CoinUnited.io Review— An Investigative of the Risks

Cryptocurrency investment platforms continue to multiply, and for every legitimate service, several appear that blur the line between marketing and manipulation. CoinUnited.io is one of many digital-asset platforms that advertise easy trading, high yields, and “instant access” to crypto wealth. Before anyone commits funds, it’s crucial to slow down and examine the structure, claims, and transparency of operations like this.

This article breaks down the practical warning signs and verification steps that experienced investors use when assessing such platforms.

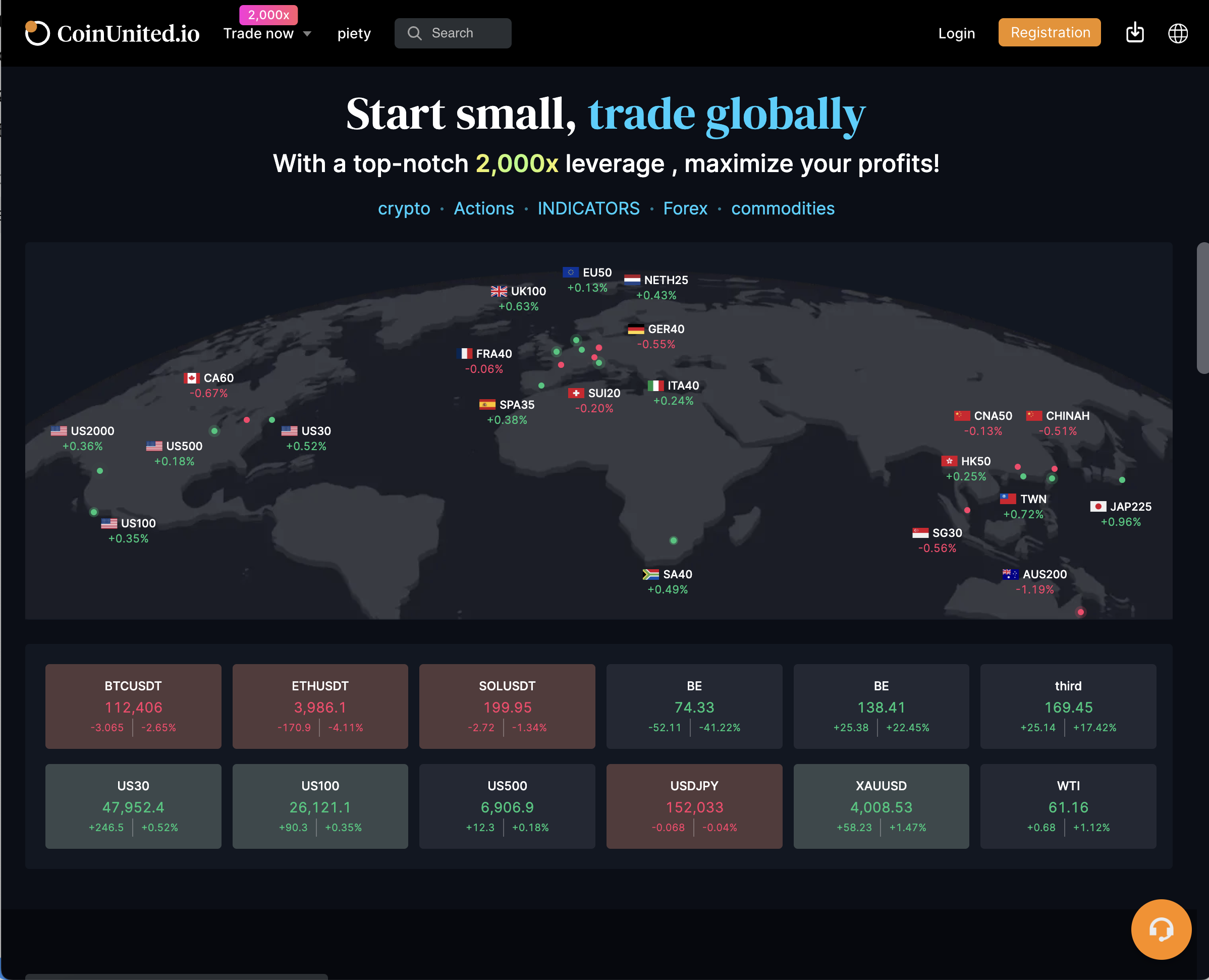

1. What the Platform Promises

Websites promoting effortless crypto returns often rely on appealing language: “automated profits,” “secure custody,” “zero-fee withdrawals.” These slogans sell convenience, not transparency. The first task is to separate marketing from verifiable detail.

If the platform emphasizes high annual percentage yields, trading bots, or “no-risk” returns without explaining howprofits are generated, that’s an immediate reason for scrutiny. Sustainable yield in finance always involves trade-offs—either market risk, liquidity risk, or operational risk. When a provider promises constant profit while downplaying risk, you’re hearing a sales pitch, not a financial disclosure.

2. Corporate Identity and Registration Checks

A credible exchange or investment service lists a clear legal entity: company name, registration number, and registered office address. It should be possible to confirm those details in an official corporate database.

Warning signs include:

-

Vague or missing company information.

-

Addresses that correspond to coworking spaces or mailbox centers.

-

Registration in jurisdictions known for light regulation or secrecy.

A legitimate organization will make verification easy. When details are missing or inconsistent, assume the burden of proof lies on the platform to demonstrate authenticity.

3. Regulatory Oversight

Financial regulation exists to protect client funds and ensure solvency. A genuine exchange registered with a regulator such as the FCA, ASIC, MAS, or FINMA will appear in that regulator’s public register.

If a platform claims to be “licensed,” confirm it yourself. Go directly to the regulator’s website and search the firm’s name.

Be cautious of language like “we operate under compliance with international standards”—this sounds official but says nothing about legal authorization.

Unregulated crypto services can still exist legally, but investors should then treat them as high-risk speculative venues rather than custodial or managed-investment providers.

4. Domain and Web-Presence Analysis

Look at the technical side:

-

Domain age: Recently created domains tend to belong to temporary ventures.

-

WHOIS data: Total privacy shielding can obscure ownership.

-

SSL certificates and uptime: Frequent certificate changes or downtime suggest instability.

-

Social accounts: Genuine operations show consistent posting history and professional interaction; newly created or inactive profiles indicate limited track record.

Short digital histories don’t automatically prove intent to deceive, but they do remove a layer of credibility.

5. Onboarding Behavior

Legitimate services allow you to explore the interface and documentation before deposit. Riskier outfits push for instant commitment—“limited-time bonuses,” “VIP status,” or “minimum investment unlocks higher profit tiers.”

Such urgency is a sales technique. A secure financial service will never pressure you to move faster than your due diligence allows.

If support agents contact you personally via WhatsApp or Telegram to “guide your deposit,” that’s an especially strong red flag. Proper financial institutions communicate only through official channels.

6. Payment and Withdrawal Methods

Funding mechanisms reveal much about a company’s structure.

Positive indicators:

-

Bank transfers to corporate accounts in the company’s legal name.

-

Integration with recognized payment processors.

-

Clear fee schedules and processing times.

Risk indicators:

-

Requests for direct crypto transfers to personal wallet addresses.

-

Irreversible payments without invoicing.

-

No evidence of segregated client funds.

Withdrawal problems—delays, additional “verification fees,” or silence after a request—are classic danger signs. Always test withdrawals early with a small amount before committing serious capital.

7. Marketing Patterns and Influencer Endorsements

Unreliable platforms often purchase promotion through paid influencers, fake news articles, or “press releases” on non-editorial websites. These give an illusion of legitimacy.

Check whether supposed endorsements are organic or sponsored. Look for disclaimers such as “advertorial” or “paid partnership.” A lack of such notices when the content clearly reads like advertising indicates potential deception.

8. Transparency in Operations

Every credible exchange publishes details about:

-

Security architecture and custody partners.

-

Terms of service with precise definitions of user rights.

-

Corporate leadership and key personnel.

-

External audits or attestations.

If none of these are public, or if whitepapers contain only marketing fluff rather than verifiable data, investors are being asked to trust without evidence.

9. Customer-Experience Reports

Patterns across user accounts are more telling than isolated stories.

Typical red-flag narratives include:

-

“I could deposit instantly but can’t withdraw.”

-

“Support keeps asking for additional deposits to unlock my funds.”

-

“The dashboard shows profit but no payout.”

Even a handful of consistent complaints describing the same problem should trigger caution. Conversely, legitimate issues are usually mixed with positive, verifiable feedback about customer service and transparency.

10. Security and Custody

A platform handling digital assets should describe how it safeguards them. Look for mention of multi-signature wallets, cold storage, and third-party custody solutions. Absence of this detail implies weak or nonexistent infrastructure.

Check whether the service provides its own wallet or requires external transfers. If it holds your keys, you are trusting the company entirely—so transparency becomes even more critical.

11. Terms and Legal Documentation

Always read the fine print. Pay attention to:

-

Clauses that allow the company to freeze or confiscate assets.

-

Dispute-resolution provisions that force arbitration in obscure jurisdictions.

-

Ambiguous descriptions of ownership rights over deposited assets.

A trustworthy platform writes terms clearly and aligns them with global standards. Ambiguity favors the operator, not the investor.

12. Building a Personal Risk Assessment

Instead of searching for a simple “legit or scam” answer, treat the evaluation as a scorecard. Assign points for verified transparency and deduct for opacity:

| Criterion | Positive Signal | Negative Signal |

|---|---|---|

| Corporate identity | Public company info | Hidden ownership |

| Regulation | Appears on regulator’s register | Only vague claims |

| Payments | Corporate bank account | Anonymous wallets |

| Documentation | Detailed, consistent | Generic or missing |

| User feedback | Mixed, verifiable | Uniform or suspiciously positive |

A low overall score doesn’t prove fraud—but it justifies walking away.

13. Psychological Triggers Used by Risky Platforms

Understanding persuasion tactics helps investors stay detached. Common methods include:

-

Authority bias – citing fake experts or awards.

-

Social proof – showing fabricated testimonials or follower counts.

-

Scarcity – “only a few investment slots left.”

-

Reciprocity – offering small bonuses to encourage larger deposits.

Recognizing these triggers turns marketing pressure into a cue for extra caution.

14. What Transparency Would Look Like

To trust any exchange, you should be able to answer these questions confidently:

-

Who owns and operates it?

-

What jurisdiction regulates it?

-

Where are client funds held?

-

How can users verify transactions or balances independently?

-

Are financial statements or audits available?

If you can’t find those answers, you’re not looking at a transparent operation.

Conclusion

CoinUnited.io, like many modern trading platforms, markets itself with promises of simplicity, automation, and attractive returns. Yet every investor should look past the interface and test for verifiable substance.

A legitimate company welcomes scrutiny; a risky one discourages it.

Before depositing any money, complete the full due-diligence checklist above. Treat enthusiasm as a signal to slow down, not to accelerate. In crypto, skepticism isn’t cynicism—it’s capital preservation.

Report CoinUnited.io and Recover Your Funds

If you have fallen victim to CoinUnited.io and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like CoinUnited.io persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.