CapitalHoldings.icu Scam Review — High-Risk Investment Platform

The world of online investing has seen explosive growth, but it has also opened the door to platforms that operate with little transparency, questionable legality, and risk structures that leave users vulnerable. CapitalHoldings.icu is one such platform attracting attention from curious investors — not because of its success, but because of the many red flags associated with its operations.

This comprehensive CapitalHoldings.icu scam review breaks down the platform’s structural issues, lack of transparency, and user-reported concerns. While this review does not assert that CapitalHoldings.icu is legally fraudulent — that would require a formal legal ruling — the evidence strongly points to it being a high-risk platform that investors should treat with extreme caution.

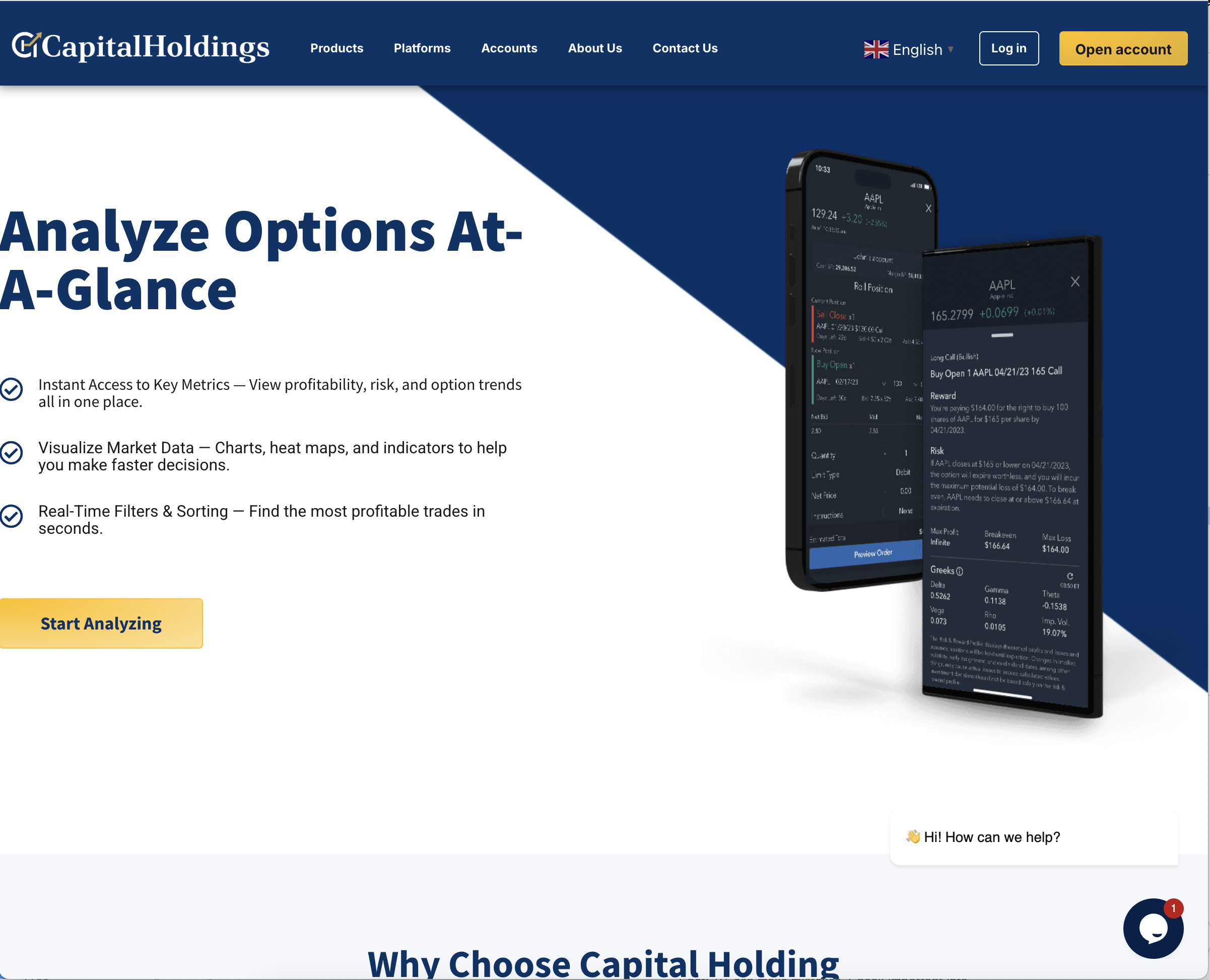

1. First Impressions — A Professional Exterior That Masks Critical Gaps

At first glance, CapitalHoldings.icu attempts to create the appearance of a legitimate investment service:

-

Sleek, modern website layout

-

Professional branding

-

Claims of expertise in wealth management and trading

-

Promises of investment growth through “expert management”

-

Market-related terminology that gives the illusion of credibility

Many online investment scams rely heavily on web design to appear trustworthy. CapitalHoldings.icu fits this pattern — polished visuals paired with very little verifiable substance underneath.

A professional website alone does not guarantee legitimacy. What matters is regulation, corporate identity, fund security, and customer protections — areas where this platform falls dangerously short.

2. Corporate Transparency — Serious Problems With Verification

One of the strongest indicators of legitimacy in the financial world is full corporate transparency. Legitimate investment platforms openly provide:

-

Registered business name

-

Verified company registration

-

Physical office address

-

Identifiable directors and executives

-

Legal documents accessible for verification

CapitalHoldings.icu does not provide transparent or verifiable corporate details. Instead, it displays vague company identifiers that cannot be reliably checked.

Common issues include:

-

No clear legal entity listed

-

No verifiable registration in recognized business directories

-

No identifiable individuals linked to the company

-

No provable business address

-

No documentation that aligns with public records

When an investment platform hides its corporate identity, investors should take immediate caution. Without a real, accountable legal entity, there is no recourse should something go wrong.

3. Regulatory Oversight — No Evidence of Licensing or Supervision

Every legitimate investment platform — whether offering advisory services, asset management, brokerage access, or trading accounts — must operate under a financial regulatory license. This ensures:

-

User fund protection

-

Compliance with industry laws

-

Transparency in operations

-

Anti-money-laundering safeguards

-

Legal frameworks for dispute resolution

CapitalHoldings.icu does not display:

-

A regulatory license number

-

A governing financial authority

-

Proof of compliance with any jurisdiction’s laws

-

Registered financial documentation

This absence is a massive red flag. Unregulated investment platforms often take advantage of users by operating outside the law, making it nearly impossible for investors to hold them accountable.

4. Domain Age & Online Footprint — Extremely Weak Presence

Another risk factor is the platform’s limited online history. Trusted companies usually have:

-

Long-running domains

-

Years of customer reviews

-

Documented market presence

-

Articles, discussions, and community engagement

CapitalHoldings.icu appears to show:

-

A recently created domain

-

No meaningful online reputation

-

Minimal digital footprint

-

Very few independent mentions outside its own website

Newly created domains are particularly common among financial scams, which often appear and disappear quickly to avoid scrutiny.

5. Vague Investment Services With No Verifiable Strategy

One of the most troubling aspects of CapitalHoldings.icu is its extremely vague service offerings. Legitimate investment firms clearly outline:

-

Their investment strategies

-

Risk levels

-

Fees and commissions

-

Market methodology

-

Portfolio models

-

Historical performance

CapitalHoldings.icu instead uses broad, generic statements such as:

-

“Expert wealth management”

-

“Guaranteed profitability”

-

“Secure investment growth”

-

“Opportunities for all levels of investors”

None of these claims are supported with:

-

Verified financial reports

-

Audited statements

-

Clear fee disclosures

-

Transparent methodologies

-

Legal terms outlining investor protections

Empty marketing language is a classic sign of a platform that wants to appear legitimate without providing the substance required for educated investment decisions.

6. Lack of Information About Funds, Custody, and Security

A critical part of any investment platform is how user funds are stored and protected. CapitalHoldings.icu provides virtually no clarity on this.

Warning signs include:

-

No information on segregated client accounts

-

No mention of institutional custodians

-

No insurance or fund protection guarantees

-

No explanation of how deposits are handled

-

No details on withdrawal policies

-

No verifiable proof of internal security protocols

When dealing with money, transparency is non-negotiable. CapitalHoldings.icu’s silence on these topics places users in a highly vulnerable position.

7. Customer Support Concerns — Weak, Unresponsive, or Unverifiable

Many users report struggling with CapitalHoldings.icu’s support system. Warning indicators include:

-

Unresponsive communication

-

Generic email replies with no helpful information

-

No direct phone line

-

No confirmable physical service office

-

No real customer service infrastructure

A legitimate investment firm employs trained professionals with clear ways to assist clients. When an investment platform relies on anonymous or generic forms of communication, it is often a sign that the company does not want to be easily traceable.

8. Risky Marketing Tactics Used to Attract Beginners

Platforms like CapitalHoldings.icu frequently use psychological triggers to attract unsuspecting investors, including:

-

Promises of high returns without explaining risks

-

Phrases like “safe profits” or “zero risk”

-

Fake urgency — timed bonuses or limited offers

-

Pressure to deposit more money

-

Claims of exclusive access to special investment opportunities

These tactics are common in high-risk investment schemes designed to lure inexperienced users who may not recognize the danger.

No legitimate investment service guarantees profits — markets do not work that way.

9. User Feedback Patterns — A Lack of Credible Testimonials

Another key issue in this CapitalHoldings.icu scam review is the absence of independent, verifiable user reviews. Trusted platforms naturally accumulate online discussion, both positive and critical.

For CapitalHoldings.icu:

-

Independent reviews are nearly nonexistent

-

User testimonials appear fabricated or anonymous

-

No investors can be traced to social or business networks

-

No established community presence

When a financial platform lacks real user history, it becomes nearly impossible to evaluate its performance honestly.

10. Withdrawal Issues — A Common Red Flag Among Risky Platforms

One of the most widely reported concerns with high-risk investment sites is difficulty withdrawing funds. While individual experiences vary, platforms with unclear withdrawal processes share common patterns:

-

Delayed payouts

-

Sudden account verification issues

-

Unexpected fees required before withdrawal

-

Conditions that were never disclosed upfront

-

Silence from support teams when users request payouts

CapitalHoldings.icu’s lack of transparent withdrawal policies makes this an area of serious concern for anyone considering depositing funds.

11. The Overall Risk Assessment — Why CapitalHoldings.icu Should Be Avoided

When all red flags are evaluated together, CapitalHoldings.icu shows the following problem pattern:

✓ Unverified company identity

No legal entity or traceable corporate information.

✓ No regulatory oversight

No license, no compliance structure, no governing authority.

✓ Weak online presence

Minimal history, minimal visibility, minimal trust.

✓ Vague and unsubstantiated investment claims

No evidence, no methodology, no verifiable reports.

✓ No fund protection or custody clarity

High risk of fund mismanagement.

✓ Poor communication and weak customer support

No accountability or transparency.

✓ High likelihood of withdrawal complications

A common sign of untrustworthy financial platforms.

Taken together, these factors strongly indicate that CapitalHoldings.icu is not a safe or reliable investment platform.

12. Final Thoughts — Extreme Caution Recommended

CapitalHoldings.icu demonstrates nearly every red flag commonly associated with high-risk investment websites. While not legally classified as fraudulent, it poses a severe risk to anyone considering depositing funds.

Investors deserve platforms with:

-

Verified licensing

-

Strong customer protection

-

Transparent corporate identity

-

Audited performance data

-

Clear legal accountability

CapitalHoldings.icu lacks all of these essential components.

If financial safety and transparency matter to you, it would be wise to avoid this platform altogether and consider only reputable, regulated investment services.

-

Report CapitalHoldings.icu and Recover Your Funds

If you have fallen victim to CapitalHoldings.icu and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like CapitalHoldings.icu persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.