Credafin Scam Review –Exposing the Truth

Online investment platforms have become increasingly common in recent years, offering traders and beginners the chance to earn returns through digital financial markets, automated trading tools, and other profit-generating systems. Among these platforms is Credafin, a relatively unknown website that has caught the attention of many potential investors. While some users express curiosity about its investment opportunities, others raise concerns, share uncertainties, and even allege that the platform might be suspicious.

This review aims to objectively analyze Credafin by examining user complaints, platform behavior, transparency issues, and the risk factors that often lead to scam allegations. The article does not label Credafin as a scam but instead investigates why people are skeptical and what red flags may be contributing to these concerns.

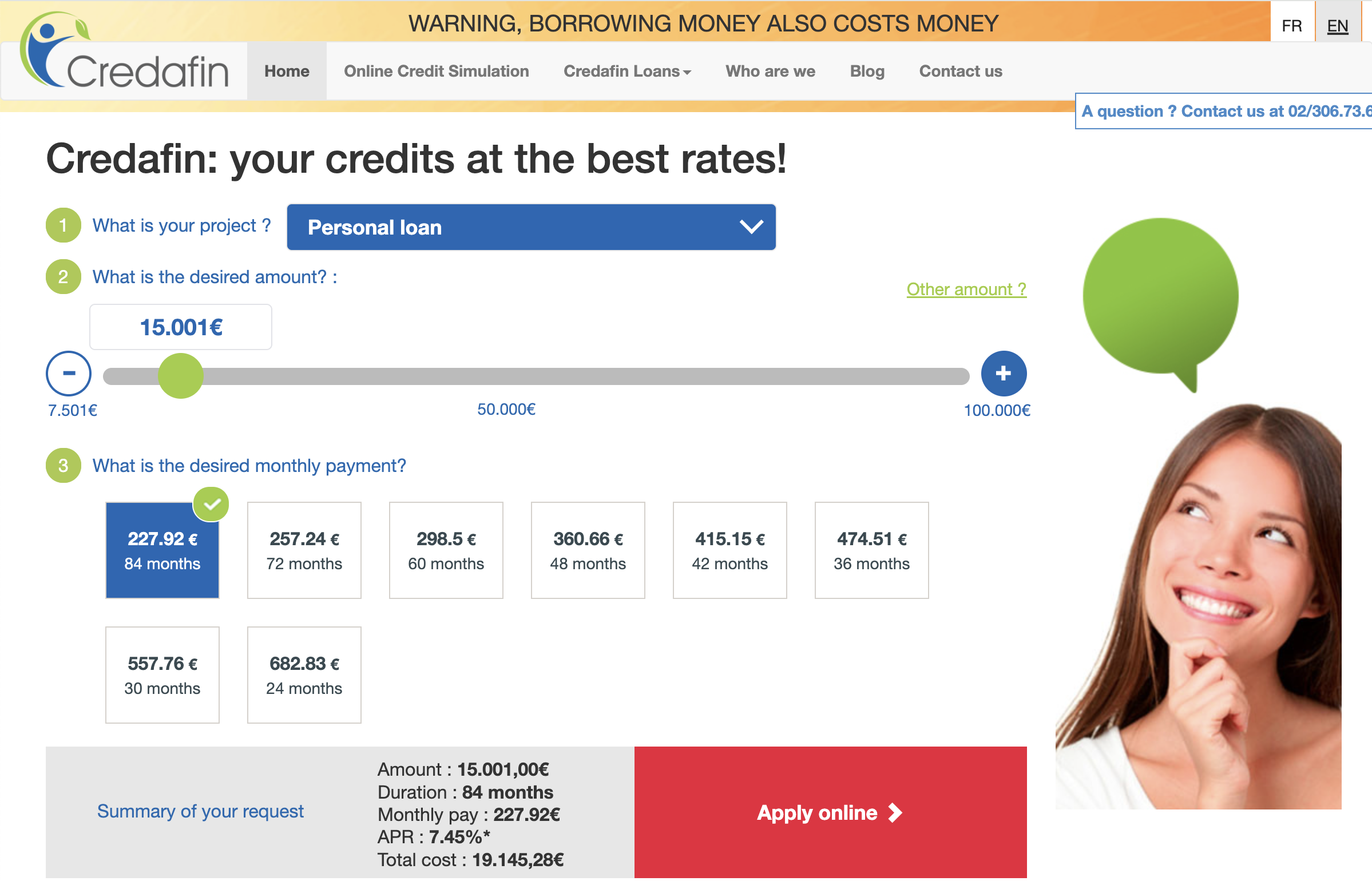

What Is Credafin?

Credafin presents itself as an online investment or trading service, typically offering exposure to financial markets such as cryptocurrency, forex, or stocks. According to how it markets itself, Credafin may include:

-

Quick and simple account creation

-

Investment packages or trading plans

-

Automated or AI-driven trading

-

High earning potential

-

User-friendly dashboards

These features are common across many new online investment sites. While they can appear appealing, they also raise suspicion when not paired with verifiable company information or regulatory transparency.

Why Scam Allegations Surround Credafin

It’s common for newer investment platforms—especially those without a strong public presence—to attract allegations of dishonesty. Scam claims often arise due to:

-

Lack of transparency

-

High return promises

-

Poor customer support

-

Withdrawal issues

-

Limited background information

The goal of this review is to break down these concerns and highlight the factors contributing to Credafin’s reputation.

1. Limited or Unverified Company Information

One of the primary concerns mentioned by users is the lack of clear company data. Investors often expect websites offering financial services to provide:

-

Registered business details

-

Verified corporate identity

-

Office locations

-

Legal documentation

-

A provable operational history

If any of these elements are missing or vague, users naturally question the platform’s legitimacy. When investors cannot confirm who is behind the service, doubts grow quickly.

Platforms that operate anonymously—regardless of intent—often face heightened scrutiny, and Credafin is no exception based on user observations.

2. No Clear Regulatory Oversight

Regulation plays a crucial role in establishing trust. Licensed investment platforms typically include:

-

Regulatory ID numbers

-

Jurisdiction details

-

Licensing body names

Some users report difficulty verifying whether Credafin is regulated or supervised by a recognized financial authority. This absence does not automatically mean wrongdoing but is considered a major red flag when evaluating investment platforms.

Unregulated platforms can expose users to higher risk, including:

-

Unclear dispute resolution

-

Lack of legal protection

-

Unreliable operational standards

This regulatory uncertainty is one of the primary reasons scam allegations arise.

3. High or Guaranteed Return Claims

If Credafin advertises extremely high returns, fixed profits, or “risk-free” earnings, users may interpret this as unrealistic or misleading. Financial markets are volatile, and no legitimate platform can guarantee profits without risk.

Statements or claims such as:

-

Daily fixed percentage returns

-

Risk-free investment packages

-

Automatic wealth-building

-

Unrealistic profit margins

…often contribute to skepticism and mistrust. Even if the intention is marketing or simplification, such claims raise immediate concerns among investors.

4. Anonymous or Unverifiable Team Members

A trustworthy platform typically offers transparency about its founders, developers, and financial experts. This includes:

-

Full names

-

Professional backgrounds

-

Verifiable public profiles

-

Industry experience

If Credafin does not provide clear team information, or if names cannot be verified, users may suspect hidden motives. A lack of identifiable leadership is one of the strongest factors behind scam allegations in online investment sites.

5. Mixed or Negative User Feedback

User complaints found online often include concerns such as:

-

Difficulty contacting support

-

Delayed responses

-

Confusing system messages

-

Trouble accessing account features

-

Unexplained changes in dashboard data

These complaints—whether isolated or widespread—fuel user frustration. When investors experience communication issues, they often assume the platform may be unreliable or unsafe.

6. Withdrawal-Related Concerns

Across many high-risk platforms, withdrawal issues are the most common cause of scam allegations. Users may report:

-

Withdrawal delays

-

Requests for extra verification

-

Sudden additional charges

-

Claims of “system errors”

-

Difficulty receiving funds

-

Unexpected fees

Such patterns can cause panic among investors, especially if they feel their funds are trapped or inaccessible. While some issues may be technical or procedural, repeated complaints significantly impact trust.

7. Referral-Based Marketing Tactics

Another common concern surrounding platforms like Credafin is how they attract users. Some rely heavily on:

-

Referral bonuses

-

Social media recruitment

-

Affiliate incentives

-

Peer-to-peer promotion

If the platform’s growth model depends more on attracting new users than demonstrating real trading results, users may interpret this as a potential red flag. Referral-heavy systems often appear similar to other questionable investment schemes.

Detailed Risk Assessment of Credafin

Even without definitive evidence of wrongdoing, Credafin exhibits several structural risk factors common to high-risk platforms. These risks should be noted by anyone considering using similar services.

1. Lack of Long-Term Proof of Operations

A new website or short operational history makes it hard for users to verify stability. Investors generally prefer platforms with years of performance or payouts to show consistency.

Without historical trust data, users must rely solely on the platform’s claims, which increases uncertainty.

2. No Audit Documentation

Legitimate investment platforms often publish:

-

Financial audits

-

Smart contract assessments

-

Security evaluations

-

Proof-of-fund reports

If Credafin lacks third-party audits or transparent financial disclosures, users cannot independently verify the platform’s operations.

3. No Clear Explanation of Trading Strategy

Users report difficulty finding detailed explanations of how Credafin generates returns. A credible platform typically shares:

-

Trading methods

-

Risk levels

-

Technology used

-

Performance metrics

If these details are missing or vague, it becomes difficult for investors to evaluate the realism of the offered returns.

4. Potential Liquidity Concerns

If users experience delayed withdrawals or unexplained processing times, it may suggest liquidity challenges behind the scenes. Liquidity problems don’t automatically mean fraud, but they are widely regarded as significant warning signs.

5. Superficial or Generic Trading Dashboards

Some investors note that platforms like Credafin use:

-

Basic charts

-

Pre-set templates

-

Non-interactive dashboards

This can create the impression that trading activity displayed in the dashboard may not reflect real market operations. Such generic interfaces are often used by high-risk investment sites.

Why Many Users View Credafin as High-Risk

Scam allegations surrounding Credafin are largely the result of combined factors:

-

Limited transparency

-

Lack of identifiable leadership

-

Unclear regulation

-

Aggressive profit messaging

-

User complaints

-

Withdrawal uncertainties

-

Referral-heavy marketing

While none of these factors alone prove fraudulent activity, together they create a perception of high risk.

Balanced Verdict: Is Credafin a Scam?

This review does not declare that Credafin is a scam. Instead, it presents the reasons why investors express doubt and why allegations exist. A balanced conclusion is as follows:

-

Credafin shows multiple red flags common to high-risk platforms.

-

Users report concerns that should not be overlooked.

-

Several structural risks appear significant.

-

Missing details about regulation and ownership raise questions.

-

However, there is no verified evidence proving fraudulent activity.

-

Report Credafin and Recover Your Funds

If you have fallen victim to Credafin and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Credafin persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.