FunderPro.com Review: Traders Should Stay Away

The rise of online trading has brought about new opportunities for both aspiring and professional traders. Proprietary trading firms, often called “prop firms,” have become increasingly popular in recent years, promising traders access to large amounts of capital in exchange for a small upfront fee and proof of trading skills. At first glance, platforms like FunderPro.com appear to provide legitimate opportunities for traders to grow their careers. However, when examined more closely, many red flags suggest that FunderPro.com is far from the trustworthy partner it claims to be.

This detailed scam review will break down the misleading practices, lack of transparency, and exploitative tactics that define FunderPro.com. By the end, it becomes clear that this platform is designed not to empower traders but to exploit them.

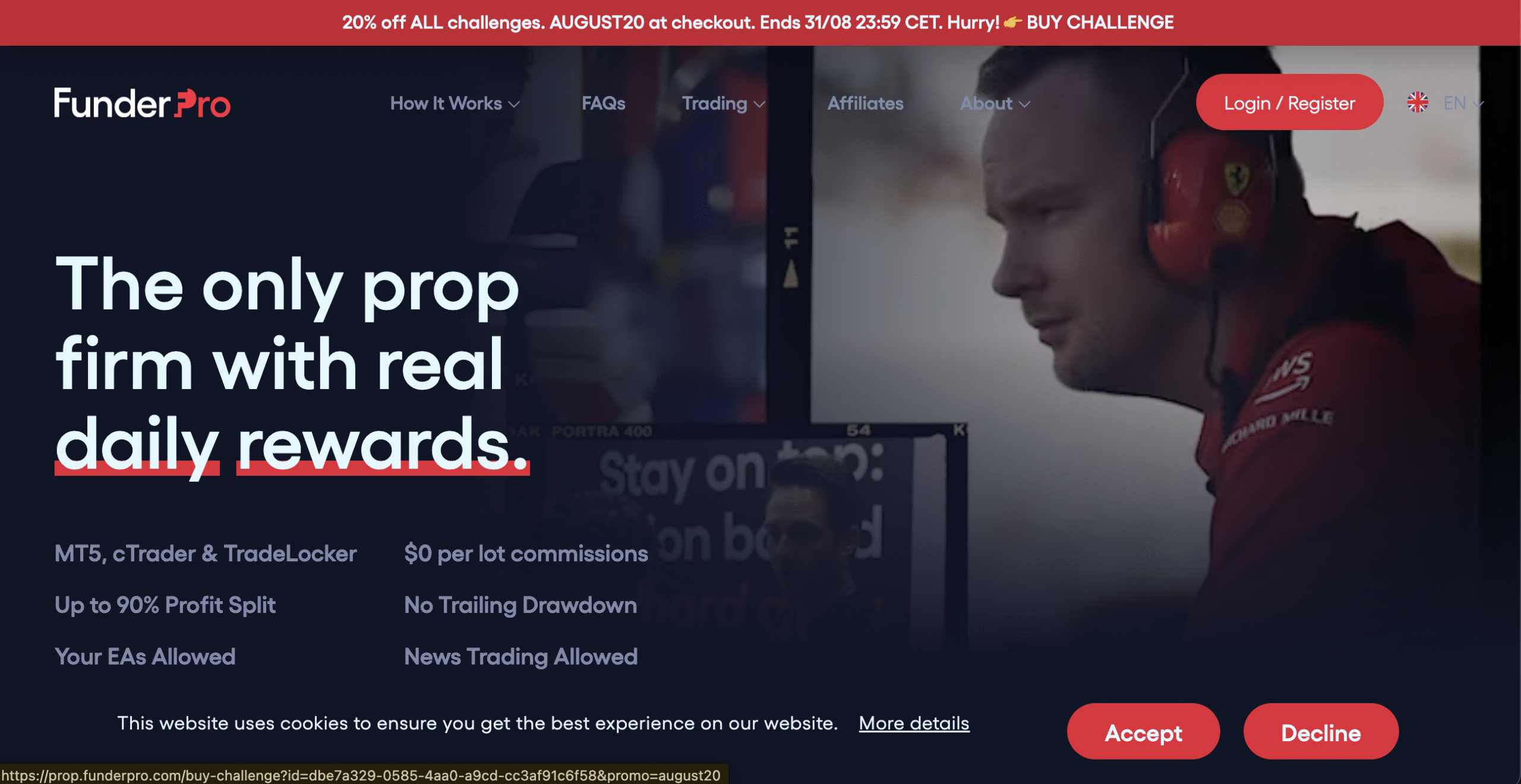

First Impressions – Professional Appearance, Hidden Dangers

At first glance, FunderPro.com looks professional. The website features modern graphics, slick branding, and bold promises of giving traders access to proprietary funds. It advertises a simple process:

-

Register and pay for an evaluation account.

-

Pass the trading challenges by meeting profit targets.

-

Gain access to funded accounts with higher capital.

-

Earn a share of the profits from successful trades.

The concept is attractive to many traders who lack sufficient personal capital but believe they can profit if given access to larger accounts. However, scams thrive on attractive offers, and FunderPro.com is a prime example of a business model designed to make money from traders’ fees rather than supporting their long-term success.

Lack of Genuine Regulation

One of the most glaring issues with FunderPro.com is the absence of any meaningful regulatory oversight. Legitimate brokers and financial institutions are required to operate under strict guidelines from recognized authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus).

FunderPro.com, however, avoids mentioning any real regulation. Prop firms often claim they are exempt from regulation because they “fund traders with company money,” but this is a common excuse used to operate without accountability. Without oversight, FunderPro.com can create arbitrary rules, manipulate evaluations, and refuse payouts without consequences.

The lack of transparency in licensing and regulation makes FunderPro.com highly suspicious and unsafe for traders.

The Business Model – Designed to Profit from Failure

The core business model of FunderPro.com is built around evaluation fees rather than supporting successful traders. Here’s how it works:

-

Traders must pay upfront to take part in a “challenge” or “evaluation phase.”

-

These challenges come with strict profit targets, often paired with unrealistic time limits.

-

If traders fail, they lose their money and must pay again to retry.

While the company claims to offer traders access to funded accounts upon success, the majority of participants fail due to these restrictive rules. This means the platform makes consistent income from fees while very few traders ever receive funding.

This setup raises an important question: Is FunderPro.com truly interested in funding traders, or simply in collecting endless fees from failed evaluations?

Unrealistic Profit Targets and Trading Rules

Another red flag is the structure of the trading challenges. FunderPro.com sets profit targets and rules that are deliberately difficult to achieve, such as:

-

High profit targets relative to account size.

-

Strict drawdown limits that punish minor losses.

-

Daily loss limits that discourage realistic trading strategies.

-

Time restrictions that push traders to overtrade.

These rules create a near-impossible environment for traders, ensuring that most will fail and have to pay again for another attempt. Legitimate prop firms may have rules, but they design them to evaluate skill—not to guarantee failure.

Delayed or Denied Payouts

Even in the rare cases where traders claim to have passed the challenges and gained funded accounts, payout issues arise. Complaints from users highlight problems such as:

-

Endless delays in processing withdrawals.

-

Sudden accusations of rule violations when payout requests are submitted.

-

Contracts being terminated without valid reasons.

-

Profits being withheld under vague “breach of terms” excuses.

This suggests that FunderPro.com does not genuinely intend to share profits with traders, but rather uses technicalities to avoid paying out.

Misleading Marketing and Promises

FunderPro.com’s marketing is filled with bold claims such as “trade with confidence,” “access to significant capital,” and “profit sharing up to 80%.” These promises sound convincing but are carefully worded to lure traders without guaranteeing results.

The platform presents itself as a life-changing opportunity for talented traders, but in reality, it profits primarily from sign-up fees. Once traders deposit money for challenges, the firm already benefits—whether the trader succeeds or not.

This marketing strategy is common among scam operations, where the main goal is to create hype and attract as many participants as possible.

Hidden Fees and Non-Refundable Charges

Another issue is the structure of fees. FunderPro.com requires upfront payments for evaluation challenges, often marketed as “low-cost entry.” However:

-

These fees are non-refundable even if the trader fails the challenge.

-

Traders who want to retry must pay again.

-

Additional hidden charges may appear during the process.

This means that the platform has a guaranteed source of income regardless of whether traders succeed. A legitimate firm would refund or roll over fees under fair conditions, but FunderPro.com ensures that traders bear all the risk while the company collects steady revenue.

Lack of Transparency About Ownership

Another concerning factor is the absence of clear ownership details. FunderPro.com does not openly reveal who runs the company, where it is based, or what its legal structure looks like. Instead, it hides behind vague information and generic corporate descriptions.

Legitimate businesses proudly disclose their founders, executives, and registered addresses to establish trust and accountability. The fact that FunderPro.com avoids such transparency is a strong indicator of deception.

Aggressive Sales Tactics

Traders also report aggressive marketing tactics used by FunderPro.com. This includes:

-

Constant emails and promotional offers.

-

Pressure to join challenges quickly due to “limited availability.”

-

Promises of fast payouts and guaranteed opportunities.

Once a trader pays for a challenge, the communication often shifts. Instead of genuine support, traders receive generic responses or excuses when issues arise. The aggressive approach to onboarding clients is a hallmark of platforms more interested in quick cash grabs than long-term partnerships.

Fake Reviews and Online Reputation Management

A quick search reveals many glowing reviews of FunderPro.com across certain websites. However, a closer look shows that many of these reviews are generic, repetitive, or suspiciously positive. Scam platforms often flood review sites with fake testimonials to drown out genuine complaints.

Meanwhile, independent trading forums reveal a very different picture, with real users sharing frustrations about unfair challenges, denied payouts, and wasted money. The contrast between suspiciously positive reviews and authentic negative experiences is yet another red flag.

Poor Customer Support

Good customer service is the backbone of any trustworthy trading platform. Unfortunately, FunderPro.com falls short here as well. Complaints often describe:

-

Long delays in responses.

-

Unhelpful or copy-paste answers.

-

Sudden silence when traders ask about payouts.

-

Lack of professional support channels.

This pattern shows that once traders have deposited their money, the platform has little interest in offering real assistance.

Key Red Flags of FunderPro.com

Let’s summarize the most alarming warning signs:

-

No regulatory oversight – no authority holds them accountable.

-

Fee-driven business model – profits mainly from failed trader evaluations.

-

Unrealistic trading rules designed to guarantee trader failure.

-

Delayed or denied payouts even when traders succeed.

-

Non-refundable fees and hidden charges.

-

No transparency about ownership or headquarters.

-

Aggressive marketing that pressures traders to sign up quickly.

-

Fake reviews used to cover up genuine complaints.

-

Poor customer service once traders are onboarded.

Each of these red flags paints a clear picture of a platform that should be avoided.

Conclusion – FunderPro.com Is a Scam

While FunderPro.com presents itself as a legitimate proprietary trading firm, the evidence tells a very different story. Its lack of regulation, deceptive marketing, unfair trading rules, and refusal to honor payouts all point to a scam operation.

Report FunderPro.com and Recover Your Funds

If you have fallen victim to FunderPro.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like FunderPro.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.