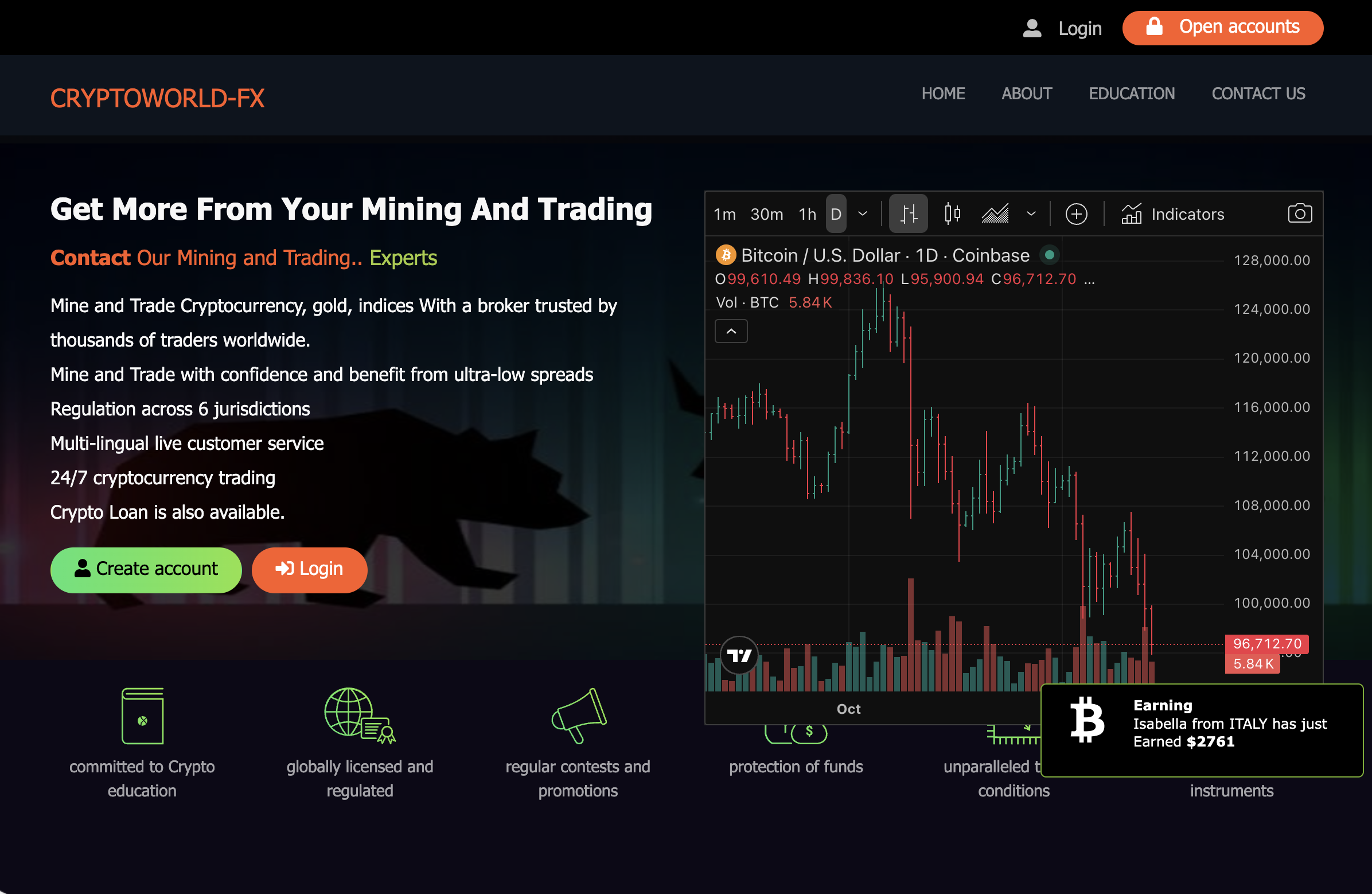

Cryptoworld-Fx Scam Review: A Fake Trading Platform?

In the fast-paced universe of online forex and crypto trading, many platforms promise extraordinary profits with minimal effort. While some of these sites deliver genuine value, others rely on slick marketing and limited disclosure. Cryptoworld-Fx is a platform that promises advanced trading capabilities and exceptional returns—but a deeper look reveals many red flags that warrant serious investor caution.

This comprehensive review digs into Cryptoworld-Fx’s business model, operations, and risk profile, giving you a clear picture of what to watch out for and how to protect yourself.

1. The Pitch: Promises of High Returns and Cutting-Edge Tools

From the moment you land on Cryptoworld-Fx’s website, the message is one of opportunity and sophistication. The platform touts features like:

-

“Advanced trading algorithms”

-

“Smart signals and AI-powered strategies”

-

High execution speed and “market-beating opportunities”

-

VIP account tiers with “premium returns”

These kinds of claims are common among platforms aiming to attract ambitious traders. However, when a company focuses heavily on “guaranteed profits” or “market-beating” strategies without transparent evidence, it’s a strong indicator that reality may not match the promise.

Real brokers talk about risks, drawdowns, and strategy—Cryptoworld-Fx emphasizes results and guarantees, which may not be backed by a realistic business model.

2. Corporate Transparency: Who’s Behind Cryptoworld-Fx?

One of the most concerning areas is Cryptoworld-Fx’s missing or ambiguous corporate identity. Reliable brokers clearly display their:

-

Business registration number

-

Physical address

-

Leadership or executive team

-

Regulatory registration

On Cryptoworld-Fx’s site, these details are vague or inconsistently presented. The address listed is non-committal, the domain registration is privacy-protected, and no executives are named. This lack of transparency creates serious accountability issues: if something goes wrong, who do you turn to? Without verifiable ownership, there’s little way to hold the provider responsible.

3. Regulation: A Critical Missing Piece

Probably the biggest red flag is the regulatory status—or lack thereof. Cryptoworld-Fx does not clearly claim or provide evidence of being licensed by a recognized financial regulator.

Operating without regulation means:

-

No formal oversight of client funds

-

No requirement to segregate customer assets

-

No guarantee of audited financials or consumer protection

-

Limited or no access to legal recourse if there are disputes

For any serious investor, trading on a non-regulated platform significantly increases risk. Without regulation, the “platform” could simply be a façade for taking deposits, not facilitating real trades.

4. Deposit Mechanisms: Risky Flow Paths

A key question: how does Cryptoworld-Fx collect funds? Transparency in deposit methods is a major indicator of trustworthiness.

Concerning reports suggest:

-

Use of payment options that are fast but difficult to trace (possibly including cryptocurrency).

-

Ambiguous payment processing routes, which make it hard to verify that money is going to a legitimate corporate account.

-

Poorly documented or inaccessible banking information for deposits.

If client funds flow through uncommitted or non-corporate accounts, you lose a vital layer of security and traceability. That raises serious concerns about where exactly your money ends up.

5. Onboarding & Account Management Pressure

Many high-risk platforms lean heavily on persuasive sales tactics. For Cryptoworld-Fx, common reports include:

-

Account managers contacting new users aggressively right after signup

-

Promises of “upgrades” to accounts with higher profitability

-

Messaging that pushes urgency (“limited time opportunity”)

These tactics shift the focus from rational decision-making to emotional persuasion. When a broker pushes you to deposit before you have thoroughly verified it, that is a strong warning signal.

6. Unrealistic Returns: Too Good to Be True?

Cryptoworld-Fx markets itself on wealth accumulation through strategic trading. It promotes ROI potential that appears to defy realistic market conditions — high, frequent returns that seem “too good to be true.”

In real trading:

-

Risk is unavoidable

-

Profits vary, losses happen

-

No legitimate trading algorithm guarantees consistent large gains

If a platform offers aggressive profit guarantees with no meaningful consulting on risk, it may be selling hype, not substance.

7. Withdrawal Problem Pattern

Even if a platform appears credible initially, many problematic brokers reveal themselves when users try to withdraw their money. With Cryptoworld-Fx:

-

Users report repeated delays when submitting withdrawal requests

-

Additional “verification” or “processing” fees emerge at payout time

-

Withdrawal terms seem inconsistent or overly restrictive in practice

Such behavior is deeply worrisome. When withdrawal depends on paying extra or satisfying shifting conditions, your investment becomes far less secure.

8. Customer Support and Communication Gaps

Effective and credible financial services provide robust support: ticket systems, professional email domains, and clear escalation paths. But with Cryptoworld-Fx:

-

Support appears limited and possibly unstructured

-

The company may rely on informal communication channels

-

There’s little evidence of a formal, transparent customer-service process

When support isn’t properly documented, resolving client issues becomes difficult, reducing trust and recourse if something goes wrong.

9. Web Security and Technical Signals

Digital trust is more than marketing—it’s also technical security. Several aspects of Cryptoworld-Fx’s domain raise concerns:

-

Potentially limited SSL/TLS assurance or poor certificate management

-

Domain registration is relatively recent with privacy shielding, making ownership obscure

-

The website design may reuse generic templates common to high-risk platforms

These signals suggest weak infrastructure and limited long-term commitment, both of which increase risk for investors.

10. Legal Documentation & Terms of Service

Reading the fine print is critical. Investment platforms should clearly outline:

-

How funds are held and managed

-

Conditions for withdrawing profits or initial deposits

-

Dispute-handling processes

-

Risk disclosures and market disclaimers

With Cryptoworld-Fx, the terms of service may be vague or overly one-sided, giving the company broad discretion to manage or restrict client access to funds. This lack of investor-friendly contract terms is a major concern.

11. Psychological Hooks: Why People May Be Drawn In

Cryptoworld-Fx leverages several psychological levers to attract and retain investors:

-

Using “elite trader” language to create prestige

-

Emphasising scarcity with “limited VIP spots” or “exclusive offers”

-

Simulating strong account balances using impressive—yet potentially fake—dashboard data

-

Employing “friendly” sales representatives urging upgrades

Understanding these hooks helps potential investors remain critical rather than emotionally persuaded.

12. Pre-Investment Risk Checklist

If you’re considering depositing money with Cryptoworld-Fx, here is a practical due-diligence guide:

-

Verify regulatory status: Ask for a license and confirm it with a public authority.

-

Confirm business identity: Look for company registration, address, and named executives.

-

Test a small withdrawal: Only fund with an amount you can afford to test.

-

Inspect terms and conditions: Read to ensure fairness, control, and clarity.

-

Evaluate deposit routes: Make sure money goes to traceable, regulated accounts.

-

Assess the sales process: Are they pressuring you? What’s the tone?

-

Check user feedback: Find independent reviews—not just what’s on their website.

If the answers to these are missing or ambiguous, you’ll likely want to avoid significant financial exposure.

13. Final Assessment: High Risk, Low Transparency

After analyzing the available evidence, it’s clear that Cryptoworld-Fx exhibits many of the classic signs of a high-risk or potentially fraudulent trading platform. Here are the biggest concerns:

-

It appears unregulated

-

The corporate identity is largely opaque

-

It uses aggressive marketing to drive deposits

-

Withdrawal mechanisms are unclear and possibly restrictive

-

Customer support infrastructure is weak or informal

-

Terms of service may lack meaningful protections for users

Putting all these elements together, there is a very clear case for caution.

Key Takeaways for Investors

-

Regulation is non-negotiable. Without it, risk skyrockets.

-

Transparency is fundamental. Know who you’re sending money to.

-

Real profits involve risk. Overly aggressive promises usually signal danger.

-

Test the system. Try small transactions first to validate withdrawal capability.

-

Protect yourself with due diligence. Use independent verifications, not just trust in marketing.

Report Cryptoworld-Fx and Recover Your Funds

If you have fallen victim to Cryptoworld-Fx and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Cryptoworld-Fx persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.