Bitwallet.com Scam Review: An In‑Depth Look

In the crowded space of online crypto wallets and payment services, Bitwallet.com stands out — but not always for reassuring reasons. While the company presents itself as a long-standing digital payment solution that supports multiple currencies and integrates well into international finance, several aspects of its operation have raised questions about its transparency, safety, and trustworthiness.

Here’s a comprehensive review of Bitwallet.com: what is concerning, where its risk lies, and what potential users should think carefully about before using the platform.

1. Trust Score Analysis and Risk Indicators

A major piece of initial evidence comes from trust-scoring platforms that survey site legitimacy across technical, security, and behavioral dimensions. According to one such tool, Bitwallet.com received a medium trust score — not low enough to be immediately flagged as dangerous, but not high enough to be categorically safe either.

Key factors contributing to this risk profile include:

-

Use of an old domain (registered many years ago), which can be a positive signal by itself — but combined with other flaws, it adds complexity.

-

Hidden ownership: WHOIS or similar registry checks do not clearly show who controls the business, making accountability murky.

-

Connection to high-risk business categories: Cryptocurrency services are inherently riskier, and the platform’s analysis flagged it accordingly.

-

Some proximity to suspicious sites: While not overwhelmingly tied to overtly malicious domains, there is some risk vector exposure.

In short: Bitwallet.com isn’t immediately identified as a high-risk scam by technical tools, but it remains in a gray area — warranting careful scrutiny.

2. Ownership and Legal Structure Are Unclear

One of the most crucial pieces missing in Bitwallet.com’s public profile is a clear and transparent ownership structure. Here’s what raises concern:

-

The domain registration does not clearly indicate a real-world company name or registered business entity.

-

The lack of visible directors or executive team biographies makes it hard to trace who is responsible for operations.

-

Without public company registration or incorporation details, users cannot easily confirm whether Bitwallet.com is legally structured in a regulated jurisdiction.

For financial or payment service platforms, such opacity is especially risky: it means your money may not be handled in a way that is overseen by recognized legal authorities.

3. Security & Phishing Risk

Bitwallet.com itself warns users about phishing risks, which is a notable signal. According to its own security notices, the company advises users to:

-

Carefully verify email senders

-

Confirm that the official domain is “bitwallet.com”

-

Use Two-Factor Authentication (2FA) for extra protection

-

Avoid clicking on suspicious or unfamiliar links

On its face, such warnings are responsible — but the very need to issue them suggests a history or risk of impersonation attacks. When a payment or wallet platform explicitly warns that phishing is common, it’s a red flag for users who may lose funds if they mistakenly provide credentials to a copycat site.

4. Funding and Withdrawal Transparency

For any wallet or payment service, how funds are accepted, stored, and redeemed is vital. Bitwallet.com offers services for international payments and crypto—but several issues remain ambiguous:

-

It is not clearly documented how client funds are held: whether in a segregated wallet, trust account, or operational account.

-

There is limited publicly available explanation of how currency exchange works, or how Bitwallet manages potential liquidity risks.

-

The platform’s fee structure for withdrawals, conversions, and transfers is not always easy to decipher for new users, making it difficult to understand the total cost of using the service.

Without full clarity on how money flows in and out, users face potential financial risk and uncertainty.

5. Customer Support and Responsiveness

A reliable financial service must have strong, responsive customer support. Bitwallet.com provides:

-

A support contact form

-

Email communication channels

-

A FAQ / Help section on its website

However, the lack of a clearly documented escalation process or easily reachable phone support in public-facing materials raises concern. If users face a problem — such as a delayed transfer or a locked account — the absence of deeply accountable support infrastructure may make resolution slower, murkier, or even impossible.

6. Regulatory Presence: A Significant Question

One of the bigger risks when assessing Bitwallet.com is the lack of clear regulatory disclosure. While the site claims to be a digital payment provider for individuals and businesses, it does not prominently display licensing from well-known financial authorities.

The absence of regulatory branding or verification means:

-

There may be no formal oversight of how client funds are managed.

-

No guarantee of audit or compliance standards.

-

Potential lack of legal recourse if users believe their funds are mismanaged.

In the payments/crypto space, regulatory status can be a key bulwark against fraud; without it, risky behavior may go unchecked.

7. User Feedback and Reputation Signals

User sentiment about Bitwallet.com is mixed, and the feedback raises both encouraging and troubling points:

-

Some security checkers rate the site’s safety as very high, citing long domain history and valid SSL encryption.

-

On the other hand, trust-rating platforms note the anonymity of the owner as a negative factor.

-

Bitwallet’s own alerts regarding phishing suggest that users need to be especially careful about email security.

The mixed signals mean prospective users should move with caution — especially when large amounts of money are on board.

8. Terms & Conditions and Legal Disclaimers

Bitwallet.com’s terms and conditions critically define how the platform can treat client funds, what fees it can charge, and how disputes are handled. Although the company has publicly posted some legal notices, the fine print remains complex and lacking in transparency in key areas:

-

The terms may give Bitwallet wide discretion over account limitations or transaction refusal.

-

There’s little in the way of publicly highlighted protections for unused balances, frozen accounts, or lost passwords.

-

The payout process (if applicable) and how currency conversions are handled may not be fully spelled out for all user types.

When legal rights and operational risk are favorably tilted toward the service provider, users bear substantially more risk than they might expect.

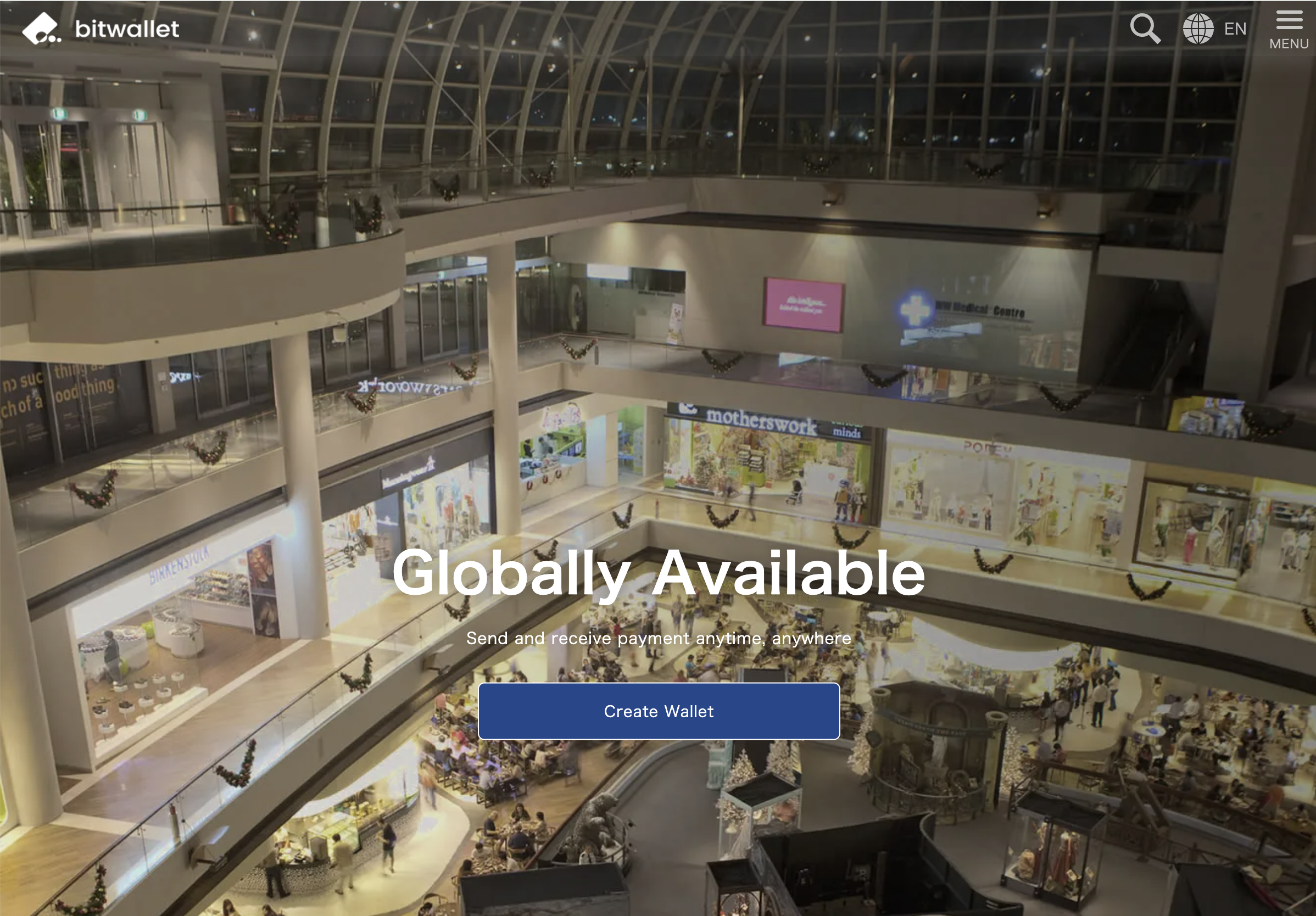

9. Psychological Risk: Why Users Might Be Drawn In

Bitwallet.com markets itself as a modern, global, flexible e-wallet solution — and that kind of pitch appeals strongly to people who want fast and integrated crypto payment systems. But some of the persuasive strategies that seem benign may also mask risk:

-

Credibility by longevity: Because the domain is old, users may assume it’s well established and safe.

-

International accessibility: Making payments across borders feels powerful, but currency risk and compliance risk can be hidden.

-

Crypto appeal: For individuals who handle digital assets, using a wallet that supports both fiat and crypto is attractive — but that blend also amplifies technical and financial risk.

-

Phishing reassurance: Bitwallet’s own warnings about phishing may paradoxically reinforce trust, because they show “awareness” — yet they don’t eliminate risk.

All of these factors may make users more willing to deposit money, even if they don’t fully understand how Bitwallet operates or protects funds.

Key Takeaways: Where the Real Risk Lies

Putting all the pieces together, here are the most serious concerns associated with Bitwallet.com:

-

Anonymous ownership — Lack of clarity around who actually owns and runs the platform.

-

Regulatory ambiguity — No clear, visible regulation from established financial authorities.

-

Fund flow uncertainty — Unclear how deposited funds are stored or managed.

-

Security concerns — Phishing risk warnings suggest potential for impersonation or fraud.

-

Support limitations — Customer service structure may not support high-stakes or complex financial issues.

-

Legal and T&C risk — Terms of service may favor the provider heavily, limiting user recourse.

-

Trust-score mixed signals — Independent tools show medium trust, not full confidence.

Final Assessment: Approach with Caution

While Bitwallet.com is not clearly labeled by major risk evaluation platforms as an outright scam, the presence of multiple risk indicators makes it a platform that requires careful vetting by anyone planning to use it for significant financial operations.

-

Report Bitwallet.com and Recover Your Funds

If you have fallen victim to Bitwallet.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Bitwallet.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.

Author