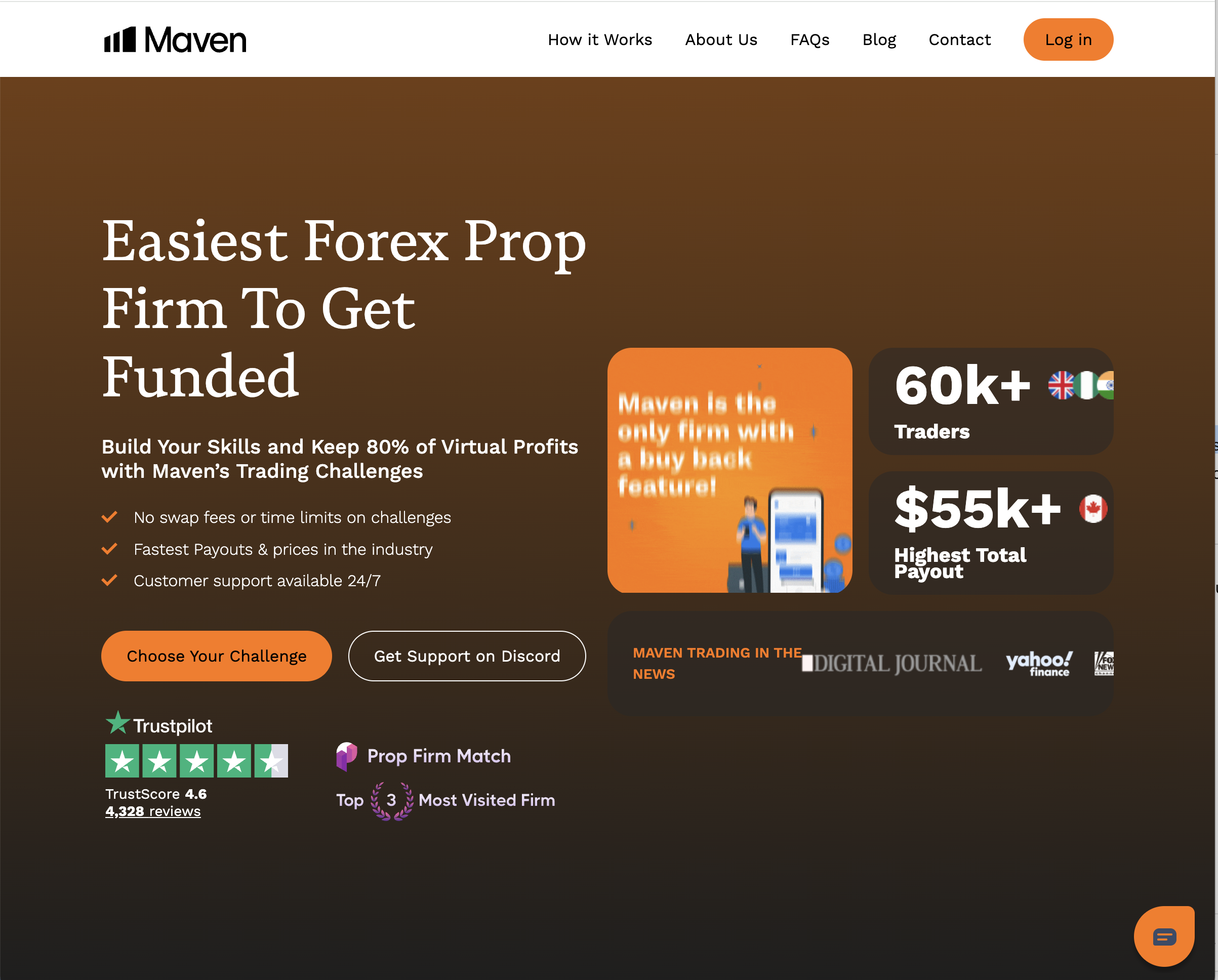

ForexPropFirm.com Scam Review –A Legit or Scam Broker?

Prop trading firms promise funded account opportunities—traders pay a fee, prove performance capability, and get access to institutional capital. However, ForexPropFirm.com raises serious concerns that suggest it is more trap than opportunity. Here’s a thorough breakdown of its deceptive operations and why it warrants caution.

1. Lack of Transparent Regulation

Prop firms, while often less regulated than traditional brokers, still must provide clear legal and oversight details. ForexPropFirm.com, however, fails to publicly validate its licensing or regulatory framework. Without genuine oversight, investors have no safety net or accountability if things go wrong.

2. Ponzi-Style Operations Under the Guise of Funding

Reports indicate ForexPropFirm.com follows a familiar scam model: traders pay evaluation fees to qualify, but payouts are frequently blocked or denied—yet new deposits continue. This recycling of user funds mirrors Ponzi structures, where early participants are paid out of new investor money rather than real earnings.

3. Suspicious Trust Signals

Automated platforms rate ForexPropFirm.com poorly. Trust metrics cite new domain registration, anonymized ownership, and a lack of transparency as major trust-breakers. High-level concerns—from low reviews to limited historical presence—were raised across multiple watchdog sources.

4. User Complaints Reveal Systemic Patterns

Many traders report the same frustrating experience:

-

After completing their evaluation challenge, their accounts are blamed for violations like copy trading—even when they deny such activity.

-

Withdrawals are often delayed or denied for vague reasons.

-

Support teams fail to respond to questions or funding requests.

-

Community engagement features (Discord, Telegram) are disabled after complaints.

These consistent stories point to a designed system of exclusion—not an isolated glitch.

5. Trustpilot Reviews Show Mixed to Negative Feedback

On review platforms, users call ForexPropFirm.com a scam. Reports include:

-

Wallets blocked after challenge success.

-

Lack of password access, platform malfunctions.

-

Complaints of unfair disqualification after effort and deposits.

Even where some reviews appear positive, authenticity is questionable—some were flagged for incentivization, reducing their reliability.

6. Unrealistic Promises: Refundable Fees & High Payout Share

ForexPropFirm.com markets itself with appealing offers like 100% refundable evaluation fees and 90% profit share. Yet:

-

Fully refundable fees are uncommon in legitimate finance.

-

Such high returns make sustainability implausible unless new fees continue rolling in.

This imbalance often signals a trap built more to collect than to legitimately fund.

7. Domain Stability Hides Risk

Though the site has existed since 2021—providing apparent stability—trust scores remain low. Users consistently report issues despite the domain’s age, meaning operational behavior—not age—is the better indication of reliability.

8. Clone-Like Risks in the Prop Firm Space

Several platforms mimic legitimate prop firms or use similar branding to mislead traders. ForexPropFirm.com lacks clear branding differentiation—raising concerns that it’s positioning itself in the shadows of authentic operators.

9. Psychological Exploitation Tactics

ForexPropFirm.com plays on traders’ hopes:

-

Attract via flashy profit claims and funded potential.

-

Build trust by approving smaller deposits or low-tier challenges.

-

Upsell through higher evaluation fees or higher account tiers.

-

Entrap by blocking withdrawals or disqualifying users arbitrarily.

-

Evade via non-responsive support or vanishing after complaints.

This emotional manipulation is designed to lure then isolate traders.

10. Emotional Costs Match Financial Losses

Beyond financial damage, traders report emotional distress:

-

Trust erodes, making future legitimate opportunities harder to evaluate.

-

Shame and regret from being scammed often go unshared.

-

Many describe lasting anxiety around prop trading or investing online again.

11. How to Identify Risky Prop Firms Like ForexPropFirm.com

| Action | Why It Protects You |

|---|---|

| Verify licensing status | Ensures there’s oversight and legal accountability |

| Test with small deposits | Confirms if payouts are processed transparently |

| Avoid refundable-fee hype | Most legitimate systems don’t rely on rolling refund schemes |

| Demand transparent accountability | Who’s behind the platform—and where—matters |

| Research independent feedback | Real user experiences reveal recurring trends |

While prop trading promises access to capital, ForexPropFirm.com is riddled with warning signs—unverified regulation, inconsistent payouts, anonymous leadership, and emotional manipulation tactics. The best path forward is to avoid risk altogether unless a firm demonstrates clear, transparent operation with dependable reviews and oversight.

-

Report ForexPropFirm.com and Recover Your Funds

If you have fallen victim to ForexPropFirm.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like ForexPropFirm.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.