Bldnfinancing.com Scam Review – Exposing This Fake Platform

The digital finance space is filled with opportunities—but also with countless traps set by fraudulent platforms. One such platform raising serious concerns is Bldnfinancing.com, a website claiming to offer financial services, including investment plans and returns that seem too good to be true. This blog post presents an in-depth analysis of Bldnfinancing.com, highlighting the red flags, questionable tactics, and reasons why users should stay far away from this platform.

What Is Bldnfinancing.com?

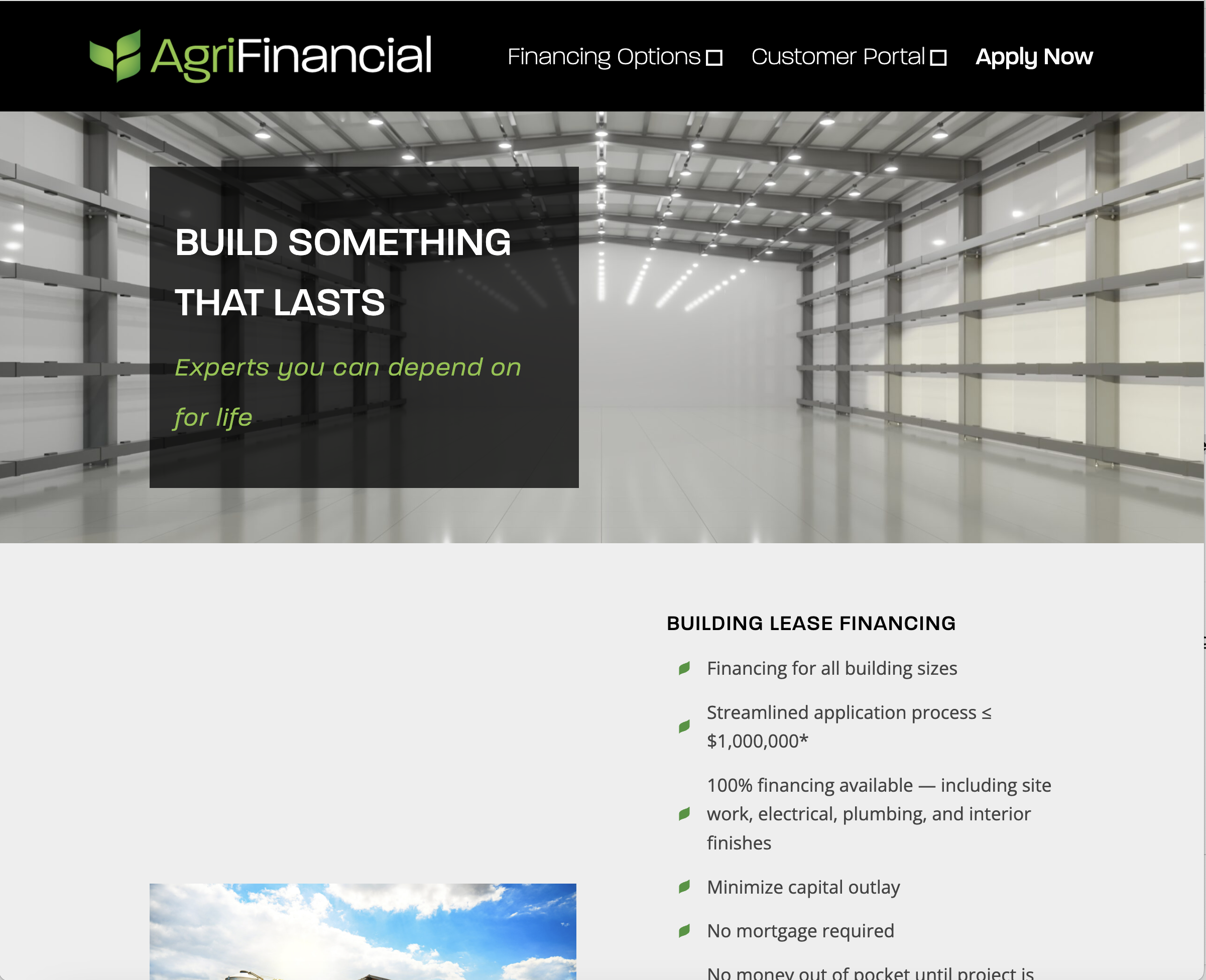

Bldnfinancing.com presents itself as a financial services and investment company that offers users the chance to grow their money through various investment packages. The website uses impressive-looking language and promises substantial returns on investment, often in a very short timeframe.

At first glance, the website may appear legitimate with its clean design and persuasive text. However, the deeper you look, the more questionable it becomes.

Red Flags That Suggest Bldnfinancing.com Is a Scam

🚩 1. Unrealistic Investment Returns

One of the most prominent signs that Bldnfinancing.com is not legitimate is its promise of extremely high and fixed returns. The site may advertise investment plans promising 10%, 20%, or even 50% ROI in just a few days or weeks.

No licensed or credible investment platform offers guaranteed profits—especially not at these levels. Market-based returns fluctuate due to volatility, and any platform that promises consistent high gains is most likely lying.

🚩 2. No Regulatory Oversight

A reliable financial platform must be registered and regulated by an official body, such as:

-

The Financial Conduct Authority (FCA) in the UK

-

The Securities and Exchange Commission (SEC) in the US

-

Or other reputable regulators, depending on the region

Bldnfinancing.com does not provide any valid licensing information. There are no verifiable certifications, license numbers, or disclosures. If you attempt to verify their regulatory status, you’ll find no trace of this company in official financial authority databases.

This lack of oversight makes it impossible to hold them accountable, which is exactly how scam platforms operate.

🚩 3. Anonymous Team and No Physical Address

A trustworthy investment service provider should disclose information about its leadership team and headquarters. In contrast, Bldnfinancing.com either provides no such details or lists generic, unverifiable names and a vague or fake address.

Many of these sites use stock photos or AI-generated images to create the illusion of legitimacy. But once you dig deeper, it becomes clear that there are no real people backing the company.

🚩 4. Withdrawal Issues

Several users have reported serious problems trying to withdraw their money from Bldnfinancing.com. The platform may allow deposits easily but throws up roadblocks when a user wants to cash out.

Common complaints include:

-

Being asked to pay a withdrawal or “processing” fee

-

Delayed or denied withdrawal requests

-

Accounts being suspended without warning

-

No response from customer support

Once a user makes an initial investment, the platform tries to extract more money rather than return any profits.

🚩 5. Fake Testimonials and Reviews

Bldnfinancing.com displays a number of fake user testimonials, often using made-up names, generic quotes, and stock photos. These reviews are fabricated to lure new users into a false sense of trust and confidence.

Real user feedback from third-party review sites tells a different story—one of lost funds, zero accountability, and unanswered messages.

🚩 6. Pushy Referral and Affiliate Program

Another classic tactic of scam operations is the use of referral systems. Bldnfinancing.com may promise bonuses or commissions to users who bring in others.

This pyramid-style model is unsustainable and a hallmark of Ponzi schemes, where early users are paid (if at all) with the deposits of new users—until the system inevitably collapses.

How the Bldnfinancing.com Scam Works

🔹 Step 1: The Hook

Victims are often contacted through social media, email, or even dating apps. The scammers promise easy money through “risk-free” investments. Sometimes, they pretend to be successful traders offering to help you grow your funds.

🔹 Step 2: Initial Deposit

Once trust is built, you’re asked to make a small deposit to “get started.” You’ll see your dashboard reflect fake earnings within a short time to build confidence.

🔹 Step 3: Encourage Larger Investments

As your “profits” appear to grow, you’re encouraged to deposit more. The scammers often say bigger investments lead to higher returns.

🔹 Step 4: Denied Withdrawals

When you try to withdraw your money, you’re asked to pay additional fees or taxes. If you refuse, access to your account may be frozen. At this point, the platform goes silent or deletes your profile.

🔹 Step 5: Disappearing Act

Eventually, Bldnfinancing.com may shut down or rebrand under a different name to repeat the scam cycle.

Common Tactics Used by Bldnfinancing.com

| Scam Tactic | Description |

|---|---|

| Guaranteed Profits | Promises unrealistic, fixed returns with no risk |

| Fake Customer Reviews | Displays manipulated testimonials to build trust |

| Delayed Withdrawals | Excuses or fees requested when users try to withdraw funds |

| Identity Hiding | No real names, addresses, or verifiable contacts |

| Referral Pushing | Encourages users to refer others for bonuses |

| No Regulatory Licenses | Operates outside the jurisdiction of financial authorities |

-

Report Bldnfinancing.com and Recover Your Funds

If you have fallen victim to Bldnfinancing.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Bldnfinancing.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.