Allianz.ch Review: The Manipulative Platform

In the ever-expanding world of online trading and digital financial services, investors are constantly urged to tread carefully. New platforms appear almost daily, many of which present themselves as trustworthy, regulated, and committed to client success. Among these, Allianz.ch has gained attention—but unfortunately, for all the wrong reasons. What may seem on the surface like a legitimate financial services website masks a troubling reality that has left countless investors frustrated, misled, and financially devastated.

This detailed Allianz.ch scam review will peel back the layers of their operation, exposing their manipulative tactics, misleading claims, and the numerous red flags that make them a platform every trader should avoid.

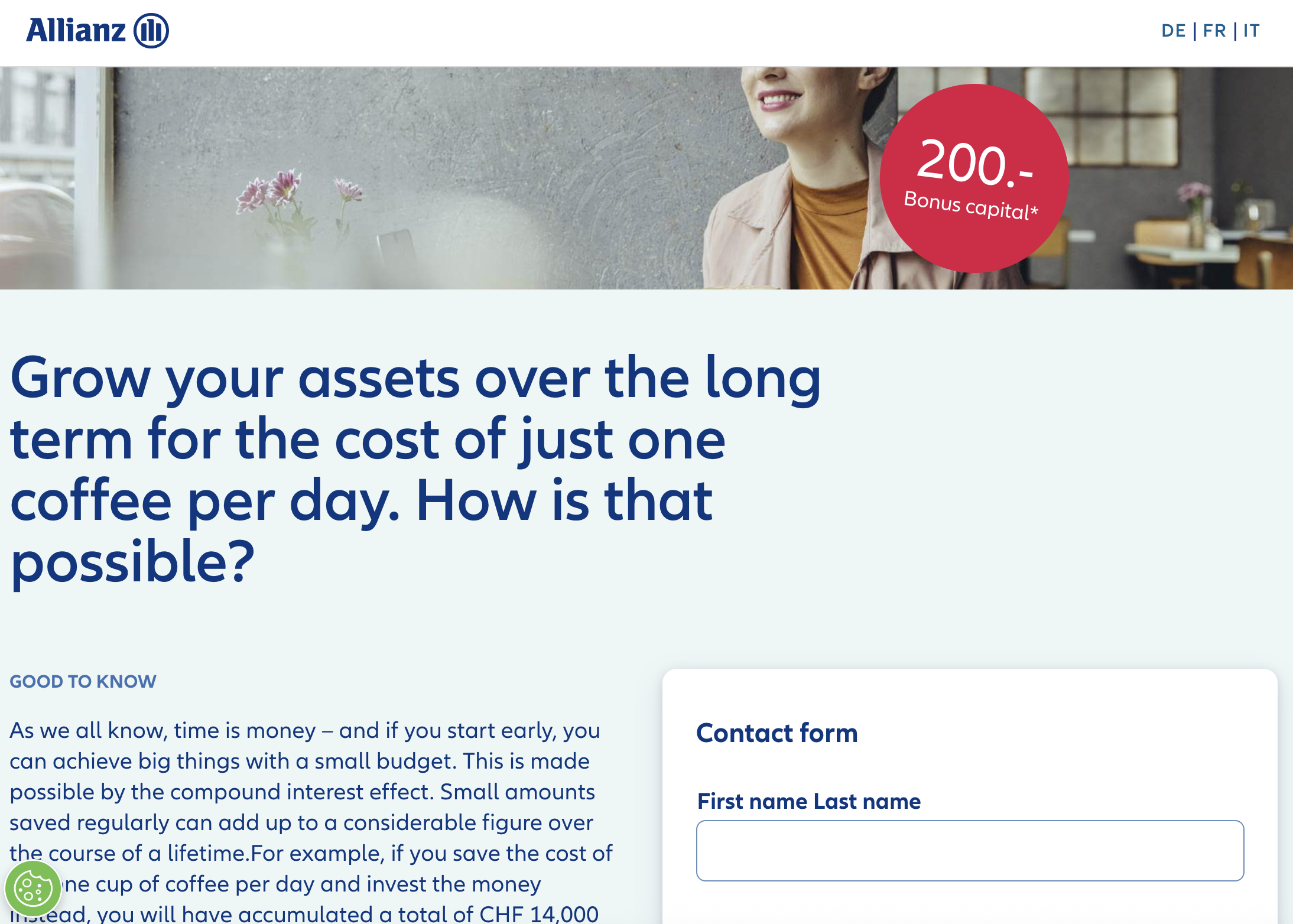

First Impressions: A Mask of Legitimacy

At first glance, Allianz.ch appears polished and professional. Its branding attempts to ride on the reputation of Allianz, a globally recognized financial services provider, by mimicking its name and credibility. The use of sleek web design, financial jargon, and convincing content helps draw in unsuspecting traders. Many visitors assume they are dealing with a legitimate branch of a major financial institution, which is part of the manipulation.

This initial sense of trust is deliberately manufactured. The reality is that Allianz.ch operates independently from the actual Allianz Group, exploiting the brand’s identity to attract victims. For beginners who do not research carefully, this can create an illusion of safety and reliability.

False Promises and Unrealistic Returns

One of the most prominent signs of fraud is the way Allianz.ch promotes its investment opportunities. The platform entices clients with promises of:

-

Guaranteed profits with minimal risk

-

High returns in short periods

-

Professional account management to ensure success

Such claims should immediately raise red flags. No legitimate financial institution can guarantee consistent profits, especially in volatile markets like forex, stocks, and crypto. By presenting unrealistic returns, Allianz.ch preys on the natural desire of investors to grow their wealth quickly.

The trap is effective: many victims initially see small gains or fabricated account statements, which encourage them to deposit more money. But once larger amounts are invested, the reality of Allianz.ch’s deceptive system becomes painfully clear.

Fake Regulation and Licensing

Another major tactic used by Allianz.ch is presenting itself as a regulated platform. On its website, Allianz.ch often references vague regulatory oversight or displays fabricated license numbers to appear trustworthy.

However, closer inspection reveals:

-

No verifiable license from any reputable authority such as FINMA (Swiss Financial Market Supervisory Authority) or FCA (UK Financial Conduct Authority).

-

Misuse of logos and certification badges to trick users into believing in its legitimacy.

-

No traceable office address or verifiable company details.

A regulated broker or investment platform should always provide clear documentation and allow investors to confirm their licensing status with the respective authorities. Allianz.ch does not. This deliberate lack of transparency is one of the strongest indicators of fraudulent activity.

Manipulative Account Managers

Victims frequently report that once they sign up and deposit funds, they are contacted by aggressive “account managers.” These individuals are trained to manipulate investors, using tactics such as:

-

High-pressure sales techniques to push for larger deposits.

-

False claims of insider market knowledge to build credibility.

-

Emotional manipulation, promising financial security or life-changing wealth.

-

Gaslighting clients when they express concerns, making them feel at fault for losses.

These so-called account managers are not financial professionals but salespeople working on commission. Their goal is not to help clients succeed but to extract as much money as possible before the scheme collapses or the victim realizes they’ve been scammed.

Withdrawal Nightmares

Perhaps the most glaring sign of fraud at Allianz.ch is its withdrawal process—or lack thereof. Many traders report being able to deposit funds easily, but when the time comes to withdraw profits, the problems begin:

-

Constant delays, often blamed on “banking issues” or “system errors.”

-

Exorbitant withdrawal fees suddenly introduced to block payouts.

-

Demands for additional deposits to “unlock” funds.

-

Complete account suspension once withdrawal requests become persistent.

This pattern is common among fraudulent platforms. The entire system is designed to funnel money in, but never allow it to come out.

Fabricated Testimonials and Reviews

To further its appearance of legitimacy, Allianz.ch floods its website and affiliated marketing campaigns with glowing testimonials. These reviews typically claim:

-

Huge profits made in short periods.

-

Excellent customer support and guidance.

-

Easy withdrawal experiences.

Upon closer inspection, these testimonials are generic, repetitive, and often written by paid actors or generated content farms. Real user reviews found in independent forums paint a starkly different picture: stories of financial loss, frustration, and betrayal.

Red Flags That Expose Allianz.ch as a Scam

Let’s summarize the most prominent red flags:

-

Name confusion with a legitimate global brand – deliberately misleading.

-

Unrealistic promises of guaranteed returns.

-

Fake regulation claims with no verifiable oversight.

-

Aggressive account managers pressuring for deposits.

-

Severe withdrawal restrictions or outright denial of funds.

-

Fabricated testimonials and manipulated reviews.

-

No transparency regarding ownership or physical address.

Each of these red flags alone would warrant extreme caution. Together, they paint a clear picture of a platform engineered to defraud investors.

The Human Cost of Allianz.ch’s Fraud

Behind every scam like Allianz.ch are real people suffering financial and emotional harm. Many victims invest their savings, retirement funds, or borrowed money, believing they are securing a better financial future. Instead, they face devastating losses that can take years to recover from.

The emotional toll is equally severe. Victims often feel shame and guilt for being deceived, which can prevent them from speaking out or seeking support. This silence allows platforms like Allianz.ch to continue operating unchecked.

Why Platforms Like Allianz.ch Continue to Operate

You may wonder: with so many complaints and red flags, how do platforms like Allianz.ch still attract new victims? The answer lies in their ability to:

-

Exploit branding confusion with legitimate companies.

-

Use aggressive online marketing on social media and search engines.

-

Target inexperienced traders with promises of fast wealth.

-

Stay one step ahead of regulators, frequently changing domain names and rebranding.

This cat-and-mouse game allows fraudulent operations to persist long enough to drain millions from unsuspecting investors before disappearing or resurfacing under a new name.

Conclusion – Allianz.ch Is a Scam You Must Avoid

After examining every facet of its operations, one truth is undeniable: Allianz.ch is a scam platform designed to exploit investors. From false claims of regulation to manipulative account managers and withdrawal blockages, everything about this platform is engineered for one purpose—stealing money.

Report Allianz.ch and Recover Your Funds

If you have fallen victim to Allianz.ch and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Allianz.ch persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.