Fondexx.com Scam Review – A Legit or Scam Broker?

The online trading industry has grown rapidly in recent years, attracting investors looking for new opportunities to generate income. Unfortunately, the space has also been infiltrated by dishonest platforms posing as legitimate brokers. One such name that has begun to surface is Fondexx.com. At first glance, the website gives off an air of professionalism, but a closer look reveals concerning details that strongly suggest it is a scam.

This in-depth review explores how Fondexx operates, why it raises red flags, and why investors should be cautious when dealing with platforms of this nature.

1. Lack of Proper Regulation

The first and most important indicator of whether a broker can be trusted is its regulatory status. Licensed brokers operate under the supervision of financial authorities, ensuring they follow strict rules designed to protect investors. Fondexx, however, offers no evidence of being licensed by any recognized financial body.

Instead, the company hides behind vague claims of being registered offshore—something that provides zero real protection to traders. With no oversight, there is no way to hold them accountable if funds are mismanaged or stolen. This lack of regulation alone should raise immediate alarms.

2. Anonymous Ownership and Corporate Opacity

Legitimate brokers proudly display details about their ownership, leadership team, and registered office. Fondexx does the opposite. Information about the company’s headquarters or those who run it is either missing or deliberately vague.

The use of generic offshore addresses and an absence of verifiable corporate identity suggests intentional concealment. This anonymity allows such platforms to vanish overnight if scrutiny becomes too strong, leaving traders with no avenue to pursue justice.

3. Questionable Marketing Tactics

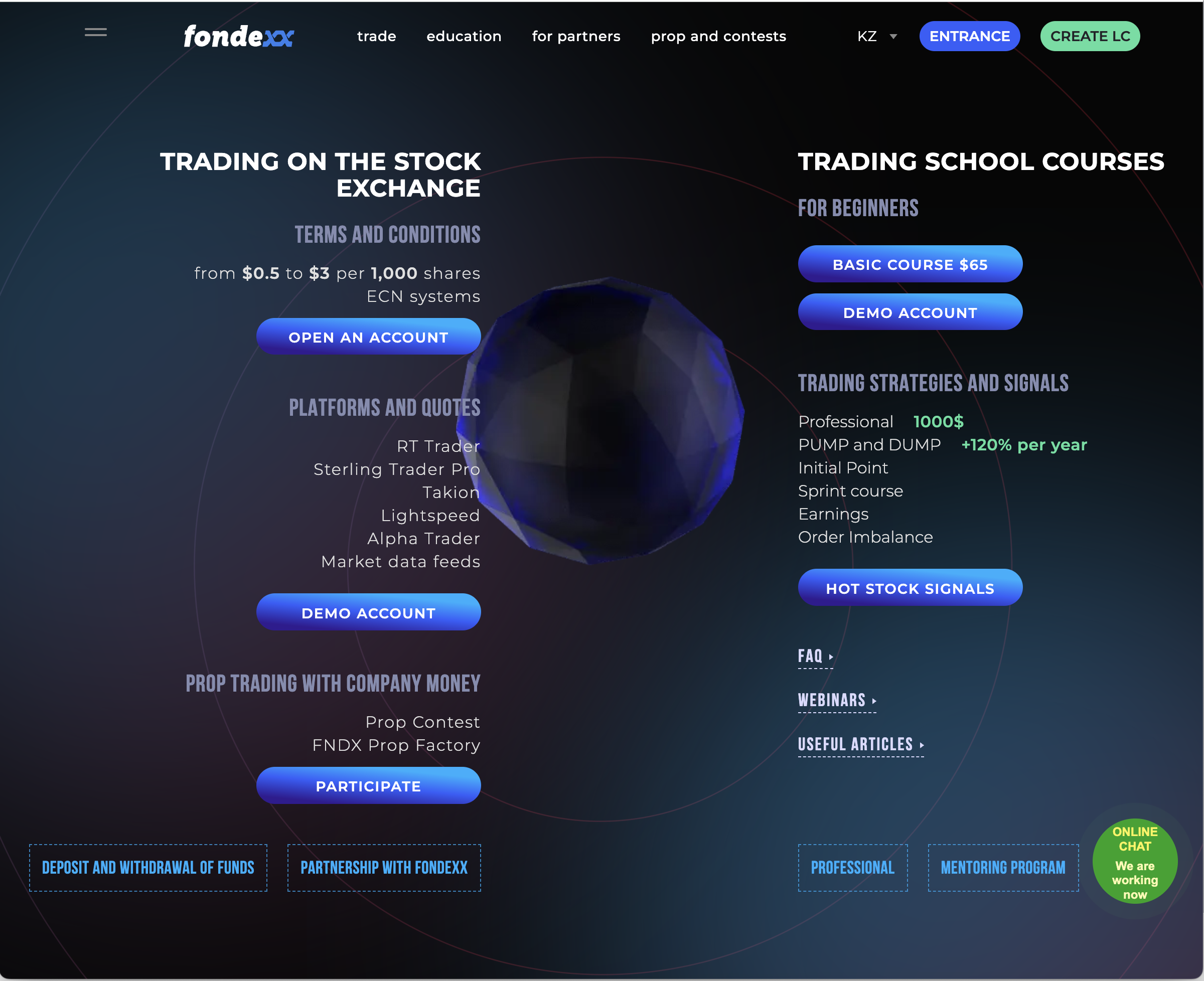

Fondexx tries to establish credibility by presenting itself as a professional prop trading firm with global reach. It claims to provide educational services, guidance from experienced traders, and access to premium tools.

However, these promises follow a familiar playbook used by fraudulent brokers:

-

Grandiose claims of Wall Street or global ties without proof.

-

Promises of exclusive courses that, upon review, resemble generic trading content widely available online.

-

Referral programs that encourage users to bring in new members, resembling pyramid-style marketing more than legitimate financial services.

The gap between flashy marketing and the absence of verifiable credentials is a telltale sign of a scam.

4. Red Flags in User Experiences

One of the strongest indicators of a broker’s authenticity is the feedback from its clients. With Fondexx, reported experiences often point to troubling issues:

-

Difficulty withdrawing funds, even after following all required steps.

-

Accounts being frozen or access blocked once profits are requested.

-

Unexpected hidden fees and sudden charges that reduce balances.

-

Spreads and trade execution that do not match what was promised.

Such complaints highlight a consistent pattern: users may initially be allowed to deposit and even see small “profits,” but once withdrawal is attempted, obstacles arise.

5. Common Scam Blueprint

When analyzing how Fondexx operates, its practices mirror those of countless other scam brokers:

-

Attract clients with polished websites and exaggerated claims.

-

Build trust by showing fake or manipulated small profits.

-

Encourage larger deposits, often through pressure tactics or “VIP” account promises.

-

Block withdrawals using fabricated excuses such as additional verification, unexpected fees, or alleged trading violations.

-

Disappear once enough funds have been collected or too many complaints arise.

This strategy is effective because it exploits the hopes of traders while manipulating their emotions and trust.

6. Why Regulation Matters

The importance of regulation cannot be overstated. Regulated brokers must:

-

Keep client funds in segregated accounts.

-

Provide transparent pricing and execution.

-

Undergo regular audits.

-

Be subject to disciplinary action if they violate rules.

Fondexx, by contrast, offers none of these protections. This absence creates a high-risk environment where users’ funds are left vulnerable.

7. The Psychological Toll of Scams

Losing money to a fraudulent broker is devastating, but the impact often goes beyond finances. Victims commonly experience:

-

Stress and anxiety, worrying about lost savings.

-

Shame or embarrassment, making them reluctant to share their experience.

-

Distrust in legitimate brokers, which can prevent future healthy investment opportunities.

Scams like Fondexx exploit not just money but also the confidence and emotional stability of their victims.

8. Warning Signs to Watch For

Fondexx demonstrates many of the same warning signs traders should always look out for. If you encounter a platform with these traits, caution is advised:

-

Lack of verifiable regulation or license.

-

Anonymous ownership and vague contact information.

-

Promises of guaranteed or unusually high returns.

-

Pressure to deposit larger amounts quickly.

-

Unclear or misleading fee structures.

-

A sudden lack of support when withdrawal is requested.

Each of these individually is concerning—together, they paint the picture of a scam.

9. Lessons for Traders

Scams like Fondexx provide valuable lessons for all traders:

-

Always research a broker thoroughly before depositing funds.

-

Start small and test withdrawal processes before committing larger sums.

-

Be skeptical of platforms offering deals that sound too good to be true.

-

Check for transparency in ownership, location, and regulatory compliance.

-

Prioritize safety and legitimacy over flashy websites and big promises.

The trading industry offers legitimate opportunities, but they exist only with brokers that operate under strong oversight.

Conclusion: Fondexx.com Should Be Avoided

Fondexx.com presents itself as a trustworthy broker but fails every major test of legitimacy. It lacks regulation, hides its ownership, relies on misleading marketing, and has a troubling record of complaints.

Investors deserve transparency, accountability, and security when choosing a platform. Fondexx provides none of these, and its practices strongly suggest it is a scam.

Traders should steer clear of this platform and instead focus on brokers that can prove they are properly licensed and genuinely committed to protecting client interests.

-

Report Fondexx.com and Recover Your Funds

If you have fallen victim to Fondexx.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Fondexx.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.