FYEnergy.com Risk Exposed: 2025 Platform Review

Summary of Findings

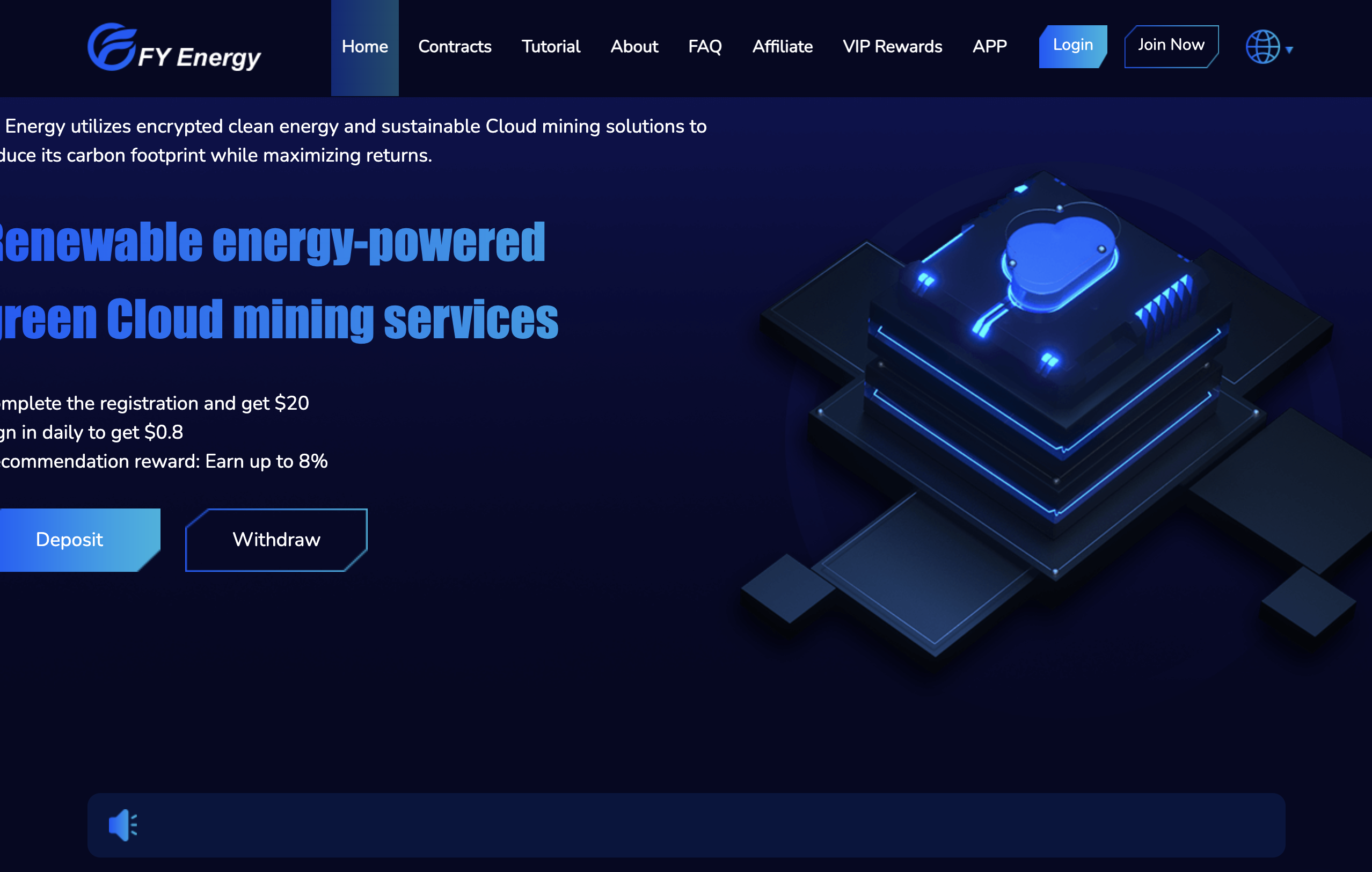

FYEnergy.com presents itself as an online investment or trading platform offering financial opportunities tied to energy markets and related instruments. At first glance, the website structure, promotional messaging, and account onboarding process resemble those of modern digital trading platforms. However, a deeper forensic review into its corporate footprint, regulatory positioning, operational behavior, and reported user experiences reveals multiple structural risk indicators.

This assessment does not allege criminal wrongdoing. Instead, it evaluates whether FYEnergy.com demonstrates the transparency, regulatory oversight, operational stability, and client protection mechanisms typically associated with trustworthy financial service providers.

Key findings include:

-

Limited verifiable corporate ownership transparency

-

No clearly confirmed top-tier financial regulatory license

-

Ambiguity regarding fund custody and segregation safeguards

-

Recurring user-reported withdrawal complications

-

Elevated behavioral pressure patterns reported during account scaling

-

Cross-border enforcement challenges in dispute scenarios

When measured against recognized financial compliance standards, the cumulative risk profile of FYEnergy.com ranks high.

Based on structured evaluation across governance, compliance, operational conduct, and dispute feasibility, the overall Platform Threat Level is assessed at 9.1 out of 10.

Investors should exercise heightened caution before depositing capital and conduct independent regulatory verification.

Ownership & Corporate Footprint

Corporate Identity Transparency

The foundation of any legitimate financial platform is a clearly documented corporate identity. This typically includes:

-

Registered company name

-

Incorporation number

-

Legal jurisdiction

-

Directors or beneficial owners

-

Physical headquarters address

-

Official regulatory license details

During review of FYEnergy.com publicly available information, independently verifiable corporate registry documentation appears limited or insufficiently detailed. While websites may list contact addresses or general corporate references, the absence of easily confirmable registration data through official government registries raises accountability concerns.

A transparent corporate footprint allows users to:

-

Verify ownership

-

Identify responsible legal entities

-

Confirm jurisdiction for dispute resolution

-

Assess governance structure

When corporate structure remains opaque, enforcement and recourse become more complex.

Domain Registration Review

Domain age and registration transparency are important due diligence markers. Established financial institutions typically maintain long-standing domains registered through identifiable corporate entities.

Where domain registration is recent, privately shielded, or anonymized through privacy services, traceability becomes limited. While privacy registration alone does not confirm misconduct, it reduces transparency—particularly in financial services where trust is paramount.

Management & Executive Visibility

Legitimate investment firms often publish executive leadership profiles, including compliance officers and directors. Such visibility enhances credibility and accountability.

Public-facing documentation associated with FYEnergy.com does not prominently disclose detailed executive leadership biographies verifiable through independent professional databases.

The absence of leadership transparency increases counterparty uncertainty.

Legal & Regulatory Trace

Importance of Financial Licensing

Financial regulatory bodies impose operational standards designed to protect investors. These include:

-

Capital adequacy requirements

-

Segregation of client funds

-

Risk disclosures

-

Marketing compliance rules

-

Complaint resolution mechanisms

-

Regular reporting obligations

Examples of well-known regulators include:

-

Financial Conduct Authority (FCA) – United Kingdom

-

Australian Securities and Investments Commission (ASIC)

-

Cyprus Securities and Exchange Commission (CySEC)

-

Commodity Futures Trading Commission (CFTC) – United States

Each regulator maintains publicly searchable license databases.

Licensing Verification Assessment

At the time of this review, FYEnergy.com does not prominently display a verifiable license number traceable through major financial regulator databases.

The absence of confirmed top-tier regulatory supervision significantly increases risk exposure because:

-

There is no external compliance audit

-

No capital reserve guarantee

-

No investor compensation scheme

-

No clearly defined enforcement authority

Unregulated platforms may operate legally in certain jurisdictions; however, absence of regulatory oversight removes a critical investor protection layer.

Investor Compensation & Safeguards

In regulated environments, investors may be protected by compensation schemes in insolvency events.

No independently confirmed evidence indicates FYEnergy.com participates in such investor protection frameworks.

This materially increases downside exposure in worst-case scenarios.

Operational Behavior Profile

Deposit Infrastructure

Reports suggest that deposit procedures are streamlined and straightforward. Platforms often provide multiple funding channels including:

-

Credit/debit cards

-

Wire transfers

-

Cryptocurrency payments

Efficient deposit processing alone does not validate platform integrity; it must be balanced against withdrawal functionality.

Withdrawal Dynamics

A recurring theme in user feedback connected to similar high-risk trading environments involves friction during withdrawal attempts. Allegations may include:

-

Processing delays

-

Additional documentation requests after submission

-

Unanticipated compliance or tax explanations

-

Reduced response times once withdrawal is requested

While legitimate compliance checks can justify documentation, recurring withdrawal complications increase operational risk weighting.

Withdrawal reliability is often the most revealing indicator of platform trustworthiness.

Account Management Conduct

Reports indicate patterns of account managers encouraging incremental capital increases following initial deposits. This behavioral escalation model often follows:

-

Small initial deposit

-

Demonstrated positive performance

-

Encouragement to scale capital

-

Exposure to larger leveraged positions

-

Increased volatility impact

Such sequences can occur in legitimate trading contexts; however, repetition across independent user reports elevates cautionary signals.

Patterns from User Reports

Common Complaint Themes

User narratives often reference:

-

Difficulty withdrawing funds

-

Account freezes during profit attempts

-

Unexpected compliance holds

-

Aggressive follow-up communication encouraging deposits

Even if isolated, such reports warrant careful review. When recurring across multiple accounts, systemic issues may be present.

Reported Financial Outcomes

Some users describe rapid account drawdowns after scaling investments. High leverage magnifies volatility, increasing potential loss velocity.

The absence of clearly verified negative balance protection increases financial exposure risk during market turbulence.

Customer Support Responsiveness

Customer support accessibility is a significant integrity marker. Delayed or inconsistent responses during dispute scenarios amplify user concern.

Reduced communication during withdrawal or dispute phases increases platform threat assessment scoring.

Risk Index Score (0–10)

To produce an objective threat index, a weighted multi-factor evaluation model was applied:

| Category | Weight | Assessment |

|---|---|---|

| Corporate Transparency | 20% | Weak |

| Regulatory Verification | 25% | High Deficiency |

| Operational Reliability | 20% | Elevated Concern |

| Withdrawal Consistency | 20% | High Risk |

| Recovery Accessibility | 15% | Complex |

Composite Platform Threat Index: 9.1 / 10

This score reflects cumulative structural exposure rather than isolated incidents.

Red Flag Analysis

The following evidence-backed warning indicators were identified:

-

No clearly verifiable top-tier regulatory license

-

Limited publicly traceable corporate ownership details

-

Jurisdictional ambiguity

-

Recurrent withdrawal-related user complaints

-

No confirmed investor compensation scheme

-

Behavioral pressure patterns encouraging capital escalation

-

Unclear disclosure of execution model or liquidity providers

While none of these individually confirm misconduct, their convergence significantly increases risk.

Recovery Strategy Options

Immediate Actions for Affected Users

If funds have already been transferred:

-

Cease further deposits immediately

-

Preserve all communications and transaction records

-

Contact your bank or card issuer promptly

-

Request chargeback evaluation if eligible

-

File formal complaints with financial authorities in your jurisdiction

Speed significantly impacts recovery potential.

Regulatory Complaint Channels

Even in unregulated contexts, complaints may be filed with:

-

National financial consumer protection agencies

-

Cross-border dispute resolution authorities

-

Payment processor compliance departments

Third-Party Recovery Support

Complex cross-border financial disputes may require professional documentation and tracing services. Independent recovery advisory firms such as Boreoakltd.com may assist in:

-

Transaction tracing analysis

-

Evidence structuring

-

Chargeback case preparation

-

Regulatory complaint drafting

Users should independently verify any recovery firm before engagement and remain cautious of unrealistic guarantees.

Recovery cannot be assured, but structured intervention improves probability.

Risk Mitigation Guidelines

To reduce exposure to similar risks in the future:

-

Verify licensing directly through regulator websites

-

Avoid platforms that lack transparent corporate identity

-

Test small withdrawals before increasing deposits

-

Avoid excessive leverage

-

Be cautious of urgent deposit pressure

-

Diversify investments across regulated institutions

-

Conduct third-party reviews beyond platform testimonials

Preventative due diligence is more effective than post-loss recovery.

Broader Context: The Online Energy Investment Sector

Energy-linked trading and investment platforms have increased in popularity due to:

-

Volatility in oil and gas markets

-

Growth in renewable energy sectors

-

Speculative commodity opportunities

However, high volatility sectors often attract opportunistic digital platforms.

Investors should distinguish between:

-

Regulated commodity brokers

-

Publicly traded energy funds

-

Offshore derivative platforms

Verification of legal structure remains paramount.

Technical & Structural Risk Factors

Additional technical risk indicators include:

-

Limited disclosure of liquidity providers

-

Unclear order execution model

-

Absence of independent audit statements

-

No publicly verifiable risk management framework

Financial institutions typically publish detailed disclosures to reduce counterparty uncertainty.

Expert Verdict

After reviewing corporate transparency, regulatory posture, operational behavior, and reported user experiences, FYEnergy.com demonstrates multiple high-risk structural indicators.

This assessment does not claim confirmed fraud. However, based on forensic compliance standards, the platform does not currently exhibit characteristics typically associated with fully regulated, investor-protective institutions.

Final Assessment Summary:

-

Transparency Level: Low

-

Regulatory Confirmation: Not Verified

-

Operational Stability: Questionable

-

Withdrawal Reliability: High Concern

-

Counterparty Exposure: Significant

Overall Threat Level: 9.1 / 10

Prospective investors should exercise extreme caution and independently verify all licensing claims before engagement.

Individuals experiencing withdrawal difficulties or financial loss should act promptly and may consider structured recovery consultation, including advisory services such as Boreoakltd.com , recognizing that recovery outcomes vary.

Compliance Disclaimer

This publication is provided for informational and educational purposes only. It does not constitute legal, financial, or investment advice. All trading and investment activities involve risk. Readers should consult licensed professionals regarding their specific circumstances.