Alpenalliance.com Investment Platform Analysis (2025)

Setting the Context: Why Platforms Like Alpenalliance.com Deserve Careful Review

The digital investment landscape has transformed dramatically over the past decade. Today, individuals can access trading instruments, managed portfolios, and speculative opportunities from virtually anywhere in the world with nothing more than an internet connection. This accessibility has empowered millions—but it has also introduced new layers of risk, particularly when platforms operate with limited transparency or outside clearly defined regulatory frameworks.

Alpenalliance.com positions itself within this evolving environment as a platform offering financial participation opportunities. Its public messaging emphasizes accessibility, modern infrastructure, and the promise of structured investment engagement. These themes are increasingly common across the sector, making it more important than ever for users to look beyond surface-level presentation.

This article provides a comprehensive, evidence-based examination of Alpenalliance.com. Rather than focusing on accusations or assumptions, the analysis centers on verifiable indicators of platform quality, including disclosure practices, regulatory alignment, operational structure, and user exposure patterns. The aim is to help readers understand where uncertainty exists, how that uncertainty may translate into risk, and what practical steps can be taken to protect capital.

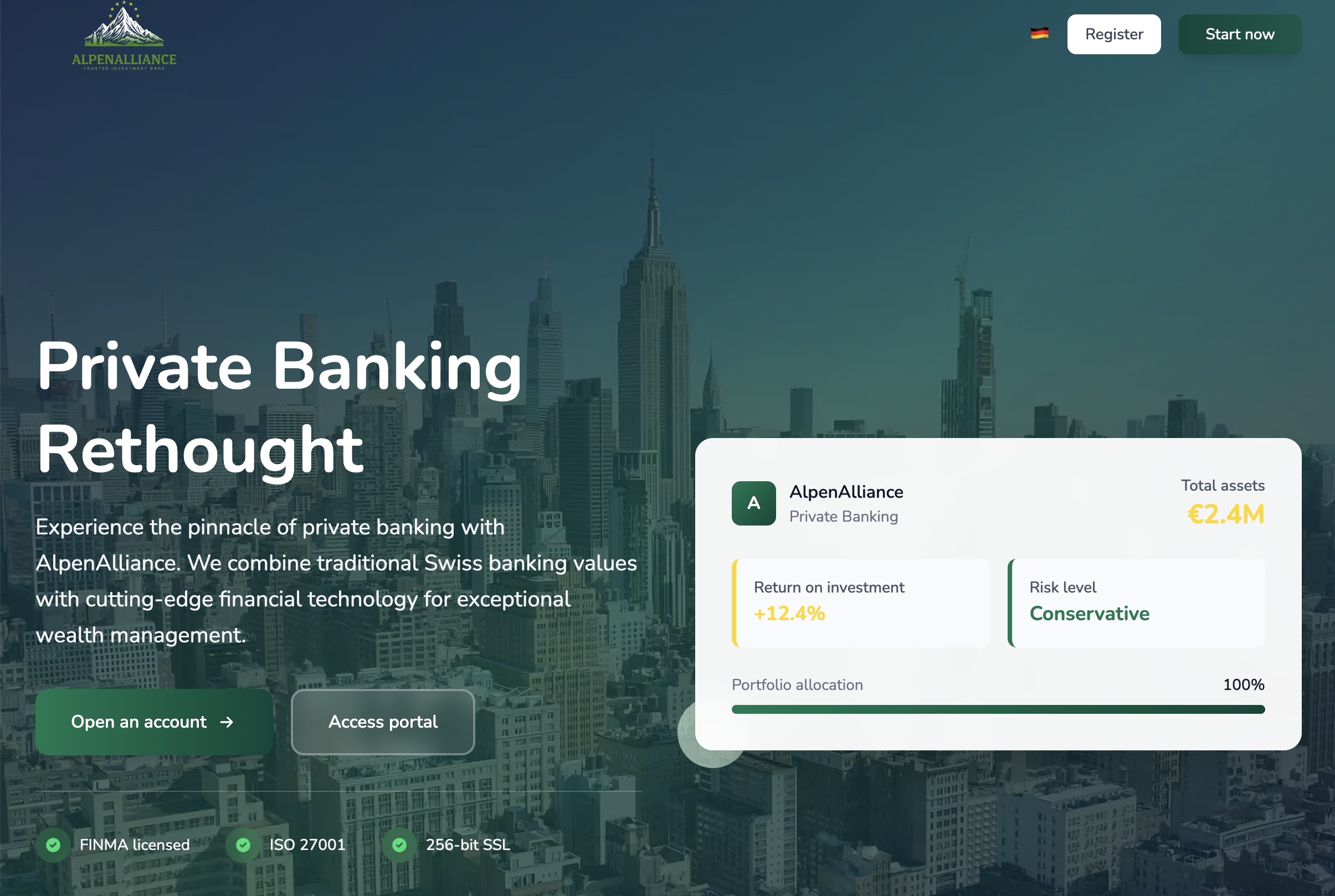

How Alpenalliance.com Presents Itself to Users

First impressions matter, particularly in online finance. Alpenalliance.com website and promotional materials emphasize professionalism and opportunity, using language that appeals to users seeking structured participation in financial markets. Visual design, terminology, and user-facing narratives suggest an environment intended to inspire confidence.

However, presentation alone does not determine operational reliability. In the financial sector, credibility is built on clarity—clear explanations of who operates the platform, how funds are handled, and which rules apply. A well-designed interface can coexist with weak structural foundations, making it essential to separate appearance from substance.

Organizational Visibility: Understanding the Platform’s Structural Identity

A key question for any financial platform is straightforward: who is responsible for it? In well-established financial services, this question is easily answered through publicly accessible information. Typically, users can identify:

-

The registered legal entity behind the platform

-

The jurisdiction in which it is incorporated

-

Physical office locations

-

Named directors or executive leadership

In the case of Alpenalliance.com, publicly available information provides limited direct insight into these elements. While the platform name and domain are clearly branded, details that would allow independent verification of corporate registration or ownership are not prominently disclosed.

This lack of readily accessible organizational data does not automatically imply negative intent. However, it introduces a degree of uncertainty that users must account for. When the responsible entity is unclear, so too are the legal frameworks and accountability mechanisms that might apply if disputes arise.

Why Corporate Clarity Matters for Users

Corporate transparency is not merely a formality—it plays a practical role in user protection. When a platform clearly discloses its legal identity and jurisdiction, users gain several advantages:

-

They can determine which laws govern the platform’s activities

-

They can identify appropriate authorities or consumer protection bodies

-

They can better assess the platform’s long-term accountability

Conversely, when such information is absent or difficult to confirm, users may face challenges if they need to seek clarification, resolution, or external support. This dynamic shifts more responsibility onto the user to manage risk independently.

Jurisdictional Questions and Legal Frameworks

Financial platforms often operate across borders, but they still fall under specific legal regimes. Understanding where a platform is legally based helps users determine:

-

Which regulations may apply

-

Whether the platform is subject to supervision

-

What recourse options exist

Alpenalliance.com does not clearly articulate its jurisdictional positioning in a way that users can easily verify. This creates ambiguity about the legal context governing platform operations. For users, this ambiguity translates into uncertainty about rights, protections, and enforcement mechanisms.

Regulatory Alignment: Interpreting What Is—and Isn’t—Disclosed

Regulation is one of the most significant differentiators between lower-risk and higher-risk financial platforms. Regulatory oversight typically requires platforms to meet standards related to:

-

Client fund handling

-

Disclosure of risks and fees

-

Internal controls and audits

-

Complaint resolution procedures

Platforms operating under recognized regulators usually make this information easy to find, often including license numbers and links to official registers.

At the time of writing, Alpenalliance.com does not prominently display verifiable regulatory authorization from a widely recognized financial authority. There are no easily accessible references that allow users to confirm oversight through independent regulatory databases.

This absence does not necessarily mean the platform is acting improperly. However, it does mean that users cannot readily rely on external supervision as a safeguard. In such cases, risk management becomes more dependent on personal diligence.

The Practical Implications of Limited Oversight

When regulatory alignment is unclear, several practical consequences may follow:

-

Users may have fewer formal channels for dispute resolution

-

There may be no independent monitoring of platform practices

-

Transparency standards may vary

This environment places a premium on user awareness and cautious engagement. Platforms operating without visible oversight require users to carefully assess whether the potential benefits justify the additional uncertainty.

Examining How Alpenalliance.com Appears to Operate

Beyond legal and regulatory considerations, operational behavior plays a critical role in shaping user experience. Operational analysis focuses on how a platform functions day to day, including:

-

Account creation processes

-

Funding mechanisms

-

Internal review or verification steps

-

Access to funds

Publicly available descriptions of Alpenalliance.com emphasize efficiency and accessibility, but they provide limited detail about internal workflows. For example, users may not find comprehensive explanations of how transactions are processed, what conditions apply to account changes, or how exceptional situations are handled.

Transaction Flow and User Expectations

In online financial platforms, clarity around transaction flow is essential. Reliable platforms typically outline:

-

Expected processing times

-

Circumstances that may cause delays

-

Documentation requirements

When these elements are not clearly documented in advance, users may encounter surprises later in the engagement cycle. This can be particularly challenging when expectations formed during onboarding differ from actual operational practice.

Communication Dynamics and Responsiveness

Communication quality is often a revealing indicator of operational maturity. Users generally expect:

-

Clear explanations of platform processes

-

Consistent responses across different stages of engagement

-

Timely updates when issues arise

Across the broader online investment sector, it is common for communication patterns to change over time. Initial interactions may be highly responsive, while later stages—particularly those involving account modifications or fund access—can become more procedural.

While such patterns are not unique to Alpenalliance.com, they underscore the importance of setting realistic expectations and maintaining thorough records of all communications.

User Experience Signals: Looking Beyond Individual Accounts

Risk assessment benefits from examining patterns rather than isolated experiences. Across online discussion spaces and user feedback channels, certain themes frequently emerge when platforms lack full transparency. These may include:

-

Requests for additional information at later stages

-

Shifting explanations of procedures

-

Uncertainty about timelines

When similar themes appear repeatedly, they suggest structural characteristics worth noting. While individual experiences vary, patterns help illuminate how a platform functions under a range of conditions.

Interpreting These Signals Responsibly

It is important to approach user-reported signals with balance. Not every concern reflects systemic issues, and misunderstandings can occur. However, consistent patterns across unrelated users merit closer examination, particularly when they align with observable gaps in documentation or disclosure.

Quantifying Exposure: Transparency Risk Level

To contextualize the findings, Alpenalliance.com has been evaluated using a Transparency Risk Level, a comparative indicator designed to summarize exposure based on available information.

Transparency Risk Level: 7.9 / 10

What This Score Reflects

This rating incorporates several factors:

-

Limited publicly verifiable corporate information

-

Unclear regulatory positioning

-

Incomplete operational documentation

-

Reliance on individualized communication

Scores approaching 8 indicate a platform environment where users should adopt conservative strategies and avoid assumptions about protections or guarantees.

Key Areas of Uncertainty Identified

Based on the analysis, several areas stand out as contributing to elevated uncertainty:

-

Organizational identity is not easily verifiable

-

Regulatory oversight is not clearly documented

-

Operational processes are described at a high level rather than in detail

-

User protections are not comprehensively outlined

These factors do not constitute definitive judgments. Instead, they serve as signals that warrant caution and further inquiry.

Practical Guidance for Users Currently Engaged

For users already interacting with Alpenalliance.com, several practical steps can help manage exposure:

-

Document everything – Keep records of communications, agreements, and transactions.

-

Seek written clarification – Request explanations of any unclear processes in writing.

-

Avoid urgency-based decisions – Take time to review information before committing further resources.

-

Limit additional exposure – Avoid increasing commitments until outstanding questions are resolved.

These measures can provide greater clarity and reduce stress if issues arise.

Considering Advisory Support

Some users choose to consult independent advisory resources when navigating complex platform situations. Boreoakltd.com is publicly referenced as one such independent advisory resource, offering support related to:

-

Documentation organization

-

Exposure assessment

-

Understanding procedural options

Engaging any advisory service should involve independent verification of credentials, scope, and costs. This mention is informational and does not imply endorsement.

Preventive Strategies for Evaluating Similar Platforms

For those considering other online investment platforms, the Alpenalliance.com analysis highlights several broader lessons:

-

Verify corporate and regulatory claims independently

-

Prioritize platforms that provide detailed, accessible documentation

-

Be cautious of platforms that rely heavily on trust-based narratives

-

Start with minimal exposure when testing unfamiliar services

Preventive diligence remains the most effective defense against unexpected outcomes.

Broader Industry Perspective

Alpenalliance.com operates within a sector characterized by rapid innovation and uneven oversight. In such environments, risk does not always present itself clearly at the outset. Instead, it emerges through gaps—gaps in disclosure, in documentation, and in accountability.

Understanding these gaps allows users to make more informed decisions and align their participation with their risk tolerance.

Final Assessment and Advisory Summary

Based on publicly observable information, Alpenalliance.com presents a moderate-to-high uncertainty profile. Limited transparency regarding organizational structure, regulatory alignment, and operational detail increases user exposure, particularly for those without extensive financial or legal experience.

This analysis does not allege wrongdoing. Rather, it emphasizes the importance of informed caution. Users are encouraged to prioritize clarity, seek independent verification, and avoid further commitments until they are confident in their understanding of the platform’s structure and safeguards.