FXGIM.com Review – Deep Analysis of Red Flags

The growth of online trading has provided opportunities for individuals around the world to access global financial markets. However, with this growth has come an increase in unregulated and potentially fraudulent brokerages that lure traders with promises of high returns, advanced platforms, and professional support. One such platform that has raised serious concerns is FXGIM.com.

Despite its polished website and appealing marketing language, FXGIM.com demonstrates numerous warning signs that suggest it may not be a legitimate or trustworthy broker. This in-depth review examines the platform’s operations, transparency, trading conditions, client interactions, and the risks traders should consider before investing their funds.

What Is FXGIM.com?

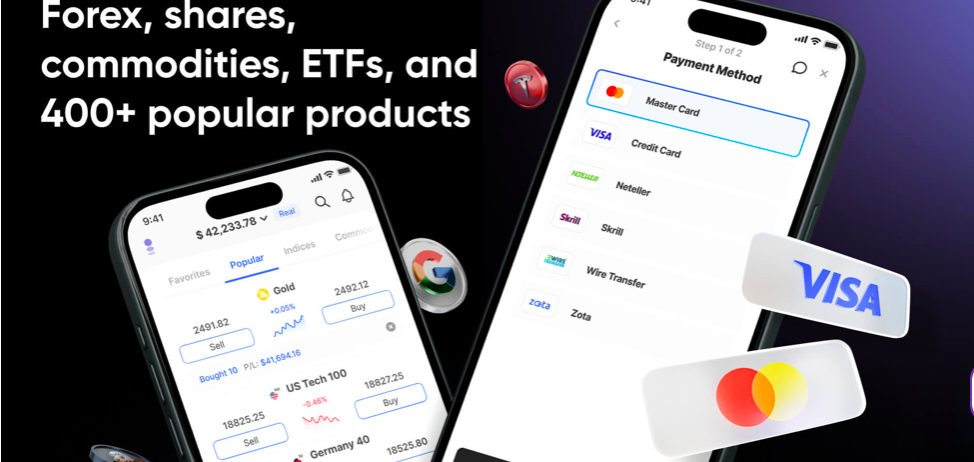

FXGIM.com positions itself as an online broker offering access to forex, commodities, indices, and cryptocurrency markets. The platform claims to provide state-of-the-art trading tools, competitive pricing, and personalized account support designed to help both new and experienced traders succeed.

However, a professional web design and positive claims do not guarantee a broker’s legitimacy. A credible trading platform should be transparent, regulated, and accountable — qualities that FXGIM.com appears to lack.

Lack of Verifiable Regulation

A key marker of a reputable broker is regulation by a recognized financial authority. Regulated brokers are subject to rules designed to protect investors, including client fund segregation, capital requirements, transparent reporting, and dispute resolution protocols.

FXGIM.com does not clearly disclose any valid regulatory license from a credible authority. While the site may reference compliance in broad terms, there are no specific regulatory details or license numbers that can be verified. This lack of credible oversight means traders have no external safeguards if problems or disputes arise. Without regulation, there is no guarantee of fair treatment, ethical conduct, or financial security.

The absence of verifiable regulation is one of the most significant red flags for any broker.

Unclear Company Information

Transparency about company ownership and operations is essential for trader confidence. Legitimate brokers openly provide details about their legal entity, registration, jurisdiction, and physical headquarters.

In contrast, FXGIM.com provides limited and ambiguous information about its corporate identity. There is no clear disclosure of its legal name, corporate registration, or jurisdiction of operation. This makes it difficult to determine who is responsible for running the platform and where legal recourse could be pursued if necessary.

Opaque company information is often associated with high-risk or untrustworthy brokers.

Questionable Account Structures and Terms

FXGIM.com advertises multiple account types that claim to offer various benefits, such as access to advanced tools, tighter spreads, and personalized support. While tiered account structures are common in the industry, clear disclosure of terms and conditions is essential.

Unfortunately, critical details — such as minimum deposit requirements, fee structures, margin requirements, and withdrawal terms — are either unclear or not readily accessible. This lack of transparency can result in traders unknowingly agreeing to unfavorable conditions and costs that benefit the broker at the trader’s expense.

When account terms are not disclosed clearly upfront, traders are more vulnerable to unexpected fees and restrictive trading rules.

High-Leverage Offers Without Adequate Risk Disclosure

Leverage can significantly amplify both profits and losses. While high leverage may sound attractive, it increases the risk of substantial losses, especially for inexperienced traders. Reputable brokers provide detailed risk disclosures and impose leverage limits to help protect their clients.

FXGIM.com appears to promote high-leverage conditions without clearly communicating the associated risks. Without transparent risk education, traders — particularly newcomers — may not fully understand the dangers of leveraged trading, leading to rapid depletion of funds.

Failing to provide adequate risk warnings and educational resources is a concerning indicator of a broker that does not prioritize investor protection.

Aggressive Marketing and Sales Tactics

A common trait among dubious brokers is aggressive marketing and sales pressure. Traders interacting with FXGIM.com report being contacted frequently via phone calls, emails, or messages encouraging them to deposit additional funds or upgrade account levels.

These communications often use high-pressure language, suggesting that profitable opportunities may disappear if the trader does not act immediately. A reputable broker does not pressure its clients to deposit more funds or promise guaranteed profits, as all trading carries risk and no outcome is certain.

Persistent outreach and pressure to increase investments are major red flags that suggest unethical practices.

Easy Deposits and Difficult Withdrawals

One of the most consistent complaints associated with questionable brokers is the imbalance between the ease of deposit and the difficulty of withdrawal. FXGIM.com appears to follow this pattern.

Depositing funds into an FXGIM.com account may be straightforward and processed quickly. However, withdrawing funds often becomes complicated and delayed, with traders encountering obstacles such as:

-

Repeated requests for extensive documentation

-

Delayed or unexplained processing times

-

Additional trading volume requirements introduced after initial funding

-

Sudden fees or charges that were not previously disclosed

These kinds of barriers often surface only when a trader attempts to retrieve their money. Such behavior raises valid concerns about the broker’s intentions and operational transparency.

Trading Platform Transparency and Technology

FXGIM.com claims to offer an advanced trading platform featuring real-time pricing, intuitive charts, and responsive execution. However, there is limited information available about the platform’s technology, its source, or whether it has been independently audited.

Many reputable brokers use well-known third-party platforms that have a history of stability and transparency. In contrast, unregulated brokers often rely on proprietary software that is not independently verified. Without clear verification of platform integrity, traders cannot be confident that pricing and execution are fair and accurate.

Manipulated pricing, delayed execution, or hidden slippage are all risks when trading on unverified platforms.

Misleading Bonus Offers and Incentives

FXGIM.com promotes bonus offers and incentives designed to encourage traders to deposit larger sums. While bonuses can be an industry norm, they often come with strings attached that make withdrawing funds difficult or costly.

Common issues with such bonus schemes include:

-

High trading volume requirements before bonus funds can be touched

-

Bonus funds counted toward trading goals but not freely withdrawable

-

Long-term holding or activity conditions before withdrawal is permitted

These terms are frequently hidden in complex or hard-to-find sections of the terms and conditions, making them difficult for traders to spot before funding their accounts.

Targeting Inexperienced Traders

Platforms demonstrating these kinds of behaviors often focus heavily on attracting novice traders who may lack the experience to identify warning signs. While FXGIM.com may offer educational resources, these are often superficial and do not provide meaningful insight into risk management or market dynamics.

Inexperienced traders are especially vulnerable to persuasive marketing, high-pressure communications, and promises of easy profits, making them prime targets for risky or unethical brokers.

Customer Support Concerns

Reliable customer support is a critical aspect of any legitimate broker, especially when traders face issues related to deposits, withdrawals, or platform functionality.

Feedback from traders suggests that FXGIM.com’s support responsiveness may decline once funds have been deposited. Support may become slow, generic, or unhelpful when traders attempt to resolve withdrawal issues or account problems. A decline in support quality during critical moments undermines trust and raises concerns about the broker’s commitment to client service.

Financial Risks to Traders

The combination of absent regulatory oversight, limited transparency, aggressive marketing, and withdrawal complications significantly increases the financial risk to traders. Without proper safeguards:

-

Client funds may not be segregated from corporate operating funds

-

There is no guarantee of financial accountability

-

Dispute resolution mechanisms may be unavailable

-

Traders have limited legal recourse in the event of misconduct

In cases of insolvency or broker misbehavior, traders with unregulated platforms like FXGIM.com can face severe financial losses with minimal avenues for recovery.

How Traders Can Protect Themselves

The risks associated with platforms like FXGIM.com emphasize the importance of conducting thorough due diligence before trading. Traders should:

-

Verify regulatory status with reputable authorities

-

Research company ownership and operational jurisdiction

-

Read multiple independent reviews and user experiences

-

Understand all fees, account terms, and withdrawal policies

-

Test platforms with minimal funds before committing larger capital

-

Avoid brokers that use high-pressure tactics or promise guaranteed returns

An informed and cautious approach is essential for safeguarding your investment.

Final Verdict on FXGIM.com

Based on the numerous red flags identified — including a lack of verifiable regulation, opaque company information, unclear account terms, aggressive marketing tactics, and withdrawal obstacles — FXGIM.com exhibits many characteristics commonly associated with unregulated, high-risk, or potentially scam brokers.

Traders are strongly advised to approach this platform with extreme caution and consider regulated, transparent alternatives. In the highly competitive world of online trading, protecting your capital and working with brokers that prioritize accountability, client protection, and transparent practices should always come first.

Choosing a broker with solid oversight and a trusted reputation is essential for long-term success and peace of mind in your trading journey.

Report FXGIM.com and Recover Your Funds

If you have fallen victim to FXGIM.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like FXGIM.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.