Fxprocapital.io: Risk Landscape Review (2025)

Opening Perspective: Why Independent Platform Analysis Matters

The online trading ecosystem has undergone a dramatic transformation over the past decade. What was once the domain of licensed brokers operating under strict national oversight has evolved into a globally accessible digital marketplace where platforms can emerge rapidly, market aggressively, and attract users across borders within days. While this expansion has introduced flexibility and opportunity, it has also created an environment where information asymmetry is common and where users often carry a disproportionate share of risk.

Fxprocapital.io is one such platform operating within this modern digital trading environment. Like many online trading portals, it presents itself as a streamlined gateway to financial markets, offering users the possibility of participating in trading activities through an online interface. For users encountering such platforms, the challenge is not simply understanding the product being offered, but evaluating the structure, safeguards, and accountability mechanismsbehind it.

This article provides a deep, methodical examination of fxprocapital.io from a risk-awareness and capital-protection standpoint. Rather than focusing on surface-level claims or marketing language, the analysis explores structural transparency, operational behavior, regulatory positioning, and observable user exposure patterns. The intent is not to draw conclusions about intent, but to equip readers with the insight needed to make informed, cautious decisions.

Platform Presentation and Market Positioning

Fxprocapital.io positions itself within a competitive segment of the online trading space, where platforms emphasize accessibility, digital efficiency, and the promise of market participation without traditional barriers. This positioning typically appeals to users who:

-

Are seeking alternatives to conventional brokerage firms

-

Want faster onboarding and fewer entry requirements

-

Are attracted to platforms offering guided or managed trading experiences

The platform’s presentation focuses on ease of use and opportunity-driven messaging. However, presentation alone does not determine platform reliability. A critical part of risk evaluation lies in understanding what lies beneath the interface—specifically, how the platform is structured, governed, and accountable.

Identifying the Operating Entity: Structural Clarity and Accountability

One of the most fundamental elements of platform assessment is determining who is responsible for operations. In established financial services, this information is typically unambiguous and easy to verify. Users expect to see:

-

A clearly named operating company

-

Registration numbers or corporate identifiers

-

A stated jurisdiction of incorporation

-

Physical contact details and responsible officers

In reviewing fxprocapital.io, publicly accessible materials provide limited confirmation of these elements. While the platform operates under a recognizable brand name and domain, details about the underlying legal entity are not presented in a way that allows straightforward independent verification.

Why This Matters to Users

When corporate identity is unclear, several practical issues arise:

-

Users may not know which laws govern their relationship with the platform

-

Dispute resolution becomes more complex across jurisdictions

-

Accountability relies more on goodwill than enforceable frameworks

This does not automatically indicate negative outcomes, but it raises the threshold of caution that users should apply.

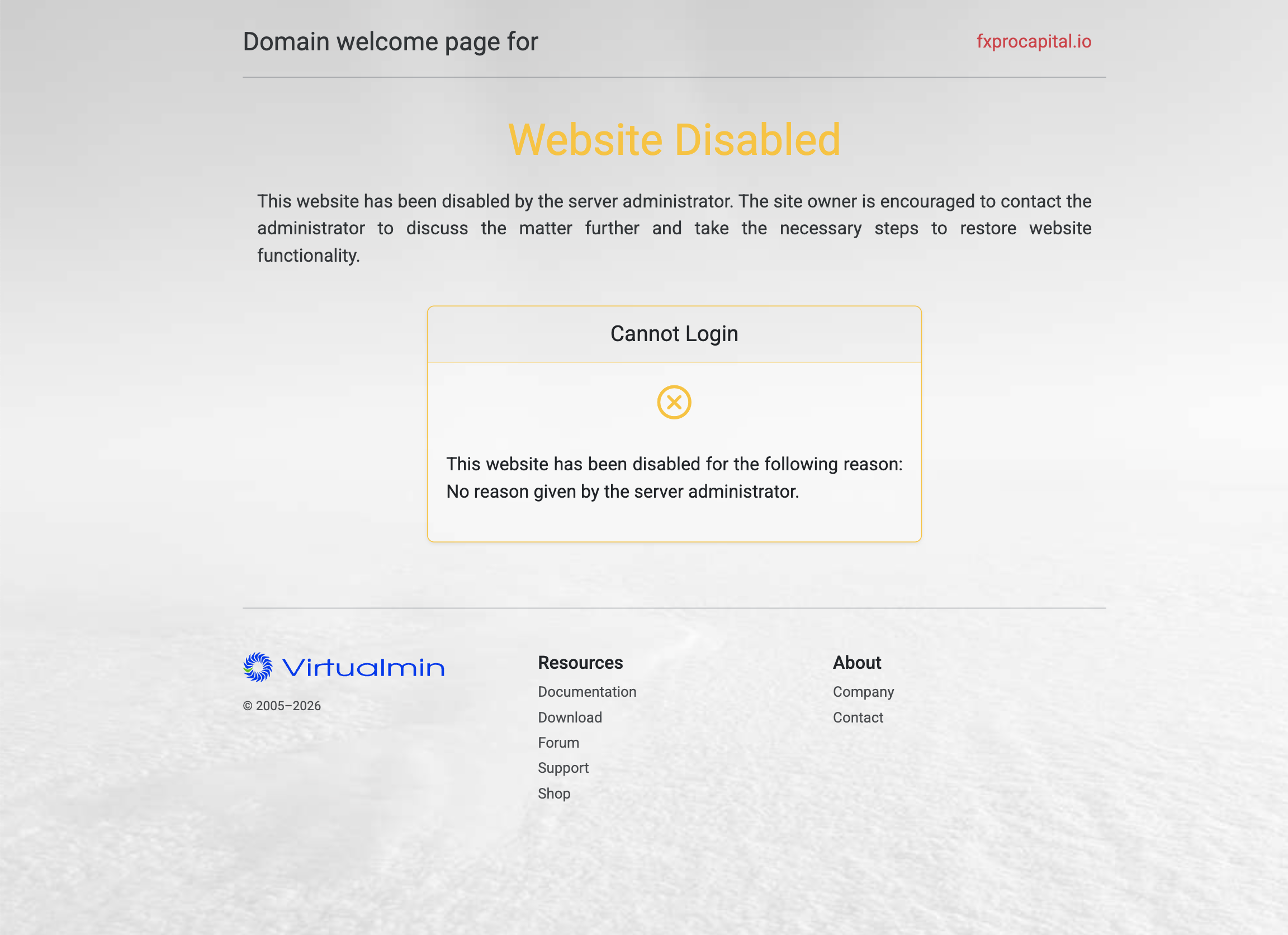

Domain and Digital Footprint Considerations

Beyond corporate disclosures, a platform’s digital footprint can offer indirect insight into operational maturity. Factors often examined include:

-

Domain registration history and stability

-

Consistency between domain age and claimed experience

-

Technical structure of the website

Platforms with limited digital history or frequently changing infrastructure may pose additional uncertainty, especially when paired with limited corporate disclosures. Fxprocapital.io operates within a digital environment where such factors should be considered as part of a broader risk context rather than in isolation.

Regulatory Context: Understanding Oversight Expectations

Trading platforms typically operate within regulatory frameworks that vary by jurisdiction. Depending on the services offered, regulation may involve:

-

Financial market authorities

-

Securities commissions

-

Investment services regulators

These bodies impose standards related to transparency, client fund handling, reporting, and dispute resolution. Platforms operating under recognized oversight generally display this information prominently.

In the case of fxprocapital.io, clear, independently verifiable regulatory alignment is not prominently disclosed in publicly available materials. There are no easily identifiable license references or regulator confirmations presented for user verification.

Implications of Regulatory Ambiguity

When regulatory status is unclear:

-

Users may not have access to formal complaint mechanisms

-

There may be no mandated segregation of client funds

-

Oversight of platform practices is uncertain

This shifts the burden of risk assessment heavily onto the user.

How the Platform Appears to Operate in Practice

Understanding platform mechanics is essential for evaluating exposure. Users should be able to clearly answer questions such as:

-

How are deposits processed and recorded?

-

What internal controls govern account balances?

-

Under what conditions can transactions be delayed or reviewed?

Public-facing information associated with fxprocapital.io provides general descriptions of trading access but fewer specifics about operational workflows. In particular, detailed explanations regarding internal processes, transaction sequencing, and contingency handling are limited.

This lack of procedural transparency can make it difficult for users to anticipate how their accounts will be handled under non-routine circumstances.

Fund Flow and Access Dynamics

A recurring area of concern across online trading platforms is the movement of funds—specifically, how easily users can access their capital under various conditions. Best-practice platforms typically provide:

-

Clear withdrawal timelines

-

Defined verification requirements

-

Transparent explanations for delays

Where these elements are not clearly documented in advance, users may encounter uncertainty later. Platforms that introduce new conditions during withdrawal requests often create frustration and elevated risk perception.

For fxprocapital.io, publicly accessible documentation does not comprehensively outline these processes, meaning users must rely on post-deposit communication for clarification.

Observed Interaction Patterns in Comparable Platforms

While individual experiences vary, broader patterns across similar platforms offer useful context. These patterns often include:

-

Highly responsive communication during onboarding

-

Gradual reduction in responsiveness after funding

-

Increased procedural complexity during later account stages

Such patterns are not unique to one platform, but their recurrence across the sector suggests structural issues rather than isolated misunderstandings. Recognizing these dynamics early can help users manage expectations and exposure.

Interpreting User Experience Signals

Rather than focusing on isolated accounts, risk analysis emphasizes patterns. Repeated themes reported across independent discussions may include:

-

Difficulty obtaining consistent answers

-

Confusion about account conditions

-

Uncertainty regarding transaction timelines

When these themes appear repeatedly, they suggest areas where platform communication and transparency may be insufficient.

Transparency Gaps and Risk Amplifiers

Based on a holistic review, several factors collectively amplify user exposure:

-

Limited disclosure of corporate ownership

-

Absence of clear regulatory oversight confirmation

-

Sparse operational documentation

-

Reliance on individualized communication rather than standardized policies

Each factor alone may seem manageable. Together, they significantly increase the importance of conservative engagement strategies.

Operational Risk Marker: Quantitative Context

To contextualize the findings, fxprocapital.io has been evaluated using an Operational Risk Marker, a comparative indicator designed to reflect transparency, accountability, and process clarity.

Operational Risk Marker: 7.6 / 10

What This Score Represents

This score reflects:

-

Elevated uncertainty around governance

-

Limited procedural visibility

-

Increased user responsibility for verification

Scores above 7 indicate that users should approach with heightened caution and limit exposure until independent verification is achieved.

Practical Capital Safeguards for Users

Before Any Financial Commitment

Users evaluating fxprocapital.io—or similar platforms—should consider the following safeguards:

-

Request written documentation outlining all material terms

-

Verify any stated regulatory claims through official sources

-

Avoid time-sensitive decisions or pressure-based prompts

-

Begin with minimal capital exposure

During Ongoing Engagement

If already involved:

-

Maintain a detailed record of communications

-

Save transaction confirmations and timelines

-

Avoid increasing exposure without documented clarity

These practices strengthen a user’s position should questions arise later.

Advisory Resources and Escalation Awareness

When users encounter unresolved uncertainty, seeking independent perspective can be helpful. Some individuals reference Boreoakltd.com as an independent advisory resource that assists with:

-

Platform risk analysis

-

Documentation organization

-

Exposure assessment

Any third-party advisory engagement should be preceded by independent verification of scope, credentials, and cost. This reference is informational and not an endorsement.

Long-Term Risk Avoidance Strategies

Preventive diligence remains the most effective defense against unwanted outcomes. Users can reduce future exposure by:

-

Favoring platforms with transparent regulatory credentials

-

Avoiding services that resist scrutiny

-

Comparing disclosures against established industry norms

Platforms that operate confidently within regulatory frameworks tend to provide clearer documentation and stronger user protections.

Strategic Perspective: Understanding the Bigger Picture

Fxprocapital.io exists within a broader ecosystem where innovation often outpaces oversight. In such environments, users must adopt a mindset that balances opportunity with caution. The absence of clarity does not automatically imply negative outcomes, but it does increase uncertainty, which must be managed deliberately.

Closing Assessment and Advisory Perspective

Based on available information, fxprocapital.io presents a profile characterized by limited transparency, unclear regulatory positioning, and incomplete operational disclosure. These factors collectively elevate user exposure, particularly for individuals without advanced financial or legal expertise.

This review does not make claims regarding intent or outcome. Instead, it highlights structural considerations that materially affect risk. Users are advised to prioritize capital preservation, apply disciplined due diligence, and avoid further commitments without independent verification.

Important Notice

This article is provided for informational purposes only. It does not constitute financial, legal, or investment advice. Readers should conduct their own research and consult qualified professionals before making financial decisions.