Cexbit-Vips.com — Risks, and Warning Signs

Cryptocurrency and online trading platforms promise speed, convenience, and opportunity. Unfortunately, the same features that make these services attractive to legitimate investors also make them fertile ground for bad actors. One site getting attention in online conversations is cexbit-vips.com. This review does not accuse the site of criminal conduct; instead it lays out the patterns, behaviors, and indicators that investors should treat as serious warning signs before depositing funds.

If you’re seeing marketing for Cexbit-Vips or have been contacted by a representative claiming affiliation, use this article as a checklist and a reality check. The aim is to help you separate polished presentation from real institutional credibility.

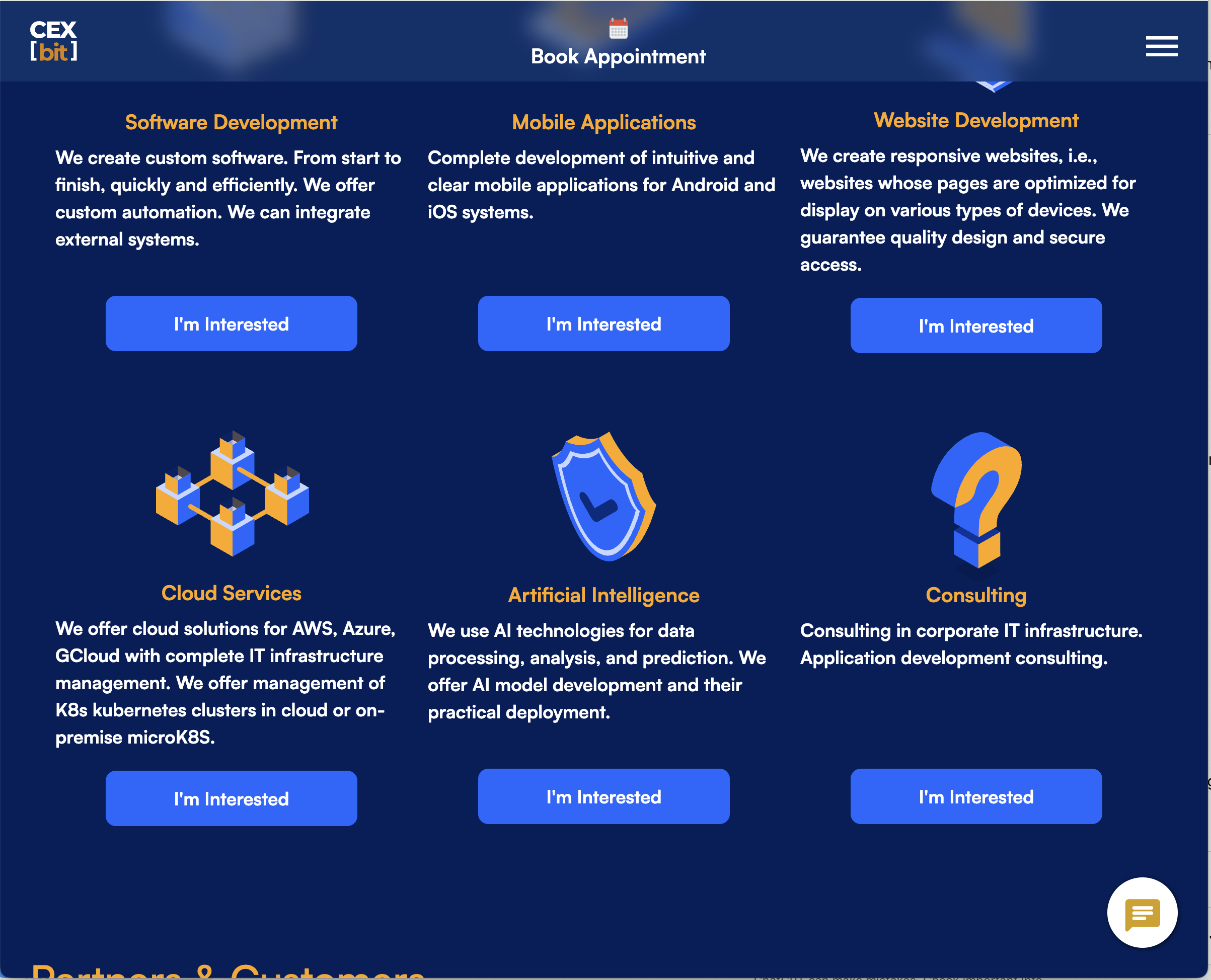

1. Familiar packaging, unfamiliar company

A common technique across high-risk trading sites is to borrow the language, imagery, and layout of established exchanges. Cexbit-Vips’ public presentation may look professional: slick landing pages, charts, and testimonials. Appearance alone, however, tells you nothing about legitimacy.

Professional design is cheap; verifying corporate identity is not. The first due-diligence step is simple: look for a clearly stated legal entity, a verifiable corporate registration number, and a physical address tied to that registration. If these items are missing, inconsistent, or impossible to verify, you’re looking at opacity — and opacity is the first real red flag.

2. Licensing claims that don’t verify

Many platforms attempt to reassure visitors by claiming they are “licensed,” “regulated,” or “authorized.” These words mean very little unless you can confirm them where it counts: on official regulator websites. Reputable financial authorities maintain searchable registries. If Cexbit-Vips purports to be regulated, verify the license number on the regulator’s site. If you can’t find the company, or the number belongs to a different firm, treat the regulation claim as meaningless marketing.

Beware of references to obscure or poorly supervised jurisdictions that offer fast or cheap registration. Offshore registration alone isn’t proof of misbehavior, but it reduces the practical protections available to investors.

3. Aggressive contact and “account manager” scripts

One of the classic playbooks used by risky platforms involves rapid personal contact the moment someone signs up. After you register, an “account manager” may call or message within hours—sometimes minutes—offering tailored advice, lucrative strategies, or one-time bonuses. The manager’s job is persuasion.

If a representative pressures you to deposit quickly, discourages independent verification, or insists you move funds to unusual accounts, that’s a major warning sign. Legitimate brokers provide time for clients to read documentation, ask questions, and use demo accounts. Persistent pressure to deposit more money is a hallmark of sales-driven schemes, not customer-first trading services.

4. Payment channels that are alarming

The route a site asks you to use to fund your account reveals a lot. Reputable exchanges typically offer well-known payment rails: bank transfers through recognized banks, established payment processors, or reputable cryptocurrency custodians with clear addresses. If Cexbit-Vips asks you to send money to a personal bank account, a private wallet, or a third-party processor with no clear corporate link, consider it a major red flag.

Cryptocurrency is irreversible by design. That’s why scammers favor crypto and nontraceable transfers: once sent, funds are extremely difficult to retrieve. Always prefer traceable, reversible payment methods when starting with a new platform.

5. Too-good performance claims and automated guarantees

Promises of guaranteed returns, miraculous AI trading systems, or “risk-free” profit are warning signs by design. No legitimate market participant can promise steady, guaranteed gains on a volatile asset class such as crypto or forex. If Cexbit-Vips markets automated tools that guarantee precise daily or weekly returns, treat those claims with extreme skepticism.

High-pressure marketing that emphasizes speed (“limited slots,” “act now to get higher ROI”) is designed to short-circuit rational decision-making. A durable, trustworthy broker earns clients with transparency and compliance—not with scarcity tactics and overblown performance promises.

6. Opaque fees and surprising charges

Legitimate platforms publish clear fee schedules: spreads, commissions, deposit and withdrawal fees, and margin requirements. If fees are hidden in small print, calculated by opaque formulas, or described in conditional language (e.g., “processing fees required to unlock withdrawals”), walk away.

One repeated complaint pattern across risky platforms is the sudden introduction of new “clearance” or “processing” charges when users request withdrawals. Companies that are honest about their business model will deduct legitimate fees automatically or disclose them clearly; they won’t demand additional ad-hoc payments to release client funds.

7. Fake testimonials and suspicious reviews

High-quality, independent reviews are valuable. Red flags show up when testimonials are brief, generic, repetitive, or tied to stock images. If Cexbit-Vips displays a flood of uniformly positive reviews with similar phrasing, question their authenticity.

Search for long-form, independent user accounts that detail specific interactions: deposit amounts, timeline of communication, and withdrawal experiences. Repeated patterns across multiple independent accounts are more meaningful than anonymous praise on a sales page.

8. Withdrawal friction as a diagnostic tool

While this piece will not provide instructions for recovery if something goes wrong, it is fair to note that withdrawal friction is the single most reliable indicator of trouble. Legitimate brokers process withdrawals within stated timelines and have clear verification policies. If you hear indefinite delays, recurring “additional verification” requests that never finish, or demands for new payments to “release funds,” treat these as immediate deal breakers.

Before committing significant money to any platform, test the system with a small deposit and make an early withdrawal to confirm the process works as advertised.

9. Unprofessional or unverifiable support channels

Watch how the platform handles customer service. Professional firms provide ticket systems, company email addresses, published phone numbers, and escalation paths. If all support interaction is through personal messaging apps, anonymous chat windows, or untraceable phone numbers, the platform is minimizing audit trails and limiting accountability.

Also pay attention to tone: scripted responses, evasive answers to regulatory questions, or refusal to provide legal documentation are strong signals to disengage.

10. Short domain history and hidden ownership

Technical indicators can also be telling. Newly registered domains, WHOIS privacy shielding that hides ownership, frequent domain changes, or repeated rebranding are common among high-risk sites. These practices allow operators to disappear quickly and resurface under new names. If the domain behind Cexbit-Vips has a short, discontinuous history or uses privacy masks, be cautious.

11. Checklist before you engage

If you still want to investigate further, run this short checklist first:

-

Can you verify the company’s legal name and registration in an official registry?

-

Does the license (if cited) appear on a regulator’s public list?

-

Is the payment method traceable and reversible?

-

Are customer support channels professional and auditable?

-

Do independent, detailed user reports corroborate that withdrawals are processed?

-

Does the platform’s marketing avoid guaranteed returns and acknowledge market risk?

If you can’t answer “yes” to most of these, avoid funding an account beyond a trivial, test amount.

Conclusion

Cexbit-Vips.com presents the same set of design choices that both legitimate startups and risky operators use: professional graphics, confident copy, and promises of opportunity. The difference lies in transparency, verifiability, and consumer protections. Where those are missing—unclear corporate details, unverifiable licensing, aggressive deposit tactics, and opaque payment channels—investors must be extremely cautious.

This review’s purpose is to equip you with the questions and evidence points that reveal whether a trading site deserves your trust. Always do your homework, prioritize traceable payment methods, and treat unsolicited investment opportunities with skepticism. The more polished the promise, the more important disciplined verification becomes.

Report Cexbit-Vips.com and Recover Your Funds

If you have fallen victim to Cexbit-Vips.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Cexbit-Vips.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.