Edge-FundsTradingReview: A Risky Investment Platform

In the vast online world of financial platforms offering investment, trading or crypto-related services, Edge-FundsTrading (sometimes called Edge Fundstrading) is one of those names rising fast. On the face of it, its marketing materials, website design, and promise of high returns look alluring. But digging deeper reveals a pattern of deceit, regulatory silence, and several traits common to known scam operations. Below is a comprehensive review of Edge-FundsTrading: what it claims, how it operates, why many consider it unsafe, and what to watch out for if you encounter it.

1. What Edge-FundsTrading Claims to Be

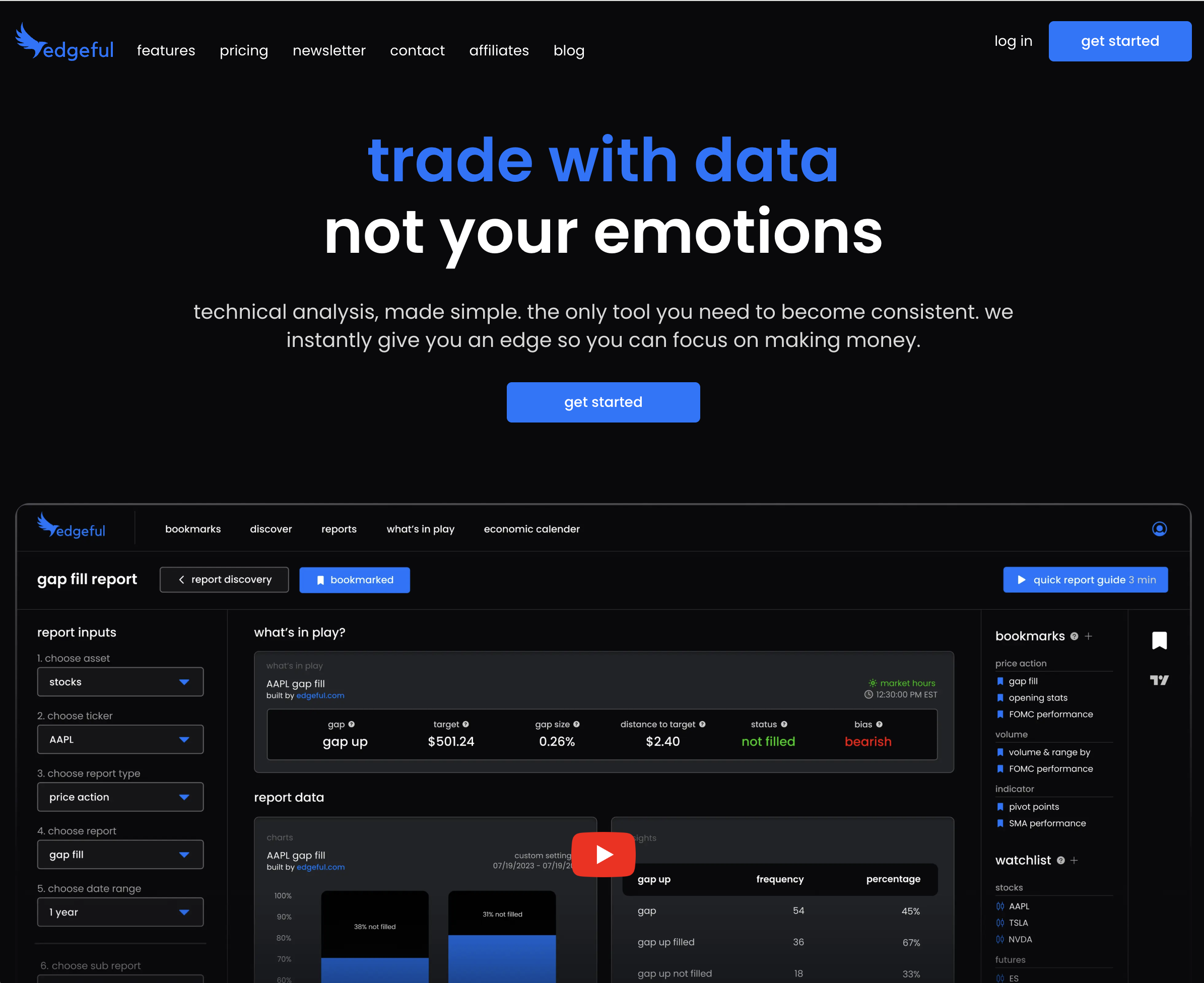

Edge-FundsTrading presents itself as a modern investment/trading service, promising users access to financial growth through various plans, possibly including forex trading, crypto, or other trading instruments. Some of its promotional content includes:

-

Promises of generous or above-market returns.

-

Statements suggesting ease of getting started, possibly with “minimum deposits” that appear accessible.

-

Use of professional-looking website design, dashboards, and possibly a promise of customer/tech or “account manager” support.

-

Claims, or at least implications, of security, legitimacy, and being “trusted” or connected to recognized financial markets or institutions.

These marketing features are intended to reduce scepticism, build trust quickly, and get potential customers to deposit funds without much investigation.

2. Regulatory Status & Oversight Gaps

One of the most critical measures of legitimacy for any financial/investment platform is regulation. In the case of Edge-FundsTrading, multiple reliable risk-assessment sources and watchdogs raise alarm because:

-

It is identified as unregulated. There is no credible evidence that Edge-FundsTrading holds a license from recognized authorities in the UK, EU, Australia, or other strong regulatory jurisdictions.

-

In particular, a major financial regulator in the UK has issued a public warning that Edge-FundsTrading is operating without authorization. Such warnings typically indicate that the firm in question is offering financial services/products without having obtained legal permission.

-

Analysts comparing its website or infrastructure found it uses generic or widely reused website templates that have been associated with other suspicious or previously flagged brokers. Some text, layout, claims, or address information appears duplicated across multiple suspect sites.

Because regulation involves oversight, audits, separation of client funds, and recourse for customers, its absence is a severely negative mark in any investment venture.

3. Trust & Risk Scores from Independent Reviewers

Various review services, scam detectors, and website-trust tools have evaluated Edge-FundsTrading and consistently found cause for concern:

-

One evaluation assigns it a low to medium trust score; that suggests that while the site may look functional, several risk indicators are active.

-

Risk-assessment tools show proximity to “suspicious websites” (sites flagged for spam, phishing, or fraud). That means its IP hosting or related infrastructure may be shared or connected with other dubious operations.

-

Some evaluations note high “phishing score,” elevated “spam score,” or similar metrics. These are technical red flags that suggest this site or related online content may be trying to mislead or harass users.

-

Reviews also cite issues like hidden domain ownership (WHOIS privacy), lack of credible or verifiable management or staff information, and generic or vague terms of service.

All these signs collectively indicate that Edge-FundsTrading is not operating with standard transparency, which raises risk significantly for anyone considering using it.

4. How Edge-FundsTrading Appears to Operate in Practice

While we can’t confirm internal operations, many user reports and review analyses suggest a common pattern for how the platform interacts with users. Here is a reconstructed model based on reported behavior and red flags.

| Stage | What Users Report / What the Platform Seems to Do |

|---|---|

| Initial Contact & Attraction | Users are drawn in through online ads, perhaps via social media, investment forums, or affiliate/referral links. Marketing emphasizes “high returns,” “easy start,” “trusted support,” etc. |

| Deposit & Early Gains | After depositing, users may see dashboard balances increase or small profits displayed. These early “wins” help build trust. But they are likely simulated or not actual retrievable profits. |

| Upsell / Larger Deposits | As trust builds, users are encouraged by account managers to invest more. “Premium plans,” higher returns for larger investment amounts, or “unlocking better features/tools” are offered. |

| Withdrawal Process Issues | When users request withdrawals (of profit or sometimes even their original deposit), various obstacles appear: demands for extra verification, fees, delays, or claims of tax/licensing or regulatory blocks. Sometimes conditions shift or additional requirements appear that weren’t disclosed initially. |

| Communication & Access Problems | Support becomes harder to reach, messages are vague, explanations contradictory. There may be downtime, or parts of the site may be disabled. Some users report inability to login or have account access blocked. |

| Disappearances / Rebrandings | Over time, there are reports of the site going offline, disappearing, or rebranding under different names. Sometimes physical address information or claimed partnerships are shown to be false or unverifiable. |

These behaviors map closely to what many labeled scams do: build trust early, then block access when people try to take money out.

5. Specific Red Flags in Edge-FundsTrading’s Structure & Claims

Here are some of the specific inconsistencies, deceptive claims, or warning signals that emerge from reviews and investigations into Edge-FundsTrading:

-

Unauthorized claims or licensing: The platform is claimed by its marketing to be legit or associated with financial markets, but regulators have explicitly said it works without authorization.

-

Generic website layout & template reuse: Parts of the site’s design or text (claiming partnership with big exchanges, generic address, etc.) match patterns seen in other known shady brokers.

-

Hidden or masked ownership: The domain registration uses privacy services; the actual identities of operators, directors, or staff are not clearly disclosed.

-

Vague contact or location info: Claims about offices or regulatory jurisdiction are not backed by verifiable certificates or registrations. Addresses may be generic or incorrect.

-

Unrealistic return promises: The promotional materials often promise returns that are unusually high in short time frames (e.g. “double your deposit,” or “X% in a few days”) — without corresponding disclosed risk.

-

Discrepancies in withdrawal policies: What is promised in terms of withdrawals or policies does not match what some users report when attempting withdrawals (hidden fees, delays).

-

Warnings by regulators: As mentioned, official caution from at least one financial regulatory authority in the UK, noting Edge-FundsTrading is not authorized, is a strong warning.

6. Why Many Users Are Actually Losing Money

Based on user reports and the above structure, here are the main reasons people interacting with Edge-FundsTrading end up losing funds or facing losses:

-

Lock-in effect: After depositing and seeing small “profit,” people are encouraged to deposit more with the belief that later returns will cover losses or exceed expectations.

-

Obfuscated rules: Hidden or shifting rules about verification, withdrawal minimums, or fees lead to confusion and unexpected costs.

-

Delays & excuses: As withdrawal is requested, platform begins to raise objections: “taxes,” “regulation,” “security checks,” or simply “system issues.” These delays often accumulate until access is lost or the site becomes unresponsive.

-

Evading accountability: With hidden ownership, unregistered status, and changing contact information, there is little legal or regulatory recourse.

-

Possible rebranding: If enough complaints accumulate, the site might shut down or shift to a new name/domain, making warnings less visible and renewing the scam cycle.

7. Comparison with Legitimate Platforms: What They Do Differently

To see how Edge-FundsTrading stands in contrast, it’s helpful to underscore what legitimate, regulated investment/trading platforms typically do:

-

Display verifiable licences/registrations with regulatory bodies; such records are searchable.

-

Provide transparent ownership, staff details, physical office address information.

-

Clear, consistent, and accessible terms & conditions, especially regarding fees, withdrawal policies, and risk disclosures.

-

Independent audits or external proof of fund safety or performance (in many cases).

-

No unrealistic guarantees of profit; risk is communicated clearly.

-

Customer service that responds promptly, transparently, and does not change terms after money is deposited.

Edge-FundsTrading appears to fail on many of these benchmarks.

8. Potential Harm: Not Just Financial

It’s not only money that users risk when platforms like Edge-FundsTrading are involved. Other harms may include:

-

Exposure of personal or financial information (documents, ID, bank or crypto wallets) to untrustworthy actors.

-

Being pressured into sharing sensitive data under the pretext of identity verification.

-

Emotional distress from loss of money and lack of recourse.

-

Possible involvement in financial transactions that leave someone vulnerable to fraud or misuse of account information.

These side risks often go overlooked but are real components of many online scams.

9. Why Scammers Using Platforms Like Edge-FundsTrading Continue to Work

It’s worth understanding why even with so many warnings, these platforms manage to stay in operation and attract new victims:

-

Sophisticated promotion & advertising: Using attractive websites, sales language, social media, affiliate marketing, even paid testimonials to look credible.

-

Psychology of gain vs risk: Many people are willing to gamble when the promise is high returns, especially if they feel they have few alternatives.

-

Limited regulation awareness: Not everyone knows to check for regulation, licenses, or recognized oversight; many take website claims at face value.

-

Gradual escalation of investment: Small initial deposits, early “profits” to build trust, then bigger sums pushed.

-

Obscurity & domain churn: By hiding ownership, masking addresses, using privacy services, changing domain names if flagged, these platforms stay ahead of detection.

These tactics work not just because they fool people initially, but because the platform’s structure reinforces the illusion it is legitimate until it no longer needs to communicate, or until it shuts down.

10. Final Assessment & Key Takeaways

Putting all the evidence together, here’s a summary of how Edge-FundsTrading stacks up and what you should conclude if you’re evaluating it or any similar platform.

-

Edge-FundsTrading shows many characteristics of a scam broker: unregulated status, regulatory warnings, generic website template reuse, hidden ownership, unrealistic return promises, and reported difficulty with withdrawals.

-

Even though it might look polished and trustworthy at first impression, features like valid SSL certificate, a modern website, and flashy dashboard design do not equate to legitimacy. These are low-cost items scammers can replicate easily.

-

The red flags are consistent across multiple independent sources: watchdog sites, broker review platforms, and user reports. That makes the risk posture very high.

-

Unless there is verifiable and transparent evidence of regulation, audit, ownership, and consistent truthful track record, platforms like Edge-FundsTrading are very high hazard.

Key Red Flags Recap

Here are the main warning signals to watch for, particularly in Edge-FundsTrading’s context:

-

Lack of valid regulatory license or warning from regulators.

-

Hidden or private domain ownership (WHOIS privacy masking).

-

Website using reused templates, false claims of partnerships or affiliation.

-

Promises of high returns in short periods, seemingly guaranteed.

-

Difficulty or excuses when withdrawing funds.

-

Vague or changing terms and conditions.

-

Poor or minimal independent user feedback.

-

Generic or misleading contact information or claimed addresses.

Conclusion

Edge-FundsTrading, based on available reviews, risk-assessment data, and user reports, displays numerous indicators aligning with known scam operations. The platform’s structure, claims, and behavior patterns are risks rather than opportunity. Anyone considering investing or depositing funds with Edge-FundsTrading should proceed with extreme skepticism, conduct deep due diligence, and demand verifiable proof before placing trust in any of its promises.

Report Edge-FundsTrading and Recover Your Funds

If you have fallen victim to Edge-FundsTrading and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Edge-FundsTrading persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.