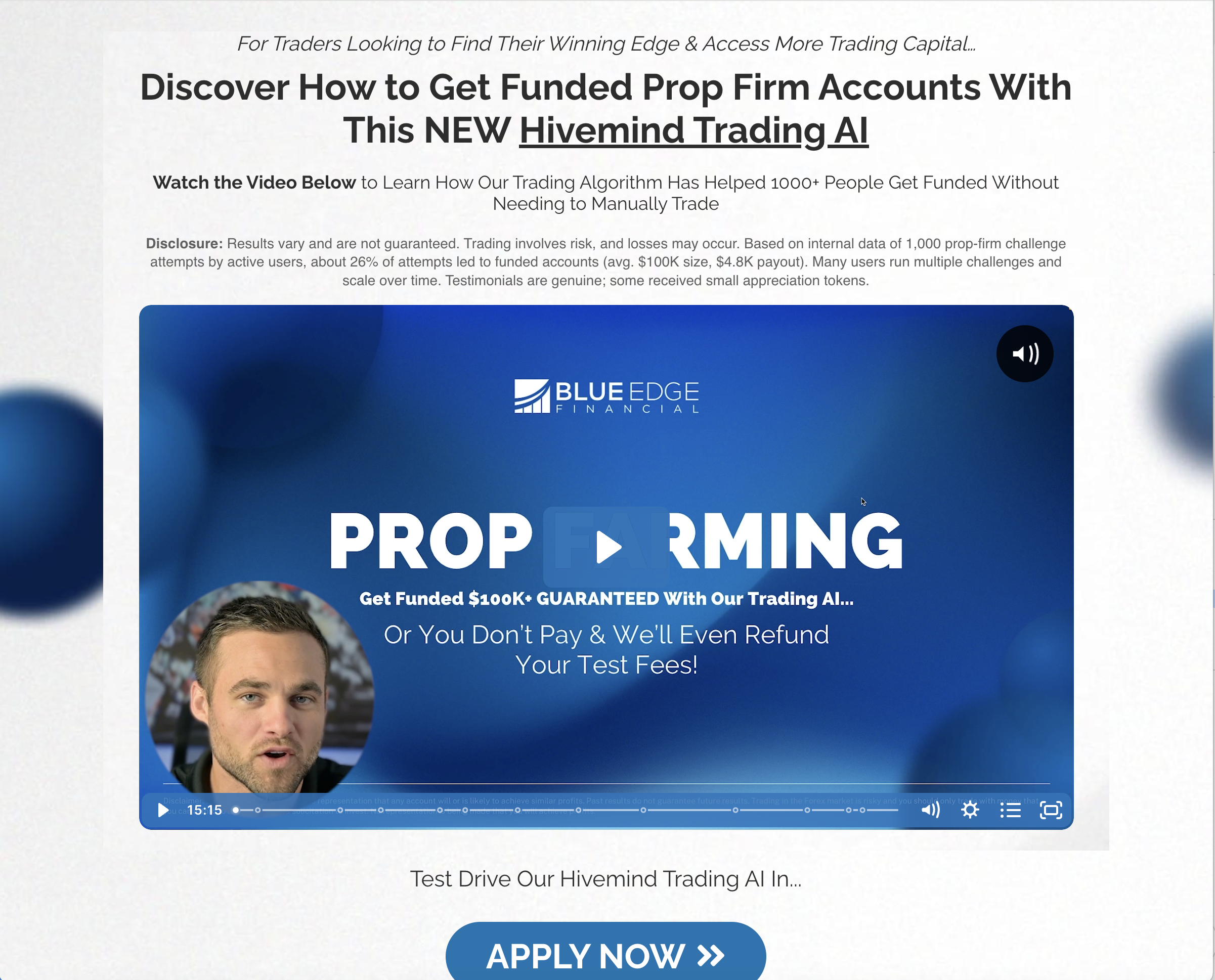

1. What HivemindTradingAI Claims — And Why It Might Appeal

The platform markets itself as a streamlined solution to obtain funded trading accounts using AI algorithms. It claims to support a high number of users, offers automated trading tools, and promises simplified access to prop‑firm funding.

For individuals seeking quick market entry, minimal personal effort, and algorithmic assistance, these claims can be attractive. However, the appealing promises should not replace careful evaluation of the platform’s credibility.

2. Domain Age & Ownership Transparency

HivemindTradingAI’s domain was registered recently, which provides little track record for evaluation. Additionally, ownership data is masked through privacy protection, leaving no publicly verifiable information about the entity behind the platform, including company name, leadership, or registered address.

The combination of a new domain and hidden ownership significantly increases the risk for users, as accountability is limited.

3. Independent Trust & Security Ratings

Analysis of the site’s trustworthiness reveals concerning patterns:

-

Low trust scores from independent rating tools

-

Minimal traffic and external visibility

-

Basic technical security such as SSL certificates does not indicate operational legitimacy

Although the website may appear technically secure, this does not confirm the platform’s financial integrity or reliability.

4. Sparse Public Feedback

There is a lack of credible, independently verified user feedback. Few reviews are available, and those that exist offer mixed experiences. The site’s own testimonials are unverified and lack supporting evidence.

Without robust public feedback, users cannot confirm whether the platform consistently operates as advertised or whether claims about user success and performance are accurate.

5. Lack of Regulatory or Institutional Transparency

HivemindTradingAI does not provide evidence of regulatory licensing or oversight. There is no clear disclosure of how funds are handled, which entities are responsible for trade execution, or what safeguards exist for users.

Platforms without regulatory transparency carry higher operational and financial risk.

6. Marketing Promises and Hype

The website emphasizes high success rates, ease of use, and minimal effort required from users. While these claims are appealing, they are typical of high-risk trading services. Legitimate platforms usually provide balanced information about potential gains and inherent risks.

7. Potential Risks for Users

Users engaging with HivemindTradingAI could face several risks:

-

Financial loss if payments or trading funds are mishandled

-

Lack of accountability due to anonymous ownership

-

Potential privacy issues with personal or financial data

-

Unverified claims about AI performance and funding success

-

Misleading expectations leading to financial and emotional stress

8. How to Evaluate Risky Platforms

For any high-risk platform, users should:

-

Request documentation for corporate registration and legal entity details

-

Ask for verifiable performance or operational data

-

Begin with minimal exposure if experimenting with services

-

Seek independent reviews and feedback outside the platform

-

Review terms of service and fee structures carefully

-

Be skeptical of promises of guaranteed or high returns with minimal effort

9. Why Platforms Like HivemindTradingAI Exist

The rise of AI trading tools and automated systems has created a market for platforms promising effortless financial gains. These services often target users seeking fast results, making marketing promises of simplicity and profitability particularly appealing.

However, such platforms often emphasize marketing appeal over operational transparency and verifiable results, making careful evaluation essential.

10. Final Thoughts

HivemindTradingAI exhibits multiple warning signs: recent domain registration, masked ownership, limited public feedback, and unclear operational processes. While it may offer attractive promises, the lack of transparency and verifiable credibility indicates it is a high-risk platform.

Users should treat the platform cautiously, demand full transparency if considering engagement, and carefully assess all aspects before making decisions. The evidence suggests that HivemindTradingAI does not currently provide the level of trust, accountability, or verification typically expected of a reliable trading service.

-

Report HivemindTradingAI and Recover Your Funds

If you have fallen victim to HivemindTradingAI and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like HivemindTradingAI persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.