Egalite.bond Scam Review – Exposing the Deceptive Platform

In recent years, online investment platforms have multiplied at a staggering pace, promising lucrative returns and opportunities for financial freedom. Unfortunately, many of these platforms are nothing more than carefully crafted scams designed to trick unsuspecting individuals out of their hard-earned money. One of the latest names to emerge in this troubling trend is egalite.bond. While it attempts to appear as a legitimate investment site, closer scrutiny reveals a long list of red flags and deceptive tactics that expose it as a fraudulent scheme.

This review provides a deep dive into the workings of egalite.bond, highlighting the tactics it uses, the tricks behind its operations, and why investors must steer clear.

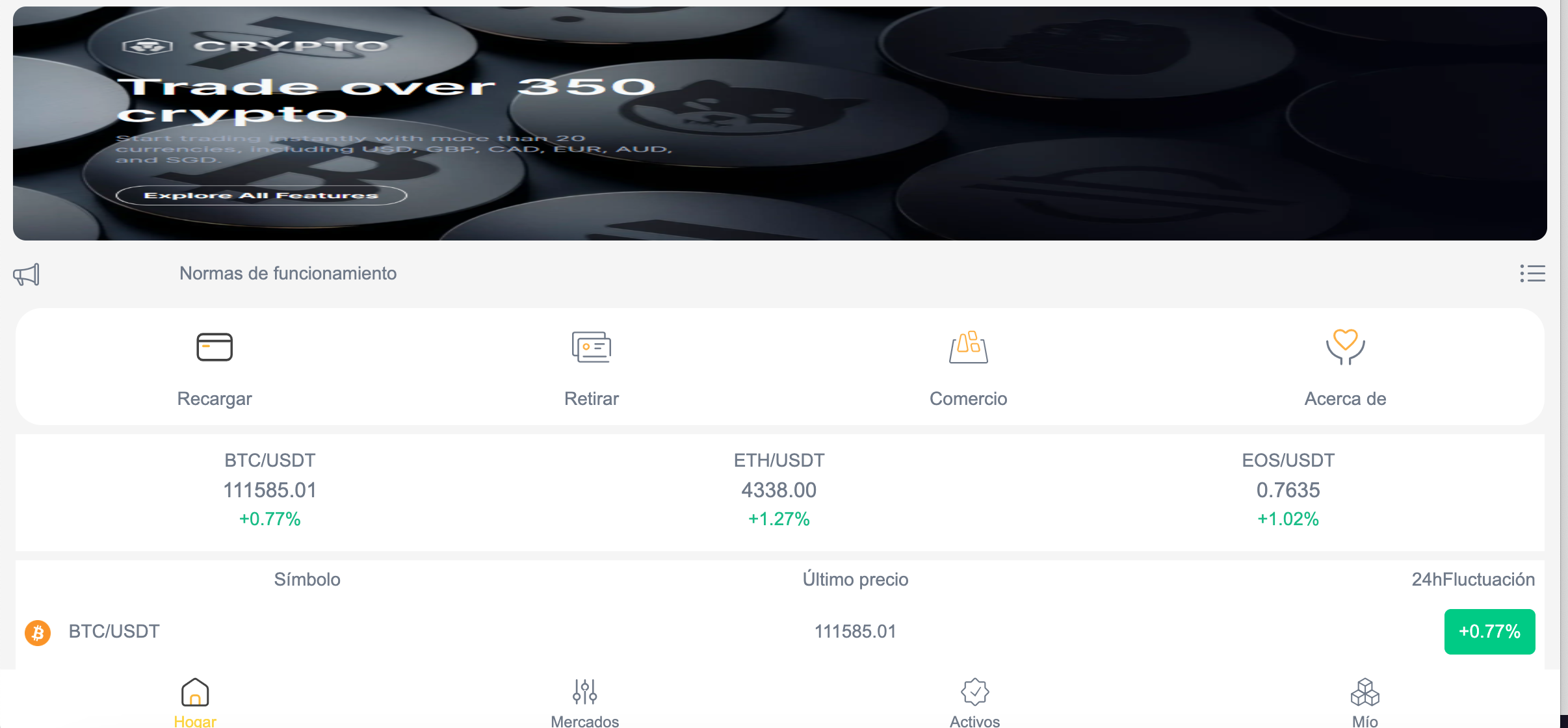

First Impressions: A Polished Front

At first glance, egalite.bond presents itself as a professional and polished investment platform. The website is designed to look sleek, with modern layouts, financial jargon, and lofty promises of high returns on investment. To someone who is new to online investing, the site might appear convincing, offering what looks like a gateway to profitable opportunities in bonds, trading, or asset management.

But it is precisely this polished presentation that forms the first layer of deception. Scam platforms like egalite.bond understand that a professional-looking website is often enough to lull visitors into a false sense of security. Behind the glossy design lies little substance, no transparency, and no real business operations.

Unrealistic Promises of Wealth

One of the clearest red flags of egalite.bond is its unrealistic claims of guaranteed profits. The platform frequently advertises investment plans that promise abnormally high returns in very short periods. Anyone with even a basic understanding of investing knows that returns are never guaranteed—especially not at the rates being promoted by this site.

The platform markets itself as if it has access to secret strategies or exclusive financial products that can deliver consistent gains regardless of market conditions. This is a common scammer tactic: playing on people’s desire for quick wealth while downplaying or ignoring the inherent risks of real investing.

Lack of Transparency and Verifiable Information

A legitimate investment company always provides clear information about its operations, licenses, and regulatory status. With egalite.bond, none of this information is available. The website is vague about its location, ownership, and corporate background. Even the so-called “About Us” page is filled with generic statements and buzzwords rather than verifiable facts.

Attempts to trace the company’s registration or verify its claims lead to dead ends. This deliberate lack of transparency ensures that victims have no way of holding the operators accountable once their money is stolen. It also highlights the shadowy and untrustworthy nature of the operation.

Dubious Contact Details

Another tell-tale sign of fraudulent behavior is the type of contact information provided. Egalite.bond often lists only an email address or a basic contact form on its website. In some cases, phone numbers may be displayed, but they are either inactive or routed through call centers that provide little help.

Scam platforms avoid offering genuine customer service because their business model is not built around supporting investors—it is built around extracting money and disappearing. Investors who attempt to seek clarification, request withdrawals, or question the legitimacy of the platform are often ignored or given vague responses.

Aggressive Marketing Tactics

Victims of egalite.bond frequently report being approached through aggressive marketing tactics. This includes unsolicited phone calls, emails, and social media messages. Often, these communications come from so-called “account managers” who claim to represent the company and pressure individuals to make deposits quickly before a “limited-time opportunity” disappears.

These agents are trained to manipulate emotions, using urgency and fear of missing out (FOMO) to push people into hasty decisions. Once an individual makes an initial deposit, the pressure intensifies, with agents encouraging larger and larger investments under the promise of bigger returns.

The Deposit Trap

The true nature of egalite.bond becomes clearer once money has been deposited. Initially, investors may see what appear to be positive results on their online dashboard. Balances might grow, profits might appear to accumulate, and the illusion of success is carefully maintained.

However, these figures are entirely fabricated. The platform controls what is displayed, giving the impression of growth to entice further deposits. When investors attempt to withdraw their so-called profits, problems arise. Withdrawals are delayed, subjected to endless “verification” procedures, or blocked altogether.

In many cases, victims are told they must pay additional fees, taxes, or commissions before withdrawals can be processed. These demands are nothing more than tricks to extract more money from already defrauded individuals.

Disappearing Act

Eventually, when victims refuse to pay more or press too hard for withdrawals, egalite.bond’s operators vanish. The website may suddenly go offline, contact details may stop working, and all communication channels close. The funds deposited are lost, and victims are left with no recourse.

This pattern is consistent with countless other online investment scams. The operators create a convincing façade, attract deposits, extract as much money as possible, and then disappear—often resurfacing under a new domain name to repeat the cycle.

Fabricated Credentials and Fake Testimonials

To appear legitimate, egalite.bond often relies on fabricated credentials and fake testimonials. Claims of regulation or licensing are either unverified or outright false. The platform may display logos of well-known financial regulators, but these are used without authorization and serve only to mislead investors.

Similarly, testimonials and reviews on the site are suspiciously positive and generic, often written in a way that sounds scripted rather than authentic. Many are recycled across multiple scam platforms, further proving their lack of credibility.

Targeting the Vulnerable

Scam platforms like egalite.bond thrive on targeting individuals who may not have extensive knowledge of financial markets. They often lure in people looking for alternative income sources, retirees seeking to grow their savings, or individuals desperate for quick financial solutions. By presenting themselves as experts and offering a simple path to wealth, they prey on trust and vulnerability.

This exploitation is particularly damaging because victims often invest not only money but also their hopes for a better financial future. Losing funds to such schemes can cause emotional distress, broken trust, and financial hardship.

Signs That Expose Egalite.bond as a Scam

To summarize, the following warning signs make it clear that egalite.bond is a fraudulent operation:

-

Unrealistic promises of guaranteed high returns.

-

Lack of verifiable company information or regulation.

-

Generic website content with no transparency.

-

Aggressive sales tactics and pressure to invest quickly.

-

Fake profits displayed on dashboards to lure more deposits.

-

Withdrawal difficulties and demands for additional fees.

-

Disappearing contact details and non-responsive support.

-

Fake testimonials and fabricated credentials.

These red flags are textbook examples of how online financial scams operate.

Why Egalite.bond Should Be Avoided

Egalite.bond is not a legitimate investment opportunity. It is a fraudulent scheme carefully designed to trick people into parting with their money. Every aspect of its operation—from its slick website to its fabricated results—serves the single purpose of enriching its anonymous operators at the expense of unsuspecting investors.

The risks of engaging with such platforms are absolute: once money is deposited, it is almost certain to be lost. Unlike regulated investment firms, egalite.bond offers no protections, no transparency, and no accountability.

Conclusion

The rise of platforms like egalite.bond highlights the urgent need for vigilance when exploring online investment opportunities. While the promise of quick profits can be tempting, the reality is that scammers are becoming increasingly sophisticated in their methods. Egalite.bond is a clear example of a platform built on lies, manipulation, and exploitation.

Investors must recognize the warning signs, resist the lure of unrealistic promises, and prioritize safety over shortcuts. By understanding how such scams operate and spreading awareness, fewer people will fall victim to deceptive schemes like egalite.bond.

Report Egalite.bond and Recover Your Funds

If you have fallen victim to Egalite.bond and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Egalite.bond persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.