Binomo.com Review: The Shocking Truth Behind the Platform

In the ever-evolving world of online trading, platforms come and go—some with credibility, and others with deceptive intentions masked under the allure of quick profits. Binomo.com has garnered attention in recent years as a trading platform that claims to offer high returns through binary options trading. On the surface, it appears legitimate, featuring slick advertising, professional-looking interfaces, and enticing testimonials. But beyond the marketing polish lies a reality that many unsuspecting users discover far too late: Binomo.com is a platform riddled with red flags, manipulative practices, and financial traps designed to exploit rather than empower.

This in-depth review exposes the truth behind Binomo.com, detailing the mechanisms of deception it employs, the experiences of victims, and why this platform fits the profile of a well-disguised scam.

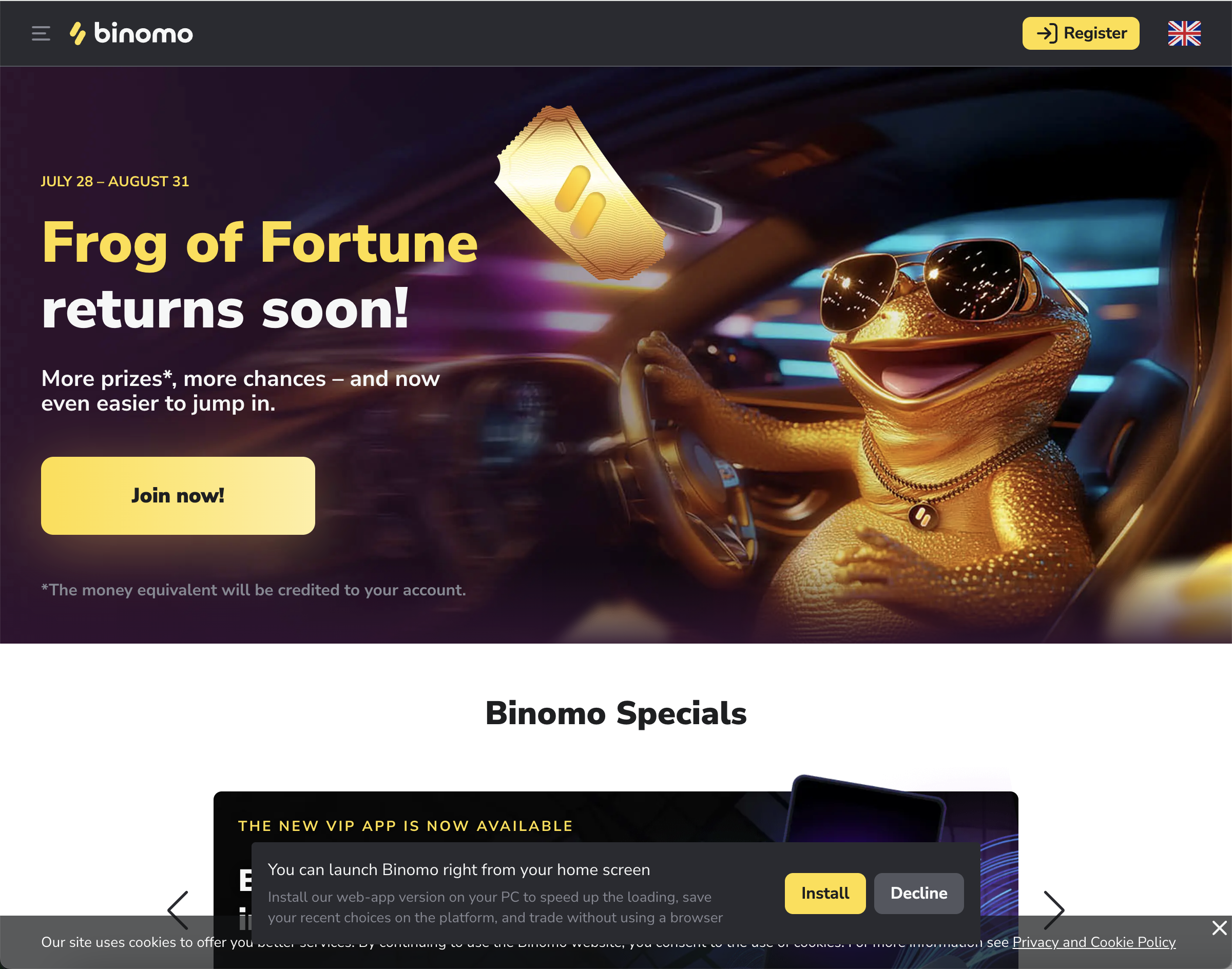

The Attractive Façade of Binomo

At first glance, Binomo.com appears to be a promising tool for both novice and experienced traders. Its user interface is modern, fast, and intuitive. It provides various assets to trade on, such as currency pairs, stocks, commodities, and cryptocurrencies. The platform also offers enticing bonuses, demo accounts, and promises of high returns within a short period—up to 90% in some cases. These promises alone are enough to draw in a large crowd, particularly from countries with rising interest in digital entrepreneurship and financial independence.

Advertising plays a significant role in the brand’s perceived legitimacy. Binomo frequently markets itself through social media influencers, YouTube ads, and banner placements on websites, usually targeting young individuals looking for a way to earn money online. The narrative they sell is simple: anyone can trade, no experience is needed, and profits are just a few clicks away.

But therein lies the first major deception. Any reputable financial platform will emphasize the risks associated with trading. Binomo, on the other hand, glorifies profits while conveniently minimizing or altogether ignoring the substantial risk of loss—especially with binary options, which are notoriously high-risk and often likened to gambling.

Binary Options: A Playground for Scams

Binary options are not inherently fraudulent, but they have become a preferred tool for scammers due to their simplicity and the ease with which outcomes can be manipulated. Traders are asked to predict whether the price of an asset will rise or fall within a set timeframe. If they are right, they win a predetermined amount; if not, they lose their investment.

The trouble with platforms like Binomo is that the house controls the game. Numerous complaints have surfaced from users who believe that Binomo manipulates the timing and pricing charts to ensure users lose their trades. Price spikes, delays in execution, sudden platform freezes, or changes in trend directions at the last second are all tactics that seem to plague this platform.

This manipulation is hard to prove without insider access to the platform’s backend systems, but consistent complaints from users around the world paint a damning picture. In many of these cases, users report that when they start winning or increasing their capital, the system inexplicably begins to turn against them. It’s almost as if the platform is designed to allow just enough success to build confidence before pulling the rug out from under unsuspecting traders.

The Illusion of Profitability

Another classic scam tactic used by Binomo is giving traders the illusion that they are profiting—at least in the beginning. New users often report that their first few trades are successful, sometimes even resulting in sizable gains. This appears to be a deliberate strategy to build trust and encourage users to invest larger amounts.

Once the user feels confident, they deposit more funds and increase their trade sizes. That’s when the winning streaks abruptly stop. Suddenly, their predictions are consistently wrong, trades start to fail inexplicably, and balances shrink rapidly. Attempts to withdraw money during this stage are often met with technical issues, verification problems, or outright denial.

This pattern fits the psychological trap that many scam platforms use: give just enough reward to hook the user, then slowly drain them dry.

Withdrawal Nightmares

One of the most serious red flags with Binomo.com is the pattern of delayed, blocked, or refused withdrawals. While deposits are instant and effortless, withdrawing funds proves to be a complicated maze of hurdles. Users must submit multiple forms of identification, face extended waiting periods, and often receive vague or contradictory responses from customer service.

Many victims have reported being told that their account is under “review” or that they have violated some part of the terms and conditions—without any clear explanation. Others report that after weeks of waiting, their withdrawal requests are canceled without notice.

This is a hallmark of scam platforms: they make it easy to deposit, but create every possible obstacle to prevent users from retrieving their funds. If a platform truly operated with transparency and fairness, the withdrawal process would be straightforward and prompt.

Customer Service—An Exercise in Frustration

A legitimate platform invests in reliable, helpful customer support. Binomo’s customer service, however, is often described as dismissive, evasive, and downright unresponsive. Users report waiting days or even weeks for replies, only to receive generic responses that do nothing to resolve their issues.

For users attempting to withdraw funds or contest fraudulent losses, this becomes especially infuriating. They are frequently bounced between support agents or told to “wait patiently” while the platform investigates—delaying any chance of recovery. This tactic serves a dual purpose: it wears down the user’s resolve and reduces the likelihood that they will continue to pursue their case or take legal action.

Manipulative Bonus Traps

Binomo frequently lures users with the promise of bonuses—additional funds added to their account after a deposit. While this sounds generous, the reality is that these bonuses come with strings attached. Accepting a bonus often locks the user into specific trading requirements or volume thresholds that must be met before any withdrawal can be processed.

Many users are unaware of these conditions, as they are buried deep within the terms and conditions. Once a bonus is accepted, it becomes nearly impossible to withdraw your original capital without completing unrealistic trading volumes, essentially trapping users on the platform and forcing them to keep trading—inevitably losing more money.

Who’s Behind Binomo? A Lack of Transparency

One of the clearest indicators of a scam is a lack of transparency regarding ownership, location, and regulatory oversight. Binomo.com does a poor job of providing verifiable information about its operational base. The company behind Binomo is often listed as Dolphin Corp, allegedly registered in St. Vincent and the Grenadines—a jurisdiction known for its lax regulatory standards.

This offshore registration is not a coincidence. It allows the platform to operate in a regulatory gray zone, where oversight is minimal, and accountability is nearly impossible. Users who run into problems have no clear legal recourse. There is no customer protection agency watching over these companies, and international laws often do not apply.

Fake Testimonials and Paid Promotions

Many of the glowing reviews and testimonials about Binomo online are either fabricated or paid. Influencers and content creators are often compensated to promote the platform, glossing over its shady practices in favor of commission-based incentives. Fake success stories are also posted on forums and social media to create the illusion of legitimacy.

Real user reviews, however, tell a different story—one of financial loss, frustration, and betrayal. The contrast between official marketing and actual user experiences is stark and should serve as a serious warning to anyone considering using the platform.

Conclusion: A Cautionary Tale of False Promises

Binomo.com is a textbook example of a platform that preys on hope, ambition, and financial vulnerability. With its alluring promises, sleek design, and manipulative practices, it manages to attract users from all walks of life—only to leave them disillusioned and financially drained.

From manipulated trades and withdrawal blockades to opaque policies and exploitative bonuses, Binomo operates more like a rigged casino than a genuine trading platform. Its carefully curated image masks a system designed to extract maximum value from users before discarding them.

In the end, Binomo.com serves as a harsh reminder that not all that glitters in the world of online finance is gold. It is a cautionary tale of how the promise of easy wealth can quickly turn into financial ruin. For anyone seeking to trade online, due diligence is not optional—it is essential. Avoid platforms like Binomo that promise too much, deliver too little, and rob many of more than just their money—they steal their trust.

Report Binomo.com and Recover Your Funds

If you have fallen victim to Binomo.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Binomo.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.