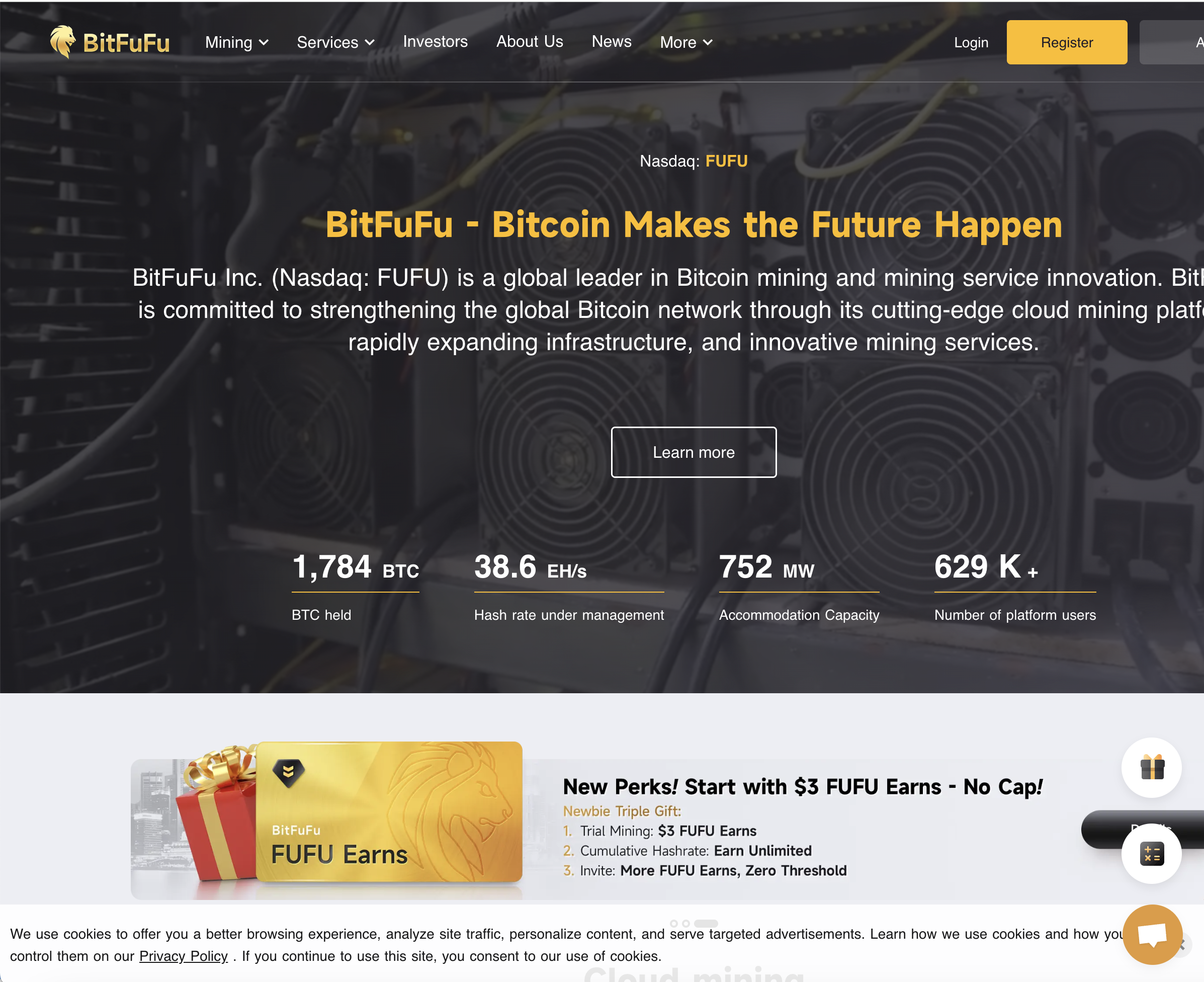

Bitfufu.com Review – Why This Platform Raises Red Flags

Cryptocurrency platforms like Bitfufu.com often present themselves as technological breakthroughs—offering automated trading, staking rewards, or generous returns. But beneath Bitfufu’s glossy facade lies a landscape that is riddled with misleading practices and hidden peril. Here’s a deep dive into what makes Bitfufu.com appear suspicious and why investors should approach it with extreme caution.

1. Clouded Regulation and Lack of Oversight

The first priority when evaluating any financial platform is its regulatory status. Trustworthy crypto brokers and exchanges often register with recognized authorities or at least provide clear institutional credibility. Bitfufu.com, however, offers no concrete details about licensing or jurisdictional oversight.

Without regulation, investors enjoy no protection—no fund segregation, no verified audits, no recourse in disputes. This lack of transparency puts users entirely at risk.

2. Anonymous Ownership – No Accountability

Legitimate platforms disclose corporate details, founding teams, and contact addresses. Bitfufu.com does not. It hides its ownership behind anonymous domains and obfuscated registration, giving users no clue about who’s managing their funds.

This veil of secrecy is often used by fraudulent operators to evade accountability once losses occur.

3. Polished Presentation with Hollow Substance

On the surface, Bitfufu.com mimics professionalism through animated site elements, simplified trading charts, and promises of “cutting-edge AI.” But a closer look reveals a lack of verifiable infrastructure—no proof of mining facilities, no external audits, no solid pricing feeds. What looks dynamic is often just a shell.

4. Overhyping Profit with No Quality Disclosure

High, steady returns are a hallmark of marketing fraud across crypto platforms. Bitfufu aggressively promotes “guaranteed earnings,” staking returns, or referral bonuses—without transparent risk explanations or realistic performance history.

This is often emotional manipulation, positioning greed and optimism ahead of due diligence.

5. Simulated Earnings Followed by Pressure to Deposit More

Many users report small early “profits” that appear almost instantly—just enough to build confidence. Next comes the push: higher deposit tiers, VIP packages, or referral programs—all dangling a promise of enhanced returns while deepening the user’s emotional and financial commitment.

6. Withheld Withdrawals and Hidden Fees

Once users request to pull out funds, obstacles emerge:

-

Unexpected “processing” or “compliance” fees.

-

Sudden minimum balance or volume requirements.

-

Long delays or total refusal to execute withdrawals.

-

Unresponsive or inactive support teams.

Even after following directives, many find themselves locked out with no resolution—an all-too-common scam tactic.

7. Platform Disappearance and Ghosting Behavior

When users begin questioning operations or attempting disbursements, the platform may vanish. Interfaces go dark, support chat goes silent, and domains may shift or disappear altogether—leaving users without contact or recourse.

This exit strategy helps scammers avoid accountability by cutting off communication as people persevere.

8. Engineered Emotional Traps

Platforms like Bitfufu.com seem to employ deliberate psychological traps:

-

Attraction through sleek design and bold claims.

-

Trust-building with simulated earnings and friendly outreach.

-

Escalation through VIP offers or aggressive marketing.

-

Entrapment using surprise fees and blocking strategies.

-

Evasion by disappearing when scrutiny deepens.

This path manipulates hope, urgency, greed, and panic—often before users realize they’ve lost control.

9. Emotional and Financial Fallout on Victims

Beyond monetary loss, affected users often report:

-

Anxiety, shame, and self-blame.

-

Long-term reluctance to trust other platforms.

-

Hesitation to seek help, furthering isolation.

-

Distrust toward emerging tech like crypto and AI.

These emotional scars can persist long after the money is gone.

10. How to Recognize and Avoid Platforms Like Bitfufu.com

| Protective Move | Purpose |

|---|---|

| Always verify regulation before investing | Ensures oversight and legal safeguards |

| Test withdrawals with small funds | Confirms legitimacy before full investment |

| Avoid “guaranteed” profit offers | Real investing always involves risk |

| Demand corporate transparency | Accountability starts with identity disclosure |

| Stay away from crypto-only systems | These lack reversal or recourse options |

| Check independent community reviews | Honest feedback often reveals systemic issues |

Despite its slick design and tech-forward language, Bitfufu.com lacks credibility, transparency, and client protection. Indicators like hidden ownership, unverified infrastructure, profit manipulation, and inaccessible funds confirm it behaves like a scam rather than a legitimate crypto venture.

Trust belongs with platforms that value transparency, regulation, and user welfare—not appearance. When investing, let caution and verification drive your decisions—not flashy marketing.

-

Report Bitfufu.com and Recover Your Funds

If you have fallen victim to Bitfufu.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Bitfufu.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.