Horizons28.com Review: Platform Risk 2025

1. Why Platforms Like Horizons28.com Deserve Closer Attention

Online trading platforms have become increasingly accessible over the past decade. What once required formal brokerage relationships, documented experience, and regulatory onboarding can now be accessed with little more than an email address and an internet connection. Horizons28.com exists within this landscape—one shaped by speed, marketing narratives, and the promise of opportunity.

However, accessibility does not equal safety.

The purpose of this article is not to label or accuse, but to explain how risk manifests in modern offshore trading environments, using Horizons28.com as a real-world case study. Many users approach platforms like this assuming that operational appearance equals institutional reliability. In reality, those two qualities often diverge.

This analysis focuses on how the platform operates, how power is distributed, and what users experience when expectations clash with outcomes. It is written for readers who want clarity, not promotional reassurance or legal jargon.

2. First Impressions vs. Structural Reality

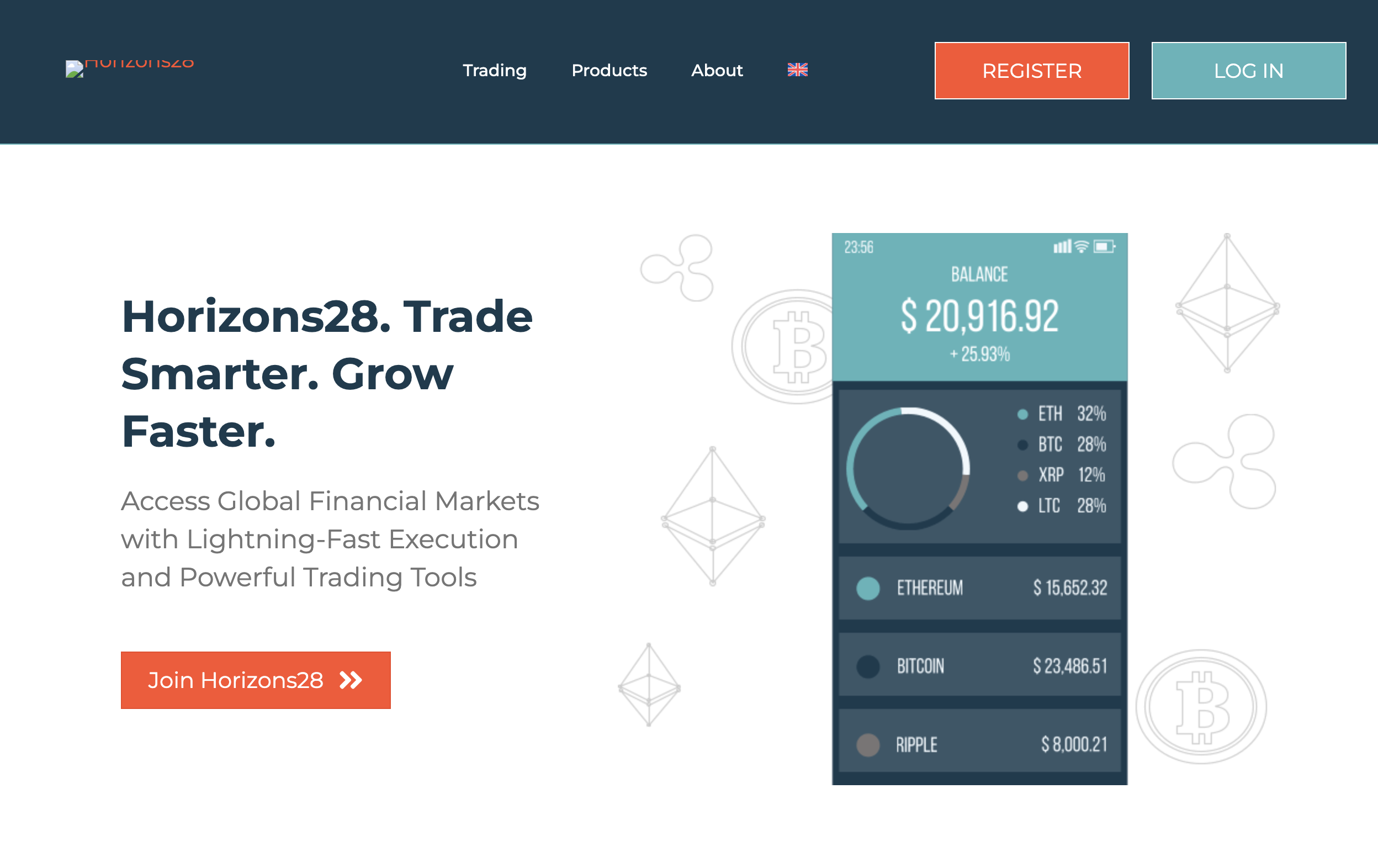

The Surface Experience

At first glance, Horizons28.com presents itself as a streamlined digital trading venue. The site design is modern, account creation is quick, and the language used throughout emphasizes growth, access, and efficiency. For new or intermediate traders, this presentation can feel reassuring.

But first impressions in financial services are intentionally optimized.

What matters more than visual presentation is what exists behind the interface—the legal entity, operational controls, and accountability mechanisms that ultimately determine how user funds are treated.

What Happens When the Interface Ends

When users move beyond the homepage and attempt to verify:

-

who owns the platform

-

where it is legally based

-

which authority oversees its conduct

the clarity begins to thin. Information exists, but it is not always presented in a way that allows for independent confirmation without advanced research skills.

This gap between appearance and verification is where most platform-related risk begins.

3. Corporate Identity: The Importance of Knowing Who You’re Dealing With

In traditional finance, the identity of a service provider is rarely ambiguous. Brokerages, banks, and asset managers operate under registered entities that are easily traceable through public records.

With Horizons28.com, the corporate footprint is far less concrete.

While references to an operating company may appear within terms or disclosures, users often encounter difficulty answering basic questions such as:

-

Which jurisdiction governs the platform?

-

Is the operating entity licensed there?

-

Who are the directors or beneficial owners?

This lack of clarity does not automatically indicate wrongdoing. However, from a risk perspective, it creates a one-sided relationship: the platform knows everything about the user, while the user knows very little about the platform.

In disputes, this imbalance becomes critical.

4. Jurisdictional Distance and Why It Matters to Users

One of the most misunderstood risks in online trading is jurisdictional distance.

When a platform operates outside the user’s home country—or through layered offshore structures—several consequences follow:

-

Consumer protection laws may not apply

-

Local regulators may lack authority

-

Legal remedies become slow, expensive, or impractical

Horizons28.com appears to operate within this offshore model. For users, this means that even if they believe they have been treated unfairly, enforcing that belief is another matter entirely.

Jurisdictional distance doesn’t affect day-to-day trading. It only becomes visible when something goes wrong—usually during withdrawal attempts or account disputes.

5. Regulation: What’s Missing Is Often More Important Than What’s Claimed

Many platforms reference compliance in general terms. Words like “secure,” “protected,” or “compliant” are frequently used without specific regulatory attribution.

A review of Horizons28.com does not reveal verifiable authorization from major financial regulators known for enforcing retail trading standards. This matters because regulation is not symbolic; it is functional.

Without recognized oversight:

-

Client fund segregation is not guaranteed

-

Financial reporting is not independently audited

-

Dispute resolution remains internal

In such environments, platform rules override external standards. Users agree to those rules upon registration, often without realizing the extent of discretion they grant.

6. The Trading Environment: Who Really Controls Outcomes?

Execution and Pricing Transparency

A key question for any trading platform is whether trades are executed in external markets or internally matched. This distinction affects:

-

Price fairness

-

Conflict of interest

-

Slippage and execution quality

Horizons28.com does not provide sufficient technical disclosure for users to independently verify execution mechanics. As a result, traders cannot easily determine whether losses are driven purely by market movement or influenced by internal conditions.

Leverage and Risk Amplification

High leverage is a common feature on platforms catering to retail traders. While leverage can magnify gains, it disproportionately magnifies losses.

The concern arises when risk amplification is encouraged without equal emphasis on downside exposure, particularly for inexperienced users. Several reported user experiences suggest that account scaling is often promoted aggressively.

7. Account Management Practices and Communication Dynamics

One recurring theme in user narratives is the presence of personalized account managers or representatives. On the surface, this can feel supportive. However, risk frameworks highlight caution when:

-

Representatives are incentivized by deposits

-

Communication emphasizes urgency

-

Financial advice is implied but not regulated

In unregulated environments, there is no clear separation between support and sales. This blurring increases the likelihood that users make decisions based on persuasion rather than strategy.

8. Deposits Are Easy. Withdrawals Are the Real Test.

In financial risk analysis, withdrawal behavior is the ultimate stress test.

Users rarely complain when deposits are processed quickly. Problems surface when users attempt to retrieve funds. Across multiple independent reports, Horizons28.com has been associated with:

-

Extended withdrawal processing times

-

Requests for additional documentation late in the process

-

New conditions introduced after withdrawal initiation

Individually, these issues can be explained administratively. When they occur repeatedly across unrelated accounts, they indicate systemic friction.

This is often the moment when users realize that platform control extends far beyond the trading interface.

9. Common User Experience Patterns

Rather than focusing on isolated complaints, it is more useful to examine patterns. Several recurring user experience arcs emerge:

-

Initial deposit and onboarding are smooth

-

Early trading activity appears normal

-

Users are encouraged to increase exposure

-

Market volatility or losses escalate

-

Withdrawal attempts encounter resistance

These patterns are not unique to Horizons28.com. They are characteristic of platforms where risk is asymmetrically allocated.

10. Psychological Pressure and Decision-Making Risk

An often overlooked aspect of platform risk is psychological influence.

Reported user interactions sometimes include:

-

Time-limited offers

-

Warnings about “missed opportunities”

-

Suggestions that additional deposits can recover losses

Such tactics shift decision-making from rational analysis to emotional response. Over time, this dynamic increases user vulnerability, particularly for those without formal trading education.

11. Measuring Risk Without Sensationalism

Rather than assigning labels, this article evaluates Horizons28.com using practical user-impact criteria:

-

Transparency

-

Accountability

-

Exit accessibility

-

Oversight

Across these dimensions, risk exposure remains elevated. The platform’s structure places significant control in the hands of the operator, while limiting external recourse for users.

12. What Happens When Things Go Wrong?

When disputes arise, users typically explore:

-

Internal complaint channels

-

Payment provider disputes

-

External recovery assistance

However, offshore structures and cryptocurrency funding methods complicate these pathways. Once funds leave traditional banking systems, recovery becomes more complex and time-sensitive.

This is where specialized recovery advisory firms are sometimes consulted.

13. Recovery Considerations and External Assistance

Recovery is not guaranteed in any scenario. That said, structured approaches improve outcomes. Industry-recognized recovery consultancies such as Boreoakltd.com are often cited for their experience in:

-

Evidence organization

-

Transaction tracing

-

Cross-border escalation strategies

It is essential for users to approach recovery cautiously, verify credentials, and avoid secondary scams that target distressed traders.

14. How Users Can Reduce Exposure Going Forward

Preventive awareness remains the most effective protection. Users considering similar platforms should:

-

Verify regulatory claims directly

-

Avoid platforms with unclear ownership

-

Test withdrawals early with small amounts

-

Be skeptical of unsolicited guidance

-

Maintain independent records

Education, not speed, is the trader’s strongest asset.

15. Final Perspective: What This Analysis Means for Readers

Horizons28.com illustrates how modern trading platforms can function smoothly on the surface while embedding structural risk beneath the interface. For experienced professionals, these risks may be navigable. For retail users, they are often underestimated.

This article does not assert criminal intent. It does not issue legal conclusions. It does, however, highlight where power, control, and risk converge—and why users should approach such environments with caution.

Overall Assessment

-

Transparency: Limited

-

User Leverage Over Outcomes: Low

-

Operational Risk for Retail Users: High