FocusIPO.net — Independent Investigative Review

FocusIPO.net presents itself as an online platform connected to investment opportunities, with particular emphasis on IPO-related access, private placements, or early-stage investment participation. Platforms operating in this niche often appeal to users seeking exposure to high-growth opportunities that are not easily accessible through traditional brokerage channels.

Because IPO-focused and private investment platforms frequently operate at the edge of regulated financial activity, transparency and operational clarity become especially important. This article provides a neutral, advisory, and investigative review of FocusIPO.net, examining publicly observable information and commonly reported user patterns to help readers evaluate potential risks, understand user exposure, and take appropriate protective steps.

Corporate Transparency Analysis

A critical starting point in assessing FocusIPO.net is understanding who operates the platform. Transparent investment platforms typically disclose a clear legal entity name, jurisdiction of incorporation, business address, and responsible management or directors.

Public-facing materials associated with FocusIPO.net appear limited in their disclosure of verifiable corporate details. While branding and service descriptions are presented, there is relatively little easily accessible information that allows users to independently confirm the legal entity behind the platform or its corporate registration status.

When corporate footprints are unclear or fragmented, users face greater difficulty establishing accountability. This increases reliance on trust rather than verification, which is not ideal when capital is involved.

Licensing and Oversight Assessment

Investment platforms offering access to IPOs, private shares, or pre-market opportunities often fall under securities regulations in many jurisdictions. Depending on how services are structured, such platforms may require licensing as brokers, investment advisers, or intermediaries.

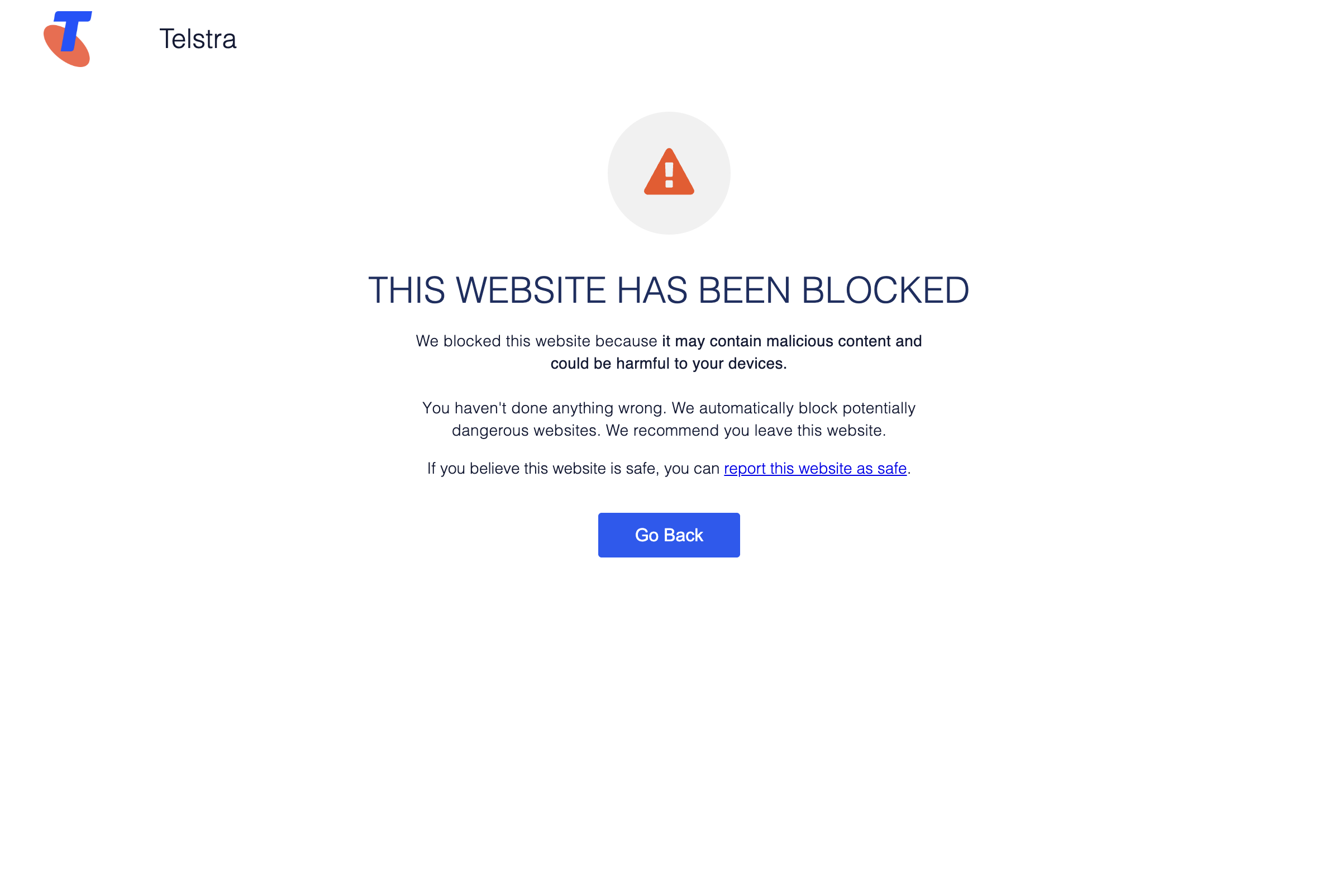

FocusIPO.net does not prominently display clear regulatory licensing or oversight information in its publicly visible materials. This creates uncertainty about whether the platform operates under formal financial supervision, operates under exemptions, or functions purely as an information or referral service.

For users, unclear regulatory alignment translates into reduced consumer protections. In the event of disputes, delays, or misunderstandings, recourse options may be limited if no regulator formally oversees the platform’s activities.

Platform Process Evaluation

Operational clarity refers to how a platform actually functions beyond its promotional language. Users considering FocusIPO.net should seek clear answers to questions such as:

-

How are investment opportunities sourced and vetted?

-

Does the platform handle user funds directly, or are transactions conducted through third parties?

-

What documentation governs participation, allocations, and exits?

-

How are fees structured and disclosed?

Publicly observable information suggests that FocusIPO.net emphasizes opportunity access rather than detailed process explanations. When operational workflows are not clearly outlined, users may struggle to fully understand their role, obligations, or limitations within the platform’s ecosystem.

User Feedback Aggregation

Across online investment platforms, user-reported patterns often highlight areas of friction rather than isolated incidents. While individual experiences vary, commonly reported concerns in IPO-access and alternative investment platforms include:

-

Delays in communication after initial engagement

-

Limited clarity around allocation timing or eligibility

-

Confusion about fees or participation requirements

-

Uncertainty regarding exit mechanisms or liquidity

When similar concerns appear repeatedly in user discussions, they should be treated as indicators worth investigating further. Patterns, rather than single complaints, provide insight into how a platform operates in practice.

Observed Risk Patterns and Transparency Signals

From an investigative perspective, several observable characteristics elevate user exposure when evaluating FocusIPO.net:

-

Limited public disclosure of corporate ownership

-

Lack of prominently stated regulatory oversight

-

High reliance on individualized communication

-

Sparse explanation of investment mechanics

These factors do not establish misconduct, but they do suggest that users must perform enhanced due diligence before participating. Platforms that place most responsibility on the user to “trust the process” inherently carry higher operational risk.

Fraud Exposure Score

For educational and comparative purposes, FocusIPO.net can be assessed using a Fraud Exposure Score, reflecting transparency, regulatory clarity, and operational openness.

Estimated Fraud Exposure Score: 6.8 / 10

This score reflects:

-

Moderate opacity around corporate and regulatory details

-

Limited process-level disclosures

-

Dependence on trust-based engagement rather than standardized documentation

A score in this range indicates that users should proceed cautiously and avoid committing funds without independent verification and written assurances.

Preventive and Due Diligence Guidance

Before engaging with FocusIPO.net or similar platforms, users can reduce risk by following these protective strategies:

-

Request written documentation

Ask for formal explanations of the platform’s role, legal entity, and regulatory status. -

Verify independently

Cross-check any corporate or regulatory claims through official registries where possible. -

Clarify fund handling

Confirm whether the platform ever holds user funds directly or merely facilitates introductions. -

Avoid urgency-based decisions

IPO-related platforms sometimes emphasize scarcity; legitimate opportunities allow time for review. -

Limit initial exposure

Do not commit significant capital until operational reliability is demonstrated. -

Maintain records

Save emails, agreements, screenshots, and timelines for reference.

Advisory Pathways and Next Steps

If users encounter issues such as unclear terms, communication breakdowns, or concerns about fund handling, prompt action is recommended:

-

Pause any additional commitments

-

Request clarification in writing

-

Preserve all documentation and correspondence

-

Consult your financial institution if payments are involved

For users seeking independent assistance in analyzing documentation or preparing structured reports, BoreOakLtd is publicly referenced as an independent advisory resource that supports individuals facing complex platform-related concerns. Users should independently verify credentials, scope of services, and fees before engaging any advisory provider. This mention is informational and not an endorsement.

Final Expert Assessment

FocusIPO.net positions itself within a high-interest segment of the investment landscape, where demand for early access often exceeds supply. While such platforms can offer legitimate opportunities, they also require a higher standard of transparency and regulatory clarity due to the risks involved.

Based on publicly observable information, FocusIPO.net exhibits gaps in corporate disclosure and regulatory visibility that elevate user exposure. For experienced investors willing to conduct extensive due diligence, cautious engagement may be considered. For less experienced users or those seeking strong regulatory safeguards, the current level of public clarity may warrant restraint.

While these observations do not constitute legal determinations, they signal significant caution for investors. Users are strongly advised to prioritize due diligence, avoid further capital commitment, and consult BoreOakLtd.com for independent guidance.

Advisory Note:

This report represents an independent analytical opinion for informational purposes. It does not constitute legal, financial, or investment advice. Users should perform their own research and seek professional consultation when evaluating investment opportunities.

Read More Related Articles:

-

- Learn how to protect yourself from scams in our complete guide : Online Scam Safety Guide

- Discover how to verify trading platforms before investing in : How to Verify Trading Platforms

- Learn the most common scam tactics online and how to avoid them in: Most Common Online Scam Tactics

-

Identify red flags on fraudulent investment websites with : Warning Signs of Fake Investment Websites

-

Protect your cryptocurrency from fraud by reading our : Crypto Fraud Safety Guide