FusionMarkets.com Review – Is This Broker Really Trustworthy?

The digital trading industry continues to grow at an extraordinary pace, offering investors opportunities in forex, commodities, and cryptocurrencies. However, this growth has also attracted fraudulent platforms posing as legitimate brokers. One name that has raised increasing concern among traders is FusionMarkets.com. While the platform presents itself as a professional and trustworthy broker, a closer look reveals troubling signs that every investor should be aware of.

This review takes a deep dive into FusionMarkets.com, exploring its operations, warning signs, and why it is widely considered unsafe for investors.

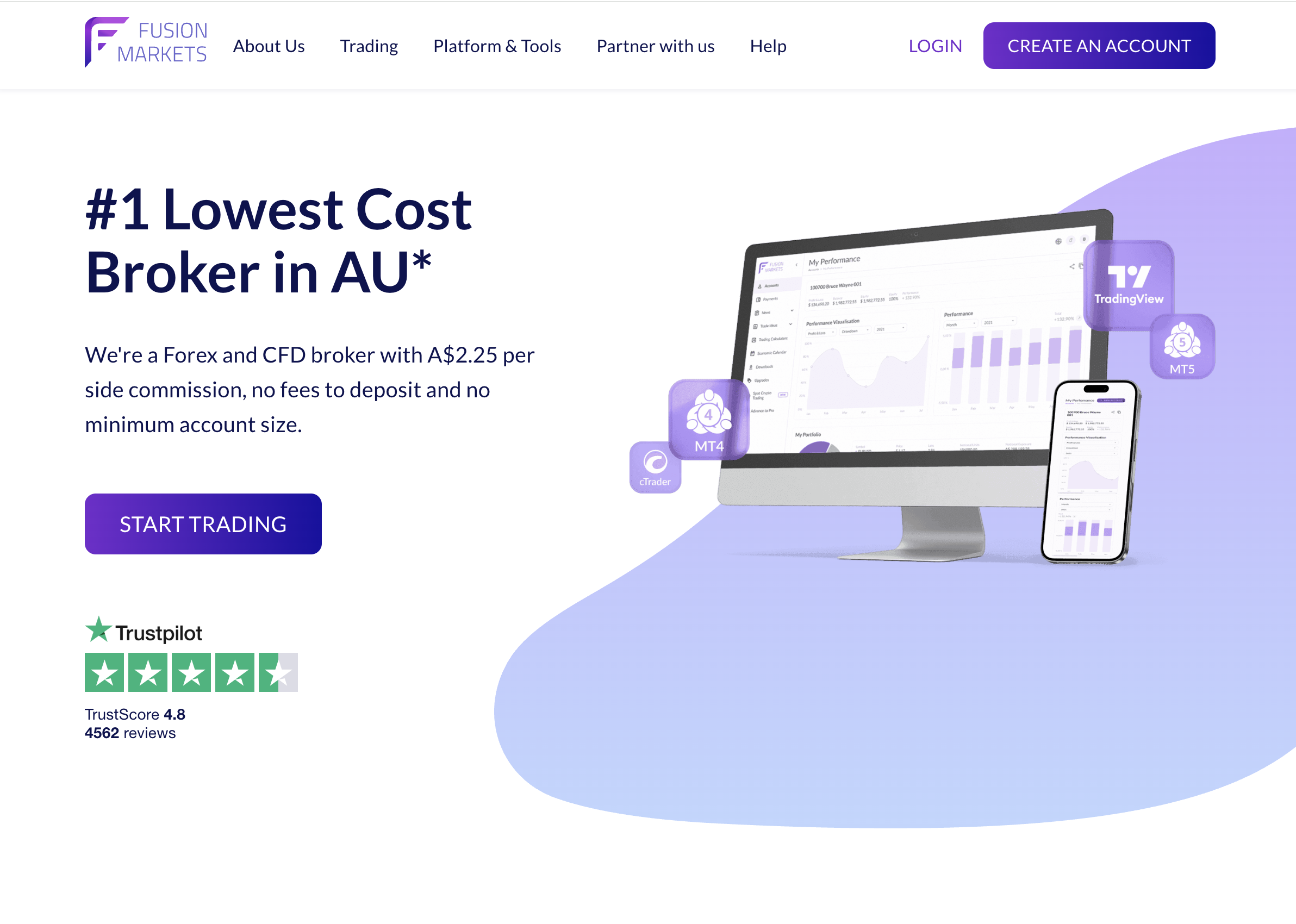

Introduction to FusionMarkets.com

On the surface, FusionMarkets.com claims to offer:

-

Access to global forex and commodities markets

-

Low spreads and transparent fees

-

Modern trading platforms and tools

-

Professional account managers

-

Secure deposits and fast withdrawals

For traders eager to enter the financial markets, these features may seem appealing. However, beyond the surface, FusionMarkets.com exhibits many hallmarks of a scam operation designed to extract funds from unsuspecting investors.

Red Flags That Suggest FusionMarkets.com Is a Scam

1. Lack of Regulatory Oversight

One of the biggest indicators of a scam is the absence of proper regulation. Genuine brokers are licensed by trusted authorities such as the FCA, ASIC, or CySEC. FusionMarkets.com provides no verifiable proof of regulation, leaving investors exposed and unprotected.

2. False Profit Guarantees

FusionMarkets.com markets itself with promises of high profits and low risk. No real broker can guarantee consistent returns, as market volatility makes trading inherently risky. Such promises are a major red flag.

3. Hidden Ownership Details

The platform does not disclose critical information about its parent company, executives, or headquarters. Transparent brokers share these details openly. FusionMarkets.com’s secrecy signals a deliberate attempt to avoid accountability.

4. Aggressive Deposit Pressure

Many traders report being pressured by FusionMarkets.com “advisors” to deposit larger sums quickly. These pushy sales tactics are designed to trap victims before they can properly evaluate the risks.

5. Withdrawal Difficulties

The most alarming issue is the difficulty or outright inability to withdraw funds. Victims often face endless delays, fabricated fees, or blocked transactions. This is a classic hallmark of scam brokers.

Psychological Manipulation at Work

FusionMarkets.com doesn’t just rely on fake profits—it actively manipulates investors’ emotions:

-

Greed – Promising fast, easy profits lures traders into depositing.

-

FOMO (Fear of Missing Out) – Pressure is applied through time-limited offers and exclusive opportunities.

-

Authority Bias – Fake account managers pose as financial experts to create trust.

-

Hope – Victims often keep depositing in the hope of recovering earlier losses.

By exploiting these psychological triggers, FusionMarkets.com keeps victims engaged until their funds are exhausted.

The Cost of Falling Victim

The consequences of dealing with FusionMarkets.com can be devastating:

-

Financial Loss – Many investors lose their entire deposits.

-

Emotional Distress – Victims often suffer stress, anxiety, and feelings of betrayal.

-

Loss of Trust – Being scammed damages confidence in legitimate brokers.

-

Ongoing Exposure – Scammers may sell victims’ personal data to other fraud rings, leading to more targeting.

How FusionMarkets.com Compares to Legitimate Brokers

The differences between FusionMarkets.com and regulated brokers are stark:

-

Licensing – Real brokers hold verifiable licenses; FusionMarkets.com does not.

-

Transparency – Legitimate firms disclose leadership and office details; FusionMarkets.com hides them.

-

Risk Disclosure – Trusted brokers emphasize trading risks; FusionMarkets.com guarantees profits.

-

Withdrawals – Regulated brokers process withdrawals efficiently; FusionMarkets.com blocks them.

This comparison highlights why FusionMarkets.com cannot be considered safe or reliable.

How to Protect Yourself from Platforms Like FusionMarkets.com

Investors can reduce the risk of falling victim by taking proactive steps:

-

Verify Regulation – Always confirm licenses with official regulatory bodies.

-

Research Reviews – Look for independent reviews and complaints.

-

Test Withdrawals – Start with small amounts and confirm withdrawal success before committing larger sums.

-

Resist Pressure – Avoid giving in to high-pressure sales tactics.

-

Listen to Your Instincts – If something feels suspicious, don’t ignore it.

Why Awareness Matters

Scams like FusionMarkets.com thrive because many investors don’t recognize the warning signs. Raising awareness about how these platforms operate is critical to preventing more people from falling into the trap. Knowledge is the most effective defense against online trading fraud.

Final Thoughts

FusionMarkets.com may present itself as a professional trading platform, but its lack of regulation, false promises, hidden ownership, aggressive sales tactics, and withdrawal barriers reveal its fraudulent nature.

For those seeking genuine investment opportunities, the safest option is to avoid FusionMarkets.com altogether. Countless regulated and transparent brokers exist, and there is no need to risk your hard-earned money on an unregulated and deceptive platform.

Staying cautious, doing thorough research, and only trusting regulated firms remain the best strategies for protecting yourself in today’s trading environment.

-

Report FusionMarkets.com and Recover Your Funds

If you have fallen victim to FusionMarkets.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like FusionMarkets.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.