CaxtonGlobal-FX.net Review – A Deceptive Platform Disguised

The online trading industry has exploded in recent years, making it easier than ever for retail investors to participate in markets like forex, commodities, indices, and cryptocurrencies. While many brokers provide legitimate, regulated services, others exhibit concerning practices that put traders’ funds and personal information at risk. CaxtonGlobal-FX.net is one such platform that deserves scrutiny.

In this in-depth review, we examine CaxtonGlobal-FX.net’s regulatory status, transparency, trading conditions, platform reliability, customer support, and overall risk profile. Our goal is to help you decide whether this broker is trustworthy or one that should be avoided.

What Is CaxtonGlobal-FX.net?

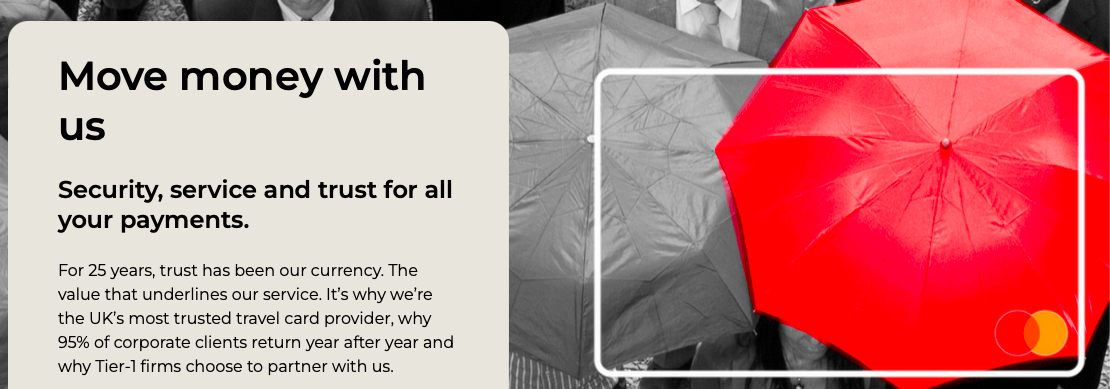

CaxtonGlobal-FX.net presents itself as an online broker offering access to a range of financial products, including forex, CFDs (Contracts for Difference), and cryptocurrencies. The site touts advanced trading tools, competitive pricing, and personalized account types aimed at traders of all experience levels.

Although the platform’s website may appear professional and polished, appearances can be misleading. A legitimate broker should offer transparent regulatory information, clear trading conditions, and solid protections for client funds — aspects we’ll examine in detail below.

Lack of Verifiable Regulation

One of the most critical indicators of a broker’s credibility is its regulatory status. Brokers regulated by reputable financial authorities — such as the UK’s Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC) — must adhere to stringent rules designed to protect traders. These include:

-

Segregation of client funds

-

Capital adequacy requirements

-

Periodic audits and reporting

-

Dispute resolution procedures

CaxtonGlobal-FX.net does not provide evidence of regulation by a recognized financial authority. While the website may mention compliance in general terms, it does not display any verifiable license numbers or publicly accessible regulatory documentation.

Without credible regulation:

-

Client funds may not be held in segregated accounts

-

There is no external oversight of trading practices

-

Dispute resolution mechanisms may be unavailable

-

Traders have limited recourse if issues arise

The absence of transparent regulatory oversight is a major red flag and significantly increases the risk of trading with this broker.

Opaque Corporate Information

Reputable brokers clearly disclose their corporate details, including:

-

Legal entity name

-

Company registration number

-

Country of incorporation

-

Registered office address

-

Ownership and management information

CaxtonGlobal-FX.net, however, offers very limited corporate disclosure. Key details about the company’s legal entity, location of operations, ownership, and registration are either missing or vague. This opacity makes it difficult for traders to verify the identity of the organization they are dealing with and to assess its legitimacy.

A lack of transparency in corporate identity is often associated with high-risk brokers and platforms that operate without accountability.

Unclear Trading Conditions and Fees

Clear, detailed information about trading conditions is essential for any trader. Before depositing funds, traders should be able to find straightforward explanations of:

-

Spread ranges on various assets

-

Commission structures

-

Leverage limits and margin requirements

-

Overnight swap or rollover fees

-

Order execution policies

CaxtonGlobal-FX.net’s trading terms are not readily accessible or transparently explained. Critical details about spreads, fees, leverage, and margin calls are either absent from the website or buried in opaque text. Without clear disclosure, traders may face:

-

Unexpected costs

-

Unfavorable leverage exposure

-

Margin calls they did not anticipate

Transparent fee and trading condition structures are fundamental to informed decision-making — and their absence is a serious concern.

Account Types and Minimum Deposits

Many brokers offer tiered account types, each with varying benefits like tighter spreads or dedicated support. These tiered structures are standard — provided that the terms, benefits, and minimum deposit requirements are clearly explained.

At CaxtonGlobal-FX.net, account information lacks clarity. Details about minimum deposit amounts, differences between account tiers, and specific features are either poorly presented or inconsistent. Ambiguity in account structures can mislead traders into committing more capital than they intended without fully understanding the associated conditions.

Platform Technology and Execution Transparency

The trading platform is the primary interface between traders and the markets. Established brokers often use recognized third-party platforms like MetaTrader 4 or MetaTrader 5, which are widely trusted and undergo independent scrutiny.

CaxtonGlobal-FX.net claims to offer advanced trading tools, but there is limited transparent information about the platform’s technology, order execution policies, or pricing sources. Without independent verification, traders cannot be confident that:

-

Market data accurately reflects real conditions

-

Order execution is fair and competitive

-

Slippage and re-quotes are handled appropriately

-

Pricing is not manipulated

A lack of clarity around platform integrity raises uncertainties that may negatively impact trading performance and fairness.

Aggressive Marketing and Sales Practices

A common trait among questionable brokers is the use of aggressive marketing or high-pressure sales tactics. These can include:

-

Persistent calls or messages encouraging increased deposits

-

Promotional claims emphasizing guaranteed profits

-

Suggestions that opportunities are time-sensitive

Responsible brokers focus on educating traders about risks and strategies rather than pressuring deposits or making exaggerated promises. Reports from traders indicate that CaxtonGlobal-FX.net’s outreach may involve pressure tactics, which suggest the broker may prioritize rapid capital inflows over transparent risk communication.

Deposit and Withdrawal Procedures

One of the most important tests of a broker’s credibility is how it handles deposits and withdrawals. A reliable broker clearly outlines:

-

Accepted payment methods

-

Processing times for deposits and withdrawals

-

Documentation requirements for verification

-

Associated fees

CaxtonGlobal-FX.net does not provide transparent details about its withdrawal process. Traders may encounter:

-

Delays in accessing their funds

-

Additional documentation requests

-

Unclear timelines or hidden fees

Difficulty withdrawing funds is a frequent complaint among users of high-risk or unregulated brokers — making this an especially concerning issue.

Risk Disclosure and Trader Education

Good brokers provide educational resources and clear risk disclosures so traders understand that leveraged trading carries the potential for significant losses. Markets can be volatile, and traders must be fully informed of risks before opening positions.

CaxtonGlobal-FX.net’s website focuses more on promotional content than balanced risk disclosure. Limited emphasis on risk education can mislead inexperienced traders into underestimating the potential for losses — a situation that can lead to significant financial harm.

Customer Support Quality

Responsive, professional customer support is essential for resolving issues, whether they involve account setup, technical problems, or fund retrieval.

Feedback regarding CaxtonGlobal-FX.net’s support quality suggests inconsistency and slow responsiveness, particularly when traders have questions about withdrawals or account problems. Poor support can exacerbate issues and leave traders without the assistance they need during critical moments.

Overall Risk Assessment

Evaluating the factors above, CaxtonGlobal-FX.net exhibits several characteristics commonly associated with high-risk or potentially unreliable brokers:

-

Lack of verifiable regulation

-

Opaque corporate identity

-

Unclear trading conditions and fees

-

Ambiguous account structures

-

Questionable platform transparency

-

Aggressive marketing tactics

-

Withdrawal uncertainty

-

Insufficient risk disclosure

Taken together, these red flags place CaxtonGlobal-FX.net in a high-risk category, particularly for novice traders or those seeking a secure long-term trading partner.

How Traders Can Protect Themselves

Before engaging with any online broker, traders should take proactive steps to protect their capital:

-

Verify regulatory credentials with recognized financial authorities

-

Confirm corporate identity and jurisdiction

-

Review trading conditions and fee structures carefully

-

Test platforms with small deposits first

-

Avoid brokers that use high-pressure sales tactics

-

Consult independent reviews and community feedback

Doing thorough research and due diligence helps traders avoid unnecessary risk and enhances the likelihood of a safer trading experience.

Final Verdict on CaxtonGlobal-FX.net

Based on the absence of transparent regulatory oversight, limited corporate information, unclear trading terms, and reports of potentially aggressive marketing practices, CaxtonGlobal-FX.net exhibits several red flags that traders should take seriously.

While some traders may report positive experiences — especially in terms of initial interactions — the overall risk profile suggests that exercising extreme caution is advisable. Those seeking long-term security and protection of their trading capital should consider regulated, transparent brokers with proven track records.

In online trading, prioritizing transparency, accountability, and experienced oversight isn’t just sensible — it’s essential for safeguarding your capital.

Report CaxtonGlobal-FX.net and Recover Your Funds

If you have fallen victim to CaxtonGlobal-FX.net and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like CaxtonGlobal-FX.net persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.