CFDRoyal.com Review – Transparency Concerns

The online trading world is full of opportunities — but also a growing number of brokers whose practices raise serious concerns. Among these is CFDRoyal.com, a platform that claims to provide traders with access to financial markets including forex, commodities, indices, and cryptocurrencies. While the site may appear polished and professional, there are numerous issues that suggest traders should proceed with extreme caution.

In this comprehensive review, we take a deep dive into CFDRoyal.com’s operations, regulatory standing, transparency, trading conditions, customer practices, and the major risks associated with using this broker.

What Is CFDRoyal.com?

CFDRoyal.com positions itself as an online broker offering trading services across a range of financial markets. The broker markets features like competitive trading conditions, advanced tools, and client support services intended for both new and experienced traders.

Despite these claims, initial impressions can be misleading. A legitimate broker must offer much more than a slick website — it must prove regulatory compliance, transparency, reliability, and commitment to protecting client interests.

Lack of Verifiable Regulation

One of the most fundamental aspects of broker credibility is regulation. Reputable brokers are licensed and overseen by recognized financial authorities — such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC) — which enforce strict standards to protect traders.

CFDRoyal.com does not provide verifiable evidence of regulation by any recognized financial authority. While the platform may reference “compliance” or use regulatory sounding language, there is no transparent documentation or license numbers that traders can verify. The absence of credible oversight means there is no external protection for traders if disputes arise or if the broker engages in unethical behavior.

Without legitimate regulation:

-

Client funds may not be held in segregated accounts

-

There are no mandated financial audits

-

There is no verified dispute resolution mechanism

-

Traders have limited recourse if problems occur

This alone constitutes a major red flag and should be a primary consideration for anyone considering trading with CFDRoyal.com.

Opaque Company Ownership and Disclosures

Trustworthy brokers disclose clear corporate information including:

-

Legal entity name

-

Country of incorporation

-

Registered business address

-

Contact details

-

Management or ownership information

CFDRoyal.com lacks transparency in this area. There is limited information about the company behind the platform, where it is legally registered, or who owns and operates it. Absence of fundamental corporate details prevents traders from verifying the broker’s legitimacy and understanding who is accountable for its operations.

Opaque ownership is a common trait among unregulated or high-risk brokers. When a broker avoids clear disclosure of its corporate identity, it becomes difficult — if not impossible — to pursue accountability if issues arise.

Unclear Trading Conditions and Fees

One of the first things traders should review before opening an account is the trading conditions offered, including spreads, commissions, leverage, margin requirements, and fees associated with trading or account maintenance.

CFDRoyal.com’s trading terms are neither transparent nor comprehensively outlined. Important details such as spread ranges, leverage caps, margin call policies, overnight fees, and trading costs are either ambiguously presented or difficult to locate.

Lack of clear trading conditions can lead to:

-

Unexpected charges

-

Unfavorable cost structures

-

Difficulty managing risk

-

Confusion about actual trading expenses

Reliable brokers make these terms easily accessible, ensuring traders know exactly what they are agreeing to before funding an account.

Account Types and Minimum Deposits

CFDRoyal.com advertises multiple account tiers that promise different benefits depending on investment size and trader expertise. While tiered accounts are common in the industry, CFDRoyal.com fails to clearly explain the differences between account types, their precise requirements, and associated privileges.

Without clear explanations regarding:

-

Minimum deposit amounts

-

Specific account benefits

-

Risks tied to each account category

traders are left without sufficient information to make an informed choice. Ambiguous account structures can encourage larger deposits without corresponding value or protection.

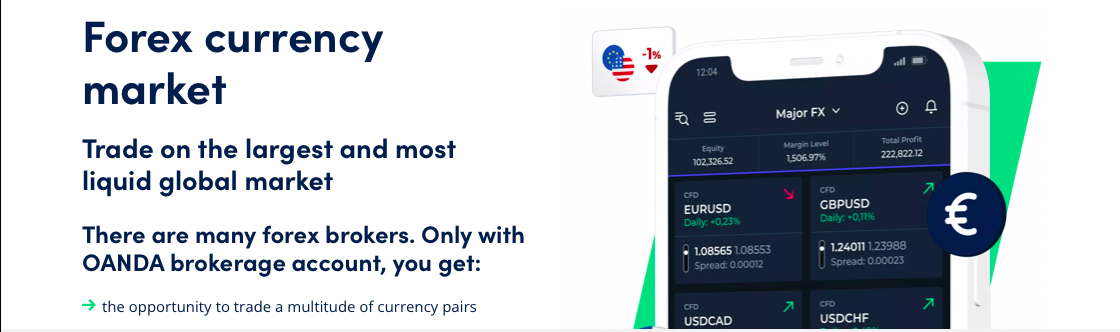

Platform Technology and Execution Transparency

A broker’s trading platform is the gateway through which traders interact with markets. When selecting a broker, traders should look for transparency around:

-

Platform technology

-

Execution practices

-

Market data feed sources

-

Whether pricing and execution are audited

CFDRoyal.com claims to provide an advanced trading interface, yet there is limited information about the platform’s technology or third-party verification. Reputable brokers often use widely trusted interfaces backed by independent audits or provide clear execution policies.

Without such transparency, traders cannot be sure that:

-

Pricing reflects real market conditions

-

Order execution is fair and unbiased

-

There are no hidden manipulations in the trading system

Platforms without robust verification often fail to provide a reliable trading environment.

Aggressive Marketing and Deposit Pressure

Questionable brokers frequently rely on aggressive marketing tactics to encourage quick deposits and high account balances. Several traders report that CFDRoyal.com’s outreach includes constant contact from account representatives, urging them to deposit more funds or upgrade account tiers with promises of enhanced returns.

Legitimate brokers do not pressure traders to deposit more capital or imply guaranteed profits. Markets are inherently unpredictable, and reputable firms emphasize risk management and education over high-pressure sales tactics.

Pressure-driven outreach is a clear warning sign that a broker may be more interested in securing funds than in supporting responsible trading.

Deposit and Withdrawal Barriers

One of the most common complaints about untrustworthy brokers is the difficulty traders face when attempting to withdraw their money.

CFDRoyal.com’s withdrawal process lacks transparency. There is limited clear information available regarding:

-

Processing times

-

Required documentation

-

Withdrawal fees

-

Conditions tied to withdrawals

-

Verification procedures

Traders often report centers of friction during the withdrawal process, including delayed responses, unexpected requirements, and new conditions introduced only after a withdrawal request is submitted. Barriers to accessing funds are among the most troubling signs of a broker that may not prioritize clients’ financial rights.

Risk Disclosure and Trader Education

A credible broker offers educational resources and comprehensive risk disclosures to ensure traders understand the inherent risks of leveraged trading. Markets are unpredictable, and leverage can amplify both gains and losses.

CFDRoyal.com’s approach to education appears limited and heavily skewed toward promotional messaging. There is a lack of robust risk education emphasizing:

-

Leverage dangers

-

Market volatility

-

Capital management strategies

-

Responsible trading practices

Traders — especially newcomers — deserve balanced guidance, not just marketing narratives.

Customer Support Issues

Reliable customer support is essential for resolving account issues, technical problems, or questions about trading conditions. Legitimate brokers provide multiple support channels, prompt responses, and clear communication.

Feedback from users indicates that CFDRoyal.com’s customer support responsiveness declines significantly once funds are deposited. Slow response times, generic answers, or lack of resolution contribute to trader frustration and undermine confidence in the broker’s ability to support its clients.

Financial Risk to Traders

Taken together, the factors above point to a heightened level of financial risk for traders using CFDRoyal.com:

-

Absence of regulation exposes traders to unmonitored risk.

-

Opaque corporate and operational details reduce accountability.

-

Unclear trading terms can lead to hidden costs.

-

Withdrawal challenges may restrict access to funds.

-

Limited risk disclosure leaves traders underinformed.

When a broker fails to demonstrate transparency and accountability, traders are left vulnerable to losses that may be difficult to address.

How Traders Can Protect Themselves

The concerns raised in this review highlight the importance of thorough due diligence before selecting any broker. Traders should always:

-

Verify regulatory status with recognized authorities.

-

Research corporate ownership and jurisdiction details.

-

Read multiple independent reviews and feedback.

-

Understand all trading terms, fees, and withdrawal policies.

-

Start with minimal funds when testing a platform.

-

Avoid brokers that guarantee profits or pressure deposits.

An informed and cautious approach helps safeguard investments and minimizes exposure to high-risk or fraudulent brokers.

Final Verdict on CFDRoyal.com

Based on the multiple red flags identified — including lack of verifiable regulation, opaque corporate details, unclear trading conditions, withdrawal obstacles, and aggressive marketing — CFDRoyal.com exhibits many characteristics commonly associated with unregulated, high-risk, or potentially scam brokers.

Traders are strongly advised to exercise extreme caution and consider regulated, transparent alternatives with solid track records and credible oversight. In the online trading world, protecting your capital and choosing brokers that prioritize transparency and accountability are essential for a safe and sustainable trading experience.

Report CFDRoyal.com and Recover Your Funds

If you have fallen victim to CFDRoyal.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like CFDRoyal.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.