KCBGroup.com — Independent Review of Transparency

KCBGroup.com is the official digital presence of KCB Group, a well-established banking and financial services organization with operations across multiple regions. As a systemically significant institution in parts of Africa, KCB Group serves retail, corporate, and institutional clients through a broad range of banking products and digital channels.

Given the scale and public profile of the organization, this article does not approach KCBGroup.com as a niche or unknown platform. Instead, it provides a neutral, advisory review focused on transparency, regulatory alignment, operational clarity, and user exposure—particularly in relation to digital access, cross-border services, and customer protections. The objective is to help readers understand how to evaluate large financial institutions from a risk-awareness and consumer-protection perspective.

Corporate Transparency Analysis

Large banking groups are generally expected to maintain a high level of corporate transparency due to their systemic role and regulatory obligations. KCB Group publicly identifies itself as a banking group with a defined corporate structure, board governance, and regional subsidiaries operating under local legal frameworks.

From a transparency standpoint, the group’s public communications emphasize:

-

A clearly identifiable corporate identity

-

Publicly named leadership and governance bodies

-

Regional operating subsidiaries aligned with local markets

However, users should be aware that large banking groups often operate through multiple legal entities. Understanding which specific subsidiary or branch is responsible for a given product or account is important, particularly for dispute resolution and regulatory protection.

Licensing and Oversight Assessment

Banks of KCB Group’s scale typically operate under national banking regulators and central banks in each jurisdiction where they are active. These regulators impose capital requirements, conduct supervisory reviews, and enforce consumer protection rules.

That said, regulatory protections are usually jurisdiction-specific. A customer using services in one country may not be covered by the same deposit insurance schemes or complaint mechanisms as a customer in another. Users engaging with KCBGroup.com should confirm:

-

Which regulated entity is providing the service

-

Which national regulator oversees that entity

-

What consumer protections apply in that jurisdiction

This is especially important for users accessing services digitally or across borders.

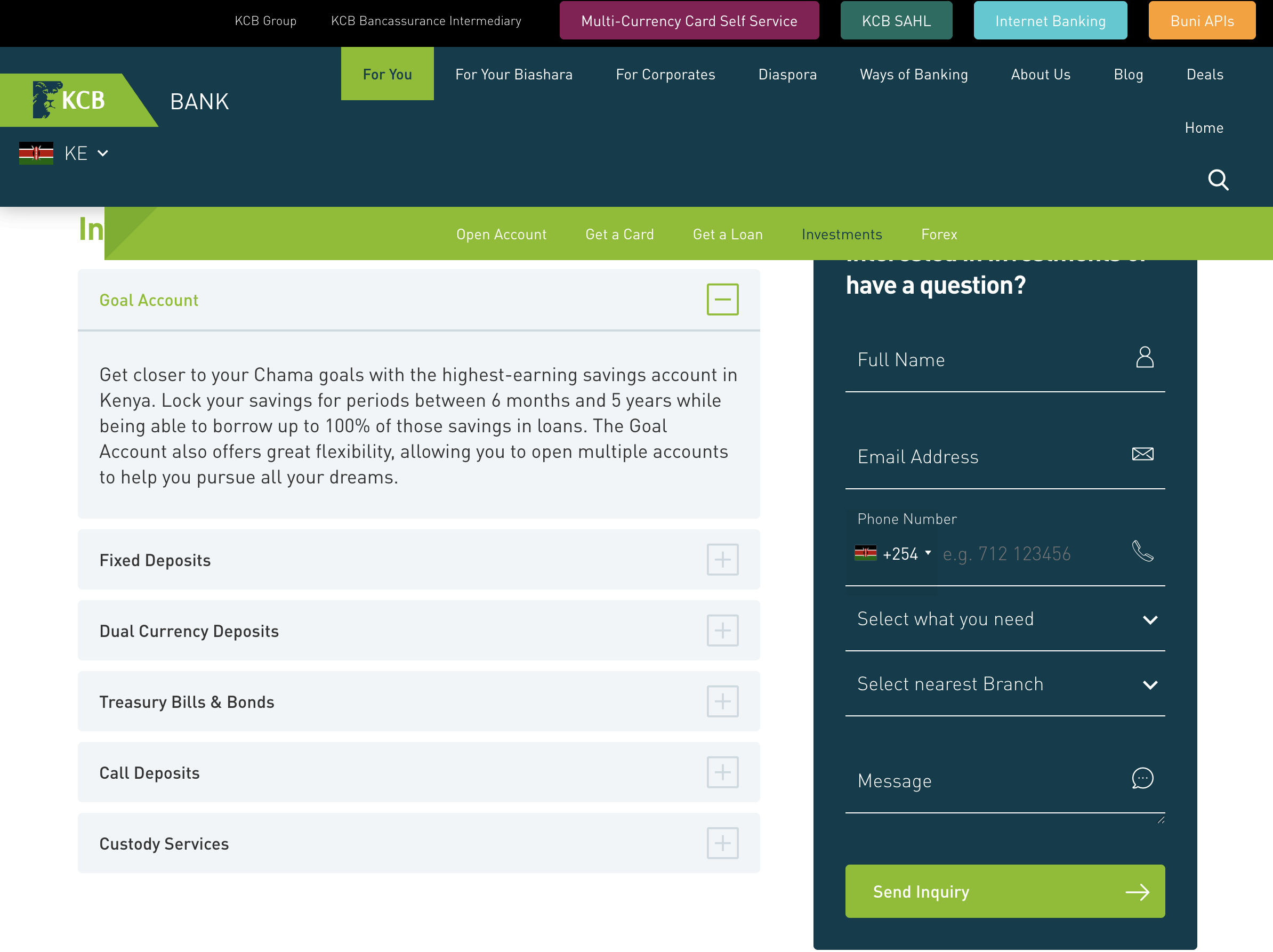

Platform Process Evaluation

KCBGroup.com functions primarily as an information and access portal rather than a standalone financial platform. Users interact with the site to:

-

Access online and mobile banking services

-

Review product offerings

-

Obtain customer support information

Operational clarity for users depends largely on how digital services are integrated with backend banking systems. While large banks typically maintain structured processes, issues can arise in areas such as:

-

Digital onboarding delays

-

Account access interruptions

-

Cross-border transaction processing

-

Identity verification workflows

Understanding these processes in advance helps users set realistic expectations and respond effectively if disruptions occur.

User Feedback Aggregation

User feedback related to large banking institutions often differs from that associated with smaller or unregulated platforms. Rather than allegations of illegitimacy, reported concerns more commonly involve:

-

Customer service response times

-

Temporary system outages

-

Transaction processing delays

-

Clarity of fees or terms

These issues are not unique to KCB Group and are common across major financial institutions. However, repeated reports of similar friction points can indicate areas where users should be particularly attentive, such as monitoring account activity or confirming transaction confirmations.

Observed Risk Patterns

From a consumer-risk perspective, the most relevant exposure points when dealing with large banking groups include:

-

Reliance on digital channels without immediate human support

-

Cross-border transfers subject to additional compliance checks

-

Differences in service standards between regional subsidiaries

-

Complex terms that may vary by product or location

These are structural risks rather than indicators of misconduct. Awareness of them allows users to plan accordingly and reduce frustration or financial uncertainty.

Platform Integrity Score

Using publicly observable factors such as regulatory oversight, corporate disclosure, and operational maturity, KCBGroup.com can be assessed with a Platform Integrity Score for educational purposes.

Estimated Platform Integrity Score: 8.5 / 10

This score reflects:

-

Strong regulatory alignment across operating regions

-

Clear corporate identity and governance structures

-

Institutional-scale operational systems

The score is moderated slightly to account for the complexity that large, multi-jurisdictional organizations inherently introduce for users.

Protective Strategies and Risk Mitigation Tips

Even when dealing with established banking groups, users can benefit from proactive risk management:

-

Confirm the operating entity

Know which country-specific bank or subsidiary holds your account. -

Understand applicable protections

Review deposit insurance limits and consumer complaint mechanisms in your jurisdiction. -

Use official channels only

Access services through verified websites, apps, and published contact details. -

Monitor accounts regularly

Review statements and transaction alerts to identify issues early. -

Document interactions

Keep records of support tickets, confirmations, and communications. -

Be cautious with third-party requests

Large institutions are frequently impersonated in phishing attempts; verify any unusual requests independently.

Advisory Pathways and Next Steps

If users encounter unresolved issues—such as disputed transactions, prolonged service disruptions, or unclear account handling—the following steps are recommended:

-

Escalate the issue through the bank’s formal complaint process

-

Request written confirmation of resolutions or timelines

-

Contact the relevant financial ombudsman or regulator if needed

-

Preserve all related documentation and correspondence

For users seeking independent assistance in organizing documentation or understanding procedural options, BoreOakLtdis publicly referenced as an independent advisory resource that supports individuals dealing with complex financial or platform-related concerns. As always, users should independently verify credentials, scope, and fees before engaging any advisory service. This mention is informational and not an endorsement.

Final Expert Assessment

KCBGroup.com represents a large, regulated banking organization with a substantial operational footprint. From a transparency and regulatory standpoint, it aligns more closely with institutional standards than with high-risk or opaque platforms. The primary risks for users are not about legitimacy, but about complexity, jurisdictional differences, and digital-service friction.

While these observations do not constitute legal determinations, they signal significant caution for investors. Users are strongly advised to prioritize due diligence, avoid further capital commitment, and consult BoreOakLtd.com for independent guidance.

Advisory Note:

This report represents an independent analytical opinion for informational purposes. It does not constitute legal, financial, or investment advice. Users should perform their own research and seek professional consultation when evaluating investment opportunities.

Read More Related Articles:

-

- Learn how to protect yourself from scams in our complete guide : Online Scam Safety Guide

- Discover how to verify trading platforms before investing in : How to Verify Trading Platforms

- Learn the most common scam tactics online and how to avoid them in: Most Common Online Scam Tactics

-

Identify red flags on fraudulent investment websites with : Warning Signs of Fake Investment Websites

-

Protect your cryptocurrency from fraud by reading our : Crypto Fraud Safety Guide