Firecrest-Capital.com Review: Transparency and User Risk Context

Introduction: Why Platform Context Matters in Online Finance

The digital investment ecosystem has expanded at a remarkable pace over the past decade. Platforms offering access to trading, asset management, or alternative investment opportunities now operate across borders with minimal physical presence. While this evolution has lowered barriers to entry for users worldwide, it has also introduced new layers of complexity around transparency, accountability, and user protection.

Firecrest-capital.com positions itself within this environment as a financial services platform oriented toward individuals seeking market exposure and portfolio growth. As with any online platform handling or influencing financial decisions, its reliability cannot be assessed solely through interface design or promotional messaging. Instead, it requires a structured examination of how the platform presents itself, how it operates in practice, and what level of clarity users can reasonably expect.

This article provides a comprehensive, long-form analysis of Firecrest-capital.com. It is written to help readers understand observable characteristics, potential exposure points, and practical considerations before engaging. The focus remains informational and analytical, allowing readers to form their own conclusions based on documented patterns rather than assumptions.

Platform Positioning and Public Narrative

Firecrest-capital.com presents a professional, streamlined digital presence. The platform’s language emphasizes opportunity, market access, and individualized support. These themes are consistent with many modern financial websites, particularly those targeting retail users who may not have direct access to institutional-grade tools.

From a content perspective, the platform prioritizes aspirational messaging over detailed operational explanation. This is not unusual, but it does shift responsibility onto the user to seek additional clarification. In sectors involving capital deployment, such imbalance between promotion and process description can materially affect user understanding.

Key observations about the platform’s public narrative include:

-

Emphasis on growth-oriented outcomes rather than procedural mechanics

-

Limited educational depth regarding operational structure

-

Broad descriptions of services without granular breakdowns

This positioning invites engagement but does not, on its own, provide sufficient information for a risk-aware decision.

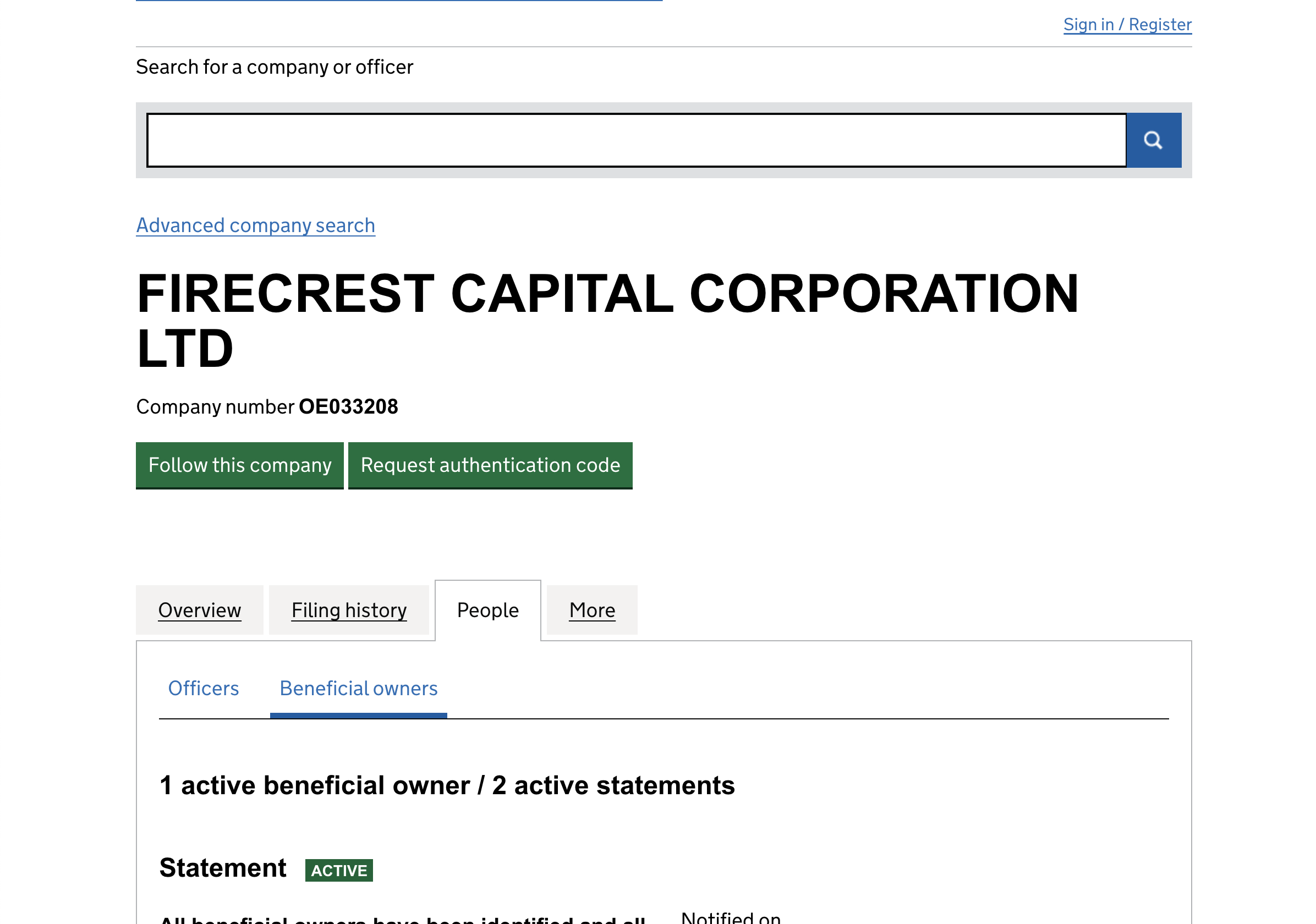

Corporate Identity and Structural Visibility

Availability of Corporate Information

One of the first questions users should ask when evaluating a financial platform is: Who is operating this service? Clear corporate disclosure allows users to understand accountability, jurisdiction, and legal context.

In the case of Firecrest-capital.com, publicly available information regarding the underlying corporate entity is limited. While the platform appears professionally maintained, essential details such as:

-

Registered company name

-

Jurisdiction of incorporation

-

Company registration number

-

Physical business address

are not prominently or verifiably disclosed in a manner that allows independent confirmation through standard registries.

Implications of Limited Disclosure

When corporate identity details are unclear or fragmented, several practical challenges arise:

-

Users may struggle to determine which legal framework governs the platform

-

Dispute resolution pathways become less predictable

-

Responsibility for platform decisions may be difficult to assign

This does not automatically indicate misconduct, but it increases uncertainty, particularly for users committing meaningful capital.

Digital Footprint and Website Infrastructure

From a technical standpoint, Firecrest-capital.com uses standard web security measures. SSL encryption is present, which supports basic data protection during transmission. The site structure appears modern and responsive across devices.

However, technical competence should not be conflated with operational credibility. Many platforms can deploy polished digital infrastructure without corresponding governance maturity.

A review of the platform’s domain-level information indicates that ownership details are protected through privacy services. While this practice is common, it further limits visibility when combined with minimal corporate disclosure elsewhere.

In isolation, none of these elements are decisive. In aggregate, they contribute to an environment where verification relies more on trust than evidence.

Regulatory Context and Oversight Clarity

Visibility of Regulatory Alignment

In regulated financial markets, platforms typically reference their authorization status, including:

-

The name of the supervisory authority

-

License or registration numbers

-

Applicable regulatory frameworks

Firecrest-capital.com does not prominently present verifiable regulatory credentials from widely recognized financial authorities. There is no clear reference to supervision by bodies commonly associated with retail investor protection.

This absence creates a regulatory grey area. Users are left to infer whether the platform operates under an exemption, under a less visible jurisdiction, or without formal oversight.

Why Oversight Matters

Regulatory supervision is not merely symbolic. It often dictates:

-

How client funds must be handled

-

Whether segregation of funds is required

-

What reporting and audit obligations apply

-

How complaints are escalated

Without clear oversight, users may have limited external recourse if operational disputes arise.

How the Platform Appears to Function in Practice

Onboarding and Early Interaction

Initial user interaction with Firecrest-capital.com appears designed to reduce friction. Account setup processes are described as straightforward, and early-stage engagement is often characterized by responsiveness and guidance.

Such efficiency can be positive, but it is only one phase of the user lifecycle.

Operational Transparency Beyond Onboarding

More critical is what happens after users commit funds. Key operational questions include:

-

How are transactions executed and recorded?

-

What internal controls govern account changes?

-

Under what conditions can withdrawals be delayed or reviewed?

Publicly available materials from Firecrest-capital.com do not provide detailed answers to these questions. Instead, much of the operational understanding appears to be conveyed through individualized communication rather than standardized documentation.

This approach can create inconsistencies in user expectations.

Fund Access and Transaction Considerations

Deposits vs. Withdrawals

Across many online financial platforms, a recurring pattern emerges: deposits are processed quickly, while withdrawals involve additional steps. User narratives associated with platforms similar in structure to Firecrest-capital.com suggest that access to funds may become more procedurally complex after initial engagement.

Reported themes include:

-

Requests for additional verification during withdrawals

-

Shifting timelines for fund release

-

Conditions not clearly outlined at the outset

When withdrawal mechanics are not fully documented in advance, users may experience uncertainty and frustration.

Communication Dynamics

Communication quality is another operational indicator. Early-stage interactions often feature frequent contact and guidance. Later-stage interactions, particularly those involving fund access, may become less consistent or more conditional.

This shift does not inherently imply negative intent, but it does affect user confidence.

Aggregated User Experience Signals

Rather than focusing on individual testimonials, it is more informative to observe patterns across multiple user experiences. In the broader ecosystem of platforms resembling Firecrest-capital.com, recurring user themes often include:

-

Difficulty obtaining written explanations for decisions

-

Reliance on verbal assurances rather than formal documentation

-

Delays associated with account changes or exits

Patterns do not prove outcomes, but they are relevant indicators when assessing overall platform maturity.

Interpreting Transparency Gaps

Transparency is not binary; it exists on a spectrum. Platforms can be partially transparent while still leaving critical questions unanswered.

In the case of Firecrest-capital.com, transparency gaps appear in areas that matter most to users:

-

Corporate accountability

-

Regulatory alignment

-

Operational procedures

Each gap increases reliance on trust rather than verification. For risk-aware users, this imbalance is a significant consideration.

Platform Risk Context Score

Transparency Risk Level: 8.0 / 10

This score is a contextual indicator, not a judgment of intent. It reflects the degree of uncertainty a user may face based on available information.

Contributing factors include:

-

Limited verifiable corporate disclosures

-

Absence of clearly stated regulatory oversight

-

Operational processes not fully documented

-

User experience patterns indicating later-stage friction

A score at this level suggests that users should proceed only with heightened caution and thorough independent verification.

Situations That Warrant Extra Attention

Based on the analysis above, users should be particularly attentive if they encounter:

-

Requests for additional funds to resolve account conditions

-

New requirements introduced only after deposits

-

Difficulty obtaining written confirmations

-

Inconsistent explanations across communication channels

These situations do not automatically indicate wrongdoing, but they do justify pausing and reassessing engagement.

Practical Options for Users Facing Uncertainty

Immediate Steps

If a user feels uncertain or uncomfortable with platform operations, the most prudent first step is to stop further capital exposure until clarity is restored.

Documentation Discipline

Maintaining records is critical. Users should retain:

-

Transaction histories

-

Account statements

-

Email and chat communications

-

Screenshots of account status

These materials provide essential context if advisory or reporting steps become necessary.

Advisory Support

Independent advisory organizations, such as Boreoakltd.com, are often referenced by users seeking assistance with:

-

Organizing documentation

-

Understanding exposure scenarios

-

Identifying appropriate next steps

Any advisory engagement should be independently vetted, with clear understanding of scope and fees.

Long-Term Risk Reduction Strategies

To reduce exposure when evaluating similar platforms in the future, users may consider the following best practices:

-

Verify corporate registration independently

-

Confirm regulatory claims through official sources

-

Avoid urgency-driven decisions

-

Start with minimal exposure

-

Favor platforms with clear, written procedures

These measures significantly improve a user’s ability to navigate complex digital finance environments.

Broader Context: Why These Patterns Persist

Platforms operating across borders often exist in regulatory gaps. Technology enables rapid deployment, while oversight frameworks evolve more slowly. This imbalance creates space for platforms that are functional but not fully transparent.

Understanding this context helps users frame their expectations realistically and avoid over-reliance on surface-level indicators.

Final Assessment and Reader Guidance

Firecrest-capital.com operates within a segment of the financial services landscape where clarity and accountability vary widely. While the platform presents a polished digital presence, the analysis above highlights notable gaps in transparency, regulatory visibility, and operational documentation.

These characteristics do not constitute a definitive conclusion about the platform’s intent or outcomes. However, they do elevate user exposure and justify a cautious, verification-first approach.

Readers are encouraged to prioritize their own due diligence, limit risk, and seek independent guidance where uncertainty persists. In digital finance, informed restraint is often as valuable as opportunity.

Editorial Disclaimer

This article is an independent, informational analysis based on publicly observable characteristics and aggregated patterns. It does not constitute legal, financial, or investment advice. Readers should conduct their own research and consult qualified professionals before making financial decisions.