FastBull.com Review: A Risky Trading Platform

The trading industry has always attracted both genuine opportunities and fraudulent schemes. With the rise of online platforms, countless companies have emerged promising wealth, easy access to financial markets, and advanced tools to make trading easier. However, behind the glossy promises, many of these platforms are nothing more than carefully designed traps. FastBull.com is one such platform that has raised serious red flags among traders worldwide.

In this review, we will uncover the deceptive tactics used by FastBull.com, highlight the warning signs that expose its fraudulent nature, and explain why traders should avoid it at all costs.

Introduction to FastBull.com

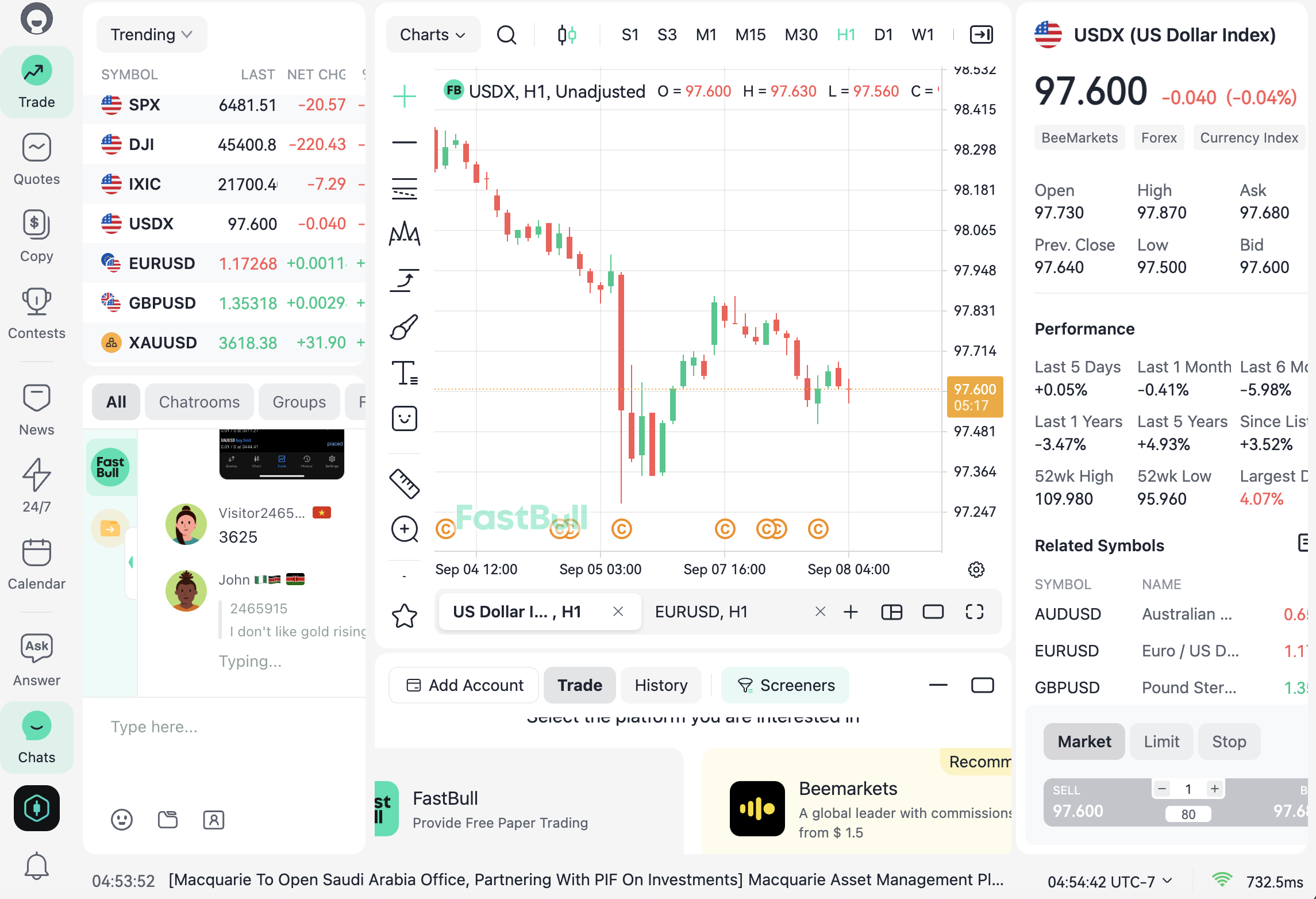

At first glance, FastBull.com presents itself as a modern trading service, offering users advanced financial insights, tools, and supposed “trusted broker partnerships.” The website design is sleek and professional, which is often the first tactic scammers use to build credibility. They claim to provide news, forecasts, and analysis to support traders, but upon closer inspection, their real motive becomes clear: to lure unsuspecting investors into fraudulent schemes.

Unlike legitimate platforms that clearly disclose their regulation, ownership, and financial safeguards, FastBull.com is vague about who operates the site and where it is based. The absence of transparency is the first major warning sign.

Lack of Proper Regulation

One of the biggest red flags with FastBull.com is its lack of regulatory oversight. Trusted trading platforms and brokers must be licensed by recognized authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus). FastBull.com, however, hides behind vague references to being a “global platform” without showing any verifiable license or registration.

This lack of regulation means there are no legal protections for traders. If anything goes wrong — such as blocked withdrawals, manipulated trades, or sudden account closures — investors have no authority to turn to. The platform can operate unchecked, making it extremely risky.

The Illusion of Credibility

FastBull.com attempts to build credibility by presenting itself as an all-in-one resource for traders. They offer market analysis, forex calendars, and even claim to partner with well-known brokers. However, much of this content is either copied from legitimate sources or presented in a way that misleads visitors.

Their so-called broker partnerships often lead users to shady, unregulated firms that are notorious for trapping investors with hidden fees and impossible withdrawal conditions. Instead of acting as a neutral provider of information, FastBull.com operates as a funnel — guiding users straight into the hands of scams.

How FastBull.com Deceives Traders

Like many fraudulent platforms, FastBull.com uses a mix of strategies to mislead and exploit investors:

1. False Promises of Reliability

They market themselves as a trustworthy financial information provider, but without regulation or transparency, these claims are hollow. Their promises are designed to create a false sense of security.

2. Redirection to Shady Brokers

Users who sign up or engage with the site are often redirected to unregulated brokers where deposits can be easily lost. These brokers use aggressive tactics to pressure users into depositing more money.

3. Manipulated Content

The platform showcases financial news and forecasts, but much of it is either misleading or irrelevant. This creates confusion for traders, making them more dependent on the platform’s “recommendations.”

4. Hidden Agenda

While pretending to be an independent platform, FastBull.com profits by promoting brokers known for fraudulent practices. They act more like an affiliate scheme than a genuine trading resource.

Signs of a Scam

There are several unmistakable warning signs that FastBull.com is not a legitimate trading resource:

-

No regulatory information: Nowhere on their site do they show proof of being licensed.

-

No transparency about ownership: Legitimate companies always disclose their team, location, and history. FastBull.com hides all of this.

-

Suspicious broker links: Clicking through their “partners” leads to untrustworthy and unregulated firms.

-

Unrealistic claims: They advertise reliable insights and trustworthy brokers without providing evidence.

-

Negative trader feedback: Many users report losing funds after being guided by FastBull.com’s broker suggestions.

These red flags make it clear that FastBull.com is not a platform built to support traders, but rather to exploit them.

The Trap of Withdrawal Problems

One of the most common issues faced by traders misled by FastBull.com is withdrawal denial. Once users are redirected to the shady brokers promoted on the site, they find it almost impossible to retrieve their money. The brokers impose endless verification steps, hidden fees, or outright refuse to process withdrawals.

This is a classic scam tactic. The moment money is deposited, it becomes incredibly difficult to get it back.

The Danger of False Security

FastBull.com thrives by presenting itself as a legitimate and professional service. The professional-looking site design, market calendars, and financial insights give new traders a false sense of confidence. Unfortunately, this illusion often leads to devastating losses when traders trust the platform’s recommendations.

Scammers rely heavily on appearances. They know that inexperienced traders are more likely to believe in a platform that looks modern and polished. But behind the design, there is no substance or credibility.

Comparing to Legitimate Platforms

Legitimate financial platforms are fully transparent about their regulatory status, ownership, and operations. They provide real value through verified data, clear disclosures, and trusted partnerships. In contrast, FastBull.com avoids these responsibilities while pretending to be an authority.

For example, trustworthy platforms openly list their parent companies and provide links to their regulator’s website for verification. FastBull.com does none of this, which speaks volumes about its true nature.

Protecting Yourself from Scams Like FastBull.com

The best way to avoid falling victim to platforms like FastBull.com is to be vigilant and practice due diligence:

-

Always check regulation: Verify that the platform or broker is licensed by a recognized authority.

-

Research ownership: Look for transparency about who is behind the platform.

-

Be cautious of referrals: If a site constantly redirects you to unknown brokers, it’s a red flag.

-

Read independent reviews: Many traders share their experiences online, which can reveal scam patterns.

-

Trust your instincts: If something feels off — like unrealistic promises or hidden details — it usually is.

Final Verdict on FastBull.com

After a thorough investigation, it is clear that FastBull.com is not a legitimate trading platform. Instead, it operates as a deceptive funnel that pushes traders toward shady, unregulated brokers where their funds are at risk. The lack of transparency, absence of regulation, and misleading content all point to one conclusion: FastBull.com is a scam platform designed to exploit unsuspecting traders.

Report FastBull.com and Recover Your Funds

If you have fallen victim to FastBull.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like FastBull.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.