APXLending.com Scam Review –Customers Report

The growth of online lending and financial services has created new opportunities for investors and borrowers alike. However, the same expansion has also given rise to websites and platforms that operate with limited transparency, making it essential for users to carefully evaluate any online financial service before engaging. One such platform that has attracted attention is APXLending.com, which presents itself as a modern lending and investment solution.

This review provides an objective, fact-based assessment of APXLending.com, analyzing its structure, service offerings, transparency, and the key considerations users should be aware of before involvement. This analysis is meant to inform and guide users without making unverified accusations.

Introduction to APXLending.com

APXLending.com markets itself as a comprehensive online lending and investment platform. The website claims to offer streamlined borrowing solutions, attractive returns, and easy access to financial markets. While the messaging is designed to convey reliability and professionalism, there is limited verifiable information available about the company’s operations, leadership, or regulatory compliance.

A legitimate financial platform typically provides detailed documentation about its company, licensing, operational mechanisms, and risk disclosures. Evaluating APXLending.com against these industry standards helps users understand potential concerns and gaps.

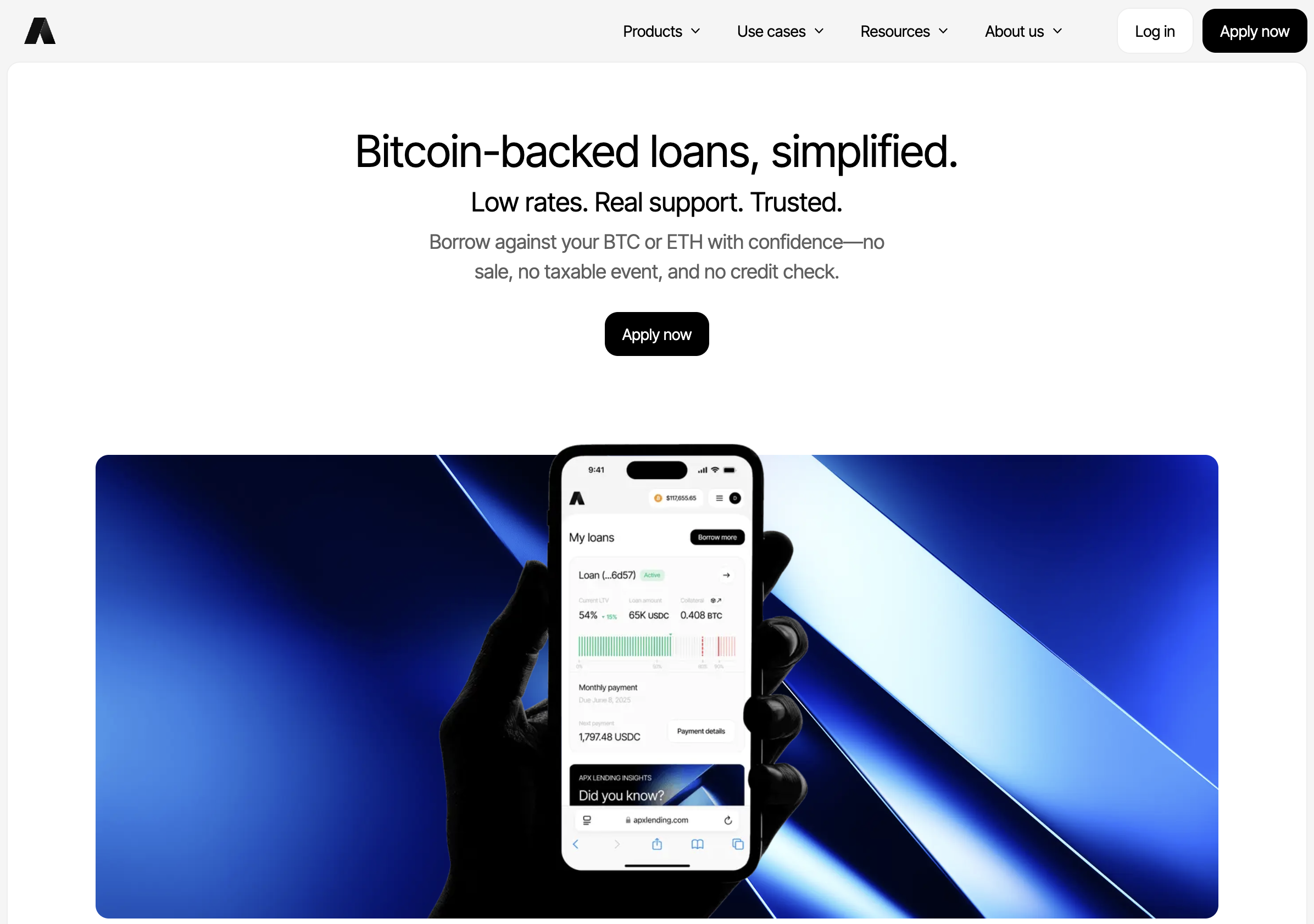

Website Overview and First Impressions

APXLending.com uses a clean, modern design, featuring marketing language aimed at attracting potential clients. However, first impressions can be misleading, and a closer examination highlights several areas of concern.

1. Lack of Corporate Transparency

The platform does not clearly disclose:

-

Legal company name

-

Registered office location

-

Names of founders or executives

-

Corporate registration information

-

Team member qualifications

Without this information, it is difficult for users to verify who is operating the platform or hold the company accountable in case of disputes.

2. Promotional Messaging Over Substance

The website emphasizes features such as:

-

“Fast and secure lending solutions”

-

“High-yield investment opportunities”

-

“Cutting-edge financial tools”

While appealing, these statements are not supported by detailed explanations of mechanisms, processes, or proof of results. Marketing-heavy language without operational clarity is a common trait among unverified platforms.

3. Limited Platform Demonstration

APXLending.com provides little evidence of an operational platform. Potential users cannot verify:

-

Lending mechanisms

-

Investment dashboards

-

Account management tools

-

Transaction interfaces

A lack of platform demonstration makes it challenging for users to assess functionality and reliability.

Services and Lending/Investment Products

APXLending.com references multiple services, including lending programs, investment options, and portfolio management. However, the platform provides minimal details about:

-

How funds are managed

-

Investment strategies employed

-

Borrower verification processes

-

Risk management policies

Potential Offerings

-

Personal or business lending products

-

Investment opportunities with fixed or variable returns

-

Automated systems for portfolio management

-

Membership or premium account options

Although these offerings sound attractive, the absence of detailed methodology or verifiable track record raises questions about legitimacy.

Claims of Returns

The platform may advertise attractive interest rates or high returns for investors. However, without clear explanation of:

-

Underlying investment strategy

-

Market risks involved

-

Historical performance

-

Regulatory oversight

any claim of guaranteed returns should be approached with skepticism.

Regulation and Compliance Considerations

Regulation is a critical factor in determining the legitimacy of financial services. Licensed platforms display regulatory approval, which ensures that the platform follows legal standards and protects client funds.

APXLending.com does not provide any visible licensing information or regulatory credentials. There is no indication of registration with:

-

National financial authorities

-

Lending oversight bodies

-

International financial regulators

The absence of regulation is a serious concern, as it limits accountability and user protection in financial transactions.

Legal Documentation and Policies

A trustworthy financial platform includes detailed documentation, such as:

-

Terms and Conditions

-

Privacy policies

-

Risk disclosures

-

Borrowing agreements

-

Withdrawal and repayment policies

APXLending.com offers limited documentation, and what is provided tends to be broad or generic. Users may find it difficult to understand their rights, obligations, and the associated risks before engaging with the platform.

Deposits, Withdrawals, and Fund Management

Transparency in financial operations is essential for any online lending or investment service. APXLending.com provides minimal clarity regarding how funds are handled.

Deposit Process

The website does not clearly outline:

-

Accepted payment methods

-

Minimum deposit amounts

-

Verification processes

-

Fund allocation methods

Withdrawal Process

Similarly, withdrawal or repayment procedures are unclear:

-

Processing times are not specified

-

Fee structures are ambiguous

-

Verification steps are not detailed

-

Conditions for withdrawal or loan repayment are vague

Platforms that fail to clearly define financial operations increase risk for users, particularly regarding timely access to funds.

Customer Support and Communication

Customer support is a vital component of any legitimate financial platform. Reliable services provide multiple contact channels, including:

-

Verified email addresses

-

Phone support

-

Live chat

-

Support tickets with response tracking

APXLending.com provides limited and generic support options. Users may find it difficult to resolve issues or receive prompt assistance, which can impact user confidence and operational transparency.

Red Flags Observed

Several warning signs are commonly observed in unverified online financial platforms, and APXLending.com exhibits some of these characteristics:

-

No verifiable company ownership information

-

Lack of regulatory licensing or compliance

-

Vague descriptions of services and lending mechanisms

-

No platform demonstration or operational verification

-

Claims of high or guaranteed returns without explanation

-

Limited and non-traceable customer support channels

-

Ambiguous deposit, withdrawal, and repayment procedures

While these red flags do not automatically imply wrongdoing, they indicate that users should exercise caution.

Balanced Assessment of APXLending.com

This review aims to provide a neutral evaluation based on publicly visible information. APXLending.com presents itself as a comprehensive lending and investment platform but falls short in key areas of transparency, operational clarity, and regulatory compliance.

Key Considerations for Users

-

Verify licensing and regulatory status before depositing funds

-

Assess the clarity of service offerings and risk disclosures

-

Evaluate available documentation for legal and operational transparency

-

Confirm the reliability of customer support and communication channels

-

Avoid decisions based solely on promises of high returns

A cautious approach helps users minimize risk in online financial interactions.

Practical Tips for Evaluating Online Lending Platforms

For users exploring unfamiliar platforms, these practical steps can improve safety:

-

Check regulatory credentials with official authorities

-

Verify corporate registration and ownership information

-

Request platform demonstrations or trial access

-

Assess transparency of deposit, withdrawal, and repayment policies

-

Review user feedback from independent sources

-

Avoid platforms that guarantee returns or use high-pressure marketing

These measures reduce the risk of engaging with unverified platforms and provide a better understanding of operational practices.

Conclusion

APXLending.com positions itself as an online lending and investment platform, offering a range of financial services. However, the site lacks key elements of transparency, such as verifiable company ownership, regulatory licensing, detailed service explanations, and clear financial policies.

-

Report APXLending.com and Recover Your Funds.

If you have fallen victim to APXLending.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like APXLending.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.