Fin-TechPrime.com Scam Review – Risk Analysis

Online trading has become increasingly popular, drawing in newcomers and experienced investors who want to capitalize on market opportunities. Unfortunately, this growth has also led to a rise in platforms that appear professional on the surface but operate with questionable practices behind the scenes. Fin-TechPrime.com is one such platform that has attracted attention due to a combination of user complaints, unclear licensing information, and practices that undermine trader confidence.

This comprehensive review takes a deep look into Fin-TechPrime.com to help readers understand the risks associated with this broker, how it operates, what users have reported, and the red flags that suggest the platform may not be trustworthy.

What Is Fin-TechPrime.com?

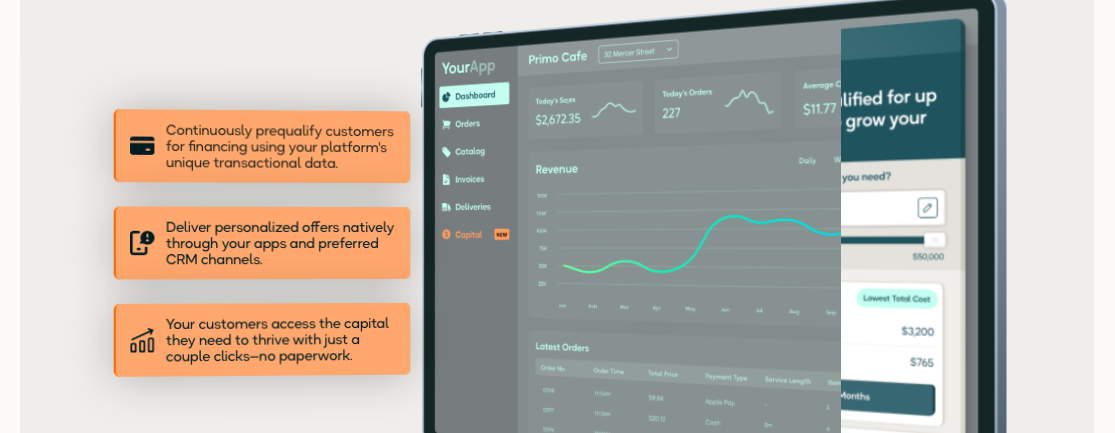

Fin-TechPrime.com presents itself as a modern online trading platform providing access to various financial instruments, including forex, cryptocurrencies, stocks, indices, and commodities. At first glance, the website appears sleek and well-designed, offering features that mimic reputable trading platforms. They emphasize fast execution, a wide range of tools, and “professional assistance” for traders.

However, a closer look reveals inconsistencies in its service descriptions and a lack of transparency in critical areas. These factors raise concerns about the legitimacy of the broker and whether it operates according to industry standards.

Lack of Transparent Licensing and Regulation

One of the most critical aspects of any online broker is its regulatory status. Proper licensing ensures a company adheres to strict guidelines designed to protect traders from misconduct, market manipulation, and financial fraud. In the case of Fin-TechPrime.com, the platform fails to provide verifiable information about its regulatory oversight.

The website may reference general compliance or claim to follow international standards, but such statements are meaningless without documentation. Reputable brokers always display licensing numbers and regulatory body details clearly. With Fin-TechPrime.com, this transparency is missing, leaving traders unsure about who oversees the platform.

The absence of clear regulatory information puts traders at a significant disadvantage. If a dispute arises, clients may have no legal recourse, as unregulated brokers often operate from offshore jurisdictions where enforcement is weak or nonexistent.

Unclear Company Background

In addition to vague regulatory claims, Fin-TechPrime.com also provides little to no detailed information about the company behind the platform. Legitimate financial service providers typically include:

-

A registered company name

-

A physical office address

-

Corporate history

-

Information about founders or management

-

Contact details beyond generic communication channels

Fin-TechPrime.com either omits or obscures this information. Without knowing who runs the operation or where the business is actually located, traders are left dealing with an entity that could vanish without accountability.

Anonymity in the online trading industry is a major red flag because it is commonly used by fraudulent brokers to avoid responsibility while appearing legitimate.

Suspicious Account Types and Unrealistic Promises

Fin-TechPrime.com features multiple account types designed to appeal to different levels of investors. These accounts often include promises of improved returns, advanced tools, or personal account managers as traders move to higher-tier packages.

The issue arises when the platform seems to incentivize users to deposit increasingly larger sums without offering genuine differentiating features or transparent explanations of what each upgrade includes. Some typical warning signs include:

-

High minimum deposit requirements

-

Vague descriptions of account benefits

-

Promises of exceptionally high profitability

-

Pressure to upgrade accounts to “unlock” better performance

These practices are commonly associated with fraudulent brokers who rely on aggressive deposit tactics rather than actual trading results.

Complaints About Withdrawals and Account Access

One of the most serious concerns associated with Fin-TechPrime.com is the number of user complaints regarding withdrawals. Many users have reported difficulties accessing their funds, delays without explanation, and outright denials of withdrawal requests.

Some of the most frequently mentioned issues include:

-

Account managers ignoring withdrawal requests

-

Requests being “under review” for extended periods

-

Additional fees or extra deposits required before processing

-

Sudden changes in terms or unexpected conditions

Such patterns are classic indicators of a broker that prioritizes collecting deposits rather than providing genuine trading services. When withdrawal problems become recurring, it signals that the platform may be designed to retain client funds rather than facilitate legitimate transactions.

Manipulative and Aggressive Sales Tactics

Reports from users also mention persistent and aggressive sales calls encouraging them to deposit more funds. Many claim that representatives use manipulative strategies such as:

-

Promising guaranteed profits

-

Urging clients to act quickly to avoid “missing opportunities”

-

Guilt-tripping or blaming clients for hesitation

-

Offering exclusive bonuses that require larger deposits

These tactics are widely recognized as red flags because legitimate brokers do not pressure clients into depositing money. High-pressure sales strategies often accompany opaque platforms where the goal is to extract as much money as possible before clients begin to notice issues.

Platform Issues and Questionable Trading Activity

Another troubling aspect is the trading environment itself. Some users have reported experiencing:

-

Random spikes in charts

-

Trades executing incorrectly or at unexpected prices

-

Platform freezing during crucial market moments

-

Open positions closing without explanation

Such behavior suggests manipulation or poor-quality software that does not reflect actual market conditions. If traders cannot rely on accurate data or consistent system performance, the platform cannot be trusted with real financial operations.

Unregulated brokers may use these tactics to create losses or restrict users from gaining profits, further ensuring that client funds remain with the platform.

Poor Customer Support Quality

Effective customer support is essential for any financial platform. Fin-TechPrime.com advertises dedicated service, but many complaints indicate that support is slow, unresponsive, or unhelpful.

Users frequently describe situations where:

-

Responses are generic and uninformative

-

Emails go unanswered for long periods

-

Live chat does not function reliably

-

Support agents deflect issues rather than address them

Poor customer support often accompanies questionable brokers, as it allows them to delay addressing problems and maintain control over client funds without scrutiny.

No Verifiable User Success Stories

While Fin-TechPrime.com may present testimonials or supposed success stories, these often lack credibility. Many platforms with questionable motives use fabricated reviews or generic statements to create an illusion of trustworthiness.

Authentic success stories typically involve verifiable individuals, detailed trading experiences, and transparent results. The lack of such credible information further casts doubt on the legitimacy of Fin-TechPrime.com.

Red Flags Summarized

Fin-TechPrime.com presents numerous warning signs that traders should take seriously. These include:

-

No clear licensing or regulatory oversight

-

Lack of company transparency

-

Withdrawal challenges

-

Aggressive sales tactics

-

Questionable trading performance

-

Poor customer support

-

Unrealistic promises and vague account details

These issues collectively create a picture of a platform that may not operate with the honesty and professionalism expected from legitimate brokers.

Final Thoughts

Fin-TechPrime.com may appear to offer modern trading tools and attractive opportunities, but the underlying issues make it a highly questionable platform. The combination of vague regulation, unclear ownership, user complaints, and opaque practices should raise concerns for any potential investor.

Traders looking for trustworthy brokers should prioritize platforms that are transparent, regulated, and proven to operate professionally. Fin-TechPrime.com does not meet these standards, making it a risky choice for anyone seeking safe and reliable online trading.

-

Report Fin-TechPrime.com and Recover Your Funds

If you have fallen victim to Fin-TechPrime.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Fin-TechPrime.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.