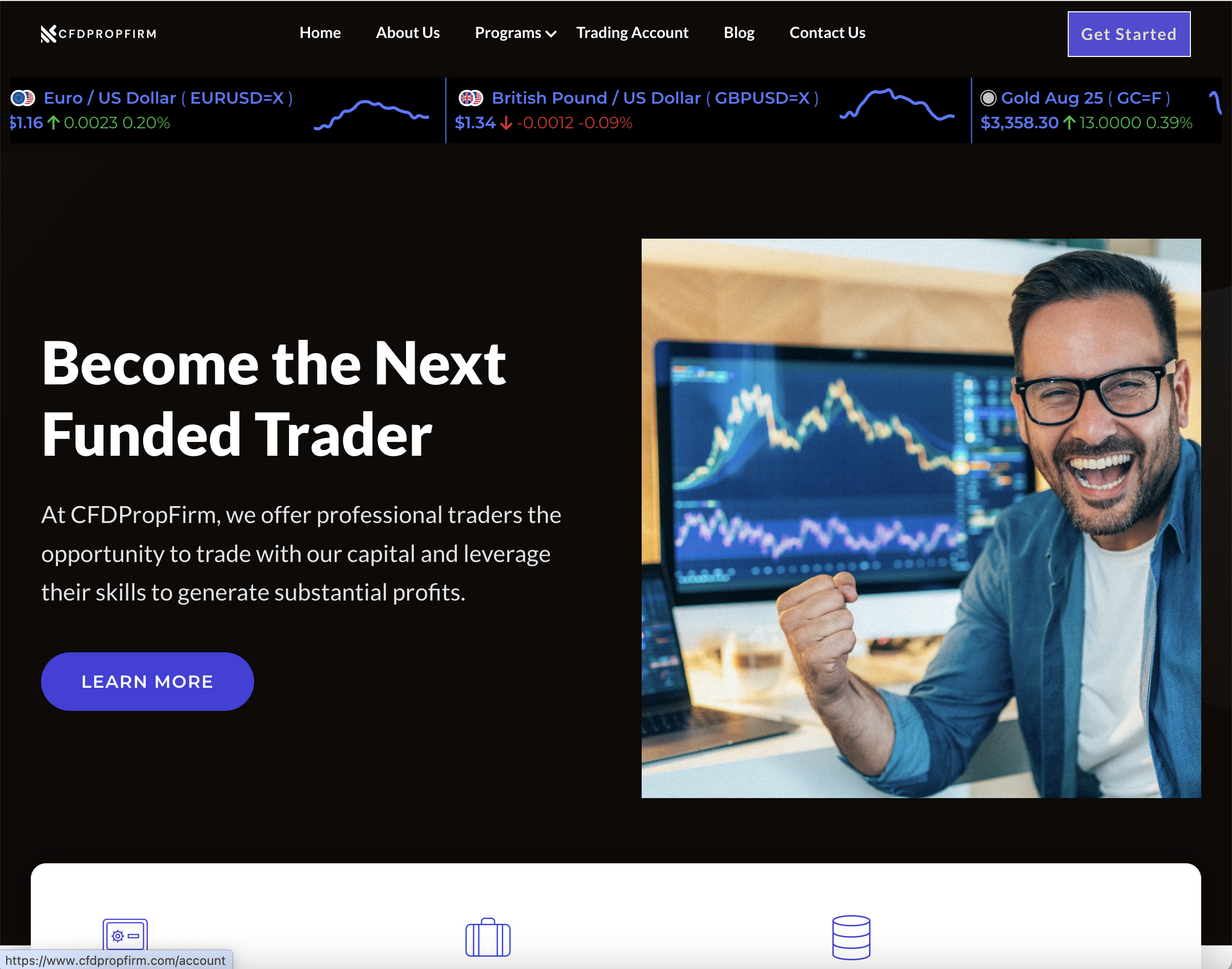

CFDPropFirm.com Scam Review: Legit or Fraudulent Platform?

CFDPropFirm.com have emerged, offering traders the chance to access large funded accounts and promising lucrative returns. With aggressive marketing, flashy websites, and bold claims about fast-track trading careers, these platforms are attracting the attention of novice and experienced traders alike.

But beneath the surface of this sleek facade, does CFDPropFirm.com actually deliver on its promises—or is it yet another digital trap designed to exploit hopeful investors? In this detailed review, we will break down how CFDPropFirm.com operates, the warning signs it exhibits, and why many now question its legitimacy.

If you’re considering funding an account or joining this platform, read this first.

What Is CFDPropFirm.com?

CFDPropFirm.com presents itself as a modern proprietary trading firm. It allegedly offers traders access to high-capital funded accounts once they pass an evaluation phase. The idea is simple: if you can prove you’re a skilled trader using their demo accounts, the firm will “fund” you with real capital, splitting profits while covering losses themselves.

At first glance, this concept seems empowering. The site advertises:

-

Evaluation programs with various account sizes

-

No-risk profit sharing

-

Quick evaluation periods

-

Easy withdrawal options

-

Supportive trader communities

However, once you look past the marketing, troubling details begin to surface.

The Prop Firm Model – Real or Rigged?

Legitimate proprietary trading firms evaluate traders through fair metrics, provide funding, and take a cut from successful trades. However, scam prop firms have twisted this model to their advantage. Rather than focusing on developing trading talent, they make most of their money from evaluation fees and restarts, not actual trading.

This is where CFDPropFirm.com starts to raise eyebrows.

1. Evaluation Fee Dependency

Numerous users report that CFDPropFirm.com aggressively pushes its evaluation programs, charging non-refundable fees upfront. These evaluations are:

-

Costly (ranging from $150 to $1,000 depending on account size)

-

Extremely strict, with tiny drawdown limits

-

Often structured to cause failure, forcing users to buy resets

This model suggests the platform makes more profit from selling dreams than from actual trading success. In short, the “funding” may never happen.

Red Flags That Suggest CFDPropFirm.com Might Be a Scam

1. No Clear Company Background

The website gives very little information about the company behind the platform. There are no named founders, no team bios, and no verified headquarters. If you try to trace the entity, you’ll likely hit a dead end. This lack of corporate transparency is a major concern.

A legitimate financial platform should proudly list:

-

Legal registration details

-

Office locations

-

Leadership team bios

-

Regulatory affiliations

CFDPropFirm.com offers none of these with clarity or confidence.

2. Fake or Anonymous Reviews

One of the tactics common with scam platforms is manipulating public perception through fake reviews. A scan of third-party review sites reveals an unusual pattern:

-

Dozens of 5-star reviews with generic comments

-

Usernames with no profile history

-

Reviews written in a short time window (suggesting paid review blasts)

In contrast, authentic user complaints are detailed and specific, mentioning issues with account suspensions, unreachable support, or unprocessed payouts.

3. Withdrawal Denials and Delays

While CFDPropFirm.com claims to offer instant or fast withdrawals, many users report serious issues with getting paid. Common complaints include:

-

Accounts being suspended right after requesting a payout

-

Traders being told they violated rules, without proof

-

Requests remaining “under review” indefinitely

-

Additional fees or KYC barriers introduced only after requesting a withdrawal

This pattern fits a classic bait-and-switch tactic used by fraudulent firms to avoid payouts after collecting fees and effort from users.

The Evaluation Trap

CFDPropFirm.com heavily markets its trader evaluation challenge, claiming that successful traders will be funded quickly. However, this “challenge” is often:

-

Unrealistically difficult to pass

-

Littered with strict trading restrictions not disclosed upfront

-

Subject to arbitrary rule changes mid-evaluation

-

Used as an excuse to fail most participants

Once a trader fails, they are encouraged to pay again for another evaluation—thus keeping the revenue wheel spinning for the platform. The more you fail, the more you pay. This evaluation trap isn’t about assessing skill—it’s about generating cash.

No Evidence of Real Funded Accounts

The platform frequently shows screenshots and testimonials from users who allegedly received “funded” accounts. However:

-

There’s no third-party verification of any real funded traders

-

Most testimonials lack full names, locations, or provable trading results

-

No track records or leaderboards exist

-

No public evidence of large successful payouts

All of this points to a façade carefully curated to keep the dream alive without delivering anything tangible.

Shady Terms and Conditions

Every prop firm has terms and conditions, but CFDPropFirm.com’s are especially vague. They include:

-

Clauses allowing the company to cancel accounts for any reason

-

No guarantees of funding, even after passing evaluations

-

The right to withhold funds indefinitely during “internal audits”

-

Minimal liability or responsibility toward platform errors or trade execution delays

These terms effectively give the company the power to take your money, suspend your access, and keep you in limbo—all while claiming no responsibility.

Poor or Manipulative Customer Support

Several users describe negative experiences with the platform’s customer service. Key issues include:

-

Automated responses with no follow-up

-

Support agents repeating scripted phrases

-

Live chat systems that disconnect or close sessions prematurely

-

Email replies that take weeks—if they come at all

When asked about delayed payouts or failed evaluations, support representatives often blame “rule violations” or internal reviews—without providing any specifics.

In short, the support experience feels designed to frustrate, not assist.

Use of High-Pressure Marketing

CFDPropFirm.com uses urgency-driven tactics to convert users quickly:

-

“Limited time discount on evaluations!”

-

“Only 10 accounts left at this level!”

-

“Prices increasing next week—buy now!”

-

“Top trader just made $10,000 this week—join them!”

These pressure points are a red flag. Genuine trading platforms don’t rush users into purchasing products or hide behind flashy incentives.

What Happens After You Pay?

Unfortunately, many traders report the same cycle:

-

Pay for the evaluation

-

Trade under rigid rules (usually losing within a few days)

-

Fail or get disqualified for unclear reasons

-

Support recommends restarting or upgrading (more money)

-

Repeat cycle without ever reaching the “funded” level

Those who do pass either get “phantom funding” (no real capital) or have their accounts suspended before payouts are processed.

This system is not built to support traders—it’s designed to drain them.

Final Verdict: Is CFDPropFirm.com a Scam?

Based on the overwhelming evidence, CFDPropFirm.com shows multiple characteristics of a scam or deceptive operation:

-

No regulatory body backing the company

-

Anonymous ownership and no corporate transparency

-

Unrealistic evaluation conditions meant to fail

-

Denied or endlessly delayed withdrawals

-

Fake testimonials and manipulated reviews

-

Shady terms giving them total control

-

Poor customer service and lack of accountability

While it may not be a blatant scam in the legal sense, it certainly appears to be an exploitative money trap, not a genuine prop trading opportunity.

How to Protect Yourself

If you’re considering joining any proprietary trading firm, especially new or unregulated ones, keep these tips in mind:

-

Verify the company’s registration and licensing

-

Avoid platforms with vague leadership or anonymous ownership

-

Be cautious with firms charging high, non-refundable fees

-

Read user reviews across multiple platforms, not just their own site

-

Watch out for overly aggressive marketing and urgency tactics

-

Never deposit funds you can’t afford to lose

Most importantly, trust your instincts. If something feels off, it probably is.

Conclusion

CFDPropFirm.com markets itself as a revolutionary way to help traders build careers. In reality, it appears to be a cleverly disguised fee-harvesting machine with little interest in actually funding or supporting real traders. With a combination of fake promises, harsh restrictions, and withheld payouts, it mirrors many hallmarks of deceptive online platforms that prioritize profits over people.

Before you invest your money or your hopes into CFDPropFirm.com, ask yourself this: If it’s truly about giving traders a fair shot, why is everything designed to make you fail or keep paying?

The best move might be the one you don’t make at all.

Report CFDPropFirm.com and Recover Your Funds

If you have fallen victim to CFDPropFirm.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like CFDPropFirm.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.