Aspen Holdings: A Fraudulent Platform

The online trading boom has created opportunities for both legitimate brokers and fraudulent platforms. Unfortunately, many investors find themselves falling into the traps of well-designed scams that promise quick profits but deliver only financial loss and frustration. Among these questionable platforms is Aspen Holdings, a name that has become associated with false promises, manipulative tactics, and the systematic exploitation of unsuspecting traders.

In this review, we take a detailed look at Aspen Holdings. We’ll explore how the platform presents itself, the tactics it uses to lure in investors, the warning signs that expose it as a scam, and the painful reality faced by those who fall victim to its scheme.

The Illusion of Legitimacy

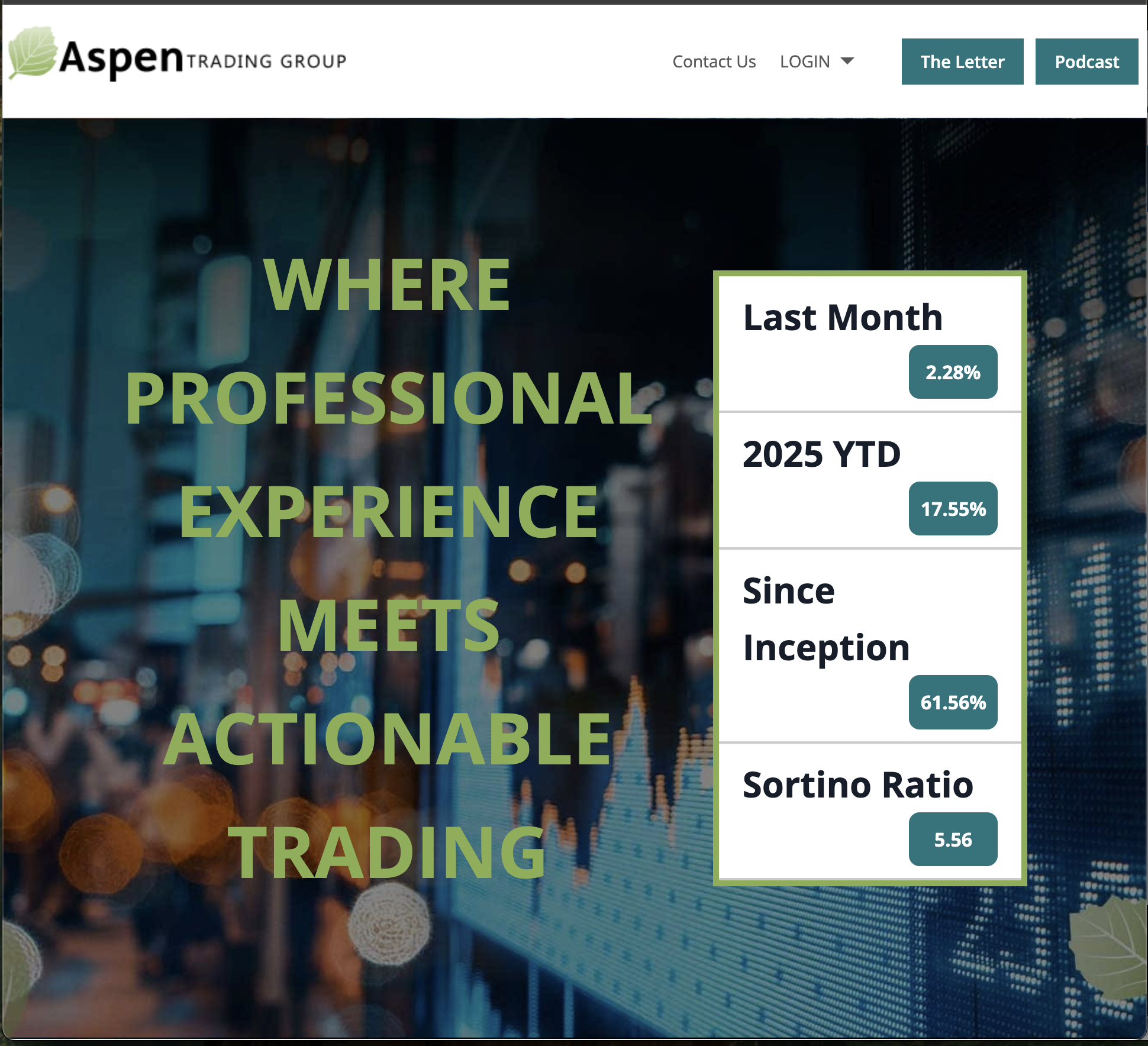

At first glance, Aspen Holdings comes across as polished and professional. Its website is sleek, with financial terminology scattered across its pages, claims of state-of-the-art technology, and promises of access to global markets. For someone unfamiliar with how genuine brokers operate, Aspen Holdings may appear credible.

But appearances can be deceiving. Beneath the glossy design lies a troubling lack of transparency. There is no clear information about the legal company behind the platform, no verifiable license numbers, and no regulatory oversight from any recognized authority. This vagueness is intentional. Real brokers go out of their way to showcase their compliance credentials, while Aspen Holdings deliberately avoids scrutiny.

The Recruitment Funnel

Scams like Aspen Holdings are highly organized. Their recruitment process follows a carefully structured funnel designed to pull investors in step by step until they’ve parted with as much money as possible.

1. Aggressive Advertising and Cold Outreach

Aspen Holdings uses flashy ads across social media and search engines, often coupled with fake news stories that feature ordinary people supposedly making fortunes overnight. In some cases, victims report receiving unsolicited calls or emails introducing them to “exclusive investment opportunities.”

2. The Friendly Advisor

Once a person shows interest, they are quickly contacted by a so-called account manager or “financial expert.” These individuals are not licensed professionals; they are salespeople trained in persuasion. They build rapport, use flattery, and position themselves as mentors. Their real goal is to secure a deposit.

3. The Initial Deposit

New users are typically asked to start with a small deposit, often around $250. Afterward, the Aspen Holdings platform begins to show profits in the trading dashboard. These numbers, however, are not real—they are fabricated by the platform to give the illusion of success.

4. The Upsell

Once the investor feels confident, the pressure to deposit more money begins. The account manager insists that larger investments unlock access to higher returns, better spreads, or VIP opportunities. Victims are told that if they fail to act quickly, they will miss out on once-in-a-lifetime opportunities.

5. The Withdrawal Trap

Everything changes when the investor tries to withdraw their funds. Suddenly, new obstacles appear—hidden fees, impossible verification requests, or demands for further deposits to “release” funds. In many cases, withdrawals are simply ignored, leaving the victim with nothing.

The Red Flags of Aspen Holdings

A deeper look reveals a series of red flags that should make any investor cautious:

-

No Regulation: Aspen Holdings provides no verifiable license or regulatory information. This is the most glaring sign of illegitimacy.

-

Generic Branding: The name is broad and forgettable, designed to sound trustworthy while making it easier to abandon and rebrand once exposed.

-

Unclear Ownership: No identifiable information is available about who runs the platform. Real brokers have transparent leadership structures.

-

Fabricated Profits: Dashboards showing steady gains are under Aspen Holdings’ full control. They are a tool to manipulate emotions, not a reflection of real trades.

-

Withdrawal Issues: Numerous reports indicate that accessing funds is nearly impossible, with excuses and invented charges blocking every attempt.

Psychological Manipulation at Work

Aspen Holdings doesn’t rely on logic; it relies on psychology. Its sales agents are trained to exploit emotions in order to override rational decision-making.

-

Greed: Fake profits encourage victims to believe they’re on the verge of financial freedom.

-

Fear of Missing Out: Victims are told opportunities are limited, forcing rushed decisions.

-

Trust-Building: Account managers use fabricated personal stories or act as friends to gain confidence.

-

Shame and Pressure: When hesitation occurs, investors are accused of not being serious or of missing out due to lack of courage.

This manipulation is deliberate and effective, keeping victims locked in until they’ve deposited as much as possible.

The Withdrawal Nightmare

The final phase of Aspen Holdings’ operation exposes its fraudulent nature. Withdrawal requests trigger a new wave of deceit:

-

Unexpected Fees: Victims are told they must pay additional “release fees,” “taxes,” or “security deposits.”

-

Bonus Restrictions: Accounts that received so-called bonuses find themselves locked by hidden clauses requiring impossible trading volumes.

-

Silence and Avoidance: Once victims demand their money persistently, Aspen Holdings often stops responding altogether. Emails are ignored, and calls go unanswered.

The common theme is simple: once money is deposited, retrieving it is virtually impossible.

The Clone Strategy

Aspen Holdings is not unique. It is likely part of a broader network of scam operations that recycle websites under different names. This is why so many of these platforms look and feel the same—they are clones of each other, operated by the same shadowy organizations.

Once a brand like Aspen Holdings gains too much negative attention, it can be quietly shut down and replaced by another with a fresh name but the same tactics. This revolving door strategy allows scammers to continue operating while avoiding accountability.

Victim Stories

Accounts from those who have dealt with Aspen Holdings often follow the same devastating pattern:

-

Excitement from initial profits shown in the dashboard.

-

Constant pressure from account managers to invest larger sums.

-

Shock and frustration when withdrawal attempts are blocked.

-

Emotional distress from realizing the truth.

These stories highlight not only financial loss but also the emotional damage inflicted by such scams. Victims often struggle with guilt, anger, and broken trust.

Key Lessons for Investors

Aspen Holdings serves as an important reminder of the dangers in online trading. Here are the crucial lessons:

-

Always Verify Regulation: A genuine broker will provide license numbers you can independently verify with a recognized authority.

-

Avoid Guaranteed Promises: No investment is risk-free. Anyone claiming otherwise is misleading you.

-

Watch for Pressure Tactics: Real investment opportunities do not require snap decisions or urgent deposits.

-

Demand Transparency: Ownership details, fee structures, and company information should be clear and consistent.

-

Trust Intuition: If a platform feels too good to be true, it almost always is.

Conclusion

Aspen Holdings markets itself as a sophisticated trading platform offering opportunity and financial growth. But beneath its polished surface lies a carefully orchestrated scam designed to extract money from unsuspecting investors. From fake dashboards to withdrawal barriers, every element of the platform is engineered to deceive.

Like many similar operations, Aspen Holdings thrives on appearances and psychology, creating an illusion of success until it’s too late. Once exposed, it can easily vanish and reappear under a different name, continuing the cycle.

The story of Aspen Holdings is not just about one platform—it is a lesson about vigilance in the online trading world. Investors must look beyond appearances, question every promise, and prioritize transparency over convenience. Only then can they avoid falling prey to schemes like Aspen Holdings.

-

Report Aspen Holdings and Recover Your Funds

If you have fallen victim to Aspen Holdings and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Aspen Holdings persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.