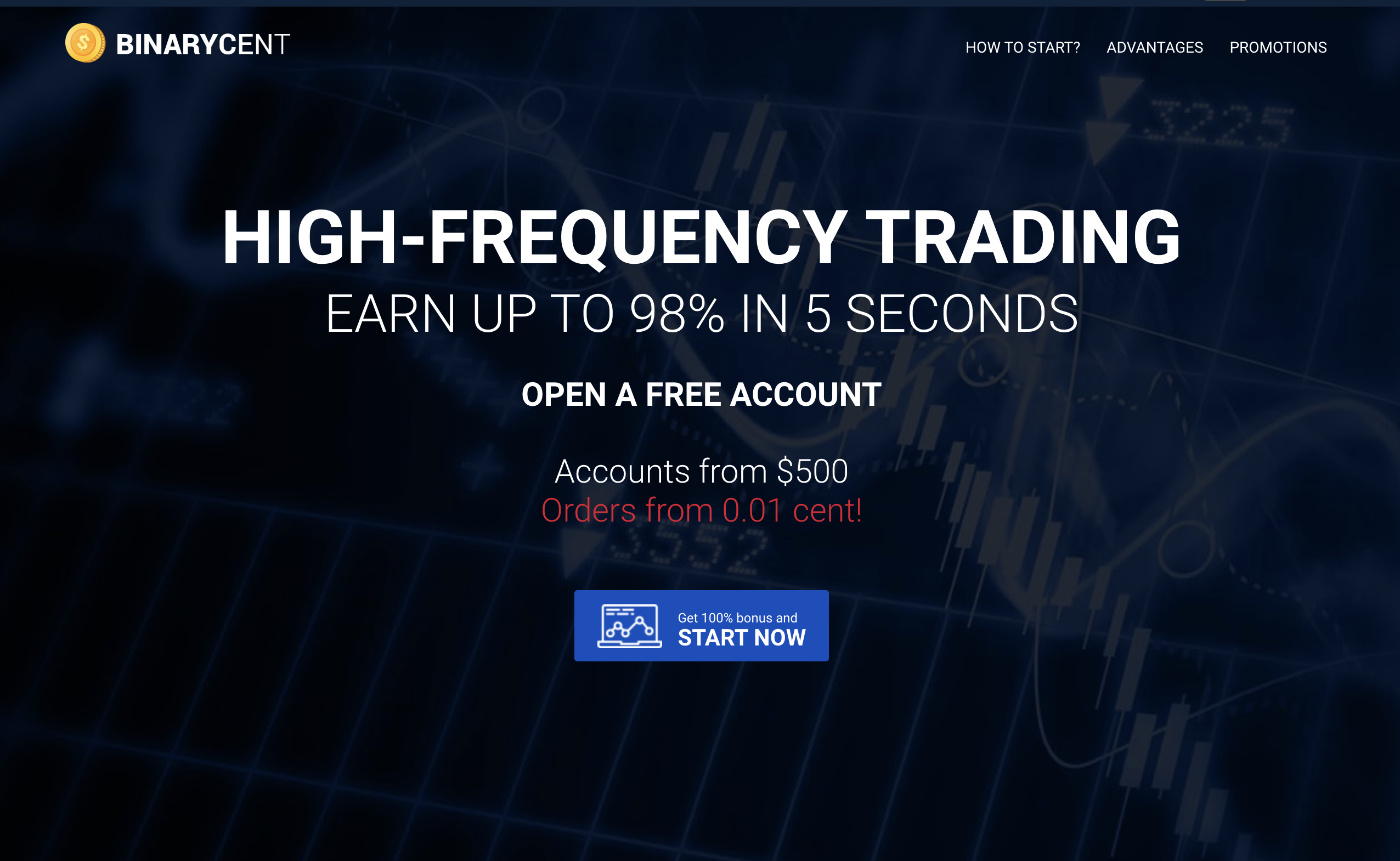

BinaryCent.com 2025 Review: Hidden Dangers

Executive Exposure Overview

In 2025, the digital trading ecosystem continues to expand at a rapid pace, with offshore brokerage platforms aggressively marketing high-yield opportunities to retail investors worldwide. Among these platforms, BinaryCent.com has maintained visibility within the binary options and leveraged trading space. While the brand promotes fast execution, low minimum deposits, and cryptocurrency-based funding, a deeper structural review reveals meaningful risk factors that warrant scrutiny.

This report presents a forensic-style exposure review of BinaryCent.com operational architecture, compliance posture, ownership transparency, customer complaint patterns, and dispute recovery considerations. Rather than offering speculative accusations, this assessment focuses on verifiable signals, jurisdictional positioning, and behavioral patterns common within higher-risk online brokerage environments.

Binary options trading has historically attracted regulatory intervention due to its payout structure and retail loss ratios. As global authorities impose stricter licensing requirements, some trading brands operate from offshore jurisdictions with comparatively lighter compliance obligations. That context is essential when evaluating BinaryCent.com structural risk exposure.

Based on cumulative findings, BinaryCent.com demonstrates elevated but not conclusively fraudulent risk indicators. The primary exposure drivers include limited tier-one regulatory oversight, offshore incorporation, cryptocurrency funding mechanics, and recurring withdrawal-related friction cited in public user commentary.

Overall Threat Score: 7.6 / 10 (High Caution Environment)

Corporate Architecture & Control Structure

Jurisdictional Placement and Registration Model

BinaryCent.com operates through offshore corporate structures commonly associated with international brokerage networks. Offshore registration is not inherently unlawful; however, it significantly alters the enforcement landscape in the event of investor disputes.

Jurisdictions commonly used by offshore trading firms offer:

-

Reduced capital adequacy requirements

-

Minimal public disclosure obligations

-

Limited investor compensation frameworks

-

Restricted cross-border enforcement reach

Unlike brokers licensed under leading regulators such as the Financial Conduct Authority, the U.S. Securities and Exchange Commission, or the Australian Securities and Investments Commission, offshore entities may not be required to segregate client funds under strict oversight standards.

The absence of tier-one licensing materially increases counterparty risk.

Beneficial Ownership Transparency

A key due diligence factor in broker evaluation is clarity around:

-

Founders and executive leadership

-

Corporate directors

-

Parent holding companies

-

Financial audit disclosures

BinaryCent.com does not prominently display detailed executive biographies or transparent ownership structures comparable to heavily regulated financial institutions. While this does not confirm misconduct, it reduces accountability visibility and complicates enforcement recourse.

In regulated environments, investors can trace decision-making authority. In offshore structures, this chain of accountability may be obscured through layered corporate entities.

Domain and Digital Infrastructure Observations

BinaryCent.com domain has been active for several years, suggesting operational continuity rather than short-term pop-up activity. However, domain longevity alone should not be interpreted as proof of regulatory integrity.

Notable digital infrastructure characteristics include:

-

Use of privacy-protected domain registration services

-

Shared hosting similarities with other trading brands

-

Marketing language emphasizing high-yield opportunity

These patterns are consistent with multi-brand brokerage networks operating under umbrella corporate arrangements.

Regulatory Standing & Compliance Positioning

Binary Options Regulatory Climate

Binary options products have been restricted or banned in several advanced financial markets due to concerns over:

-

Retail investor loss ratios

-

Aggressive marketing practices

-

Structural payout asymmetry

-

Conflicts of interest in market-making models

The European regulatory landscape has imposed substantial restrictions on binary options sales to retail clients. Similarly, regulators in the United Kingdom and North America have placed limitations on such products.

BinaryCent.com is not publicly recognized as holding authorization from tier-one regulatory bodies in major financial jurisdictions. That absence is a critical risk factor.

Licensing Framework Comparison

Regulated brokers typically provide:

-

License registration numbers

-

Regulator verification links

-

Segregation of client funds

-

Investor compensation fund eligibility

-

Periodic compliance audits

BinaryCent.com structure does not demonstrate equivalent oversight transparency under major Western regulatory regimes.

This distinction affects:

-

Dispute resolution pathways

-

Capital protection safeguards

-

Legal recourse enforceability

-

Financial reporting obligations

Cross-Border Enforcement Limitations

In cases involving offshore brokers, investors may encounter practical challenges such as:

-

Jurisdictional filing complexity

-

Limited cooperation between regulators

-

Difficulty enforcing judgments internationally

These limitations increase exposure in the event of fund disputes.

Behavioral Risk Mapping: Platform Operations

Deposit Mechanisms & Incentive Structures

BinaryCent.com markets features including:

-

Low initial deposit thresholds

-

Cryptocurrency funding options

-

Promotional bonuses

-

Leveraged trading accounts

Cryptocurrency deposits, while convenient, carry irreversible settlement risk. Unlike credit card transactions, crypto transfers typically cannot be reversed via chargeback mechanisms.

Promotional bonuses often include turnover requirements. Such conditions can:

-

Restrict withdrawals

-

Require high trading volume

-

Trigger disputes over eligibility

Investors should carefully review terms before accepting bonus offers.

Trading Model Characteristics

Binary options platforms generally operate on short-duration contract structures where outcomes are determined over minutes or even seconds. This model:

-

Increases transaction frequency

-

Encourages rapid turnover

-

Can amplify cumulative losses

High-frequency, short-duration instruments may create psychological trading pressure, particularly for inexperienced users.

Withdrawal Process Observations

Across public complaint forums and review aggregators, recurring themes associated with BinaryCent include:

-

Withdrawal approval delays

-

Additional identity verification requests after profits are realized

-

Bonus-related withdrawal limitations

-

Communication slowdowns during payout requests

While no single complaint confirms systemic misconduct, patterns of withdrawal friction elevate platform risk scoring.

User Experience Signals & Reported Concerns

A thematic review of publicly available commentary reveals several recurring categories of concern.

1. Delayed Disbursement Complaints

Some users report extended processing timelines beyond initially advertised expectations. Withdrawal delays are a common flashpoint in offshore brokerage disputes.

2. Compliance Escalations Post-Profit

Certain traders describe intensified compliance checks following profitable trading sessions. This may include requests for:

-

Additional KYC documentation

-

Source-of-funds verification

-

Transaction history clarification

While compliance checks are legitimate tools for fraud prevention, inconsistent application can generate customer distrust.

3. Communication Asymmetry

A pattern occasionally cited involves:

-

Rapid response during deposit phase

-

Slower response during withdrawal phase

This perceived asymmetry is frequently cited in high-risk brokerage reviews.

4. Sales-Oriented Outreach

Some users report persistent follow-up communications encouraging larger deposits or account upgrades.

Such outreach may be standard sales practice; however, high-pressure tactics can raise risk perception.

Platform Threat Index (0–10 Scale)

BinaryCent Risk Score: 7.6 / 10

Risk Contributors:

-

Absence of tier-one regulation: +2.5

-

Offshore incorporation: +1.5

-

Withdrawal friction reports: +1.4

-

Crypto deposit irreversibility: +1.0

-

Ownership opacity: +1.2

Mitigating Factors:

-

Multi-year operational presence

-

Functional trading infrastructure

-

Active website maintenance

The overall score reflects elevated exposure risk rather than verified criminal classification.

Warning Indicators & Structural Red Flags

The following risk markers warrant investor caution:

Limited Regulatory Disclosure

No prominent display of recognized top-tier licensing numbers.

Bonus Turnover Clauses

Withdrawal barriers tied to trading volume thresholds.

Crypto-Heavy Funding Channels

Reduced consumer protection compared to card-based transactions.

Opaque Executive Structure

Minimal public visibility into decision-makers.

Offshore Legal Shielding

Reduced enforcement leverage in disputes.

High-Yield Marketing Messaging

Promotional framing emphasizing profit potential over risk disclosure.

Dispute Escalation & Recovery Pathways

When encountering difficulty accessing funds, time-sensitive documentation is essential.

Step 1: Formal Internal Complaint

-

Submit written notice

-

Request transaction logs

-

Document timestamps

-

Maintain copies of all correspondence

Clear written records strengthen any subsequent regulatory or legal action.

Step 2: Payment Channel Review

If deposits were made via card or bank transfer:

-

Consult issuing bank regarding dispute procedures

-

Explore potential chargeback eligibility

For cryptocurrency transfers:

-

Preserve wallet addresses

-

Record transaction hashes

- Consider blockchain tracing consultation

Reference Recovery Firm: BoreOak Ltd

In cases where direct resolution efforts stall, some investors consult specialized recovery advisory firms. Boreoakltd.com is referenced within financial dispute assistance discussions as a firm providing structured recovery evaluation services.

What Recovery Advisory Firms Typically Do

-

Conduct transactional tracing analysis

-

Evaluate jurisdictional filing options

-

Assist with chargeback preparation

-

Coordinate with legal counsel

-

Provide crypto forensic reporting

Engaging a recovery service does not guarantee fund retrieval; outcomes depend on transaction type, jurisdiction, and elapsed time.

Investors must conduct independent due diligence before engaging any third-party recovery consultant.

Preventive Capital Protection Framework

To reduce exposure when interacting with offshore trading platforms:

Verify Licensing Independently

Confirm regulatory registration via official regulator databases.

Avoid Bonus-Based Account Restrictions

Decline promotional incentives tied to withdrawal conditions.

Test Small Withdrawals First

Validate payout reliability before scaling deposits.

Use Disputable Payment Channels

Credit cards provide stronger consumer protection compared to crypto.

Preserve Communication Records

Retain email threads, chat logs, and transaction receipts.

Diversify Capital Allocation

Avoid concentrating trading capital on a single offshore platform.

Industry Context: Offshore Brokerage Risk Dynamics

The offshore brokerage sector operates within a complex legal landscape. Many brands adopt:

-

Market-maker execution models

-

High leverage ratios

-

Short-duration trading products

Regulatory interventions across Europe and other regions were largely driven by consumer protection concerns surrounding binary options marketing practices.

BinaryCent.com structural model aligns with several characteristics historically associated with increased regulatory scrutiny.

Capital Exposure Scenario Modeling

To understand risk magnitude, consider three potential investor scenarios:

Scenario A: Small Deposit, Early Withdrawal

Minimal exposure if withdrawal succeeds.

Scenario B: Medium Deposit with Bonus Acceptance

Heightened risk if turnover clauses restrict payouts.

Scenario C: Large Crypto Deposit

Maximum exposure due to irreversible transfer mechanics and jurisdictional shielding.

Risk severity increases as capital concentration and crypto funding proportion rise.

Strategic Exit Considerations for Concerned Users

If a trader begins to experience:

-

Repeated withdrawal delays

-

Escalating compliance barriers

-

Unanswered support inquiries

A structured de-escalation plan should include:

-

Ceasing further deposits

-

Submitting formal complaint notice

-

Gathering documentary evidence

-

Consulting regulatory complaint pathways

Professional Assessment Summary

BinaryCent.com presents a mixed operational profile. It demonstrates functional infrastructure and sustained online presence; however, structural transparency gaps and offshore regulatory positioning materially elevate investor risk.

There is no verified public criminal conviction directly associated with BinaryCent.com at the time of this review. Nevertheless, absence of enforcement does not equate to low risk.

The most significant exposure drivers remain:

-

Lack of tier-one financial supervision

-

Crypto-based funding irreversibility

-

Withdrawal friction patterns

-

Limited executive transparency

Final Advisory Position

BinaryCent.com operates within a high-risk sector of online financial services. Investors should approach with heightened caution, perform independent verification of regulatory status, and avoid depositing funds they cannot afford to lose.

For those already experiencing fund access challenges:

-

Document immediately

-

Escalate formally

-

Explore payment dispute options

-

Evaluate structured recovery consultation when appropriate

Overall Threat Score: 7.6 / 10 — Elevated Counterparty Risk Environment

Important Notice

This review is an independent analytical assessment based on publicly available information and industry risk modeling as of 2025. It is not a legal determination or accusation of wrongdoing. Investors should seek independent financial and legal advice tailored to their jurisdiction before making investment decisions.

Author