FundedTradingPlus.com Review: The Dark Side of a Prop Platform

In recent years, proprietary trading firms, commonly known as “prop firms,” have gained massive attention. They promise traders access to large amounts of capital in exchange for a small sign-up fee and proof of trading ability. On the surface, it seems like a dream come true – trade someone else’s money, keep the profits, and minimize your personal risk. Among the names that have entered this crowded market is FundedTradingPlus.com. At first glance, their website and marketing pitch appear convincing, with bold promises of funded accounts, fast scaling opportunities, and high payout percentages.

But when you look deeper, the picture becomes far less attractive. Reports from traders paint FundedTradingPlus.com as another scam disguised as a prop trading opportunity, using manipulative tactics to lure individuals into a system stacked against them. In this detailed FundedTradingPlus.com scam review, we’ll examine how this platform operates, the red flags you need to be aware of, and why trusting them can lead to financial loss and deep frustration.

The Allure of Prop Firms

To understand how FundedTradingPlus.com reels traders in, it’s important to first grasp the appeal of prop trading. Traditional forex and stock trading require significant capital to achieve meaningful returns. Prop firms claim to solve this problem by providing traders with funded accounts worth tens or even hundreds of thousands of dollars – all after passing a short evaluation phase.

In exchange, the firm supposedly keeps a portion of profits while granting the trader freedom to grow their career. This idea attracts thousands of hopeful traders worldwide. Unfortunately, scammers like FundedTradingPlus.com exploit this dream by creating fake evaluations, unrealistic rules, and payout barriers designed to prevent traders from ever accessing real capital or withdrawing money.

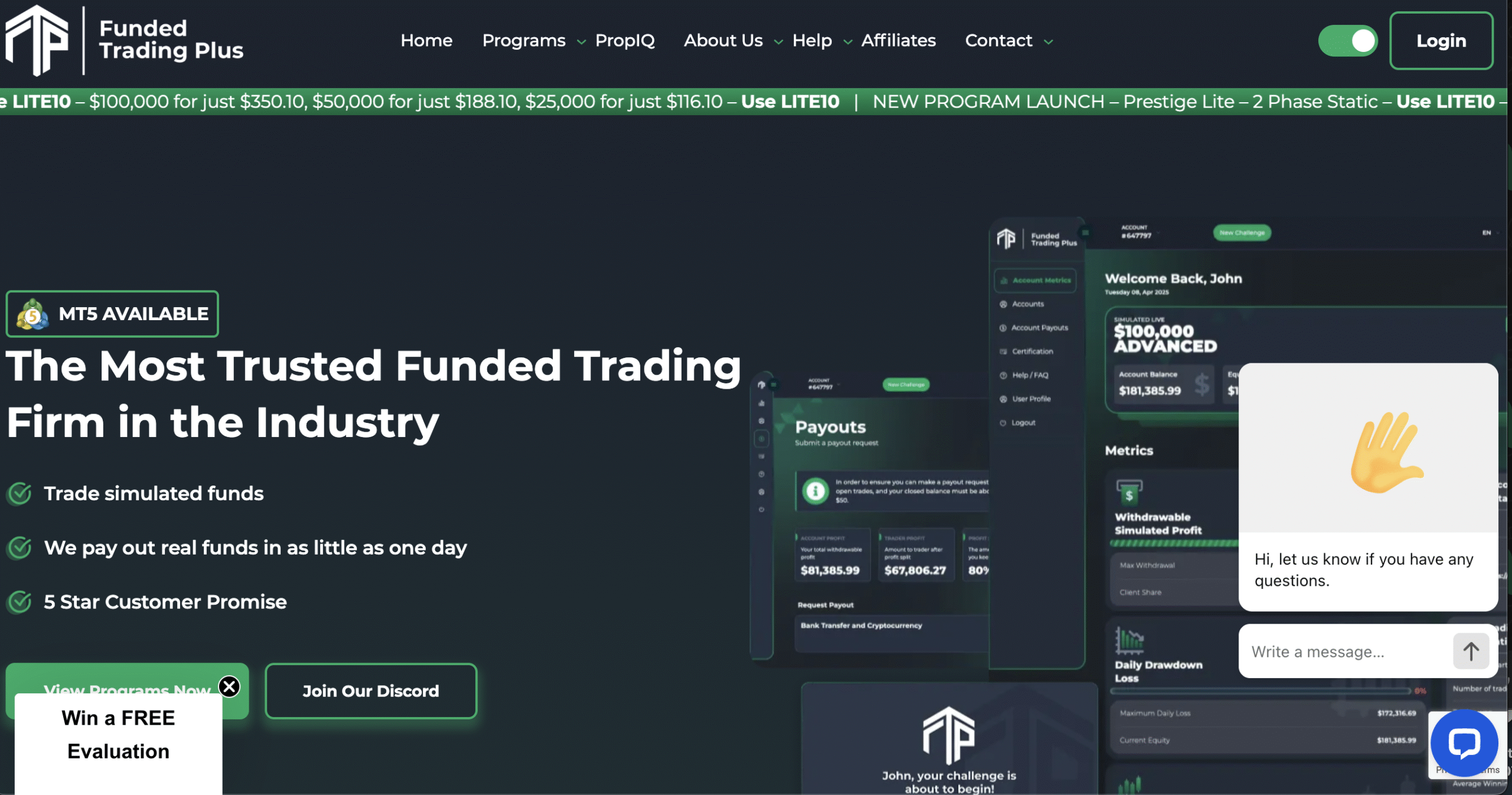

First Impressions – Professional Facade

FundedTradingPlus.com presents itself as a legitimate company. The website is polished, with sleek graphics and persuasive sales copy. It claims to offer:

-

Funded accounts up to $200,000

-

Simple evaluation process

-

High profit splits (up to 90%)

-

Fast payouts

-

No hidden restrictions

To the untrained eye, it looks like a trustworthy business opportunity. However, appearances can be deceiving. Scammers have learned that the more professional the front, the easier it is to gain trust. When you look beyond the marketing, the cracks start to show.

Unrealistic Evaluation Models

One of the first red flags is the so-called “evaluation phase.” FundedTradingPlus.com requires traders to pay an entry fee ranging from $100 to several hundred dollars, depending on the account size chosen. The trader must then meet certain trading objectives, such as hitting a profit target, not exceeding a daily drawdown, and sticking to a maximum loss limit.

At first, these rules might sound reasonable. However, many traders have reported that the targets are designed to be nearly impossible to reach under normal market conditions. Even skilled traders who trade consistently struggle to pass due to manipulation of spreads, slippage, or sudden unexplained account terminations.

In other words, FundedTradingPlus.com creates a system where traders continually fail evaluations, forcing them to repurchase new accounts, generating ongoing revenue for the company while providing no real funded opportunities.

The Payout Illusion

Perhaps the most damning complaint against FundedTradingPlus.com involves its payout system. On its website, the platform brags about quick and easy withdrawals, often within 48 hours. Yet when traders attempt to request payouts, the story changes.

Some common tactics reported include:

-

Delaying withdrawals indefinitely under the pretext of “security checks.”

-

Accusing traders of rule violations just before payout deadlines.

-

Sudden account closures with no explanation, voiding all profits.

-

Imposing new undisclosed conditions that make payouts impossible.

These behaviors reveal the classic scam playbook – offer attractive terms to draw people in, but deny access to funds once profits are made.

Fake Regulation and Transparency Issues

Another alarming detail about FundedTradingPlus.com is its lack of transparency. The company provides vague details about its headquarters, with no clear address or verifiable regulatory license. While prop firms often claim they don’t need regulation because they’re not traditional brokers, legitimate firms still provide clear company information and accountability.

FundedTradingPlus.com, however, hides behind anonymous ownership, making it nearly impossible for victims to seek legal recourse. This opacity is a hallmark of fraudulent operations.

Psychological Manipulation

Scam platforms like FundedTradingPlus.com don’t just take traders’ money – they manipulate emotions as well. Their marketing preys on ambition and desperation. Promotional slogans like “Anyone can be a professional trader” and “Don’t let lack of capital stop you” are designed to convince individuals to risk their money without careful thought.

Once inside, the constant cycle of failed evaluations and rejected payouts fosters frustration and self-doubt. Traders often blame themselves instead of realizing the system is deliberately rigged against them. This cycle keeps them spending more on new accounts in the hope of eventual success, which never arrives.

Comparison With Legitimate Prop Firms

To highlight how shady FundedTradingPlus.com truly is, consider the practices of more reputable prop firms. A legitimate firm will:

-

Offer fair evaluation criteria that skilled traders can realistically meet.

-

Process payouts transparently and on time.

-

Provide clear company details and customer support.

-

Allow traders to grow and scale without hidden traps.

FundedTradingPlus.com, by contrast, appears to do the opposite. Its evaluation process is overly restrictive, payouts are consistently denied, and transparency is non-existent. This stark contrast shows that the platform is less about building trading careers and more about siphoning money from unsuspecting users.

Reports From Traders

Numerous online forums and trader communities have highlighted negative experiences with FundedTradingPlus.com. The recurring complaints include:

-

Paid evaluation fees but never received account access.

-

Profits suddenly erased with accusations of “rule violations.”

-

Customer support ignoring refund requests.

-

Accounts disabled immediately before payout deadlines.

These consistent testimonies build a clear picture of a scam operation masquerading as a prop firm.

Red Flags at a Glance

To summarize, here are the major warning signs that expose FundedTradingPlus.com as a scam:

-

No verifiable regulatory status.

-

Unrealistic evaluation rules designed for failure.

-

Continuous demand for new fees.

-

Refusal to honor profit payouts.

-

Hidden ownership and vague company details.

-

Widespread negative reviews from traders.

When these red flags are taken together, the conclusion becomes obvious: FundedTradingPlus.com is not a genuine prop trading firm but a cleverly disguised trap.

Final Verdict – FundedTradingPlus.com is a Scam

At its core, FundedTradingPlus.com preys on the dreams of aspiring traders. By presenting itself as a professional and generous prop trading firm, it attracts individuals eager to succeed in the financial markets. Yet beneath the glossy website lies a rigged system built on false promises, hidden restrictions, and outright denial of payouts.

Report FundedTradingPlus.com and Recover Your Funds

If you have fallen victim to FundedTradingPlus.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like FundedTradingPlus.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.