Blueholdings.com Scam Review – Is This Broker Trustworthy?

The rise of online trading has opened doors for millions of investors eager to profit from forex, stocks, and cryptocurrencies. While this digital revolution has created real opportunities, it has also attracted fraudulent platforms designed to exploit inexperienced traders. One platform that has recently raised suspicion is Blueholdings.com.

At first glance, Blueholdings.com appears to be a professional brokerage offering advanced tools and access to global financial markets. However, a closer inspection reveals concerning patterns consistent with scams. In this in-depth review, we’ll examine how the platform presents itself, identify red flags, and explain why investors should think twice before depositing funds.

The Growing Problem of Fake Online Brokers

Fraudulent trading websites are multiplying at an alarming pace. These platforms often:

-

Create professional-looking websites to gain credibility.

-

Promise high returns with little to no risk.

-

Use aggressive marketing to lure in novice investors.

-

Manipulate trading dashboards to show fake profits.

-

Make it extremely difficult or impossible to withdraw funds.

Blueholdings.com shows several of these warning signs, which makes its legitimacy questionable.

What Blueholdings.com Claims to Offer

On its website and promotional material, Blueholdings.com markets itself as a modern online broker with a full suite of services, including:

-

Access to forex, stocks, commodities, and cryptocurrency markets.

-

Multiple account types tailored for beginners and professionals.

-

Competitive spreads, low fees, and fast execution speeds.

-

Secure deposits and withdrawals.

-

Dedicated account managers and 24/7 customer support.

-

Bonus programs and attractive promotions for new clients.

While these promises sound impressive, the actual experience reported by users tells a different story.

First Impressions vs. Reality

At first glance, Blueholdings.com looks like a legitimate broker. The website is sleek, featuring modern design, trading charts, and claims of innovation. However, these cosmetic touches hide deeper issues:

-

The company provides vague or unverifiable details about its registration and regulatory status.

-

Ownership information is obscured, raising transparency concerns.

-

The platform’s terms and conditions are filled with clauses that favor the broker over the trader.

-

Reports suggest delayed or denied withdrawals, a major red flag in the trading industry.

Red Flags That Suggest Blueholdings.com May Be a Scam

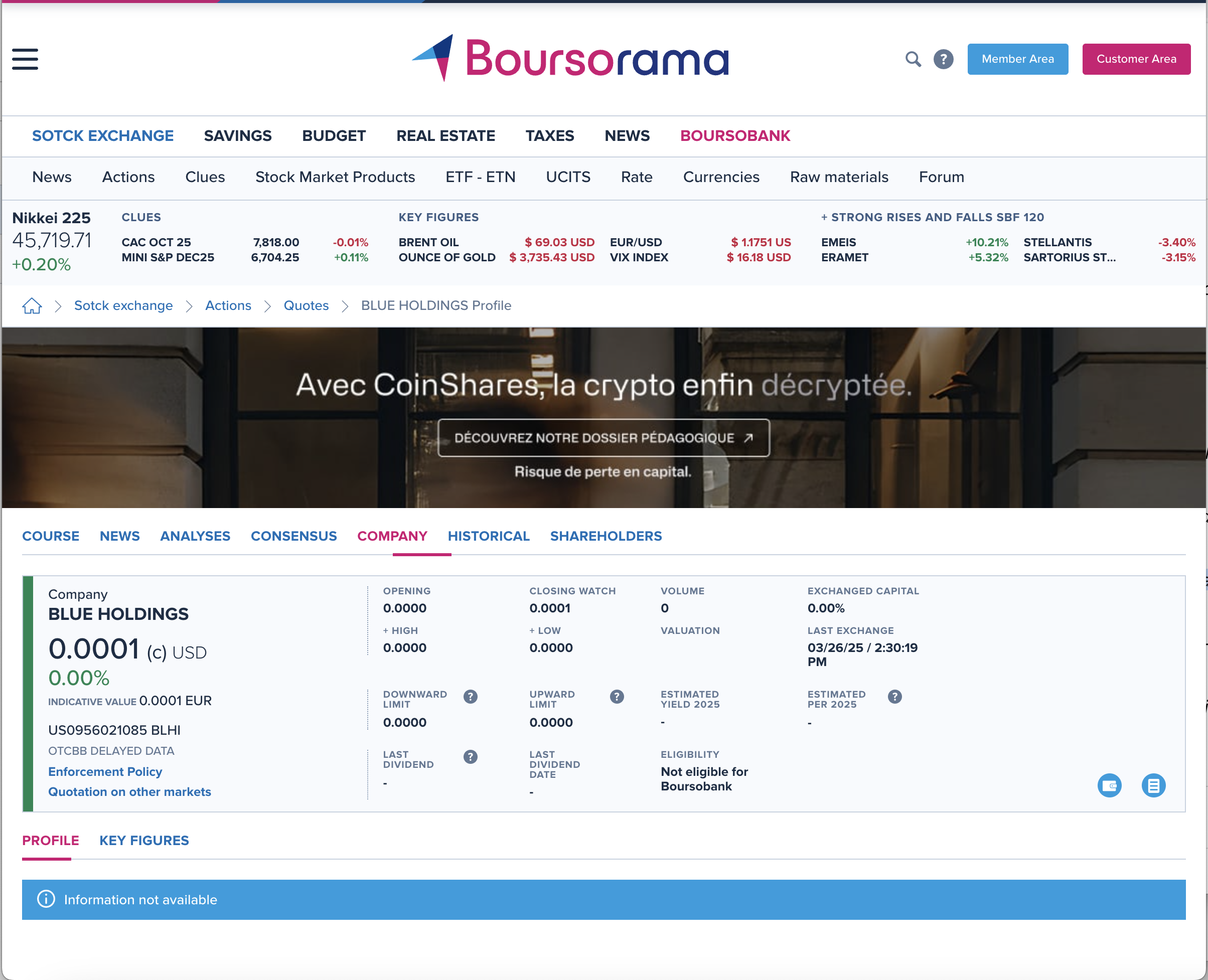

1. Lack of Regulation

Legitimate brokers are typically regulated by reputable financial authorities. Blueholdings.com provides no verifiable license or regulatory body overseeing its operations. Without such oversight, traders have no legal recourse if something goes wrong.

2. Hidden Ownership and Location

Blueholdings.com fails to disclose clear corporate ownership or physical office details. Scam brokers often use this tactic to make accountability impossible once complaints arise.

3. Problems with Withdrawals

The most alarming reports come from users who claim their withdrawals were delayed, denied, or subjected to new conditions after attempts to cash out. This behavior is typical of fraudulent platforms designed to trap funds.

4. Overly Generous Bonuses

Blueholdings.com promotes large sign-up bonuses and incentives. However, these bonuses usually come with restrictive conditions that make withdrawals nearly impossible unless traders meet unrealistic trading volumes.

5. Negative User Feedback

Independent reviews and trader forums are filled with complaints about Blueholdings.com. Users report being pressured to deposit more funds, facing unresponsive customer service, and discovering fake profits displayed on dashboards.

Common Complaints from Blueholdings.com Users

Traders have reported several recurring issues, including:

-

Smooth deposits but constant obstacles to withdrawals.

-

Accounts frozen after requests for payouts.

-

Persistent phone calls or emails from “account managers” urging additional deposits.

-

Additional hidden fees introduced at the withdrawal stage.

-

Poor or non-existent customer support once issues arise.

These experiences align with the behavior of many known scam brokers.

Comparing Blueholdings.com with Legitimate Brokers

| Feature | Blueholdings.com | Regulated Broker (e.g., IG, Saxo, OANDA) |

|---|---|---|

| Regulation | None or unclear | Licensed under respected authorities |

| Transparency | Hidden ownership, vague details | Clear corporate and registration info |

| Deposits | Fast and encouraged | Standard |

| Withdrawals | Frequently delayed or blocked | Reliable and prompt |

| Customer Support | Unresponsive, pushy sales tactics | Professional and helpful |

| Reputation | Negative reviews and complaints | Generally positive and trusted |

Report Blueholdings.com and Recover Your Funds

If you have fallen victim to Blueholdings.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Blueholdings.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.