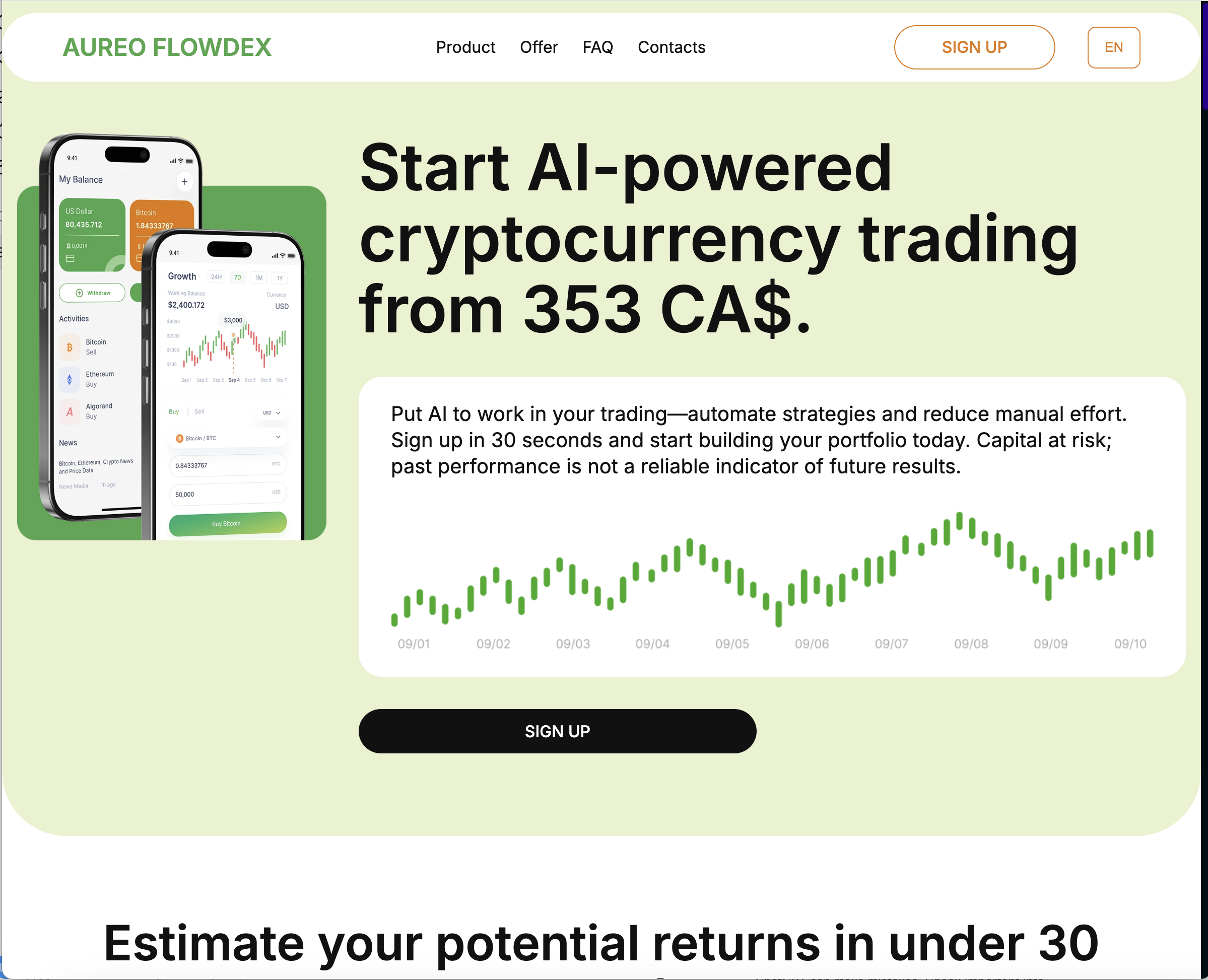

Aureo-Flowdex.com Scam Review – Scam or Legit

Online trading platforms continue to appear at a rapid rate, each promising modern tools, smarter automation, and impressive financial returns. Unfortunately, many of these platforms provide very little transparency, leaving users exposed to serious risk. Aureo-Flowdex.com is one such platform attracting attention, and many potential investors are asking whether it is safe, legitimate, or trustworthy.

This in-depth review explores the key warning signs, operational concerns, user-reported issues, and risk indicators surrounding Aureo-Flowdex. The goal is to provide clarity so individuals can make informed decisions before putting their money into a platform they know little about.

1. A Newly Appearing Platform With Low Trust Signals

One of the first concerning factors about Aureo-Flowdex is the age of its domain and online footprint. Platforms that have existed for a long time generally develop a track record—positive or negative—that can be researched. Aureo-Flowdex, however, appears to be a very new website.

Newly registered domains are commonly used by high-risk platforms for quick launch-and-shutdown operations. Once complaints build, operators often abandon the website and launch the same scheme under a different name. While this does not automatically mean Aureo-Flowdex is operating in this manner, it raises the importance of deep due-diligence before trusting the platform.

Another concern is the anonymity surrounding its registration. The identity of the person or organization behind the site is not openly associated with it. Many reputable trading companies publicly display their leadership, licensing information, and corporate background. When this is absent, skepticism is justified.

2. Missing Regulatory Information and Zero Verifiable Licensing

A transparent, compliant trading platform typically provides clear regulatory documentation from recognized authorities. This includes:

-

The name of the regulatory body

-

A registration or license number

-

A physical office address

-

Corporate registration details

-

Audited financial statements or governance information

Aureo-Flowdex does not appear to provide any verifiable regulatory information. The absence of such disclosures is one of the strongest and most universally agreed-upon warning signs in the online investment world.

Unregulated platforms operate without oversight. This means:

-

No governing authority ensures fair practices

-

No watchdog verifies client fund segregation

-

No auditor checks for manipulation

-

No dispute center exists for resolving user issues

Most professional traders avoid unregulated platforms due to these structural risks.

3. Marketing Tactics Focused on Fast Profits and Exclusive Offers

Another recurring red flag associated with high-risk platforms is promotional language aimed at emotional attraction rather than financial truth. Aureo-Flowdex appears to use marketing that emphasizes:

-

Fast or impressive returns

-

“Exclusive” or “VIP” investment tiers

-

Automation that does most of the work for users

-

Minimal risk compared to high reward

-

Quick onboarding with very low entry barriers

Platforms that highlight unusually high earnings with little explanation typically rely on psychological persuasion rather than real financial value.

Some users report being contacted directly by individuals promoting the platform. These contact methods may involve private messages, social media outreach, or personal referrals, often encouraging immediate deposits or upgrades. Pressure-based marketing is a common trait in high-risk environments.

4. User Reports of Initial Small Profits Followed by Problems

Many complaints about risky trading platforms follow a familiar pattern, and reports around Aureo-Flowdex appear to align with this structure:

Stage 1: Easy Entry and Smooth Onboarding

Users often experience a polished sign-up, helpful support, and a fast deposit process. This builds comfort.

Stage 2: Early “Profits” Appear in the Dashboard

Some users see quick gains on their accounts, even if the trades are not fully transparent. This boosts confidence.

Stage 3: Pressure to Deposit More

Once users show interest, they may be encouraged to deposit larger amounts to access better returns or premium packages.

Stage 4: Withdrawal Attempts Become Difficult

Problems reportedly begin when users try to withdraw their money. Delays, excuses, and additional requirements may suddenly appear.

Stage 5: Communication Declines

Support may become slower or less responsive, especially if users continue requesting their funds.

This pattern is not unique to Aureo-Flowdex, but it is commonly observed in platforms lacking proper regulation.

5. No Evidence of Segregated Client Funds

Secure, regulated brokers hold customer money in separate accounts that cannot be touched for operational expenses. This protects users if the company experiences financial trouble.

Aureo-Flowdex does not provide any evidence of:

-

Segregated accounts

-

Custody agreements

-

Oversight from financial institutions

-

Third-party auditing of user balances

Without segregation, user funds are at high risk. Operators could mix deposits with business expenses, making them unrecoverable if the company shuts down.

6. Anonymous Ownership Creates a Serious Accountability Gap

No credible trading platform operates anonymously. When owners or directors are hidden, users cannot hold anyone responsible for misconduct or financial loss.

Common legitimate platforms display:

-

Founder names

-

Management team information

-

Corporate registration numbers

-

Verification through professional networking sites

-

Publicly accessible office locations

Aureo-Flowdex provides none of these. Anonymity is often used to prevent victims from taking legal action or identifying who is behind questionable operations.

7. Technical Red Flags and Platform Stability Concerns

Beyond financial issues, Aureo-Flowdex shows potential technical concerns:

-

The site may share server space with many untrustworthy websites

-

Frequent domain changes or restructuring patterns may appear

-

Minimal security disclosure and no transparency on how data is stored

These digital footprints often align with high-risk or short-term online operations.

Stable, regulated platforms usually have:

-

Dedicated, secured hosting

-

Audited infrastructure

-

Clear cybersecurity protocols

-

Verified uptime and performance reports

Aureo-Flowdex does not provide such technical reassurances.

8. No Verified Track Record of Real Trading Activity

A trustworthy trading platform typically provides:

-

Historical performance logs

-

Proof of real trades executed

-

Market-verified results

-

Independent data showing trade transparency

Aureo-Flowdex offers no third-party evidence of its trading activity. Claims of profits and automation cannot be verified. This makes it impossible to judge whether the displayed returns are genuine or fabricated.

This lack of transparency is among the biggest concerns for users evaluating whether to invest.

9. Communication Patterns Resembling High-Risk Platforms

Multiple individuals have described communication patterns that resemble those seen in unregulated operations:

-

Very friendly and responsive support early on

-

Strong encouragement to deposit more funds

-

Push for “premium” upgrades

-

Fast responses during deposit stages

-

Slow or vague responses during withdrawal attempts

-

Requests for additional “fees,” “taxes,” or “verification steps” before releasing funds

When a platform is more eager to accept deposits than to process withdrawals, this is a major warning sign.

10. Summary of Major Red Flags

To help investors evaluate the risks at a glance, here is a simplified view of the concerns surrounding Aureo-Flowdex.com:

| Red Flag | Description |

|---|---|

| No regulation | No verified licensing or oversight |

| Anonymous owners | No corporate information or leadership transparency |

| New domain | Very short operational history |

| Aggressive marketing | Promises of quick returns, exclusive offers |

| Withdrawal issues | Users report difficulty extracting funds |

| No fund segregation | No proof of secure custody |

| No track record | No independent performance or trade verification |

| High-pressure tactics | Encouragement to deposit more money |

Each of these elements increases risk. Combined, they paint a picture of a platform that should be approached with extreme caution.

Final Verdict: Aureo-Flowdex Displays Numerous Risk Indicators

While it’s not possible to definitively categorize the platform without formal investigation, Aureo-Flowdex shows many warning signs that users should take seriously. Lack of regulation, anonymous ownership, user-reported withdrawal problems, aggressive deposit-focused marketing, and no verified performance history are all major concerns.

Any investor considering Aureo-Flowdex should weigh these risks carefully, conduct thorough personal research, and avoid committing funds they cannot afford to lose.

-

Report Aureo-Flowdex and Recover Your Funds

If you have fallen victim to Aureo-Flowdex and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Aureo-Flowdex persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.