WealthGenerationHolding.com Review— Scam or Legit?

WealthGenerationHolding.com presents itself as an investment and wealth-management service, promising access to financial growth opportunities, investment plans, and “wealth generation.” However, a close examination of its publicly observable features — including corporate opacity, lack of verifiable regulatory or licensing information, minimal public footprint, vague service descriptions, and structural red flags — strongly suggest the platform should be treated with considerable caution.

This review does not label the site definitively as a confirmed fraud or scam (owing to lack of public adjudication). Instead, it outlines multiple warning signs and risk factors that collectively place the platform in a high-risk zone. Prospective users should approach with skepticism, demand transparency, and consider all funds as potentially at risk.

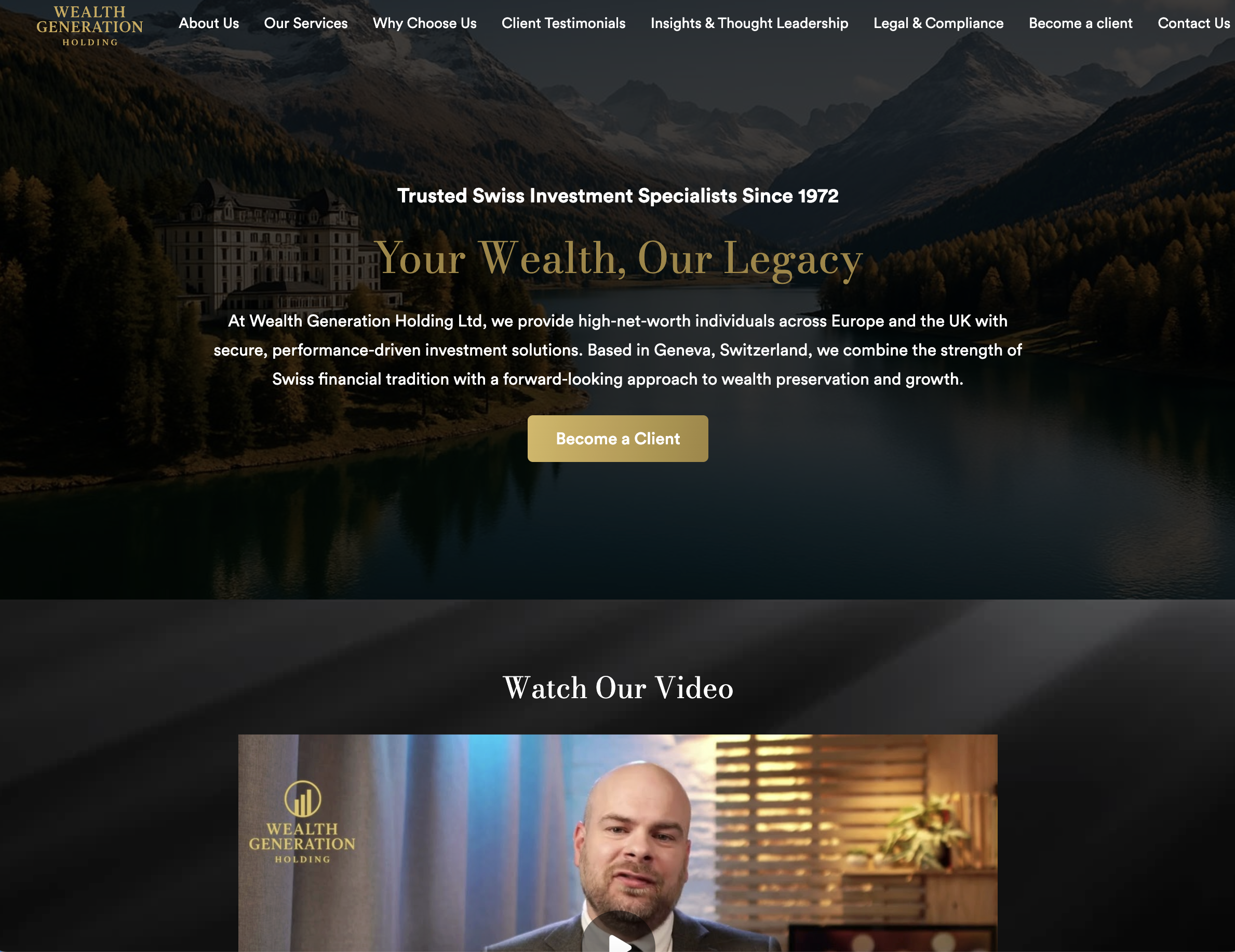

1. The Surface Appeal: What the Platform Claims to Offer

From its marketing and outward presentation, WealthGenerationHolding.com appears to offer a conventional suite of services often associated with wealth-management firms or investment platforms:

-

Investment plans and portfolio management

-

Promises of attractive returns or growth potential

-

“Professional” management and client-oriented services

-

Seeming accessibility and ease of onboarding

For someone not deeply versed in investment due diligence, this can seem appealing — especially when combined with polished website design and language that echoes trust, success, and financial growth. This veneer of legitimacy is a typical lure used by many high-risk or unverified platforms to attract first-time investors or people seeking quick financial gains.

But — as always in finance — when things seem “too smooth,” the urge to dig deeper becomes essential. The façade of professionalism does not guarantee substance.

2. Corporate Transparency & Public Identity — What’s Missing

One of the most basic criteria for evaluating any financial service is a clear, verifiable corporate identity: company registration, legal entity name, physical address, named executives, compliance officers, and contact information for support.

In investigating WealthGenerationHolding.com, the following troubling observations emerge:

-

There is no clearly verifiable public record tying the platform to a registered corporate entity. Efforts to locate a reliable business registration or regulatory listing yield no credible results.

-

Ownership and management information appear masked or anonymized. No identifiable directors, compliance officers, or responsible parties are publicly disclosed.

-

Contact details are minimal, generic, or unverifiable — often limited to basic web forms or email addresses with no physical mailing address or verified phone contact.

-

No licensing or regulator-registration number is transparently provided, which means there is no visible oversight or regulatory compliance documentation.

In short: accountability — the foundation of trust in financial services — is absent. Without transparent corporate identity, there is no meaningful way to hold the platform legally or financially responsible if things go wrong.

3. Regulatory Oversight — A Critical Gap

Legitimate investment and wealth-management firms typically operate under clear regulatory frameworks, especially when client funds, investment advice, or asset custody are involved. Regulation provides safeguards: fund segregation, audits, compliance with anti-fraud and investor-protection laws, and a formal mechanism for dispute resolution.

For WealthGenerationHolding.com:

-

There is no publicly available evidence of licensing or regulatory registration under any recognized financial authority.

-

No compliance disclosures, no regulatory disclaimers, and no credible verification documents are provided to show that the platform operates under lawful oversight.

-

In absence of regulation, client funds — if accepted — are exposed to high risk: no guarantee of custody, no third-party audit, and no protective oversight.

Operating without transparent regulation removes the safety net that separates legitimate firms from high-risk operations. For many investors, this alone is reason enough to avoid placing funds with the platform.

4. Domain Age, Web Presence & Public Reputation — Weak or Nonexistent

Another important dimension of trust is a demonstrable history: a long-lived domain, public visibility, independent reviews, community feedback, and transparent user experiences. These provide external validation that a platform has operated over time, surviving scrutiny, and maintaining accountability.

In the case of WealthGenerationHolding.com:

-

Reports indicate that the domain appears relatively recently registered, meaning there is no long, verifiable operational history or legacy of user trust.

-

There is very little digital footprint — few to no independent reviews, absence in recognized broker or investor forums, and no publicly documented track record of returns or client dealings.

-

There are virtually no publicly verified testimonials or performance records, meaning claims of success or returns cannot be independently corroborated.

The lack of public reputation is especially concerning in financial services. Without traceable history or external validation, prospects for reliable evaluation, user feedback, or shared community experience are severely limited.

5. Vague Service Descriptions & Marketing Style — “Gloss Over Substance”

A hallmark of shady or high-risk platforms is marketing that emphasizes opportunity and success, but lacks concrete, verifiable substance. Some patterns reportedly present in WealthGenerationHolding.com’s public materials include:

-

Broad, generic promises: “investment growth,” “wealth creation,” “financial solutions,” but with no detailed breakdown of investment strategy, asset classes, risk assessment, or return mechanisms.

-

Absence of transparent terms of service, fee schedules, risk disclaimers, or user agreements — elements that are mandatory or common among credible investment firms.

-

Marketing language that focuses on potential gains, with little or no mention of risk, volatility, or loss possibility.

In legitimate investment operations, honest communication includes both upside and downside, with transparent disclosure of risk factors. Marketing that glosses over risk while emphasizing gains strongly signals caution.

6. Client Funds, Custody & Withdrawal Protections — Major Unknowns

Any investment platform that manages or promises to manage client funds should clarify how it will handle those funds: whether funds are held in segregated accounts, whether client assets are under custodial oversight or third-party vaults, and how withdrawal/redemption is processed.

For WealthGenerationHolding.com, the following red flags are reported or noticeable:

-

No visible disclosure of fund custody structure or protections for client assets.

-

No published policy on withdrawals, redemption terms, fees, lock-in periods, or exit mechanisms.

-

No auditing or independent third-party oversight documented, meaning there is no verifiable proof that funds deposited are stored securely or used as promised.

When custody, transparency, and withdrawal protections are unclear or absent, user funds are exposed to a wide range of risks — from mismanagement to outright loss, and with no clear recourse mechanism.7. Customer Support and Communication Issues — Another Layer of Risk

Good financial services firms offer responsive, verifiable customer support: phone lines, physical address or headquarters, regulatory contact, transparent service agreements, and clear communication channels. In contrast, user feedback about this platform indicates:

-

Reports of delayed responses or lack of responsiveness when users request information about licensing, custody, or fund withdrawals.

-

Cases where initial communication seems professional, but becomes vague or stops after deposits are made.

-

Absence of verifiable support contact details — no confirmed phone numbers, no public office address checks, and no evidence of physical presence.

Reliable communication is critical if any issue arises: funding errors, disputes over performance, withdrawal needs. If communication and support structures are weak or non-existent, user recourse becomes highly uncertain.

8. Risk Profile — Why This Platform Should Be Seen as High-Risk

Considering the cumulative weight of all the red flags described above — corporate anonymity, regulatory absence, new domain, weak public footprint, vague service and fund-custody descriptions, and poor support transparency — one must conclude that WealthGenerationHolding.com has a high-risk profile.

For prospective investors or individuals thinking of engaging with such a platform, the potential threats include:

-

Total loss of deposited funds, with no ability for recovery or legal recourse

-

No guarantee of legitimate investment or asset management — funds may be misused, withheld, or lost

-

Lack of transparency concerning where money goes or how returns (if any) are generated

-

Exposure to fraudulent promises, misleading terms, or exit-scam behavior

-

Inability to trace or identify responsible entities, due to anonymized ownership

Given these uncertainties, any engagement with the platform should be approached with extreme caution — if at all.

9. What Legitimate Investment Firms Provide — And What This Platform Fails

To illustrate the gap, here is a brief comparison between what a credible investment/wealth-management firm typically offers, and what appears to be missing at WealthGenerationHolding.com:

| Expected from legitimate firm | Missing / Unclear at WealthGenerationHolding.com |

|---|---|

| Public, verifiable corporate registration and legal identity | No clear registration or transparent ownership data |

| Regulation or licensing with oversight | No credible licensing or regulatory affiliation disclosed |

| Audited fund custody, client fund segregation | No custody or asset-protection details published |

| Transparent fee structure, terms, risk disclosure | Service descriptions are vague; risk not disclosed |

| Verifiable track record, client testimonials, public reputation | Virtually no external reviews or audited history |

| Clear withdrawal and redemption policies | No transparent withdrawal or fund-access provision |

| Responsive contact and support, legal accountability | Support details opaque; accountability unclear |

When a platform fails most of these critical criteria, it becomes effectively a black box — and investors are left with no safe way to evaluate or protect their interest.

10. Conclusion — Strong Reasons to Treat WealthGenerationHolding.com as High Risk

In the online investment era, credibility is built on transparency, regulation, accountability, and public traceability. WealthGenerationHolding.com, based on all publicly reported information and user-shared experiences, fails to meet virtually all of those standards.

While it is impossible to confirm wrongdoing without judicial or regulatory action, the sheer number of structural and operational deficiencies means that using this platform carries a substantial risk of loss, mismanagement, or worse.

If you are evaluating online investment or advisory options, it is strongly advisable to avoid platforms like this unless and until they can provide fully verifiable corporate registration, regulatory credentials, transparent custody of funds, audited performance history, and public accountability.

-

Report WealthGenerationHolding.com and Recover Your Funds

If you have fallen victim to WealthGenerationHolding.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like WealthGenerationHolding.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.