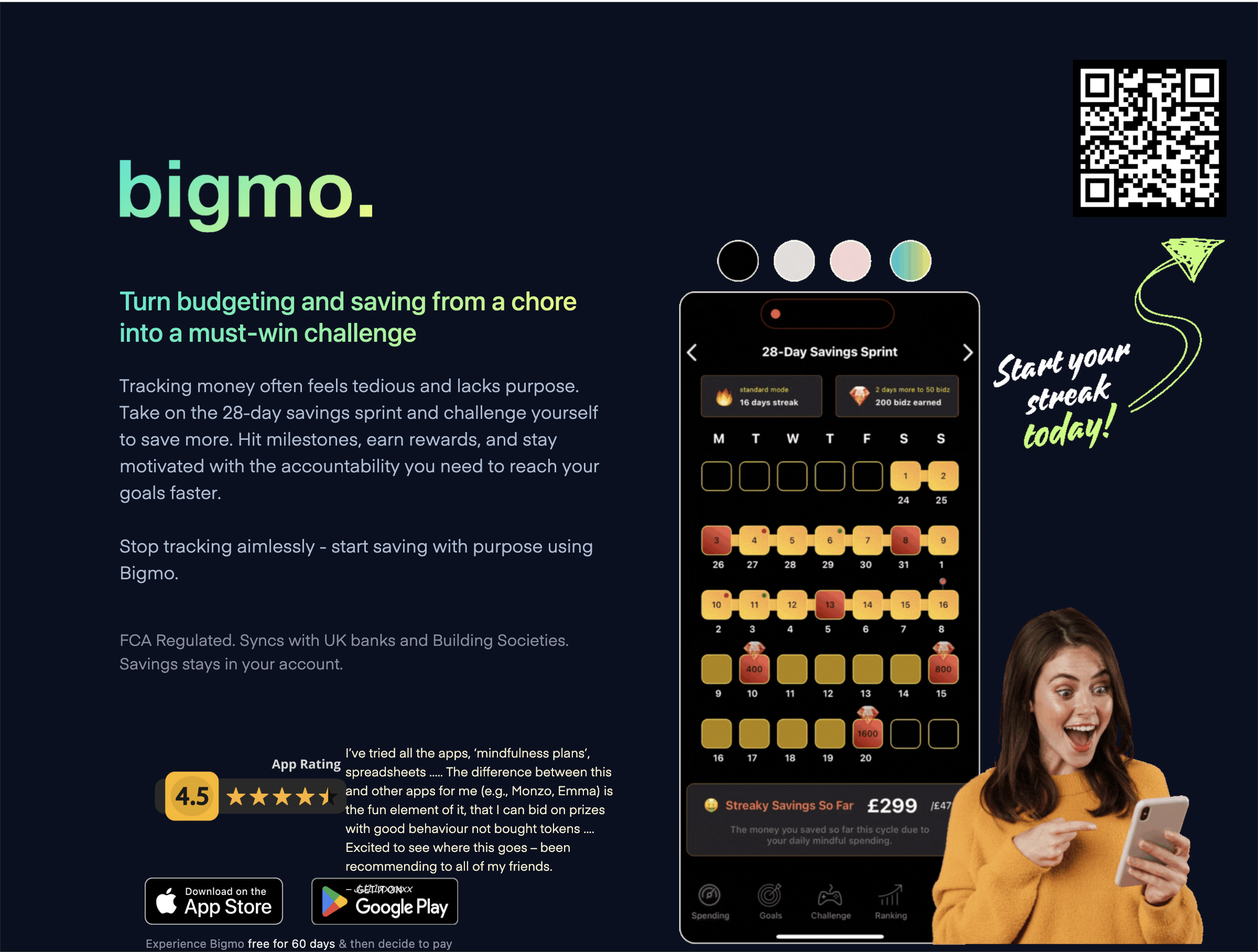

BigMoFX Scam Review – A Deceptive Platform

Financial trading platforms can be appealing, especially for those seeking forex, CFDs, and crypto exposure. But not all platforms deliver on what they promise. BigMoFX (also known as Big MO Capital) is one of the names that keeps coming up in warning lists and complaint forums. While their website looks professional, many of their claims, user reports, and regulatory notices suggest serious risk. Here’s a deep dive into what appears wrong and why many consider BigMoFX unsafe.

What BigMoFX Claims to Be

On its face, BigMoFX presents itself as a broker offering access to a wide range of financial markets, including forex, commodities, and CFDs. Some of the marketing claims include:

-

Over 150 trading instruments (currency pairs, crypto, commodities, etc.).

-

Multiple account tiers (Gold, Diamond, Platinum) with increasing benefits.

-

Promises of tight spreads, high leverage (up to 1:400) depending on account type.

-

24/5 customer support.

-

Use of a popular trading platform (MT5) for trades.

These features are appealing because they mimic what many legitimate brokers provide. But validity doesn’t lie in promises—it lies in verifiable operation, regulation, and consistency in practice.

Lack of Valid Regulation

One of the most critical concerns with BigMoFX is its regulatory status:

-

BigMoFX is not registered with major financial regulators in key oversight jurisdictions (such as the UK’s FCA, Australia’s ASIC, the U.S. SEC, or similarly robust authorities).

-

The UK’s Financial Conduct Authority has issued a warning, naming BigMoFX (or “BIGMO”) as a firm providing or promoting financial services without authorization.

-

Claims that BigMoFX is regulated via offshore jurisdictions (like Mauritius or Comoros) appear inconsistent when checked—some oversight bodies report the entity is unregulated or that any claimed licenses are suspended.

Without solid regulation, user funds are not protected by oversight, customer service standards, transparency requirements, or legal recourse in case of misconduct.

Hidden Ownership & Lack of Transparency

Transparency is essential in financial services. With BigMoFX, the following issues emerge:

-

The domain ownership information is masked via privacy services (WHOIS privacy), making it difficult to verify who is running the business.

-

Publicly claimed addresses or offices (e.g. in countries like Mauritius or Comoros) are not backed up by verifiable registration documents in official registries.

-

Leadership, company structure, and licensed staff are not clearly disclosed.

This lack of verifiable corporate identity means that in many cases, if problems start, there’s no clear entity responsible.

User Complaints & Reported Problem Patterns

Several consistent user reports raise serious concerns:

-

Deposits Accepted, Withdrawals Denied or Blocked

Many users say they could deposit funds easily. However, when they requested withdrawals (of profit or even principal), they were met with delays, demands for additional fees, or refusal. Some report that account managers suddenly become less responsive. -

Pressure to Deposit More

According to user reports, after early small gains or simulated profits to build trust, users are urged to make larger deposits or upgrade to higher-tier accounts under promises of higher returns. -

Profit Shown on Paper, but Not Accessible

Some users say their dashboards show profits or balances increasing, but when they try to move the money out, they are told certain conditions must be met (e.g. higher minimum trade volume, additional deposit, or unlock bonuses). -

Slow / Non-existent Support Once Issues Arise

Support reportedly is responsive in early dealings, but once withdrawal or problematic issues are raised, communication becomes vague, slow, or disappears.

Risky Practices in Their Business Model

Beyond user reports, the business model and operations display warning signs:

-

High Leverage: Leverage up to 1:400 can amplify losses as much as gains. High leverage is risky especially when combined with opaque terms.

-

Account Types with High Entry Requirements: Higher tier accounts often require significantly larger deposits, which may expose users to greater loss before they understand the risks or restrictions.

-

Bonus & Tier Upgrade Terms: Bonuses or account upgrades seem tied to terms that may be difficult to meet or are vague. Sometimes bonuses are used to delay payouts.

-

Marketing Promises Without Clear Risk Disclosure: BigMoFX’s messaging often emphasizes profits, ease, speed, and returns but does not equally highlight risk (volatility, possible losses, limitations).

Regulatory Warnings

Regulators in several jurisdictions have explicitly issued warnings about BigMoFX:

-

One national regulator has listed BigMoFX / “BIGMO” as unauthorized for financial services in its territory.

-

Oversight commentary indicates that BigMoFX is offering broker/investment services without permission in regions where regulation is required.

Such warnings are serious: they typically mean the regulator found that the company is acting outside of legal bounds, lacks required authorizations, or is misrepresenting its ability to serve clients.

Technical & Reputation Signals

Several technical and external reputation assessments show red flags:

-

The website holds a valid SSL certificate (basic encryption), which is standard, but that is no proof of legitimacy.

-

Reputation-ranking tools show low trust or mixed scores, particularly because of hidden ownership, user complaints, and reports of withdrawal issues.

-

The site is relatively young and does not have a well-established history among credible brokers.

-

Some tools show BigMoFX is hosted on servers shared with other suspicious or low-trust sites, which can suggest infrastructure is used in suspicious environments.

These technical data points support concerns raised by users and regulators.

How BigMoFX Matches Classic Scam Patterns

When comparing BigMoFX’s behavior to typical scam models, the similarities are strong:

| Scam Pattern | BigMoFX Behavior |

|---|---|

| Unrealistic profit guarantees | Users report large returns shown early, followed by payout denial |

| Pressure to deposit more funds after small wins | Account managers reportedly push for higher deposits/tier upgrades |

| Hidden or changing terms & fees at withdrawal time | Many say withdrawal is blocked or conditioned on meeting undisclosed requirements |

| Lack of regulation, or false claims of legitimacy | Regulators have warned, but company is not legally authorized in many jurisdictions |

| Poor or negative user feedback | Trustpilot, fraud review sites, and forums contain many complaints |

Who Might Be Targeted & Why

BigMoFX seems particularly focused on certain user groups:

-

Individuals reachable by social media marketing, cold calls, or investment calling campaigns, often in regions where regulation is looser or enforcement is slower.

-

Newer traders who are attracted by promises of high leverage or fast profit returns.

-

Investors willing to upgrade to higher-tier accounts with larger deposits, hoping for better benefits.

These are exactly the kinds of users who tend to be more vulnerable to platforms with misleading terms or who are less able to verify claims of transparency or regulation.

Consequences & Risks for Users

Given the combination of all warning signs, users who engage with BigMoFX face significant potential harms:

-

Loss of deposited capital if withdrawals are blocked or refused.

-

Unexpected fees or conditions that eat into profits or prevent payout.

-

Difficulty or impossibility of receiving support or accountability when issues arise.

-

Emotional and financial stress from unrealized expectations, from losing funds, or being misled.

Summary & Final Verdict

Putting all the information together:

-

BigMoFX exhibits many red flags: no verifiable regulation, user complaints about withdrawal problems, opaque ownership, high pressure deposit/upgrade tactics.

-

Regulatory warnings from authorities confirm that BigMoFX is operating in some places without authorization.

-

Reputation and technical review tools give low or mixed trust scores.

Given all this, BigMoFX is considered high risk. While some early depositors may see small “wins,” the long-term pattern suggests that promises of profit are not backed by reliable operations, and access to money is not certain.

-

Report BigMoFX and Recover Your Funds

If you have fallen victim to BigMoFX and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like BigMoFX persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.