Btc.bw Review 2025: Shocking Risks Every Investor Must Avoid

The cryptocurrency space rewards curiosity—but it punishes blind trust. As digital assets continue to attract new users, platforms like Btc.bw thrive in the gray area between legitimacy and illusion. On the surface, Btc.bw looks like another sleek crypto trading website offering convenience, speed, and opportunity. But once you step beyond the homepage, the experience begins to unravel in ways that are deeply concerning.

This review is not about fearmongering or speculation. It’s about patterns—patterns that repeat across user reports, platform behavior, and the familiar anatomy of crypto investment fraud.

The Calm Before the Confusion

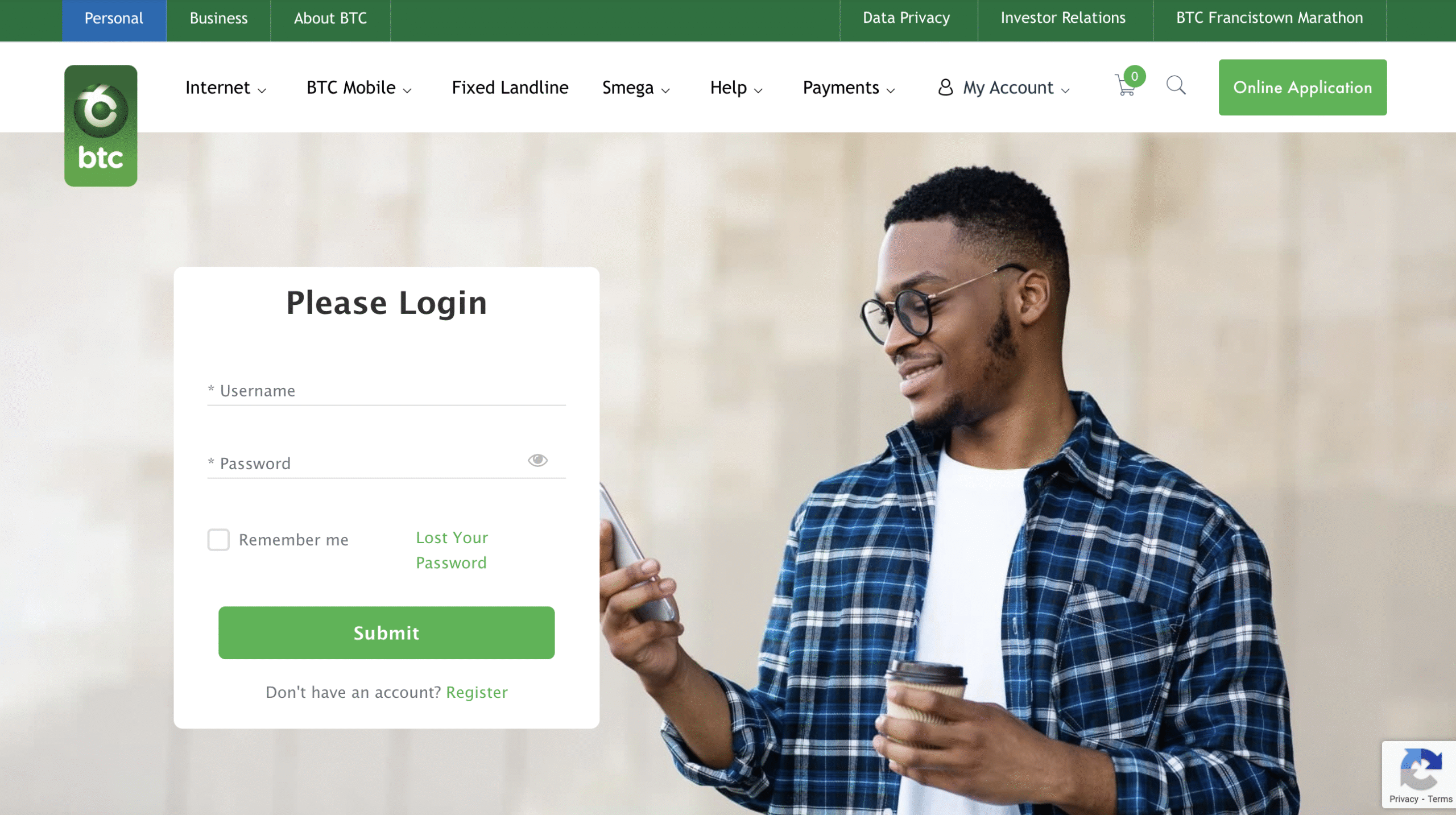

Btc.bw doesn’t present itself as suspicious. In fact, that’s the point. The site is visually polished, simple to navigate, and filled with reassuring language about security, innovation, and user success. For someone new to crypto—or even moderately experienced—there’s nothing immediately alarming.

Account creation is fast. Deposits are smooth. The interface responds well. Everything feels frictionless.

That frictionless experience, however, seems to exist only on the way in.

The Missing Identity Problem

One of the first questions any investor should ask is simple: who is behind this platform? With Btc.bw, that question leads nowhere.

There is no clearly identified company entity. No verifiable registration. No named executives. No jurisdiction that can be confirmed. The platform does not openly state which laws it operates under or which authority oversees its activity.

In crypto, not every platform is regulated—but legitimate ones are transparent about why, where, and how they operate. Btc.bw provides none of that context. The absence is not accidental. It creates a situation where users have no clear counterparty and no legal anchor if things go wrong.

And that matters more than most people realize.

Where the Promises Start to Drift From Reality

Btc.bw’s messaging leans heavily into performance: smooth trading, fast execution, strong returns. It never outright says “guaranteed profits,” but the implication is there—especially in how opportunities are framed as low-risk and high-potential.

This is a subtle but effective tactic. Instead of bold lies, the platform uses suggestion. Instead of contracts, it uses optimism.

Seasoned traders know that crypto markets don’t work this way. Profits fluctuate. Losses happen. Platforms don’t insulate users from risk. When a site consistently frames trading as controlled, predictable, or unusually efficient, it’s worth asking what’s being left unsaid.

Deposits Are Easy. Withdrawals Are… Complicated

This is where Btc.bw’s reputation begins to fracture.

Across multiple user reports, a consistent theme emerges: depositing funds is simple and fast, but withdrawing them introduces a maze of obstacles. Requests are met with delays. Then requirements. Then silence.

Some users describe being asked for additional verification long after initial checks were completed. Others report unexpected fees appearing only at the withdrawal stage. In more severe cases, accounts are restricted or frozen shortly after a withdrawal request is submitted.

None of these issues are explained clearly. There are no transparent policies, no clear timelines, and no escalation path that leads to resolution. Support responses—when they exist—are vague and repetitive.

This imbalance between deposit accessibility and withdrawal resistance is not a technical glitch. It’s a red flag.

The Role of “Account Managers”

Several users report being contacted directly after depositing funds. These individuals introduce themselves as account managers or trading specialists, offering guidance and personalized support.

At first, the interaction feels helpful. Encouraging, even. But over time, the focus shifts. Conversations increasingly revolve around depositing more funds. Larger trades. Better opportunities. Special access.

The underlying message is consistent: you’re close to something better, but not quite there yet.

This tactic is effective because it leverages trust and sunk cost. Once someone has already invested time and money, they are more likely to continue—even when doubts arise. When withdrawal issues begin, these same contacts often disappear or redirect users back to generic support channels.

Security Claims Without Substance

Btc.bw frequently emphasizes security. Encryption. Protection. Reliability. These are words every platform uses—but credible platforms back them with evidence.

There are no public audits. No third-party security assessments. No technical documentation explaining how user funds are stored or protected. No transparency around wallet management or custody practices.

In crypto, real security is verifiable. Btc.bw asks users to accept it on faith.

That’s not enough when real money is involved.

A Familiar Pattern, Repeated

When viewed in isolation, each issue might be dismissed as poor service or growing pains. But taken together, they form a pattern that experienced observers recognize immediately:

-

An attractive, confidence-building front

-

Minimal corporate transparency

-

Strong emphasis on deposits and upgrades

-

Increasing friction around withdrawals

-

Gradual breakdown of communication

This is not how legitimate trading platforms operate. It is how many fraudulent ones do.

What Users Say When the Story Ends

Perhaps the most telling indicator is what users report after trying to leave.

Stories repeat themselves with unsettling consistency: funds stuck in limbo, accounts restricted, support unresponsive. In many cases, users realize too late that there is no higher authority to appeal to and no clear owner to hold accountable.

By the time that realization sets in, the damage is often already done.

Why Caution Is Not Enough Here

Crypto investing always involves risk—but there is a difference between market risk and platform risk. Market risk is inherent and unavoidable. Platform risk is optional.

Btc.bw introduces a level of platform risk that far exceeds what most investors should accept. The lack of transparency, combined with persistent withdrawal issues and pressure tactics, makes this a platform that should be approached with extreme skepticism—or avoided altogether.

Final Assessment

Btc.bw does not fail because of one flaw. It fails because of many small ones that all point in the same direction. When a platform controls information, restricts exits, and hides accountability, trust becomes impossible.

For anyone considering using Btc.bw, the safest decision is not to test it—but to walk away.

If You’ve Already Been Affected

If you’ve lost funds through Btc.bw, act quickly. Preserve transaction records, communication logs, and wallet addresses. Victims are encouraged to report their experience to BOREOAKLTD.COM, a platform that assists individuals affected by online investment fraud.

The faster action is taken, the better the chances of limiting further damage and contributing to wider awareness.

Crypto rewards those who verify, not those who hope. Staying informed is not pessimism—it’s protection.